We notably needed to grasp gift-spending and buying round toys, and we additionally requested questions on vacation buying in probably the most common sense.

Under is a fast have a look at the survey outcomes throughout six key areas:

Let’s wrap-up the 2022 holidays collectively. Here is what you missed:

Wrapping It Up: Takeaways from the 2022 Vacation Procuring Season

HOLIDAY SPENDING

As we shared already already, early indications counsel vacation spending elevated year-over-year. Given the excessive inflation ranges, this will likely come as a positive shock to retailers and the manufacturers they promote?

However was it a shock for customers, too?

It appears that evidently approach.

Wanting again on their latest vacation spending, just about half (46%) mentioned they spent extra on items than anticipated or deliberate this yr, in comparison with 34% who spent much less. You’ll be able to see the breakdown:

Impulse purchases, it appears, might have had one thing to do with the last-minute enhance to vacation spending in 2022.

In our survey, totally 89% mentioned they made at the least one unplanned buy of a present this vacation season. Whereas solely 17% indicated that every one or most of their reward purchases have been impulsive in nature, 41% admitted that at the least “a number of” of their reward buys have been unplanned.

Did customers give any of this spending again within the type of merchandise returns? Returns are huge enterprise—although not precisely welcomed—simply after the vacations.

Greater than half (55%) of 1,170 households that acquired merchandise-gifts in 2022 mentioned they’d not be returning any of them in anyway.

(And to assume you have been anxious about giving your aunt that set of oven mitts that includes the nationwide parks. No? Simply us?)

One other 33% prompt they’d return solely 1-2 gadgets.

ONLINE SHOPPING

It additionally appears customers shocked themselves by how a lot they went on-line to purchase items within the lead as much as the 2022 holidays.

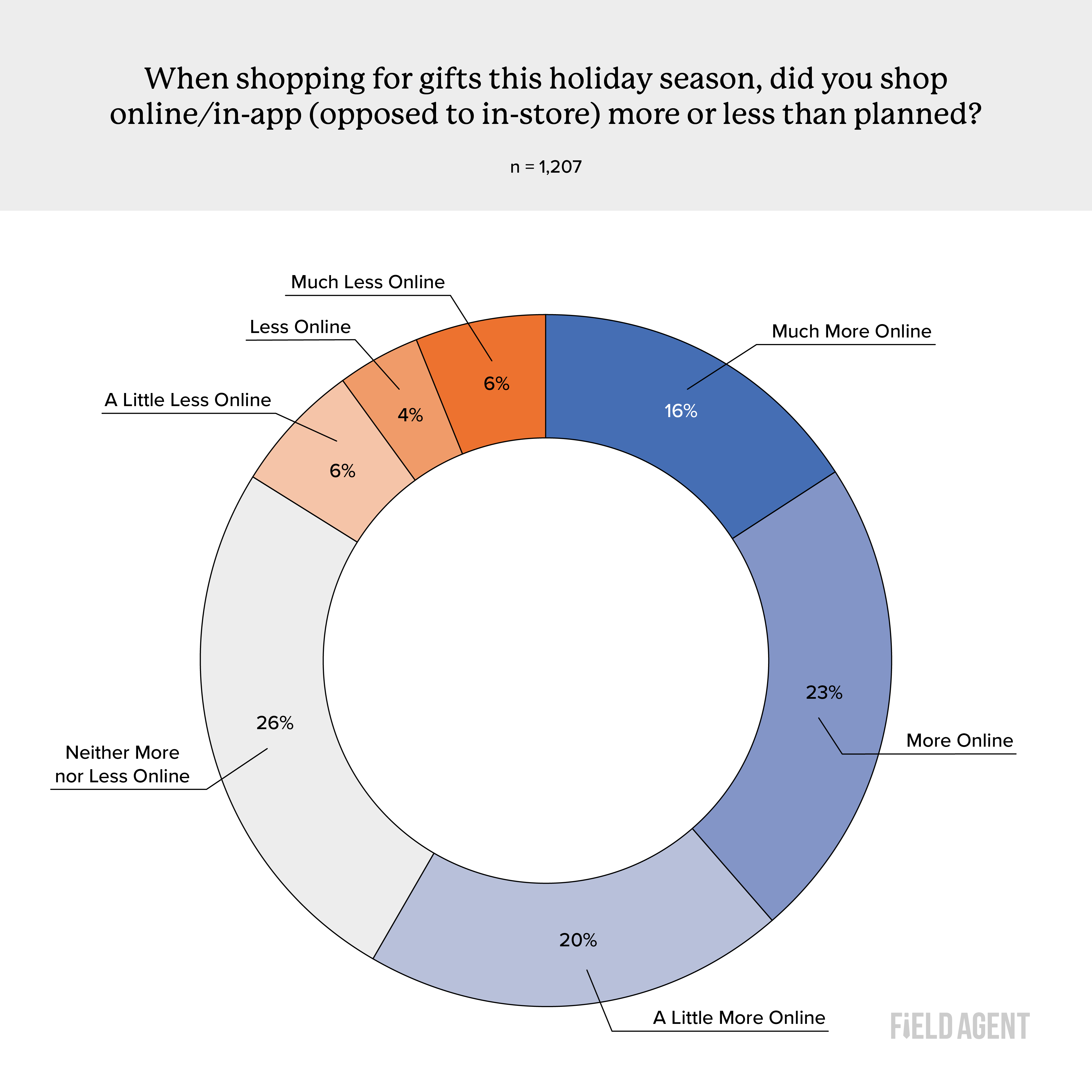

Certainly, greater than half (59%) of respondents mentioned they gift-shopped on-line extra this season than they’d deliberate, in distinction to solely 16% who did so lower than anticipated.

It appears issues actually “clicked” with vacation customers in 2022.

Extra about on-line gift-shopping, notably toy-gifts, somewhat later within the article.

TOP KID GIFTS

Totally four-in-five (80%) survey respondents mentioned they bought at the least one reward for a kid 18 years or youthful this vacation season. These purchases have been barely extra widespread for youthful youngsters (e.g., ages 4-8) than older youngsters (e.g., 13+).

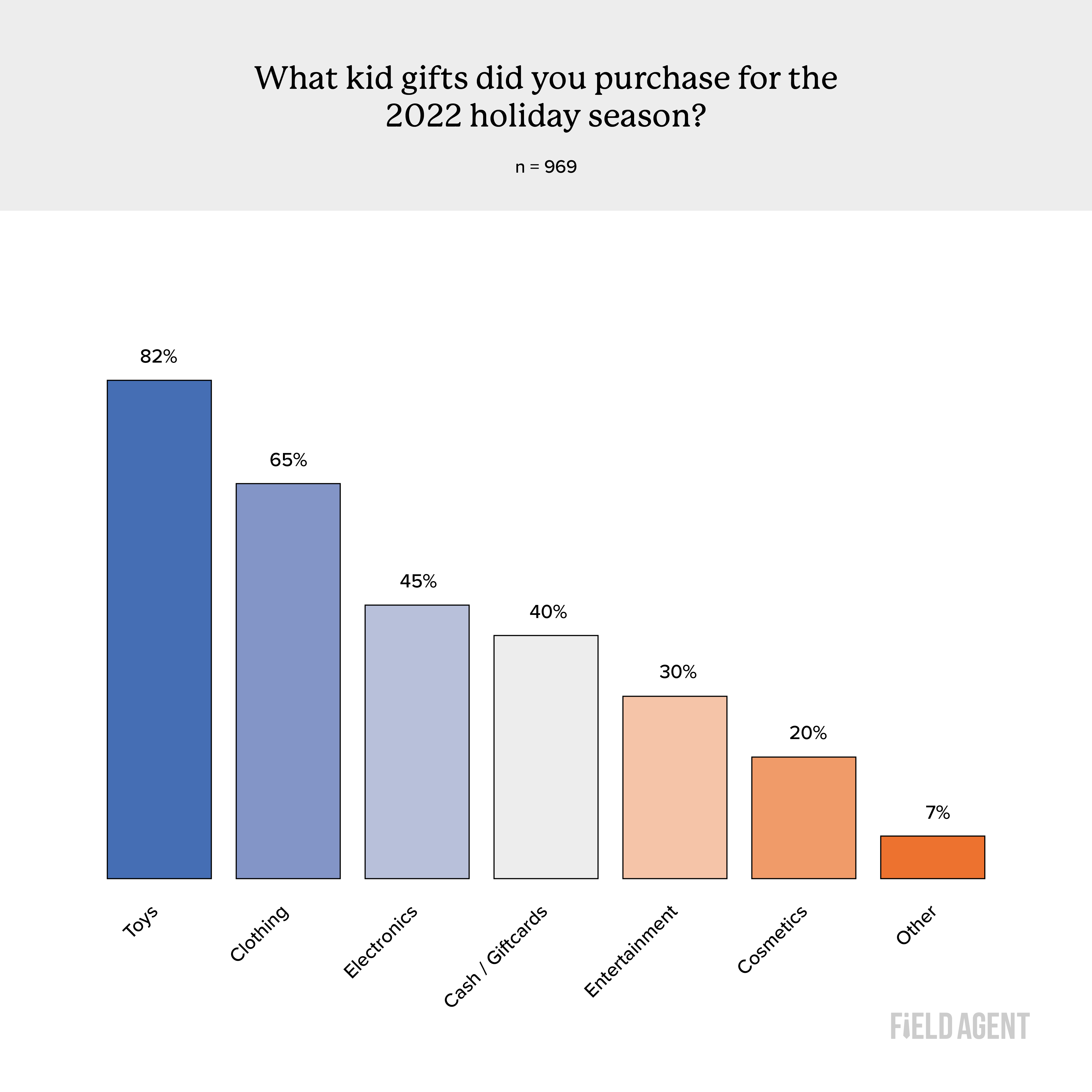

However shock! (not likely): Toys have been the most typical reward buy for youths.

Amongst respondents who purchased a child’s reward for the 2022 vacation season (n = 969), 82% recalled shopping for a toy reward, in comparison with 65% who bought a present of clothes and 45% who gave electronics.

Apparently, amongst vacation customers who bought toys for youths this Christmas season (n = 790), 85% mentioned they purchased at the least one smaller, “stocking-stuffer” toy of lower than $10. Although solely one-in-five (20%) mentioned half or extra of the toys they gave to youngsters through the 2022 holidays might be thus categorized.

So what toy classes, particularly, loved the happiest holidays?

Let’s break it down, lady vs boy:

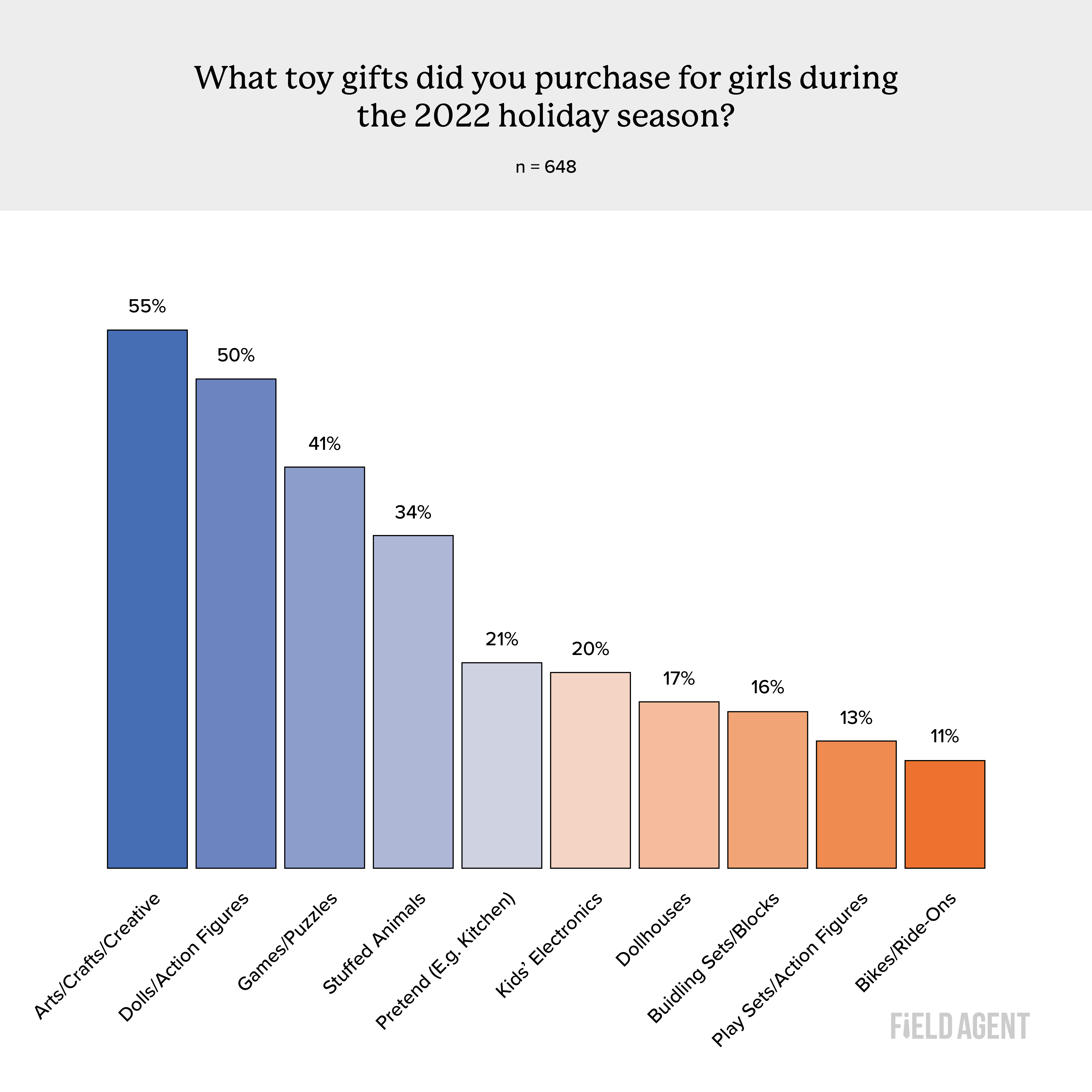

It was a inventive vacation for the gals. (Right here’s hoping you’ve gotten stain-resistant carpets and partitions.)

Of these adults who bought toy items for women 18 or youthful (n = 648), 55% mentioned they purchased art-and craft “toys” for women, in comparison with dolls/motion figures (50%), video games/puzzles (41%), and stuffed animals (34%).

Right here we present the highest 10 alternatives:

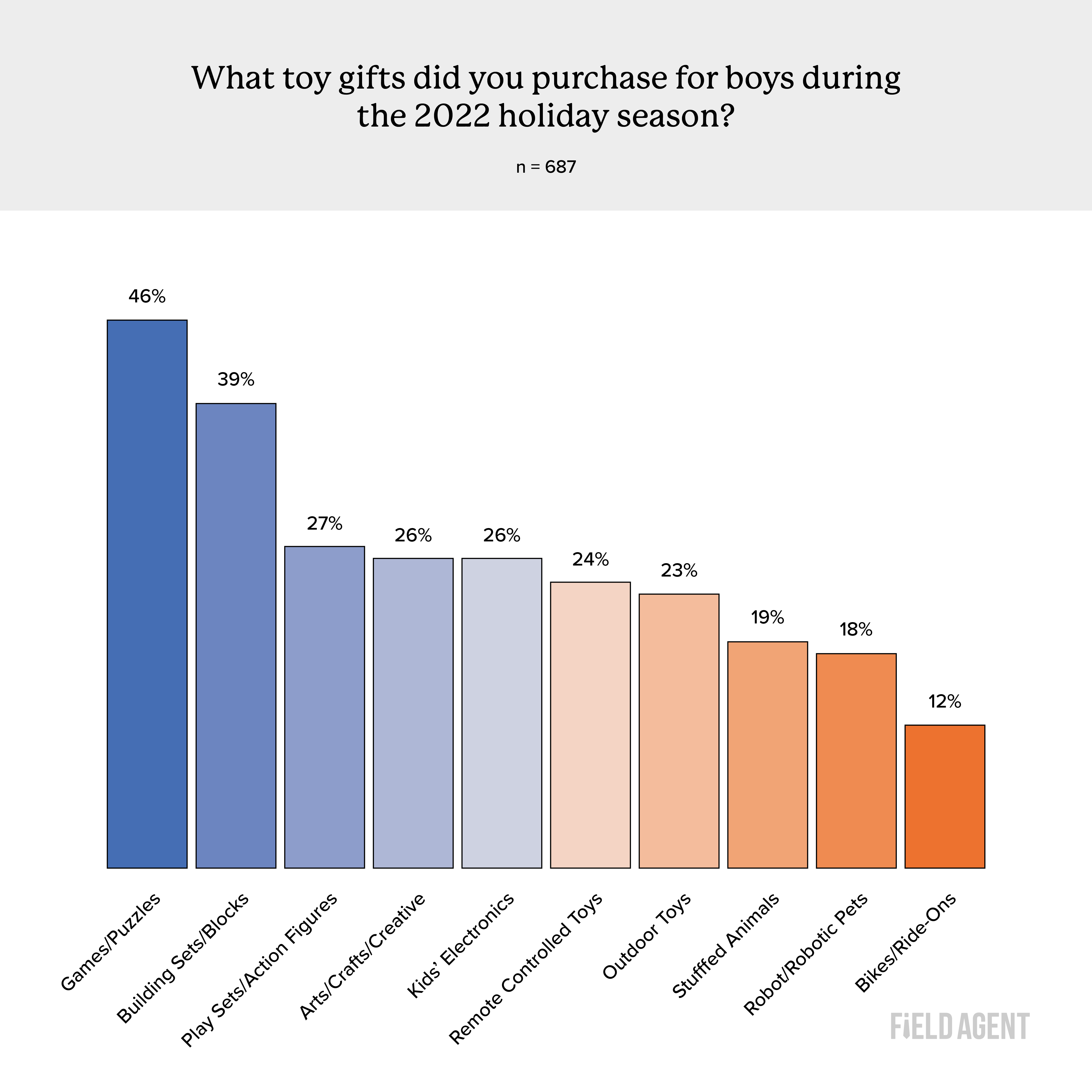

How do the boys examine?

We finally surveyed n = 687 customers who bought toy items for boys. Of those, practically half (46%) purchased video games/puzzles – the only hottest toy-gift given to boys this yr. Examine this to constructing units/blocks (39%), play units/motion figures (27%), and humanities/crafts (26%). Cautious the place you step, dad and mom.

Once more, exhibiting solely the highest 10 toy-gift classes:

TOY-BUYING DECISIONS

From the what to the why.

Understanding why customers purchase the items they do is a worthwhile endeavor for survey efforts like this one, notably when you will get to customers proper after an occasion – earlier than they overlook their ideas, motivations, actions, and the like.

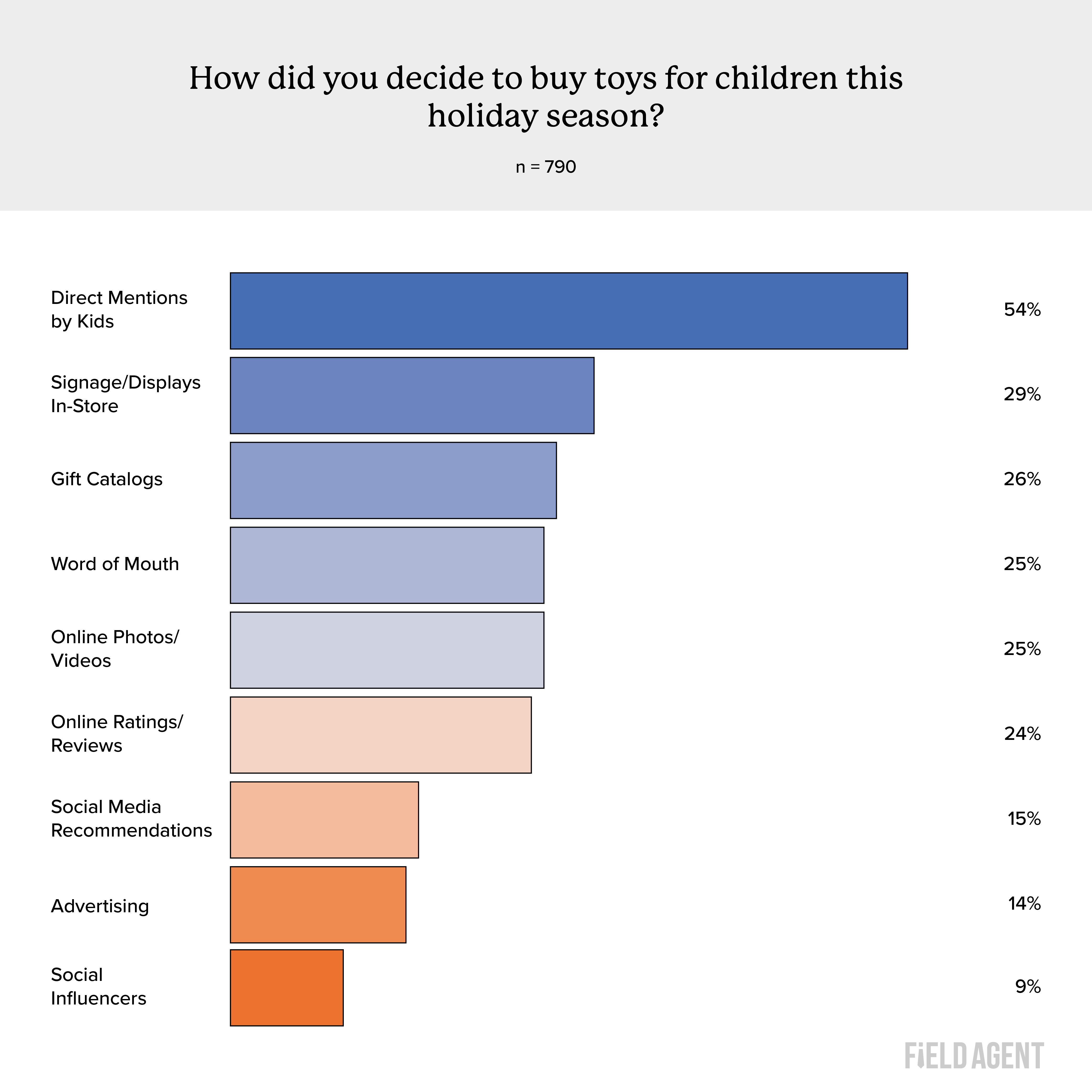

We requested n = 790 respondents, all who purchased toy-gifts for youths this vacation season, to determine the important thing influences on these purchases.

The children themselves – “Mother, pleeease!” – have been naturally the highest issue. However, behind that, corporations have been in a position to successfully make use of in-store signage/shows, reward catalogs, and on-line photographs/video to persuade customers to purchase toys this season.

You’ll be able to see the numbers beneath.

Respondents’ qualitative remarks solely reinforce the quantitative information. We learn loads of feedback like:

Youngsters’ mentions: “…what the youngsters ask for is primary”

In-store signage/shows: “… I really like shopping for craft units [because I can do them with the kids], and Goal and Michaels each had good shows in retailer for that class”

Reward catalogs: “The toy catalogs we acquired within the mail allowed my youngsters to circle gadgets they needed…”

On-line rankings/opinions: “The toy has to have nice opinions!”

We have been additionally curious to grasp how vacation customers determined between two or extra toys of the identical sort. In different phrases, what issue(s) persuaded the patron to purchase one toy over one other, when the toys have been related in nature?

Of 716 respondents who felt they might reply to the query, 66% mentioned they went with whichever toy had the “higher worth level,” whereas 47% mentioned “higher rankings/opinions” was the true difference-maker. Model title was the deciding issue for 34%.

Clearly, on-line rankings and opinions performed a extremely impactful position through the 2022 vacation buying season. Extremely.

Particularly for on-line toy purchases.

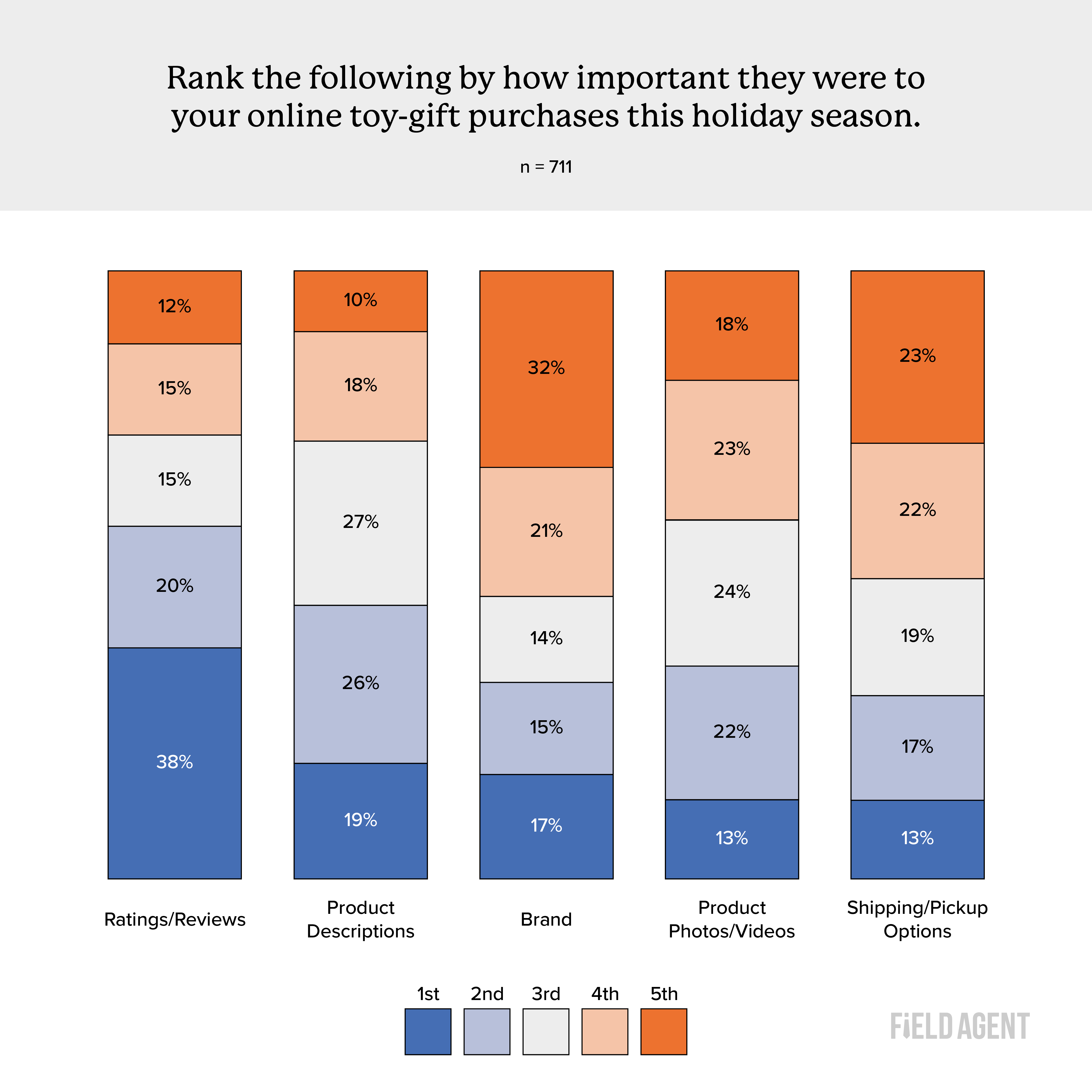

At one level we requested 711 customers to rank 5 elements by their relative affect over their on-line purchases of toy-gifts this yr.

Shock, shock. As you’ll be able to see, rankings and opinions simply acquired the best proportion of #1 rankings in addition to the best variety of #1 and #2 rankings (mixed).

That’s extra affect than even model title!

In 2022, rankings and opinions have been completely important to serving to customers make vacation purchases of toys.

Do you know? Subject Agent is a certified supplier of rankings and opinions to Walmart.com. Store our R&R merchandise on the Plum retail-solutions market.

TOP TOY RETAILERS

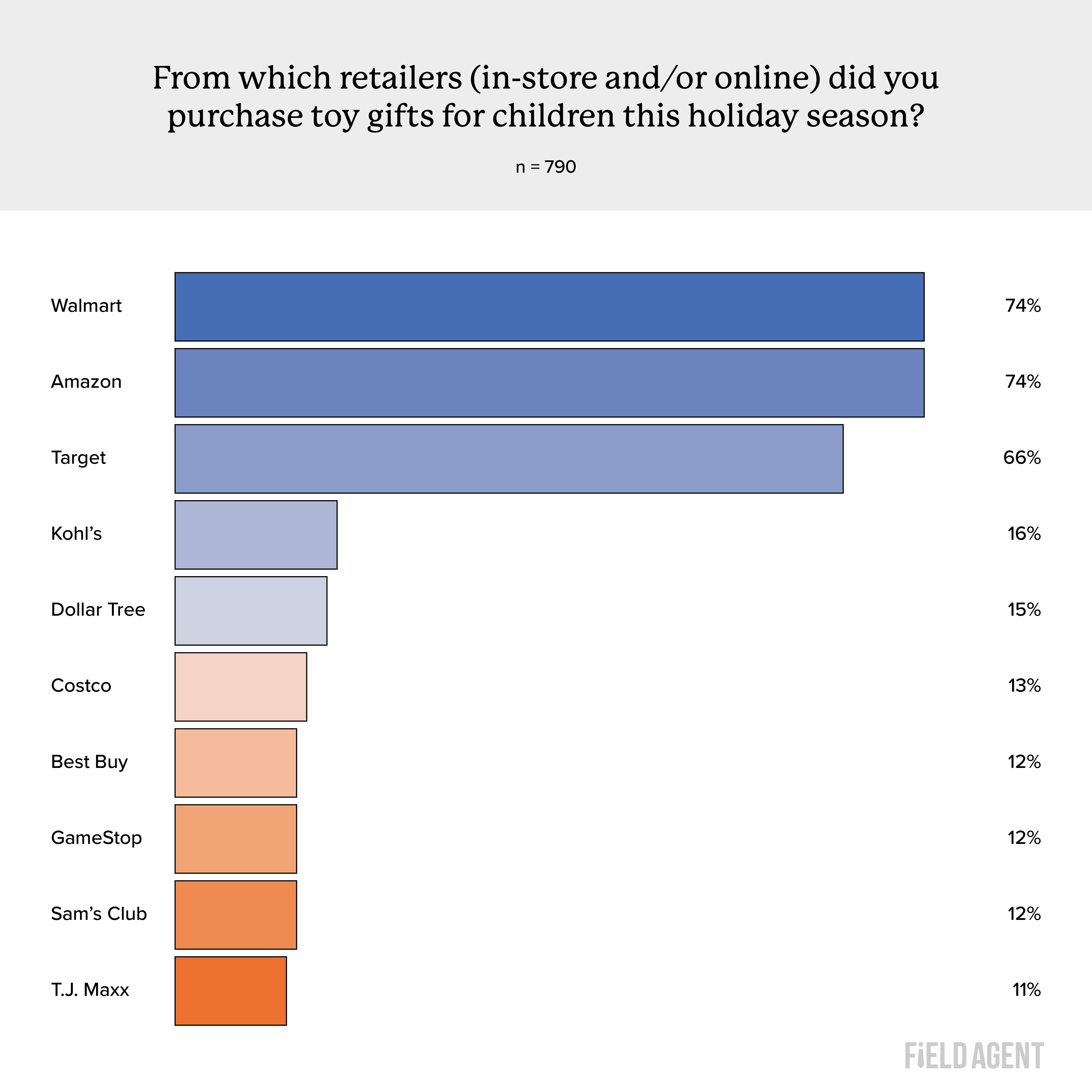

And the place, may we ask, did these toy purchases transpire? That’s, which toy retailers had the perfect 2022 vacation season?

We put the query to n = 790 vacation customers who bought toy-gifts this yr. In a channel-agnostic sense, Walmart and Amazon tied for high place. About three-in-four mentioned they purchased toy-gifts from Walmart, and about the identical quantity from Amazon.

Goal captured third spot at 66%, adopted by a precipitous drop-off to fourth place and past.

And what about on-line purchases of toy-gifts?

This query we requested considerably otherwise. As an alternative of a number of alternative, we requested “On which one app/web site, if any, did you buy the MOST toy items this vacation season?”

Of 712 vacation customers who certified for the query, 60% indicated Amazon acquired the lion’s share of their on-line toy-gift greenback whereas Walmart received 19% and Goal 16%.

BRICK-AND-MORTAR TOY-SHOPPING

To not counsel brick-and-mortar toy-gift buying wasn’t of first-order significance through the 2022 holidays.

A fast have a look at the survey information, and greater than 9-in-10 (91%) vacation customers who bought toy-gifts through the 2022 holidays (n = 790) mentioned they did so by means of at the least one brick-and-mortar retailer.

Yeah, that’s just about everybody who bought toy-gifts.

For toys at the least, it’s brick-and-mortar AND on-line.

In reality, one-quarter of respondents (24%) visited 5 or extra bodily shops to buy toy-gifts for the youngsters of their lives. And 6% of them – who you might be – are nonetheless soaking their ft as a result of they visited eight or extra B&M shops.

Vacation Classes Discovered. Now What?

The vacations provide a high-stakes, action-packed enviornment for studying about customers – and the way retailers and types can serve them higher. For example, from this survey analysis we discovered…

On-line rankings and opinions play a pivotal position in gift-buying selections and gross sales

In-store shows and signage have stopping energy amongst purchase-minded vacation customers

Vacation customers typically shock themselves, as an illustration, in what they purchase (e.g., impulse purchases), how they purchase it (e.g., on-line), and the way a lot they spend

However what do you do with such insights?

Act on them – through the holidays; throughout different important promoting seasons; and, in some methods, each day all year long.

The Plum retail-solutions market makes it straightforward to behave.

In only a few minutes, with only a few clicks, you’ll be able to…

Launch a rankings and opinions undertaking to actual customers wherever

Begin auditing in-store shows and signage

Mobilize actual prospects to submit about your merchandise on-line (hi there, micro-influencers)

Go on shopalongs with prospects as they store inside shops

Fee skilled product photograph or video shoots

If it helps you win at retail, through the holidays and all year long, it’s most likely on the Plum Market.

It’s a revolution in retail options.