The yr 2021-22 marked a serious milestone for the Ombudsman mechanism of RBI because it witnessed the combination of the three erstwhile Ombudsman Schemes viz., Banking Ombudsman Scheme (BOS) 2006, Ombudsman Scheme for Non-Banking Monetary Corporations (OSNBFC) 2018, and Ombudsman Scheme for Digital Transactions (OSDT) 2019 into the Reserve Financial institution – Built-in Ombudsman Scheme (RB-IOS), 2021. Listed here are 4 charts on the on the character of plaints in opposition to banks and NBFCs, how complaints are addressed and why typically they aren’t thought of.

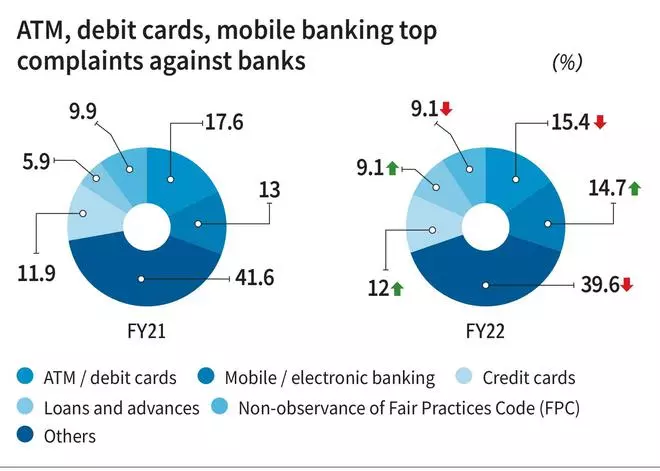

What angers financial institution prospects

Complaints in opposition to banks fashioned the most important portion, accounting for 88.04% of complaints. Buyer complaints in opposition to ATM, debit playing cards, cellular/web banking accounted for highest share.

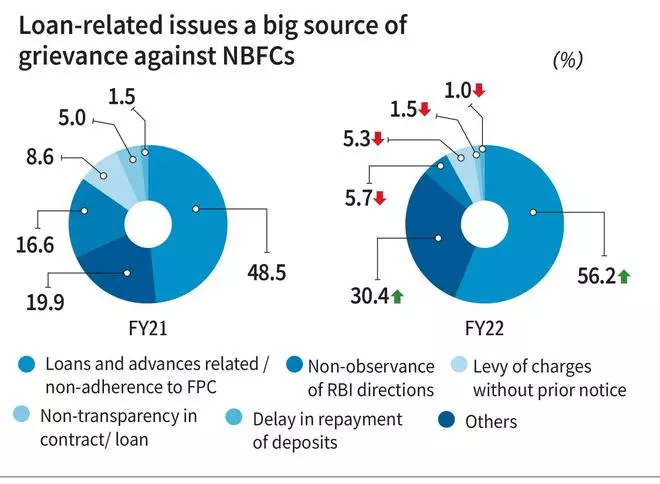

What makes NBFC prospects sad

Loans and Advances contribute to majority of complaints in opposition to NBFCs, adopted by non-adherence to Honest Practices Code (FPC), which can be not directly associated to loans and advances.

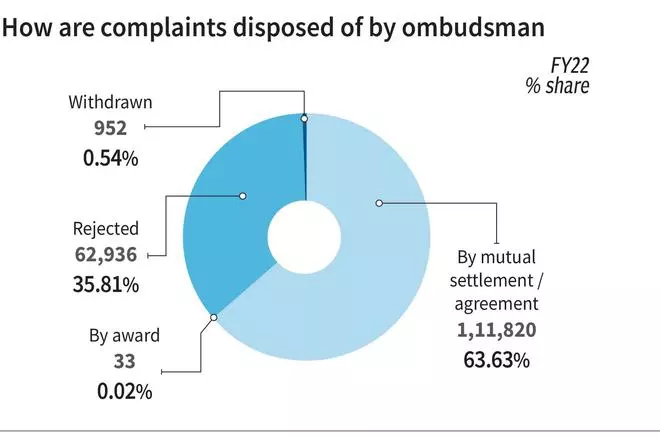

Regular methods of coping with complaints

Below the Ombudsman Schemes, nearly all of complaints are settled by means of conciliation and mediation efforts.

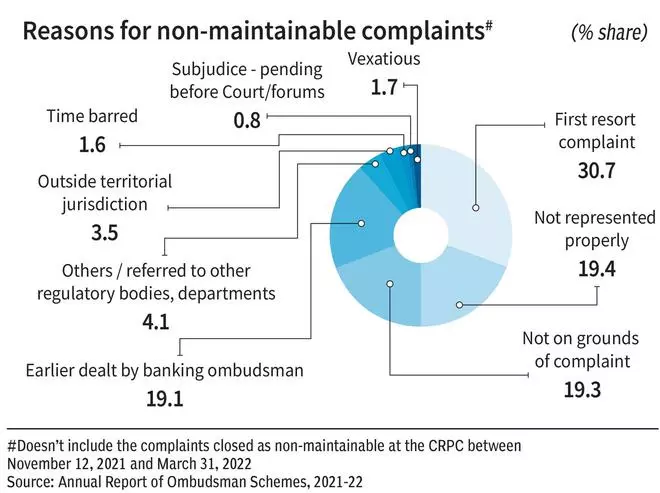

Why complaints are usually not thought of

A complete of 1,35,326 (42.62%) of the full dealt with complaints at ORBIOs had been closed as non-maintainable in the course of the yr.