Fortitude Gold is a small gold mining agency that was separated from Gold Useful resource Company and became a public firm in December 2021.

They function in Nevada, a area well-known for being welcoming to the mining business, and deal with extracting high-grade gold utilizing open pit heap leach strategies. It owns six properties, all situated inside a 30-mile radius and located within the productive Walker Lane Mineral Belt.

It must be famous that their shares are traded within the OTC market, that means that they don’t seem to be listed on main inventory exchanges.

Supply: Investor Presentation

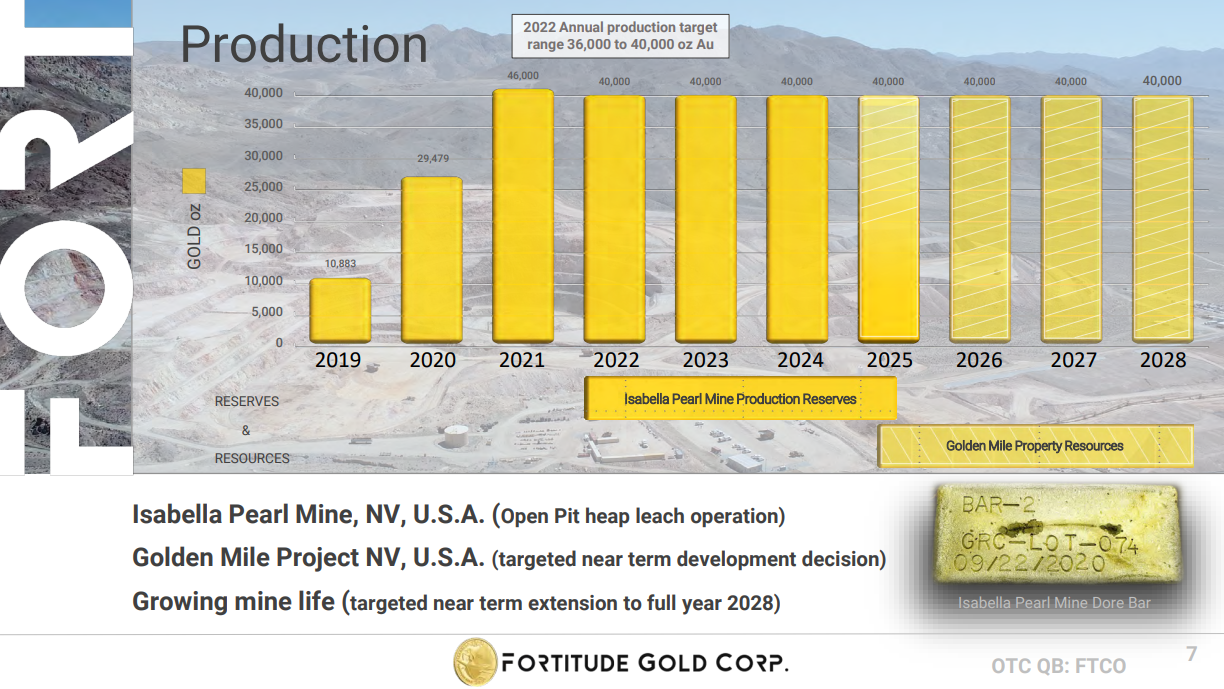

The corporate skilfully manages its gold manufacturing, leading to relatively steady outcomes regardless of the fluctuations within the value of gold. This was as soon as once more illustrated in its most up-to-date Q3 outcomes.

The corporate bought round 9.4K ounces of gold for the quarter, 18.2% decrease than final 12 months. This is because of a drop in whole gold manufacturing, which declined by 17.3% to 9.5K ounces, as the corporate seemingly anticipated higher gold costs in This autumn. Certainly, they’ve been proper, with the worth of gold rebounding in This autumn.

The corporate maintained its 2022 annual outlook, focusing on a manufacturing of 40K gold ounces. We count on this to consequence within the firm producing round $0.55 for the 12 months based mostly on the present gold value ranges.

Development Prospects

On the subject of Fortitude Gold’s future progress prospects, it’s laborious to make very correct predictions, as fluctuations within the value of gold can sway the corporate’s outcomes both manner.

On the one hand, rising gold costs and improved working processes can considerably improve the corporate’s monetary efficiency amid increased revenue margins.

Then again, declining gold costs and rising bills, significantly throughout an inflationary atmosphere like the present one, might negatively have an effect on profitability.

That mentioned, administration has added some predictability to Fortitude Gold’s funding case by predicting that their yearly gold output will keep round 40,000 ounces till 2028.

Investor Presentation

Accretive acquisitions of different mines might additionally profit outcomes over the medium time period.

Aggressive Benefits

Fortitude Gold’s edge within the business lies within the experience of its administration crew and its historical past of making vital worth for shareholders. Earlier than the spin-off from Gold Useful resource Company, that they had generated over $1 billion in income there, maintained profitability for ten consecutive years, and distributed over $116 million in dividends to shareholders.

Moreover, Fortitude Gold’s properties have high-grade ore and floor deposits, which leads to low-cost operations in comparison with their opponents. The corporate’s monetary place can be fairly strong, with $127.4 million in property and solely $12.6 million in liabilities, leading to a powerful fairness worth of $114.8 million.

Though the corporate’s future efficiency is partially linked to gold costs, and gold costs usually lower in recession occasions, the corporate’s low working prices and strong stability sheet might assist to mitigate the destructive results throughout an financial downturn.

Dividend Evaluation

Fortitude Gold has an bold strategy to dividends. The corporate’s aim is to pay out as a lot money to shareholders as quickly as potential whereas nonetheless considering the necessity for capital for operations, reinvestment for progress, and taxes.

The corporate’s CEO, Jason Reid, has talked about that the corporate needs to handle the widespread criticism that mining equities present no yield by offering a fascinating yield and paying out dividends on a month-to-month foundation.

The management crew is of the opinion that this attribute will make the corporate stand out from its mining opponents within the eyes of traders, stopping shares from buying and selling at a reduction, which is widespread within the business.

We take into account Fortitude Gold’s annual dividend of $0.48 to be comparatively reliable, appropriately sustainable even within the occasion of a notable lower in gold costs. Nevertheless, a dividend lower within the occasion of a chronic adversarial scenario within the gold market isn’t unlikely.

Closing Ideas

Fortitude Gold Company is likely to be an acceptable selection for income-oriented traders in search of an organization within the gold mining business that gives constant and hefty dividends.

The inventory has one of many highest yields within the business, but payouts ought to stay well-covered, particularly close to the present gold value ranges.

Nevertheless, it’s value noting that the corporate’s future earnings shall be intently tied to the fluctuations within the value of gold, and thus the dividend shouldn’t be blindly trusted.

In case you are concerned about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

The key home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them commonly: