everydayplus/iStock through Getty Photographs

by Levi at StockWaves; produced with Avi Gilburt

Fundamentals Of The Banking Sector With Lyn Alden

Lyn Alden supplies rather more detailed info and evaluation to our members frequently. Listed here are just a few transient snippets from some latest commentary on the banking sector:

My outlook for the banking sector is blended, however appears to vary significantly from the consensus.

I am somewhat unsure in regards to the pricing of most danger property in 2023, together with financial institution shares, attributable to recession danger. Nonetheless, if a recession does happen, I do not suppose the banking sector shall be on the epicenter of it prefer it was within the 2008 recession. I believe numerous macro analysts are ‘preventing the final battle’ and assuming that if a recession happens, it could devastate the banking system. I believe the banking system is likely one of the stronger areas of the economic system at present, and is priced inexpensively.

In different phrases, I might say that I’m ‘much less bearish’ on banks than the market appears to be, although I am not precisely pounding the desk on them but. I like them for diversification and usually suppose they will outperform the S&P 500 over the following 5 years, inclusive of dividends.

In 1929 and 2008, banks have been on the epicenter of the disaster, and have been subsequently recapitalized. Within the Nineteen Forties and 2020s, banks have been/usually are not on the epicenter of the disaster.

Now, that does not imply banks would not be negatively-affected by a recession. Slightly, it means they are not going to be on the epicenter of it, they usually’re in fairly fine condition main as much as it.

The largest danger for banks is mortgage losses. If the US economic system enters a significant recession, as many individuals are frightened about, then financial institution property shall be impaired as some important share of their loans are defaulted on. Whereas this danger is materials, I believe it is already well-accounted for in financial institution inventory costs.

For my part, too many buyers are preventing the final battle and assuming each recession shall be a repeat of 2008, even when circumstances (e.g. financial institution steadiness sheets) are fully reverse.

(AXP) – One other Of Our 22 Mega Cap Shares Poised To Transfer Larger

It was again in mid-November of final yr that our lead analysts in StockWaves printed an inventory of twenty-two Mega Cap shares with potential for brand spanking new all-time highs into 2023. Zac Mannes and Garrett Patten scoured tons of of charts to filter them down to those 22 potentialities.

We then marry these technicals with favorable fundamentals to search out excessive chance setups.

StockWaves

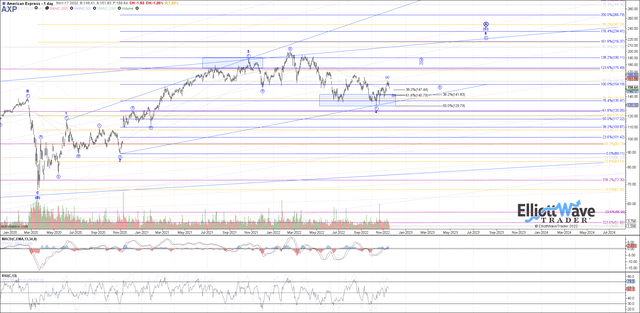

The Present Technical Setup For American Categorical (NYSE:AXP)

StockWaves / MotiveWave

As you may see from the chart shared above, our present expectation is for AXP to see $216 or greater someday in 2023. It has already taken the primary steps up from the October 2022 low to fill out this anticipated construction.

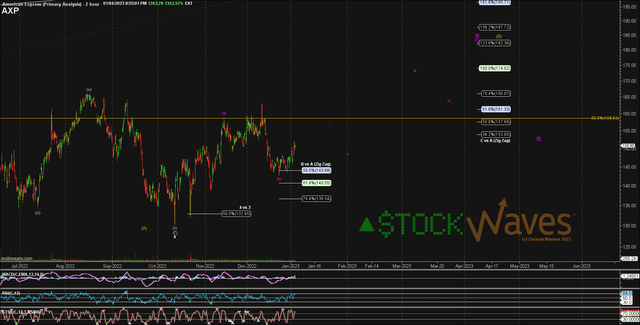

StockWaves / MotiveWave

Notice on this up to date chart how the subwave path might unfold going ahead. And properly, you may see the value targets we see as possible. The 2 highest chance swing buying and selling alternatives will probably be within the respective ‘c’ waves of the bigger circle ‘a’ and circle ‘c’ of the bigger wave 5 of [C] of a Major A wave.

Why All The Alphabet Soup?

It is a nomenclature customary that, as soon as understood, will change the best way you view markets without end. Elliott Wave evaluation, when accurately utilized, is the one methodology that we all know of that may present present context as to the place we discover ourselves at any time limit within the markets.

To simplify and specify this to AXP, we see the inventory as reaching for an essential excessive someday this yr. It’s probably that when this excessive is struck, it will likely be long-lasting and provoke important corrective motion.

Dangers And Conclusion

Ought to AXP break again under the low struck in October of final yr, that may have us reassess our present viewpoint. There are after all the macro variables in play as properly. At any second within the stream of time, dangers exist. Nonetheless, we view the market from a probabilistic standpoint. So, within the right here and now, we see the probably path as greater into 2023. (Learn into the following part to see why)

We Invite You To Be taught The True Nature Of Markets

Within the latter a part of 2018, Avi Gilburt, Founding father of ElliottWaveTrader.web, printed a six-part collection of articles that right here on Looking for Alpha entitled, “This Evaluation Will Change The Method You Make investments Ceaselessly”.

(Half One, Half Two, Half Three, Half 4, Half 5, Half Six)

Here’s a transient excerpt from Half Three of that collection, wherein Avi discusses Phi (the primary a part of the article explains this absolutely) and its function in Elliott Wave evaluation:

The Elliott Wave concept can also be based mostly upon Phi, as Elliott Wave postulates that markets transfer in 5 steps ahead, and three steps again (a Phi relationship). Phi, when used appropriately along with Elliott Wave, will be an extremely predictive market instrument. The inner wave construction inside an Elliott Wave evaluation should show relationships based mostly upon Phi so as to have the ability to appropriately predict the following transfer inside a market with any type of accuracy. The truth is, after you establish the suitable Elliott Wave sample inside a market, you’re typically in a position to then establish the following transfer of the market with stunning accuracy based mostly upon a Phi-based goal.

Now we all know that actions in markets happen inside waves, as found by R.N. Elliott, and we all know that call making and adjustments in pattern are ruled by Fibonacci arithmetic and the properties of Phi. So, how will we apply this to our personal buying and selling to generate earnings?

Keep tuned for subsequent week’s installment after we start to maneuver into the meat of Elliott Wave evaluation, adopted by our personal discovery we name ‘Fibonacci Pinball’. That is the meat of what we’re working our means up in direction of. This could provide you with a lot larger perception into the place we’re inside a pattern so that you could align your portfolios to match the pattern, in addition to the maturity of the pattern.

This Final Level Is Extremely Necessary To The AXP Chart

Sure, we see AXP with a high-probability setup to succeed in new all-time highs in 2023. However after that, it can probably have reached the ‘maturity of its pattern’ and be concerned in protracted corrective motion for a while thereafter.

I want to take this chance to remind you that we offer our perspective by rating probabilistic market actions based mostly upon the construction of the market value motion. And if we keep a sure major perspective as to how the market will transfer subsequent, and the market breaks that sample, it clearly tells us that we have been incorrect in our preliminary evaluation. However here is crucial a part of the evaluation: We additionally offer you another perspective on the similar time we offer you our major expectation, and allow you to know when to undertake that different perspective earlier than it occurs.

There are various methods to investigate and monitor shares and the market they kind. Some are extra constant than others. For us, this methodology has proved essentially the most dependable and retains us on the best facet of the commerce a lot most of the time. Nothing is ideal on this world, however for these seeking to open their eyes to a brand new universe of buying and selling and investing, why not think about finding out this additional? It could simply be some of the illuminating initiatives you undertake.