Vera Bracha

Overview

The purchase case for AdaptHealth (NASDAQ:AHCO) is predicated on the expansion of the house medical tools [HME] trade, which is projected to succeed in $62.1 billion by 2030. This development is pushed by components resembling an getting older inhabitants and the rising prevalence of power illnesses, which spotlight the necessity for suppliers like AHCO to ship high-quality medical instruments on to sufferers’ houses.

Enterprise description

AHCO is a significant provider of medical provides, residence healthcare tools, and different related companies in the USA. AHCO gives its companies to expert nursing amenities, sleep labs, ambulatory care facilities, and hospitals.

The house medical tools trade is rising

The HME sector offers in offering important medical merchandise and ongoing provide companies to sufferers within the consolation of their very own houses, with the objective of enhancing their high quality of life. Sufferers with a number of, long-term well being points can regain a number of the independence they’d to surrender after they entered institutional care because of the HME sector. Whereas the healthcare sector has traditionally targeted on outpatient care and fewer extreme situations, developments in expertise have made the inpatient care of extra critical situations extra accessible and reasonably priced. Due to this, the main focus of the sector has shifted to superior acute diseases.

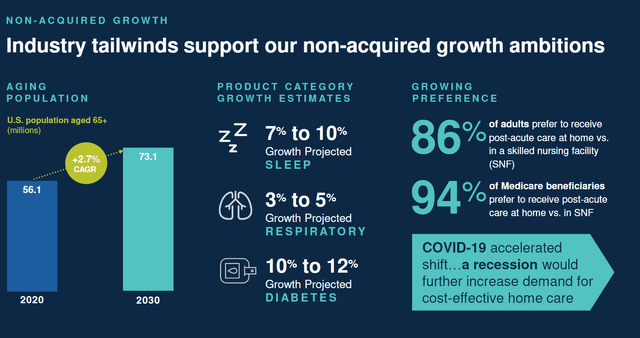

The HME market is predicted to succeed in $62.1 billion by 2030, based mostly on analysis carried out by trade specialists. Expenditures on in-house long-term companies and helps appear prone to be a significant factor on this. This growth is being pushed by just a few various factors.

An getting older inhabitants is the first issue. In the USA, the variety of individuals aged 65 and up is projected to maintain rising. In 2030, the US census predicts, individuals aged 65 and older will make up 21% of the inhabitants, up from 15% at present. This growth highlights the necessity for suppliers like AHCO to ship high-quality medical instruments on to sufferers’ houses, the place they can be utilized to hurry restoration and cut back hospital stays. The prevalence of power illnesses additionally rises because the inhabitants ages. HME is essential in helping with the therapy of significant well being issues affecting tens of millions of People. I anticipate an increase in provider demand inside the HME sector because the prevalence of those situations continues to rise.

Jan’23 presentation

AHCO presents a novel platform

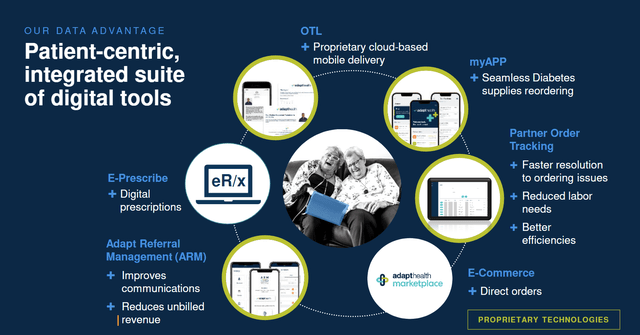

In my view, AHCO has a leg up on the competitors within the HME market because of the built-in expertise system it has developed over the previous few years. The AHCO built-in platform stands out from the competitors by automating processes which are historically handbook, error-prone, and inefficient. Physicians and insurance coverage firms have an interest within the platform due to its user-friendliness, enhanced compliance, and automatic, complete workflow for offering care. As well as, I consider that digital prescribing options will improve openness, whereas reducing each scientific errors and delays. All of this has a real-world affect as a result of it implies that sufferers can anticipate faster service from their healthcare suppliers after inserting an order. The mannequin’s scalability additionally means it might again up AHCO’s deliberate natural development and facilitate the well timed integration of any acquisitions.

To sum up, I feel AHCO’s capacity to put money into a cutting-edge expertise platform units them other than rivals who’re caught utilizing antiquated, handbook processes as a result of they lack the funds to improve their infrastructure.

Jan’23 presentation

Nationwide protection

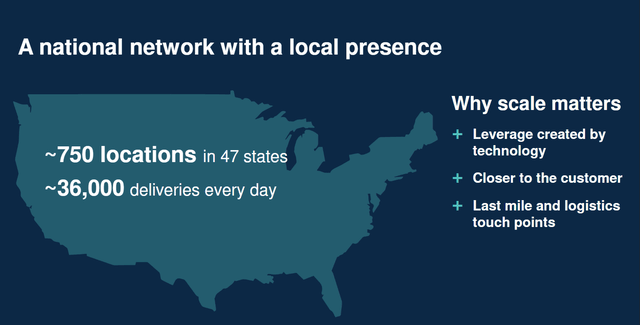

By way of its relationships with giant distribution gamers, AHCO is ready to provide drop delivery of HME merchandise on to affected person’s residence inside a brief discover interval. AHCO’s nationwide attain and skill to serve sufferers ought to make it interesting to payers, in my view. To date, AHCO has efficiently established relationships with a number of payors, together with main nationwide insurers. In contrast to lots of its rivals, the AHCO can provide higher charges to the overwhelming majority of potential sufferers because of its intensive payor community. In consequence, extra sufferers, suppliers, and amenities would have the ability to reap the benefits of AHCO’s choices, strengthening the corporate as an entire.

Moreover, AHCO has a big distribution community, with 750 places that may make 36,000 deliveries day by day. The important thing right here is that AHCO has positioned a variety of smaller depots throughout the nation in optimum positions to assist its supply fleet, taking into consideration tools quantity and drive occasions.

Jan’23 presentation

M&A method

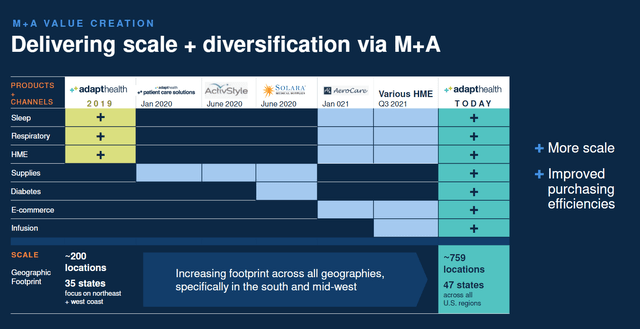

Along with its natural growth, AHCO’s platform additionally options modular and unified front- and back-office processes that help within the easy integration of acquisitions and the conclusion of price synergies. If we have a look at AHCO’s previous, we are able to see that it has proven it might put its cash the place its mouth is by way of acquisitions, having spent tons of of tens of millions on greater than five-dozen offers since its inception. As AHCO expands, I anticipate that it’s going to proceed to put money into growth by buying and integrating bigger targets.

The corporate has said an annual income development objective of at the very least $100 million from M&A (2Q22 earnings), and the variety of offers carried out since 2020 clearly illustrates AHCO capacity to hit these development targets.

Jan’23 presentation

AHCO deep pool of shoppers is a bonus

An underappreciated side of AHCO’s story is the truth that they’ve helped near 4 million sufferers thus far. My opinion is that AHCO has a large platform from which to extend their TAM and seize alternatives for supplemental income by capitalizing on their entry to sufferers. That is very true as administration continues to implement its 2.0 plan, which includes shifting care away from hospitals and into individuals’s houses. Essentially the most notable areas the place I see room for enchancment and potential synergies with AHCO’s present enterprise choices are in residence infusion and affected person acquisitions.

Pre-released steering seemed good

Administration has reiterated their This fall and FY23 pre-released steering, which requires natural internet income development of 8-10%. Administration anticipate Sleep and Diabetes provides to develop by 11-12%, whereas Respiratory, HME, and different provides will develop by 3-6%. 4Q income is predicted to be round $2.98B, with adjusted EBITDA forecast to be within the low finish of the beforehand established vary of $620M to $650M. The upper labor prices and a few of FY23’s bills pulled ahead are the primary components influencing administration’s EBITDA outlook for the fourth quarter. In my view, AHCO’s administration has taken a cautious method to steering this 12 months, taking into consideration the adverse results of 2022 of their projections for FY23.

Forecast

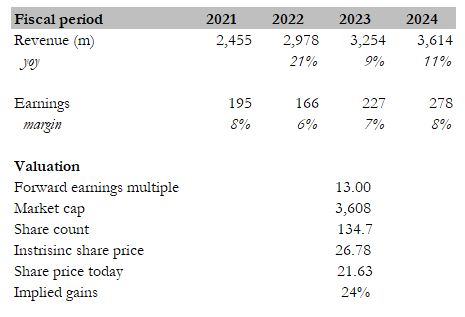

AHCO has a 24% upside, in my view. In keeping with my mannequin, it’s value $26.78 in FY23. The underlying secular development for the AHCO trade is as sure as it may be. In my view, it is just a matter of execution whether or not AHCO can proceed to execute and acquire extra market share to develop. This technique is relevant to each natural and inorganic alternatives. Additionally, administration reaffirming steering and outlining and assembly natural development targets is useful to the inventory.

In keeping with consensus estimates, AHCO ought to earn round $278 million in FY24. If we assume that AHCO will commerce on the identical ahead PE a number of in FY23, the inventory shall be value $26.78, or 24% extra.

Creator’s estimates

Key danger

Consolidation within the healthcare trade

A rising development within the insurance coverage trade over the previous few years has been the consolidation of well being care suppliers and insurance coverage firms. Because the medical insurance sector consolidates, insurers might acquire benefits in negotiations and {the marketplace}, resembling simpler entry to knowledge on claims, prices, and different metrics. It’s doable that the AHCO’s capacity to cut price for higher charges and phrases with medical insurance suppliers in some markets will endure because of this merger. Moreover, if bigger insurers discover value-based fee fashions to be financially helpful, this shift may very well be hastened.

Conclusion

The HME market is predicted to succeed in $62.1 billion by 2030, which is the inspiration for the funding case for AHCO. The getting older inhabitants and the rise in power illnesses are driving this growth, and so they present simply how necessary it’s for firms like AHCO to convey medical tools proper to sufferers’ doorways. When in comparison with its rivals, who nonetheless depend on time-consuming and error-prone handbook procedures, AHCO stands head and shoulders above the pack because of its progressive platform, which automates processes and improves compliance. Drop delivery sure HME merchandise on to sufferers’ houses can be doable because of the corporate’s nationwide protection and partnerships with nationwide healthcare distribution firms. Extra sufferers, suppliers, and amenities are in a position to reap the benefits of AHCO’s companies as a result of the group has established constructive relationships with a number of payors, together with main nationwide insurers. Along with with the ability to serve a bigger variety of prospects, the corporate’s 750 distribution facilities’ capability to course of 36,000 day by day deliveries will permit them to broaden their choices and enhance entry for extra individuals in want.