Revealed on January seventh, 2023 by Josh Arnold

Utility shares are usually nice sources of dividends for traders that search earnings. The reason being as a result of utilities have fastened pricing that every one however ensures a sure degree of income, set by regulators within the localities the place they function. That degree of revenue is sufficient to reinvest within the firm’s infrastructure, but in addition to supply ample returns to shareholders. As well as, the demand for energy tends to be fairly secure, with a mild upward slope, that means utility shares additionally are inclined to land on the listing of these with the longest dividend improve streaks. Not often, we see a inventory within the utility sector that additionally has an impressive present yield.

One such inventory is Algonquin Energy & Utilities Company (AQN), a reasonably sized energy utility with a market cap of slightly below $5 billion, and a streak of dividend will increase that stands at 10 years. Algonquin’s present yield is fractionally underneath 5%, touchdown it on our listing of high-yield shares.

This listing incorporates about 200 shares with yields of a minimum of 5%, that means all of them yield a minimum of 3 times that of the S&P 500.

You may obtain your free full listing of all securities with 5%+ yields (together with necessary monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink under:

Within the article under, we’ll check out Algonquin’s funding prospects immediately.

Enterprise Overview

Algonquin is a holding firm for a portfolio of regulated and non-regulated energy era, distribution, and transmission utility belongings. The corporate has two segments: Regulated Companies, and Renewable Vitality. The regulated enterprise is a conventional utility that operates within the US, Canada, Chile, and Bermuda. It supplies distribution companies to 1.1 million connections in electrical, pure fuel, water, and wastewater. The renewable enterprise is non-regulated, and generates and sells electrical vitality, capability, and associated services and products within the US and Canada. The corporate generates renewable energy via hydroelectric, wind, photo voltaic, and thermal services.

Algonquin was based in 1988, is anticipated to supply about $3 billion in income in 2023, and trades with a market cap of $4.8 billion.

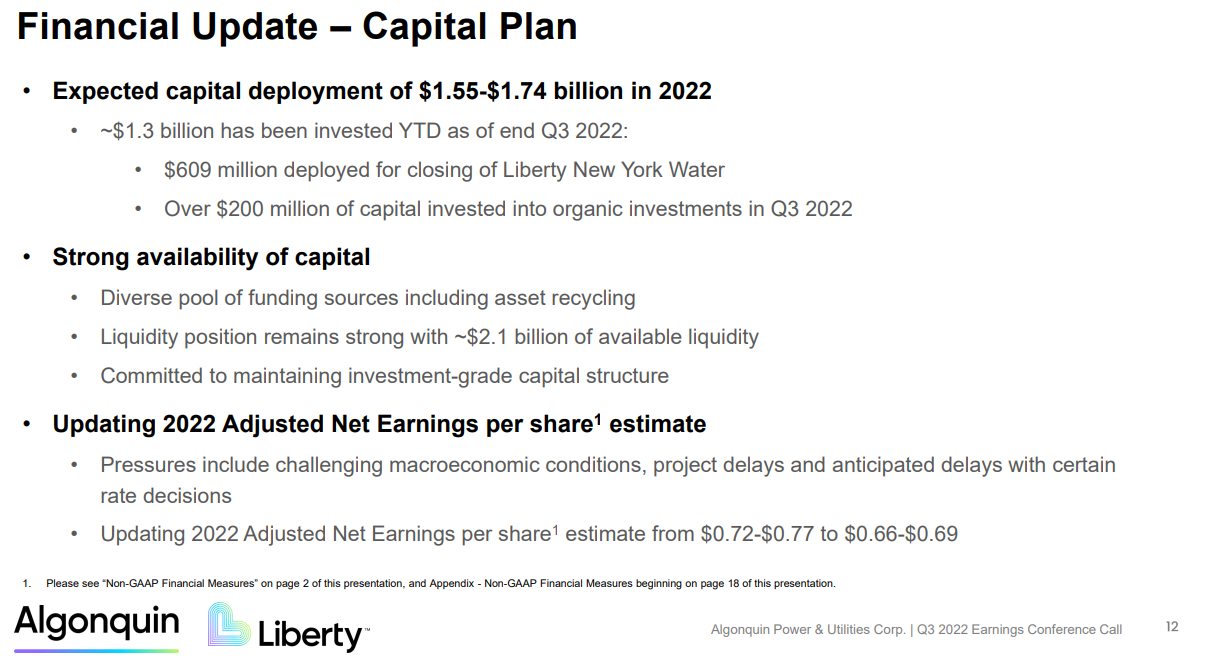

The corporate posted third quarter earnings on November eleventh, 2022, the abstract of which is under.

Supply: Investor presentation, web page 11

Adjusted earnings-per-share got here to 11 cents in Q3, which missed estimates by a nickel. Income was $667 million, up 26% year-over-year, and beat estimates by a staggering $72 million. Nonetheless, steerage for the 12 months was slashed from a spread of 72 cents to 77 cents in earnings-per-share, to a brand new vary of 66 cents to 69 cents. The inventory traded 30% decrease within the quick aftermath of the report as traders grew to become involved about its skill to finance the dividend. Algonquin cited “difficult” macroeconomic circumstances, in addition to development delays that it believes will prolong effectively into 2023. As well as, larger rates of interest had been cited as an earnings headwind, in addition to the timing of tax incentives on sure renewable vitality tasks.

The deliberate acquisition of Kentucky Energy was rejected by regulators in mid-December, that means Algonquin should both show the acquisition received’t hurt clients – possible via value cuts – or it should abandon the acquisition. Both state of affairs will end in lower-than-planned long-term progress within the regulated utility enterprise.

With all of that in thoughts, we up to date our estimate of 2022 earnings-per-share to 68 cents, which might signify a modest decline in opposition to 2021’s earnings of 71 cents per share.

Development Prospects

Algonquin, in contrast to most utilities, really has a reasonably robust earnings progress historical past. Nonetheless, that was due in no small half to the corporate’s lackluster earnings in previous years, which made the bottom from which to develop fairly small. For example, the corporate earned simply 14 cents per share in 2012, however almost doubled that whole in 2013. We venture the potential for six.5% earnings progress within the years to return, as Algonquin is making aggressive investments in its infrastructure, in addition to deliberate acquisitions, to assist develop its regulated and non-regulated bases. We notice the rejection of the Kentucky Energy enterprise as a possible headwind to this progress fee.

We reiterate that in contrast to many utilities, Algonquin’s earnings progress over the previous decade has been erratic moderately than clean. The corporate has diversified its asset base with its renewable enterprise, however we notice that enterprise is extra unstable given it’s unregulated.

Supply: Investor presentation, web page 12

One headwind to notice is that the corporate prefers utilizing fairness to finance acquisitions, so if Kentucky Energy finally ends up being consummated, or every other deal, shareholder dilution is a probable end result. The corporate is concentrating on about 70% of its funding capital into the regulated enterprise, and about 30% into the renewable enterprise.

Aggressive Benefits

Algonquin operates in a lot the identical manner as each different energy utility, and whereas that doesn’t make it totally different, it does imply it has what quantities to a monopoly in its service areas. That creates built-in demand and recession resistance, a minimum of within the regulated enterprise. The renewables enterprise is extra of a wildcard, in that it provides higher long-term progress prospects, on the expense of predictability and built-in pricing energy. As a utility, there isn’t something the corporate can do to spice up its aggressive benefit given the trade’s huge quantity of regulation.

Dividend Evaluation

Algonquin has boosted its dividend for 10 consecutive years, but it surely has routinely paid extra in dividends than it produced in earnings. This has required the corporate to fill the hole with different sources of funding, together with fairness and steadiness sheet sources, which is unsustainable. Certainly, earnings for 2022 are projected to be slightly below the dividend by about 4 cents. That kind of shortfall will be crammed quickly, however we imagine the corporate could a minimum of must pause will increase, or probably put in a dividend lower to avoid wasting money.

The corporate has a staggering $7.3 billion in long-term debt, which makes further borrowing both very costly, or unimaginable. That exacerbates the necessity to save capital with the dividend, significantly if earnings are in danger.

The yield is at present 4.9%, which is kind of good for any inventory, however specifically, for a utility. Nonetheless, we imagine that is in no small half as a result of danger that the dividend could should be lower in 2023, or on the very least, that the rise streak is at excessive danger of not persevering with.

Remaining Ideas

Algonquin shares have a lovely yield, however we warning that’s possible as a result of market pricing within the odds of a possible dividend lower. The 4.9% yield is way larger than the corporate’s historic common yields, so if Algonquin can handle to proceed paying the dividend, it provides vital worth immediately. Nonetheless, we imagine the dangers in the meanwhile are elevated {that a} lower will change into essential.

The inventory was down about 50% in 2022, and whereas 2023 possible received’t be as harsh, we can’t suggest Algonquin as a safe dividend inventory immediately.

If you’re fascinated about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases can be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them recurrently:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].