Paul Morigi

Should you’re conversant in my work then you must’ve labored out that I am an enormous Warren Buffett (Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B)) fan. Each time I point out or reference Warren, I virtually all the time confer with him as “Sir Warren.” By the way, Malcolm Gladwell has explored the idea of greatness and he argues that longevity is woefully undervalued, under-appreciated, and albeit an below reported facet of the evaluation of greatness. When it comes an incredible long run file of compounding capital, there isn’t a one higher than Sir Warren. Philip Fischer, Peter Lynch, and Invoice Miller all posted some distinctive stretches. And within the hedge fund world, people like Jim Rogers, Stan Druckenmiller, Invoice Ackman, Seth Klarman, and David Tepper are proper up there. There are additionally others inside the hedge fund world, with really spectacular data, however we’re expressly speaking concerning the rarefied air of the greats.

When it comes to broader markets, measured by the most important indices, 2022, 2000-2002, and 2008-2009 are related by way of unhealthy return outcomes, not less than for lengthy solely buyers, however dissimilar by way of the origins or drivers of these poor outcomes.

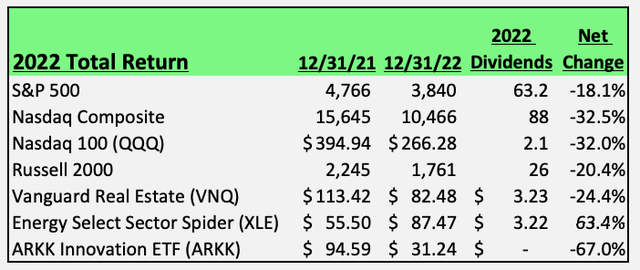

As I am positive most individuals are conscious, in 2022, the S&P 500 (SPY) was down 18.1%, the Nasdaq 100 (QQQ) down 32%, the Russell 2000 (IWM) down 20.4%, the extremely standard Vanguard Actual Property ETF (VNQ) down 24.4%, and Cathie Wooden’s ARK Innovation ETF (ARKK) down a whopping 67%. Bucking the development, although, was E&P vitality, and a proxy for that was the Vitality Choose Sector Spider ETF (XLE), which was up a blistering 63.4%!

Writer’s Chart

With that stated, the aim of as we speak’s piece is reminder readers, that aside from about maybe as soon as per decade, market timing would not actually work. Understandably, 2022 was exceptionally tough for many 60% shares / 40% bonds portfolios. Once you expertise a extremely nasty drawdown and defensive bonds do not act because the cushion, I can perceive why some individuals merely threw up their palms and wish to hand over. Or maybe, others pushed by recency bias and the emotionally scarring related to dwelling by way of a 2022, wish to make a 180-degree shift and alter ways.

Candidly, as a proxy for short-term popularism, I am see method too many trending articles on market timing. Inside the commentary threads, of those seemingly extremely standard market timing items, I am seeing a variety of “all or none approaches.” Individuals appear to suppose they will gracefully run between raindrops and transfer out and in of the market, whereas capturing these juicy returns and magically avoiding the nasty drawdowns.

Subsequently, and however the ridiculously heat January 2023 to-date, not less than right here within the Northeast, January tends to be a month of reflection, planning, and fascinated about the yr forward.

To that finish, my concern is that ache, skilled in 2022, was so acute, that many individuals’s visceral response may negatively affect the trajectory of their future outcomes.

To that finish, I took the time to overview Sir Warren Buffett’s treasure trove of annual shareholder letters. These letters are freely and available for anybody to learn. The one requirement is an Web connection, mental curiosity, time, and the flexibility to synthesize. As I am guessing most individuals do not have all 4 of these necessities, subsequently as a substitute, I took the time to share the overwhelming majority of related references, to the subject of “Market Timing” from the Berkshire Hathaway annual letter archives. On this iteration of this train, I am focusing solely on Sir Warren and Charlie Munger’s references, intelligent explanations, and ideas on the subject of “Market Timing.”

(To be clear, each single reference is a direct quote from the annual shareholder letter archives, organized by the yr.)

Sir Warren And Charlie’s Ideas On Market Timing

1978 Letter

We make no try and predict how safety markets will behave; efficiently forecasting quick time period inventory worth actions is one thing we expect neither we nor anybody else can do. Within the longer run, nevertheless, we really feel that lots of our main fairness holdings are going to be price significantly extra money than we paid, and that funding good points will add considerably to the working returns of the insurance coverage group.” We aren’t involved with whether or not the market shortly revalues upward securities that we imagine are promoting at cut price costs. Actually, we choose simply the other since, in most years, we count on to have funds out there to be a internet purchaser of securities. And constant engaging buying is prone to show to be of extra eventual profit to us than any promoting alternatives offered by a short-term run up in inventory costs to ranges at which we’re unwilling to proceed shopping for.

1980 Letter

After all, this translation of retained earnings into market worth appreciation is very uneven (it goes in reverse some years), unpredictable as to timing, and unlikely to materialize on a exact dollar-for-dollar foundation. And a foolish buy worth for a block of inventory in an organization can negate the consequences of a decade of earnings retention by that company. However when buy costs are smart, some long-term market recognition of the buildup of retained earnings virtually actually will happen. Periodically you even will obtain some frosting on the cake, with market appreciation far exceeding post-purchase retained earnings.

As a fast apart, and barely off matter, please see Sir Warren’s commentary on reinsurance and the parallels of chasing yield.

The reinsurance enterprise continues to mirror the excesses and issues of the first writers. Worse but, it has the potential for magnifying such excesses. Reinsurance is characterised by excessive ease of entry, massive premium funds prematurely, and much-delayed loss studies and loss funds. Initially, the morning mail brings lots of money and few claims. This state of affairs can produce a blissful, virtually euphoric, feeling akin to that skilled by an harmless upon receipt of his first bank card. The magnetic lure of such cash-generating traits, presently enhanced by the presence of excessive rates of interest, is remodeling the reinsurance market into “newbie night time”. And not using a tremendous disaster, business underwriting shall be poor within the subsequent few years. If we expertise such a disaster, there may very well be a massacre with some firms not in a position to dwell as much as contractual commitments. George Younger continues to do a first-class job for us on this enterprise. Outcomes, with funding earnings included, have been fairly worthwhile. We’ll retain an energetic reinsurance presence however, for the foreseeable future, we count on no premium development from this exercise.

1981 Letter

Whereas market values observe enterprise values fairly properly over lengthy durations, in any given yr the connection can gyrate capriciously. Market recognition of retained earnings additionally shall be inconsistently realized amongst firms. It is going to be disappointingly low or adverse in circumstances the place earnings are employed non- productively, and much better than dollar-for-dollar of retained earnings in circumstances of firms that obtain excessive returns with their augmented capital. Total, if a gaggle of non-controlled firms is chosen with affordable talent, the group end result ought to be fairly passable.

1982 Letter

Nonetheless, this very unevenness and irregularity provides benefits to the value-oriented purchaser of fractional parts of companies. This investor could choose from virtually the whole array of main American companies, together with many far superior to nearly any of the companies that may very well be purchased of their entirety in a negotiated deal. And fractional-interest purchases may be made in an public sale market the place costs are set by members with conduct patterns that typically resemble these of a military of manic-depressive lemmings. Inside this gigantic public sale area, it’s our job to pick out companies with financial traits permitting every greenback of retained earnings to be translated finally into not less than a greenback of market worth. Regardless of a variety of errors, we now have to date achieved this aim. In doing so, we now have been tremendously assisted by Arthur Okun’s patron saint for economists – St. Offset. In some circumstances, that’s, retained earnings attributable to our possession place have had insignificant and even adverse affect on market worth, whereas in different main positions a greenback retained by an investee company has been translated into two or extra {dollars} of market worth. Up to now, our company over- achievers have greater than offset the laggards. If we will proceed this file, it can validate our efforts to maximise “financial” earnings, whatever the affect upon “accounting” earnings. Our partial-ownership method may be continued soundly solely so long as parts of engaging companies may be acquired at engaging costs. We want a moderately-priced inventory market to help us on this endeavor. The market, just like the Lord, helps those that assist themselves. However, not like the Lord, the market doesn’t forgive those that know not what they do. For the investor, a too-high buy worth for the inventory of a wonderful firm can undo the consequences of a subsequent decade of favorable enterprise developments.

1983 Letter

One of many ironies of the inventory market is the emphasis on exercise. Brokers, utilizing phrases corresponding to “marketability” and “liquidity”, sing the praises of firms with excessive share turnover (those that can’t fill your pocket will confidently fill your ear). However buyers ought to perceive that what is nice for the croupier will not be good for the client. A hyperactive inventory market is the pickpocket of enterprise.

1985 Letter

Most institutional buyers within the early Seventies, however, regarded enterprise worth as of solely minor relevance once they have been deciding the costs at which they might purchase or promote. This now appears laborious to imagine. Nonetheless, these establishments have been then below the spell of teachers at prestigious enterprise colleges who have been preaching a newly-fashioned principle: the inventory market was completely environment friendly, and subsequently calculations of enterprise worth – and even thought, itself – have been of no significance in funding actions. (We’re enormously indebted to these teachers: what may very well be extra advantageous in an mental contest – whether or not it’s bridge, chess, or inventory choice than to have opponents who’ve been taught that pondering is a waste of vitality?).

1986 Letter

Widespread shares, in fact, are probably the most enjoyable. When situations are proper that’s, when firms with good economics and good administration promote properly beneath intrinsic enterprise worth – shares typically present grand-slam dwelling runs. However we presently discover no equities that come near assembly our assessments. This assertion under no circumstances interprets right into a inventory market prediction: we do not know – and by no means have had – whether or not the market goes to go up, down, or sideways within the near- or intermediate time period future. What we do know, nevertheless, is that occasional outbreaks of these two super-contagious illnesses, worry and greed, will ceaselessly happen within the funding neighborhood. The timing of those epidemics shall be unpredictable. And the market aberrations produced by them shall be equally unpredictable, each as to length and diploma. Subsequently, we by no means attempt to anticipate the arrival or departure of both illness. Our aim is extra modest: we merely try and be fearful when others are grasping and to be grasping solely when others are fearful.

1987 Letter

When investing, we view ourselves as enterprise analysts – not as market analysts, not as macroeconomic analysts, and never at the same time as safety analysts. Our method makes an energetic buying and selling market helpful, because it periodically presents us with mouth-watering alternatives. However not at all is it important: a protracted suspension of buying and selling within the securities we maintain wouldn’t hassle us any greater than does the dearth of every day quotations on World E book or Fechheimer. Finally, our financial destiny shall be decided by the financial destiny of the enterprise we personal, whether or not our possession is partial or whole. Ben Graham, my pal and trainer, way back described the psychological angle towards market fluctuations that I imagine to be most conducive to funding success. He stated that you must think about market quotations as coming from a remarkably accommodating fellow named Mr. Market who’s your companion in a personal enterprise. With out fail, Mr. Market seems every day and names a worth at which he’ll both purchase your curiosity or promote you his. Although the enterprise that the 2 of you personal could have financial traits which can be steady, Mr. Market’s quotations shall be something however. For, unhappy to say, the poor fellow has incurable emotional issues. At occasions he feels euphoric and may see solely the favorable elements affecting the enterprise. When in that temper, he names a really excessive buy-sell worth as a result of he fears that you’ll snap up his curiosity and rob him of imminent good points. At different occasions he’s depressed and may see nothing however hassle forward for each the enterprise and the world. On these events he’ll title a really low worth, since he’s terrified that you’ll unload your curiosity on him. Mr. Market has one other endearing attribute: He would not thoughts being ignored. If his citation is uninteresting to you as we speak, he shall be again with a brand new one tomorrow. Transactions are strictly at your possibility. Underneath these situations, the extra manic- depressive his conduct, the higher for you. The worth of market esoterica to the patron of funding recommendation is a special story. In my view, funding success is not going to be produced by arcane formulae, laptop applications or indicators flashed by the value conduct of shares and markets. Somewhat an investor will succeed by coupling good enterprise judgment with a capability to insulate his ideas and conduct from the super-contagious feelings that swirl concerning the market. In my very own efforts to remain insulated, I’ve discovered it extremely helpful to maintain Ben’s Mr. Market idea firmly in thoughts. Following Ben’s teachings, Charlie and I let our marketable equities inform us by their working outcomes – not by their every day, and even yearly, worth quotations – whether or not our investments are profitable. The market could ignore enterprise success for some time, however finally will verify it. As Ben stated: “Within the quick run, the market is a voting machine however in the long term it’s a weighing balance.” The pace at which a enterprise’s success is acknowledged, moreover, will not be that necessary so long as the corporate’s intrinsic worth is growing at a passable price. Actually, delayed recognition may be a bonus: It might give us the prospect to purchase extra of a great factor at a cut price worth. Typically, in fact, the market could decide a enterprise to be extra beneficial than the underlying information would point out it’s. In such a case, we’ll promote our holdings. Typically, additionally, we’ll promote a safety that’s pretty valued and even undervalued as a result of we require funds for a nonetheless extra undervalued funding or one we imagine we perceive higher. We have to emphasize, nevertheless, that we don’t promote holdings simply because they’ve appreciated or as a result of we now have held them for a very long time. (Of Wall Road maxims probably the most silly could also be “You may’t go broke taking a revenue.”) We’re fairly content material to carry any safety indefinitely, as long as the possible return on fairness capital of the underlying enterprise is passable, administration is competent and sincere, and the market doesn’t overvalue the enterprise. Following Ben’s teachings, Charlie and I let our marketable equities inform us by their working outcomes – not by their every day, and even yearly, worth quotations – whether or not our investments are profitable. The market could ignore enterprise success for some time, however finally will verify it. As Ben stated: “Within the quick run, the market is a voting machine however in the long term it’s a weighing balance.” The pace at which a enterprise’s success is acknowledged, moreover, will not be that necessary so long as the corporate’s intrinsic worth is growing at a passable price. Actually, delayed recognition may be a bonus: It might give us the prospect to purchase extra of a great factor at a cut price worth. The disadvantages of proudly owning marketable securities are typically offset by an enormous benefit: Often the inventory market provides us the prospect to purchase non-controlling items of extraordinary companies at really ridiculous costs – dramatically beneath these commanded in negotiated transactions that switch management. For instance, we bought our Washington Publish inventory in 1973 at $5.63 per share, and per-share working earnings in 1987 after taxes have been $10.30. Equally, Our GEICO inventory was bought in 1976, 1979 and 1980 at a mean of $6.67 per share, and after-tax working earnings per share final yr have been $9.01. In circumstances corresponding to these, Mr. Market has confirmed to be a mighty good pal.

1988 Letter

One nice cause is that our money holdings are down – as a result of our place in equities that we count on to carry for a really very long time is considerably up. As common readers of this report know, our new commitments aren’t based mostly on a judgment about short-term prospects for the inventory market. Somewhat, they mirror an opinion about long-term enterprise prospects for particular firms. We do not need, by no means have had, and by no means can have an opinion about the place the inventory market, rates of interest, or enterprise exercise shall be a yr from now. The previous dialogue about arbitrage makes a small dialogue of “environment friendly market principle” (EMT) additionally appear related. This doctrine grew to become extremely trendy – certainly, virtually holy scripture in tutorial circles throughout the Seventies. Primarily, it stated that analyzing shares was ineffective as a result of all public details about them was appropriately mirrored of their costs. In different phrases, the market all the time knew all the pieces. As a corollary, the professors who taught EMT stated that somebody throwing darts on the inventory tables might choose a inventory portfolio having prospects simply pretty much as good as one chosen by the brightest, most hard-working safety analyst. Amazingly, EMT was embraced not solely by teachers, however by many funding professionals and company managers as properly. Observing accurately that the market was continuously environment friendly, they went on to conclude incorrectly that it was all the time environment friendly. The distinction between these propositions is night time and day. In my view, the continual 63-year arbitrage expertise of Graham-Newman Corp. Buffett Partnership, and Berkshire illustrates simply how silly EMT is. (There’s loads of different proof, additionally.) Whereas at Graham-Newman, I made a research of its earnings from arbitrage throughout the whole 1926-1956 lifespan of the corporate. Unleveraged returns averaged 20% per yr. Beginning in 1956, I utilized Ben Graham’s arbitrage ideas, first at Buffett Partnership after which Berkshire. Although I’ve not made an actual calculation, I’ve achieved sufficient work to know that the 1956-1988 returns averaged properly over 20%. (After all, I operated in an setting way more favorable than Ben’s; he had 1929-1932 to deal with.)

1990 Letter

Buyers who count on to be ongoing patrons of investments all through their lifetimes ought to undertake an identical angle towards market fluctuations; as a substitute many illogically turn out to be euphoric when inventory costs rise and sad once they fall. They present no such confusion of their response to meals costs: Realizing they’re ceaselessly going to be patrons of meals, they welcome falling costs and deplore worth will increase. (It is the vendor of meals who would not like declining costs.) Equally, on the Buffalo Information we might cheer decrease costs for newsprint – though it might imply marking down the worth of the massive stock of newsprint we all the time hold available – as a result of we all know we’re going to be perpetually shopping for the product.

Equivalent reasoning guides our fascinated about Berkshire’s investments. We shall be shopping for companies – or small components of companies, referred to as shares – yr in, yr out so long as I dwell (and longer, if Berkshire’s administrators attend the seances I’ve scheduled). Given these intentions, declining costs for companies profit us, and rising costs harm us.

The commonest reason for low costs is pessimism – typically pervasive, typically particular to an organization or business. We wish to do enterprise in such an setting, not as a result of we like pessimism however as a result of we like the costs it produces. It is optimism that’s the enemy of the rational purchaser.

None of this implies, nevertheless, {that a} enterprise or inventory is an clever buy just because it’s unpopular; a contrarian method is simply as silly as a follow-the-crowd technique. What’s required is pondering slightly than polling. Sadly, Bertrand Russell’s commentary about life generally applies with uncommon power within the monetary world: “Most males would slightly die than suppose. Many do.”

1991 Letter

An method of this type will power the investor to consider long-term enterprise prospects slightly than short-term inventory market prospects, a perspective probably to enhance outcomes. It is true, in fact, that, in the long term, the scoreboard for funding selections is market worth. However costs shall be decided by future earnings. In investing, simply as in baseball, to place runs on the scoreboard one should watch the enjoying subject, not the scoreboard.

1992 Letter

Our equity-investing technique stays little modified from what it was fifteen years in the past, once we stated within the 1977 annual report: “We choose our marketable fairness securities in a lot the way in which we might consider a enterprise for acquisition in its entirety. We wish the enterprise to be one (a) that we will perceive; (b) with favorable long-term prospects; (c) operated by sincere and competent individuals; and (d) out there at a really engaging worth.” We’ve seen trigger to make just one change on this creed: Due to each market situations and our dimension, we now substitute “a lovely worth” for “a really engaging worth.” The rationale has to do with the way in which costs are set in every occasion. The secondary market, which is periodically dominated by mass folly, is consistently setting a “clearing” worth. Irrespective of how silly that worth could also be, it is what counts for the holder of a inventory or bond who wants or needs to promote, of whom there are all the time going to be a couple of at any second. In lots of cases, shares price x in enterprise worth have offered out there for 1/2x or much less. The brand new-issue market, however, is dominated by controlling stockholders and companies, who can often choose the timing of choices or, if the market appears to be like unfavorable, can keep away from an providing altogether. Understandably, these sellers aren’t going to supply any bargains, both by the use of a public providing or in a negotiated transaction: It is uncommon you may discover x for 1/2x right here. Certainly, within the case of common-stock choices, promoting shareholders are sometimes motivated to unload solely once they really feel the market is overpaying. (These sellers, in fact, would state that proposition considerably otherwise, averring as a substitute that they merely resist promoting when the market is underpaying for his or her items.)

1993 Letter

Let me add a lesson from historical past: Coke went public in 1919 at $40 per share. By the tip of 1920 the market, coldly reevaluating Coke’s future prospects, had battered the inventory down by greater than 50%, to $19.50. At yearend 1993, that single share, with dividends reinvested, was price greater than $2.1 million. As Ben Graham stated: “Within the short-run, the market is a voting machine – reflecting a voter-registration take a look at that requires solely cash, not intelligence or emotional stability – however within the long- run, the market is a weighing balance.”

1995 Letter

There isn’t any cause to do handsprings over 1995’s good points. This was a yr wherein any idiot might make a bundle within the inventory market. And we did. To paraphrase President Kennedy, a rising tide lifts all yachts. Another little bit of historical past: I first grew to become serious about Disney (DIS) in 1966, when its market valuation was lower than $90 million, though the corporate had earned round $21 million pre-tax in 1965 and was sitting with more money than debt. At Disneyland, the $17 million Pirates of the Caribbean experience would quickly open. Think about my pleasure – an organization promoting at solely 5 occasions rides! Duly impressed, Buffett Partnership Ltd. purchased a major quantity of Disney inventory at a split-adjusted worth of 31› per share. That call could seem sensible, provided that the inventory now sells for $66. However your Chairman was as much as the duty of nullifying it: In 1967 I offered out at 48› per share.

1996 Letter

I emphasize this lugubrious level as a result of I’d not need you to panic and promote your Berkshire inventory upon listening to that some massive disaster had price us a major quantity. Should you would are likely to react that method, you shouldn’t personal Berkshire shares now, simply as you must fully keep away from proudly owning shares if a crashing market would lead you to panic and promote. Promoting effective companies on “scary” information is often a nasty determination. (Robert Woodruff, the enterprise genius who constructed Coca-Cola (KO) over many many years and who owned an enormous place within the firm, was as soon as requested when it could be a great time to promote Coke inventory. Woodruff had a easy reply: “I do not know. I’ve by no means offered any.”) To take a position efficiently, you needn’t perceive beta, environment friendly markets, fashionable portfolio principle, possibility pricing or rising markets. Chances are you’ll, in actual fact, be higher off realizing nothing of those. That, in fact, will not be the prevailing view at most enterprise colleges, whose finance curriculum tends to be dominated by such topics. In our view, although, funding college students want solely two well-taught programs – The right way to Worth a Enterprise, and The right way to Suppose About Market Costs. Your aim as an investor ought to merely be to buy, at a rational worth, a component curiosity in an easily-understandable enterprise whose earnings are nearly sure to be materially greater 5, ten and twenty years from now. Over time, you can see just a few firms that meet these requirements – so once you see one which qualifies, you should purchase a significant quantity of inventory. You could additionally resist the temptation to stray out of your tips: Should you aren’t prepared to personal a inventory for ten years, do not even take into consideration proudly owning it for ten minutes. Put collectively a portfolio of firms whose combination earnings march upward over time, and so additionally will the portfolio’s market worth.

1997 Letter

Given our achieve of 34.1%, it’s tempting to declare victory and transfer on. However final yr’s efficiency was no nice triumph: Any investor can chalk up massive returns when shares soar, as they did in 1997. In a bull market, one should keep away from the error of the preening duck that quacks boastfully after a torrential rainstorm, pondering that its paddling abilities have precipitated it to rise on the earth. A right-thinking duck would as a substitute examine its place after the downpour to that of the opposite geese on the pond.

A brief quiz: Should you plan to eat hamburgers all through your life and aren’t a cattle producer, do you have to want for greater or decrease costs for beef? Likewise, if you’ll purchase a automotive every now and then however aren’t an auto producer, do you have to choose greater or decrease automotive costs? These questions, in fact, reply themselves.

However now for the ultimate examination: Should you count on to be a internet saver throughout the subsequent 5 years, do you have to hope for the next or decrease inventory market throughout that interval? Many buyers get this one mistaken. Although they’ll be internet patrons of shares for a few years to return, they’re elated when inventory costs rise and depressed once they fall. In impact, they rejoice as a result of costs have risen for the “hamburgers” they are going to quickly be shopping for. This response is not sensible. Solely those that shall be sellers of equities within the close to future ought to be glad at seeing shares rise. Potential purchasers ought to a lot choose sinking costs.

Although we do not try and predict the actions of the inventory market, we do strive, in a really tough method, to worth it. On the annual assembly final yr, with the Dow at 7,071 and long-term Treasury yields at 6.89%, Charlie and I acknowledged that we didn’t think about the market overvalued if 1) rates of interest remained the place they have been or fell, and a couple of) American enterprise continued to earn the exceptional returns on fairness that it had not too long ago recorded. Up to now, rates of interest have fallen — that is one requisite glad — and returns on fairness nonetheless stay exceptionally excessive. In the event that they keep there — and if rates of interest maintain close to current ranges — there isn’t a cause to think about shares as typically overvalued. However, returns on fairness aren’t a positive factor to stay at, and even close to, their current ranges.

In the summertime of 1979, when equities appeared low cost to me, I wrote a Forbes article entitled “You pay a really excessive worth within the inventory marketplace for a cheery consensus.” At the moment skepticism and disappointment prevailed, and my level was that buyers ought to be glad of the actual fact, since pessimism drives down costs to actually engaging ranges. Now, nevertheless, we now have a really cheery consensus. That doesn’t essentially imply that is the mistaken time to purchase shares: Company America is now incomes far extra money than it was just some years in the past, and within the presence of decrease rates of interest, each greenback of earnings turns into extra beneficial. Immediately’s worth ranges, although, have materially eroded the “margin of security” that Ben Graham recognized because the cornerstone of clever investing.

1999 Letter

If we now have a energy, it’s in recognizing once we are working properly inside our circle of competence and once we are approaching the perimeter. Predicting the long-term economics of firms that function in fast-changing industries is solely far past our perimeter. If others declare predictive talent in these industries — and appear to have their claims validated by the conduct of the inventory market — we neither envy nor emulate them. As an alternative, we simply stick to what we perceive. If we stray, we can have achieved so inadvertently, not as a result of we received stressed and substituted hope for rationality. Happily, it is virtually sure there shall be alternatives every now and then for Berkshire to do properly inside the circle we have staked out.

2008 Letter

Moreover, the market worth of bonds and shares that we proceed to carry suffered a major decline together with the overall market. This doesn’t hassle Charlie and me. Certainly, we take pleasure in such worth declines if we now have funds out there to extend our positions. Way back, Ben Graham taught me that “Worth is what you pay; worth is what you get.”

2009 Letter

Final yr we noticed, in a single occasion, how sound-bite reporting can go mistaken. Among the many 12,830 phrases within the annual letter was this sentence: “We’re sure, for instance, that the financial system shall be in shambles all through 2009 – and doubtless properly past – however that conclusion doesn’t inform us whether or not the market will rise or fall.” Many information organizations reported – certainly, blared – the primary a part of the sentence whereas making no point out in any respect of its ending. I regard this as horrible journalism: Misinformed readers or viewers could properly have thought that Charlie and I have been forecasting unhealthy issues for the inventory market, although we had not in that sentence, however elsewhere, made it clear we weren’t predicting the market in any respect.

2010 Letter

Market worth and intrinsic worth typically observe very totally different paths – typically for prolonged durations – however finally they meet.

2011 Letter

Over the previous 15 years, each Web shares and homes have demonstrated the extraordinary excesses that may be created by combining an initially smart thesis with well-publicized rising costs. In these bubbles, a military of initially skeptical buyers succumbed to the “proof’ delivered by the market, and the pool of patrons – for a time – expanded sufficiently to maintain the bandwagon rolling. However bubbles blown massive sufficient inevitably pop. After which the outdated proverb is confirmed as soon as once more: “What the clever man does at first, the fools does in the long run.”

2013 Letter

Certainly, who has ever benefited throughout the previous 237 years by betting in opposition to America? Should you examine our nation’s current situation to the prevailing within the 1776, you must rub your eyes in marvel. And the dynamism embedded in our market financial system will proceed to work its magic. America’s greatest days lie forward. House owners of inventory, nevertheless, too typically let capricious and sometimes irrational conduct of their fellow homeowners trigger them to behave irrationally as properly. As a result of there’s a lot chatter about markets, the financial system, rates of interest, worth conduct of shares, and so on.., some buyers imagine it is very important take heed to pundits – and, worse but, necessary to think about appearing upon their feedback.

2014 Letter

Buyers, in fact, can, by their very own conduct, make inventory possession extremely dangerous. And lots of do. Lively buying and selling, makes an attempt to “time” market actions, insufficient diversification, the cost of excessive and pointless charges to managers and advisors, and using borrowed cash can destroy the respectable returns {that a} life-long homeowners of equities would in any other case take pleasure in. Certainly, borrowed cash has no place within the investor’s device equipment. Something can occur anytime in markets. And no advisor, economist, or TV commentator – and undoubtedly not Charlie nor I – can inform you when chaos will happen. Market forecasters will fill your ear however by no means fill your pockets.

2016 Letter

Additional complicating the seek for the uncommon high-fee supervisor who’s price his or her pay is the truth that some funding professionals, simply as some amateurs, shall be fortunate over quick durations. If 1,000 managers make a market prediction at the start of the yr, it’s extremely probably the calls of not less than one shall be appropriate for 9 consecutive years. After all, 1,000 moneys can be simply prone to produce a seemingly all-wise prophet. However there would stay a distinction: The fortunate monkey wouldn’t discover individuals standing in line to investing with him.

2017 Letter

Charlie and I view marketable widespread shares that Berkshire owns as pursuits in companies, not as ticker symbols to be purchased and offered based mostly on their “chart” patterns, the “goal” costs of analysts or the opinions of media pundits. As an alternative, we merely imagine that if the companies of the invests are profitable (as we imagine most shall be) our investments shall be profitable as properly.

2018 Letter

My expectation of extra inventory purchases will not be a market name. Charlie and I do not know as to how shares will behave subsequent week or subsequent yr. Predictions of that kind have by no means been part of our actions. Our pondering, slightly, is concentrated on calculating whether or not a portion of a pretty enterprise is price greater than its market worth.

2019 Letter

Charlie and I don’t view the $248 billion detailed above as a group of inventory market wagers – dalliances to be terminated due to downgrades by “the Road,” an earnings “miss,” anticipated Federal Reserve actions, doable political developments, forecasts by economists or no matter else could be the topic du jour.

2020 Letter

The tens of tens of millions of different buyers and speculators in the US and elsewhere have all kinds of equities decisions to suit their tastes. This can discover CEOs and market gurus with attractive concepts. If they need worth targets, managed earnings and “tales,” they won’t lack suitors. “Technicians” will confidently instruct them as to what some wiggles on a chart portend for a inventory’s subsequent transfer. The requires motion won’t ever cease.

Placing It All Collectively

Sir Warren is probably the most profitable worth investor and allocator of capital in historical past. This file and longevity speaks for themselves. Given his extraordinary success, he has very generously shared his sensible insights and laborious fought classes, acquired together with the way in which, from the varsity of laborious knocks. That stated, given this self-discipline, unquenchable mental curiosity, and keenness, he discovered very fast from a couple of costly mis-adventures, and course corrected.

Though I’ve nowhere near the quantity of expertise of Sir Warren, and I actually do not have entry to the kind of long run and affected person capital both, we will all be taught from his annual letters. I’d argue that method too many individuals are getting too distracted, misplaced even, and maybe getting swept up within the folly that market timing works. Sure, it might probably work, and on the extremes, corresponding to 2000 – 2002, 2008- 2009, and in 2022, you may appear like a genius. That stated, in case you’re really dedicated and engaged within the pursuit of changing into a greater investor and attempting to successfully allocator your capital, then market timing ought to be in your repertoire. I expressly wrote this piece to assist re-orient individuals again on the yellow brick street. And bear in mind, market timing, over lengthy stretches, would not work, and it’s a great waste of your treasured bandwidth.

In closing, I hope by spending plenty of hours combing by way of Sir Warren’s treasure trove of Annual Letters, that I offered sufficient empirical proof that neither he nor Charlie Munger put any inventory within the concept of market timing. And I’d argue nor do you have to.