nicolas_/E+ by way of Getty Photographs

Affirm Might Lose Its Main Market Share Quickly

Affirm Holdings (NASDAQ:AFRM) could have introduced its partnership with Amazon (AMZN) with a giant bang in August 2021, particularly boosted by the improve to an unique BNPL service supplier by January 2023. The previous’s cost platform has been equally embedded in Amazon Pay’s US digital pockets since then, suggesting its large publicity to the e-commerce big’s Prime members.

This issues, since AMZN stays the main participant within the US e-commerce market, with 37.8% of the market share in June 2022. Notably, the corporate boasts 163.5M of US Prime members as of 2022, with a subscription price of $14.99 month-to-month or $139 yearly. Regardless of the supposed tightened discretionary spending over the previous few quarters, extra US customers have been selecting Amazon Prime at a fee of 77% by mid-2022, in comparison with 68% in 2021, and 69% choose shopping the e-commerce platform over solely 54% in 2021. 90% of its client stickiness can be attributed to the corporate’s enticing Prime Day reductions and free two-day delivery services.

With AFRM seeking to aggressively increase its consumer base and Gross Merchandise Quantity [GMV], it’s no marvel that it has been beneficiant with AMZN, giving the latter two tranches of warrants. To this point, $281M of bills had been recorded attributed to the e-commerce big. Curiously, the BNPL firm expects to comprehend as much as $133.5M of financial profit over the three.2-years of the industrial settlement. Assuming so, we’re taking a look at an approximate partnership expiry by the top of 2024, if not additional prolonged.

Based mostly on these phrases, AFRM could probably stay a long-term BNPL accomplice to the e-commerce big, although it stays to be seen if the exclusivity could also be prolonged from January 2023 onwards. Assuming not, we may even see a notable headwind in its ahead progress and client onboarding, regardless of its early successes to date.

Within the meantime, AFRM’s partnership with Walmart (WMT) seems shaky as effectively, with the latter’s fintech enterprise, One, reportedly providing an identical BNPL service by the retailer by 2023 onwards. That is on high of the earlier banking accounts provided to the retailer’s 1.7M staff since October 2022. For now, WMT solely studies a minimal ~12% e-commerce contribution to the US-based revenues of $412.1B over the LTM. Nonetheless, the quantity has been notably rising by leaps and bounds in comparison with the ~5% reported in 2019. As well as, since AFRM customers spent essentially the most at WMT and AMZN through the current Black Friday/Cyber Monday in 2022, it’s evident that One’s BNPL could cannibalize AFRM’s enterprise transferring ahead.

In the meantime, because the announcement of AFRM’s a number of partnerships, together with Peloton (PTON), Shopify (SHOP), Reserving (BKNG), amongst others, the corporate has recorded glorious progress in GMV by 62% YoY to $4.38B in FQ1’23. Lively customers have naturally elevated by 69% YoY to 14.7M on the similar time, with a median transaction progress per lively client of 43.4% YoY to three.3, respectively.

Subsequently, it’s unsurprising that AFRM’s quarterly revenues have additionally expanded by 34.2% YoY to $362M within the newest quarter, suggesting great tailwinds in client onboarding and spending. We reckon a part of the success is attributed to AMZN, WMT, and SHOP, which reported glorious gross sales/GMV of $502.1B, $600.1B, and $190.4B over the past twelve months, respectively.

As well as, market analysts be aware that AFRM stays essentially the most steadily used BNPL app within the US for eight consecutive months as of October 2022. The platform averages 2.9M month-to-month lively customers, rising by 81.2% YoY, partly attributed to the rising app downloads of 30% in Q3’22, in opposition to 25% in Q2’22. Notably, its direct competitor, Klarna (KLAR), recorded a contrasting decline from 40.6% in Q2’22 to 27.5% in Q3’22. It’s obvious that the previous’s aggressive market seize has been a terrific success.

Nonetheless, we stay involved about AFRM’s minimal profitability, regardless of its bettering gross margins. By FQ1’23, the corporate reported glorious gross margins of fifty.4%, rising by 8.8 proportion factors YoY. Nonetheless, its working margins have additionally declined by -17.9 factors YoY to -79.5%. Notably, it’s partly attributed to the elevated Inventory-Based mostly Compensation of $417.61M over the LTM, rising by 10% sequentially. Naturally, IPO buyers would have additionally been diluted by 24.6% since January 2021, additional exacerbated by the a number of warrants issued to AMZN and SHOP.

With market analysts anticipating AFRM to ship EPS of -$1.75 by FY2025, it’s no marvel the inventory continues to boast an elevated brief curiosity of 14.14%, regardless of the catastrophic plunge of -93.1% since November 2021.

So, Is AFRM Inventory A Purchase, Promote, or Maintain?

AFRM 1Y EV/Income and P/E Valuations

S&P Capital IQ

AFRM is at present buying and selling at an EV/NTM Income of three.17x and NTM P/E of -3.22x, decrease than its 2Y imply of 14.44x and -67.01x, respectively. Whereas its GMV and client base could develop organically, it stays to be seen how the corporate could cope if its present partnerships with AMZN and WMT are disrupted from 2023 onwards.

Solely time will inform, since AFRM’s client base can be reportedly extra more likely to default with supposedly decrease credit score scores of >550 being accepted, in opposition to SoFi’s (SOFI) stricter rating of >650. It’s unsurprising then, that the previous reported as much as $191.5M/7.1% of its loans as overdue within the newest quarter, in opposition to the latter’s weighted common of 5%. We predict the outperformance has contributed to SOFI’s eye-watering NTM P/E of -53.26x certainly, regardless of the height recessionary fears.

Nonetheless, we should additionally spotlight that the BNPL area stays speculative, because it primarily targets customers with decrease credit score scores. There’s a cause why the Financial institution of America typically requires a rating of >750 for the applying of bank cards, since it’s immediately attributed to the customers’ functionality in repaying their loans.

Even regulators, Shopper Monetary Safety Bureau [CFPB], are growingly involved about BNPL’s large penetration, since it’s a “potential for debt accumulation and overextension.” This explains why late funds and charges are more and more frequent for BNPL customers at 42% in 2022, in opposition to 10.5% in 2021 and seven.8% in 2020.

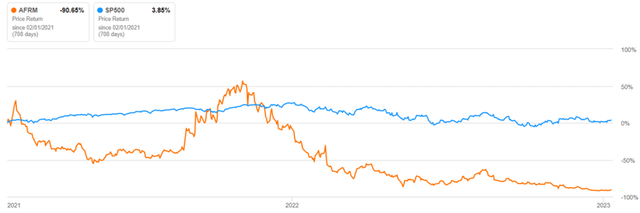

AFRM 2Y Inventory Worth

Looking for Alpha

As a consequence of AFRM’s lack of profitability by FY2025, it’s naturally troublesome to position a value goal on the inventory. There are additionally minimal tailwinds for restoration, with the Fed’s current assembly minutes suggesting raised terminal charges of above 5% by mid-2023. Lastly, a pivot could solely occur from 2024 onwards. In consequence, the extended curiosity pains could additional have an effect on the difficult funding setting and bearish market sentiment within the brief time period.

As a result of minimal profitability, elevated SBC bills, and lack of moat, the AFRM inventory could proceed declining by 2023, sadly. Subsequently, we choose to fee the inventory as a Maintain, since there’s a minimal margin of security right here in our view.