© Reuters. FILE PHOTO: Banknotes of Japanese yen are seen on this illustration image taken September 22, 2022. REUTERS/Florence Lo/Illustration/File Picture/File Picture

By Rae Wee

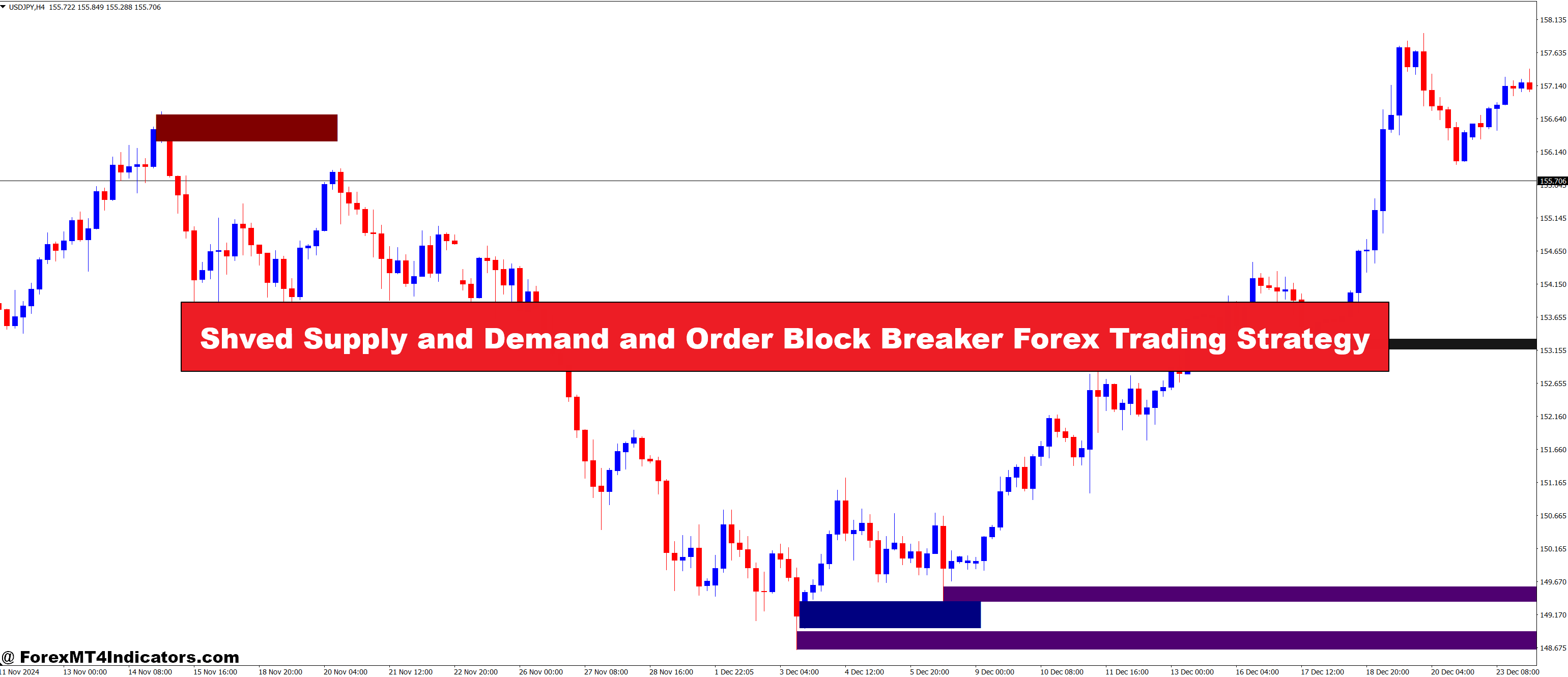

SINGAPORE (Reuters) – Japan’s yen, lengthy favoured as a safe-haven and funding forex, has in current weeks turn out to be so enmeshed in market hypothesis over central financial institution coverage that Wednesday’s determination to retain the established order set off the steepest yen fall in practically three years.

The yen dropped greater than 2% after the Financial institution of Japan stated it was sticking to its controversial yield management coverage, in defiance of market expectations of a tweak to its yield cap or different settings. These expectations had pushed a 14% rally within the yen prior to now three months. Within the bond market, the place the central financial institution has battled bond bears to defend its yield cap, the BOJ has purchased up so lots of Japan’s excellent 10-year authorities bonds that market liquidity has nearly dried up.

Speculators have seemed as a substitute to the yen, a neater goal the place their bets on BOJ coverage have induced huge swings and historic ranges of volatility.

Moh Siong Sim, forex strategist at Financial institution of Singapore, stated it was a query of when, not if, the BOJ shifts its ultra-dovish stance, and the market would proceed to check that by pushing the yen increased.

“For our shoppers, they consider the yen as a funding forex. That will need to shift,” Sim stated.

Till late final 12 months, the BOJ’s dovishness within the face of aggressive price rises by the Federal Reserve and different main central banks meant the yen was low-cost and weak, making it the right forex to borrow for investments.

However it’s not really easy now, Sim stated.

“A one-sided story is beginning to flip round, and now it entails a bit extra of a balancing act, between the low borrowing value and forex strikes.”

Because the yen rallied greater than 15% from October’s 32-year low of 151.94 per greenback to final week’s peak close to 127, volatility spiked. The in a single day volatility priced into yen choices is round a six-year excessive of 54%.

BIGGER YEN BETS

Analysts count on bets on the BOJ quickly abandoning its yield curve management coverage will get greater and louder, for quite a few causes.

Some buyers count on the central financial institution to make use of proof of rising inflation and a change of the guard on the BOJ in April as an excuse to make a transfer. Home buyers say the pressures of managing a extremely distorted yield curve and rising bond market dysfunction are ample motive for the BOJ to behave.

Most of that hypothesis must be channelled into the yen.

Tareck Horchani, head of dealing, prime brokerage, at Maybank Securities, stated macro funds have been shopping for by-product constructions and put choices on the dollar-yen pair, betting on the yen heading to 115 or 110.

Even fairness fund managers investing in Japan have stopped hedging their forex publicity within the hope of cashing in on yen appreciation, he stated. James Athey, an funding director at fund supervisor abrdn, has held an extended place on the yen for some time.

“We have been fairly well-positioned for the transfer in December from the BOJ. We had a major chubby on the Japanese yen, (and) within the aftermath, we took revenue on a few of our yen place,” Athey stated.

Rises in bond yields and the yen may create a vicious tailwind of fund repatriation flows into Japan, but some buyers count on the yen’s path increased will not comply with a straight line.

Amongst these watching from the sidelines are hedge funds that took successful on their short-yen trades, which have been vastly worthwhile for about 10 months of 2022 till a swift reversal within the yen in the previous few months.

“Macro hedge funds that misplaced cash within the last months of 2022 on their long-dollar positions are simply mildly positioned for a yen rally and are apprehensive a few sharp reversal,” stated Maybank’s Horchani.

Such uncertainty can be a problem for the allocations of inventory buyers, who benefited from a less expensive yen final 12 months as exports grew to become extra aggressive and plenty of Japanese corporations received an earnings increase, lifting the .

“The controversy round the way forward for BOJ coverage is way from settled,” stated Howard Smith, associate and portfolio supervisor at Indus Japan Methods.

Smith nonetheless sees worth in Japanese property and corporations because the yen heads for 120 per greenback, and even 110, however for now he’s solely partially unhedged in his fund’s long-short merchandise.