Ratchapon Supprasert/iStock through Getty Pictures

Introduction

The share value of Hudson Applied sciences, Inc. (NASDAQ:HDSN) has skilled a curler coaster experience just lately, reaching an all-time excessive. However in 2020, the inventory crashed from $9.17 (all-time excessive in September 2017), to an all-time low of $0.37 in August 2019, representing a lower of 96%! HDSN inventory is, subsequently, appropriate just for buyers with excessive threat tolerance.

The query now’s whether or not buyers can nonetheless discover worth in HDSN inventory after its current sturdy rally.

Because of the American Innovation and Manufacturing (AIM) Act, Hudson Applied sciences anticipates speedy progress in income over the subsequent few years. As well as, the corporate anticipates a gross margin of 35%, and when factoring in its common historic valuation, there may be nonetheless room for inventory value appreciation.

Firm Overview

American Hudson Applied sciences Inc. supplies refrigerant providers. Its main market is the industrial sector, the place its merchandise are put in in HVAC, processing, and refrigeration items. Merchandise supplied by the agency comprise system decontamination through the RefrigerantSide service, in addition to refrigerant and industrial gases, refrigerant administration providers, and RefrigerantSide providers. These are carried out on the buyer’s location with the assistance of its Zugibeast system, a speedy and transportable system that permits the R-Aspect providers workforce to hurry up vital providers whereas saving prospects time, cash, and problem. Moreover, the ability’s refrigeration methods and different power methods make use of the corporate’s real-time monitoring service.

AIM Act Will Enhance Income

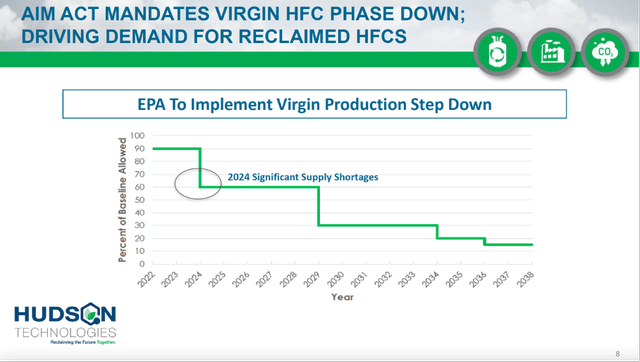

AIM Act Mandates Virgin HFC Section Down. (Hudson Applied sciences’ 3Q22 Investor Presentation)

Hudson has lengthy been an business chief in facilitating and implementing sustainable refrigerant administration. The USA Environmental Safety Company (EPA) is engaged on sustainable refrigerant administration as a result of local weather change is a significant concern in at this time’s world.

The EPA is implementing the AIM Act, which grants new authority in 3 ways:

To part down the manufacturing and consumption of listed HFCs. Handle these HFCs and their substitutes. Facilitate the transition to next-generation applied sciences.

In 2022 and 2023, the AIM Act mandates a ten% lower in virgin HFC manufacturing and consumption, with an additional 40% lower from the baseline in 2024. Compared to the R-22 phase-out, which happened a couple of years in the past, the reductions mandated by the Act are rather more impactful and speedy. Decreased virgin manufacturing boosts demand for recycled refrigerants. Though the transition to utilizing recycled refrigerants will not occur in a single day, it is anticipated that greater than 100 million HFC home equipment can be in use all over the world by 2020.

The transition to conformity with the AIM Act has begun, with this yr marking the start of compliance.

Due to this fact, Hudson is in a first-rate place to satisfy the anticipated HFC provide hole with reclaimed refrigerants as virgin manufacturing is phased down, as it’s the main reclaimer with the quickest state-of-the-art expertise and many years of proprietary information.

The corporate can be exploring partnership alternatives in response to compliance and points proposed by some states and the federal authorities, all of that are associated to the AIM Act.

The state of California mandates that unique tools producers (OEMs) use a minimum of 10% reclaimed refrigerant within the manufacturing facility charged tools, and Hudson Applied sciences has been very vocal about this requirement. Using recycled HFCs is being thought-about for necessary regulation in a variety of different states as properly.

With an estimated 35% market share, Hudson Applied sciences is in a first-rate place to provide reclaimed refrigerant to the present tools base as virgin HFC manufacturing is phased out, and to additionally turn out to be an OEM-level provider for brand new tools. The enterprise has been round for many years and has efficiently accomplished a number of phasedowns of various kinds of refrigerants. Due to this fact, the supply of reclaimed HFCs to bridge the discount in virgin provide is essential to making sure a easy transition to low GWP refrigerants and tools.

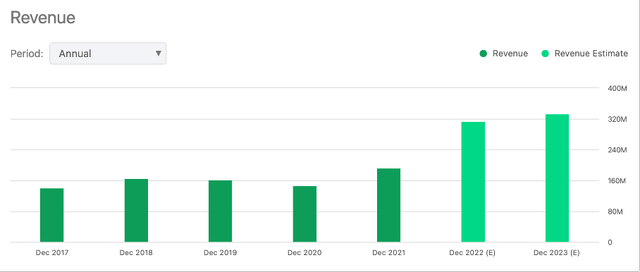

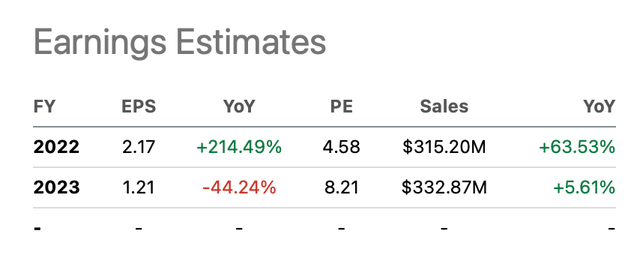

Analysts predict wholesome income progress within the years forward. It’s anticipated that revenues will rise by 64% from 2022 ranges, and EPS will rise to $2.17. By 2025, Hudson Applied sciences expects to have grossed over $400 million in income and keep a gross margin of round 35 %. The AIM Act has supplied the impetus for this sturdy progress, which can profit each buyers and finish customers of reclaimed refrigerant.

Income (Hudson Expertise’ Searching for Alpha Ticker Web page) Earnings Estimate (HDSN Searching for Alpha Ticker Web page)

The Inventory Is Nonetheless Undervalued

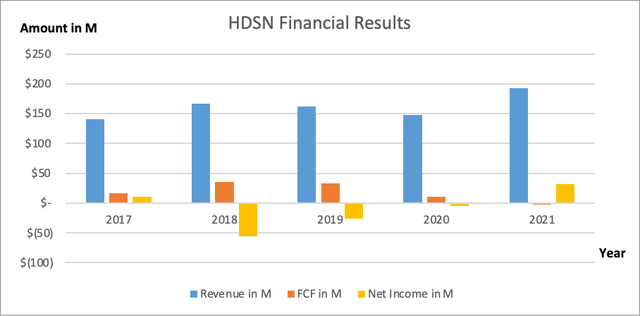

The monetary outcomes of Hudson Applied sciences have been a bit unstable over the previous few years, with adverse free money circulate in 2020 and 2021. Within the third quarter of 2022, we’re seeing an uptick in gross sales, with a 48% enhance in comparison with the identical interval final yr. The administration is assured in continued speedy enlargement.

Hudson Expertise Monetary Outcomes (SEC and creator’s personal graphical illustration)

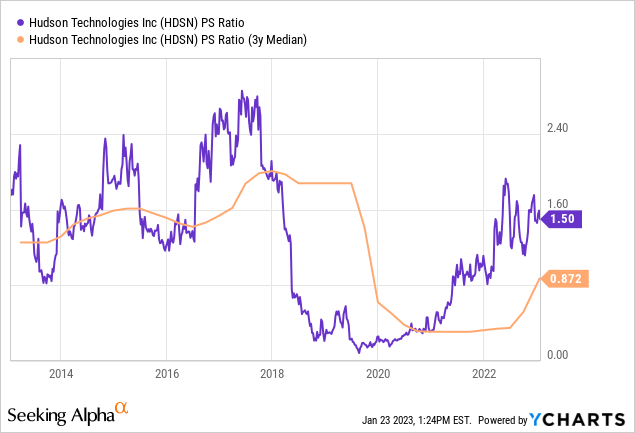

HDSN inventory’s value to gross sales ratio is graphed to achieve perspective on its valuation. The value to gross sales ratio is chosen due to the corporate’s 2025 income purpose that has been set.

The present value to gross sales ratio is bigger than the three-year common ratio, indicating that the corporate is buying and selling at a barely larger valuation.

The three-year median value to gross sales ratio was round 1.6 previous to the market crash of 2020. By multiplying Hudson’s 2025 (estimated) income by the median P/S ratio of 1.6, we get a market cap of $640M. On the present market cap of $450M, this represents a possible return of 42% over the subsequent three years (at a median annual fee of 12.5%). Regardless of the current value rally, HDSN inventory remains to be undervalued.

Conclusion

The share value of Hudson Applied sciences, Inc. has skilled a curler coaster experience just lately, reaching an all-time excessive. The inventory is, subsequently, appropriate just for buyers with excessive threat tolerance. The transition to utilizing reclaimed refrigerants has begun, and Hudson Applied sciences is in a first-rate place to satisfy the anticipated provide hole as virgin manufacturing is phased out.

Hudson Applied sciences, Inc. can be exploring partnership alternatives in response to compliance and points proposed by some states and the federal authorities associated to the AIM Act. The AIM Act has supplied the impetus for this sturdy progress, which can profit each buyers and finish customers of reclaimed refrigerant. By 2025, Hudson Applied sciences expects to have grossed over $400 million in income and keep a gross margin of round 35 %. Hudson Applied sciences, Inc. administration is assured in continued speedy enlargement. Regardless of the current value rally, Hudson Applied sciences, Inc. inventory stays undervalued.