Andres Victorero

Shares have posted robust good points to start out a yr wherein the bears proceed to warn us we’ll see new lows within the S&P 500, in addition to a recession in addition. They higher get busy, as a result of time just isn’t on their facet. JPMorgan CEO Jamie Dimon is backing away from his forecast for an “financial hurricane,” and Nobel-prize-winning economist Paul Krugman’s considerations are abating, as he now sees higher probabilities for a gentle touchdown this yr. These are examples of sentiment bettering from a number of the worst ranges in additional than a decade, and that may turn out to be infectious over time. Traders begin wanting past the valley because the headwinds everyone seems to be already conscious of begin to give solution to tailwinds.

Finviz

As I discussed yesterday, a few of final yr’s strongest headwinds have already turned. China’s reopening from an overbearing pandemic coverage ought to produce a significant enhance in financial progress this yr. The vitality disaster anticipated in Europe has been headed off with a lot hotter climate, which is resulting in forecasts for modest progress this yr. The greenback peaked three months in the past and needs to be declining on a year-over-year foundation by the second quarter. I feel this helps clarify why shares have been holding their floor over the previous three months, however crucial price of constructive change is for inflation, which posted one other significant decline for a 3rd month in a row this morning.

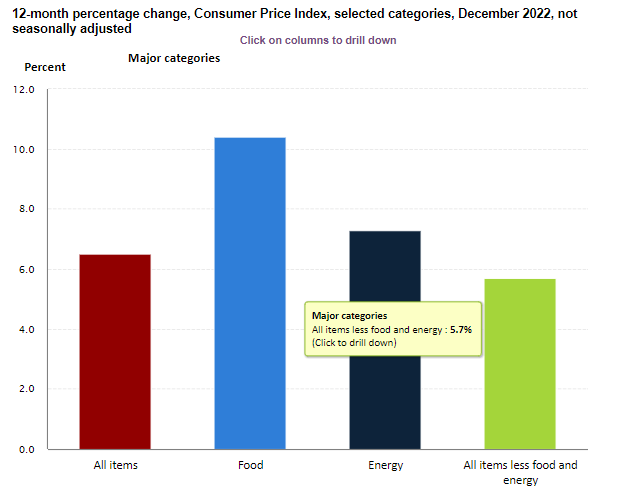

BLS

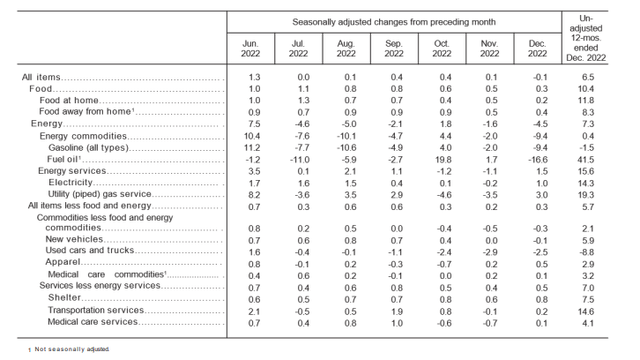

In truth, the Client Value Index decreased by -0.1% for the month of December, which was in keeping with expectations, leading to a year-over-year enhance of 6.5% that’s down from 7.1% in November. That is the bottom price of inflation in 16 months. The lower was largely as a consequence of vitality costs, which fell by 4.5% in December and for the fifth time prior to now six months. The year-over-year enhance in vitality costs was practically halved from 13.1% in November to 7.3% in December. We noticed a really modest lower in meals costs on an annual foundation, however the smallest month-to-month enhance since final spring. That bodes properly shifting ahead.

BLS

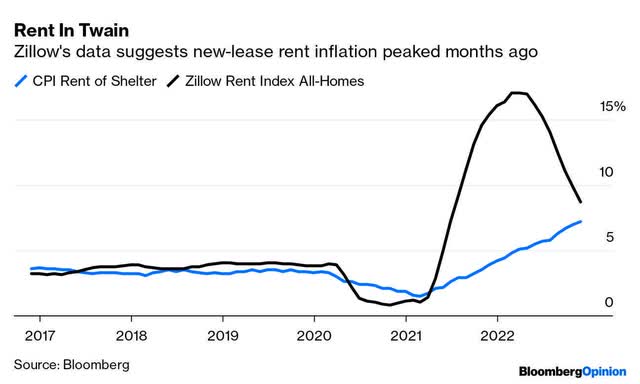

On the core, which excludes meals and vitality, the annual price of enhance fell from 6% in November to five.7% in December. New automobile costs fell for the primary time on a month-to-month foundation to hitch used automobile costs, which proceed to plunge, whereas medical care and transportation companies noticed modest will increase in comparison with the prior month’s decreases. Shelter stays the most important contributor to the general core price of inflation, and it has but to replicate the deflation that’s already within the pipeline, however it’s going to come because the yr progresses. The speed of enhance for brand new leases is plunging. New lease charges might be factored into the typical regularly every month, reducing the typical of all leases in power, but it surely takes 6-12 months for these new charges to overwhelm the trailing 12-month quantity.

Bloomberg

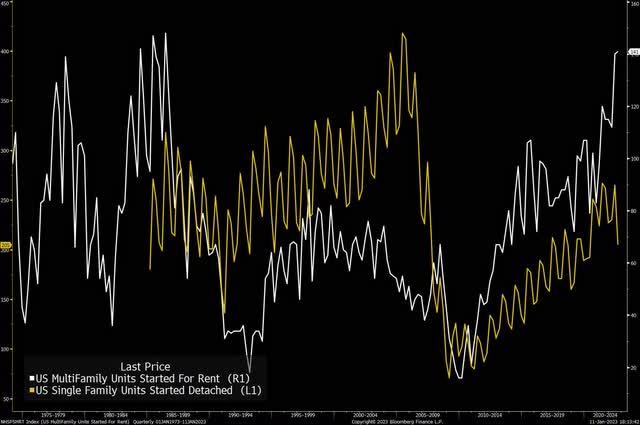

One other issue weighing on new lease price will increase, which may finally turn out to be decreases, is the availability of recent multi-family items. Due to sky-high hire will increase final yr, builders have targeted their consideration on this market, with new builds now surpassing Nice Monetary Disaster highs.

Bloomberg

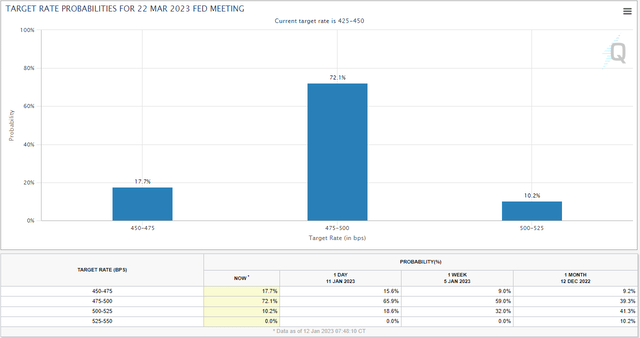

The response to this morning’s report seems bullish, as I’ve been anticipating, but it surely needs to be considerably tempered given the surge in inventory costs we now have seen to start out the yr. After final month’s stellar inflation report, shares surged after expectations for price will increase in each February and March of this yr had been reduce in half from 50 foundation factors to simply 25 foundation factors. These possibilities elevated sharply after the discharge of this morning’s report, and rates of interest are plunging throughout the yield curve. This is the reason inventory costs look to open increased.

CME

I feel in the present day’s report additionally will increase the chance that the October lows for the S&P 500 are firmly behind us. The terminal price for Fed funds needs to be properly under what the Fed has been forecasting, and the speed of inflation is prone to fall at a extra speedy price than its forecast as properly. Regardless, Fed officers will discuss robust in an try to include enthusiasm for danger property and forestall monetary circumstances from loosening, however a gentle touchdown stays my base case, together with the beginnings of a brand new bull market.