Crypto analytics platform Santiment is revealing that the beneficial properties made by Bitcoin (BTC) whales after the top of the bull run final 12 months weren’t cashed out into fiat currencies.

Santiment says that because the bull market led to 2021, Bitcoin whales transformed their income into stablecoins.

Based on the analytics platform, the variety of stablecoin addresses holding over $100,000 price of dollar-pegged crypto belongings has elevated by between 53% and 1,689% in a single 12 months.

“It’s no secret that Bitcoin’s whales dumped as crypto markets retraced in 2022. However as an alternative of cashing to fiat, 2021 income are sitting in stablecoin wallets. As illustrated, USDT, USDC, DAI and BUSD have exploded with new giant addresses.”

Santiment reveals that the variety of giant Tether (USDT) addresses has elevated by 53% in a single 12 months, whereas the depend of deep-pocketed Dai (DAI), USD Coin (USDC) and Binance USD (BUSD) addresses has gone up 271%, 926% and 1,689%, respectively, over the identical interval.

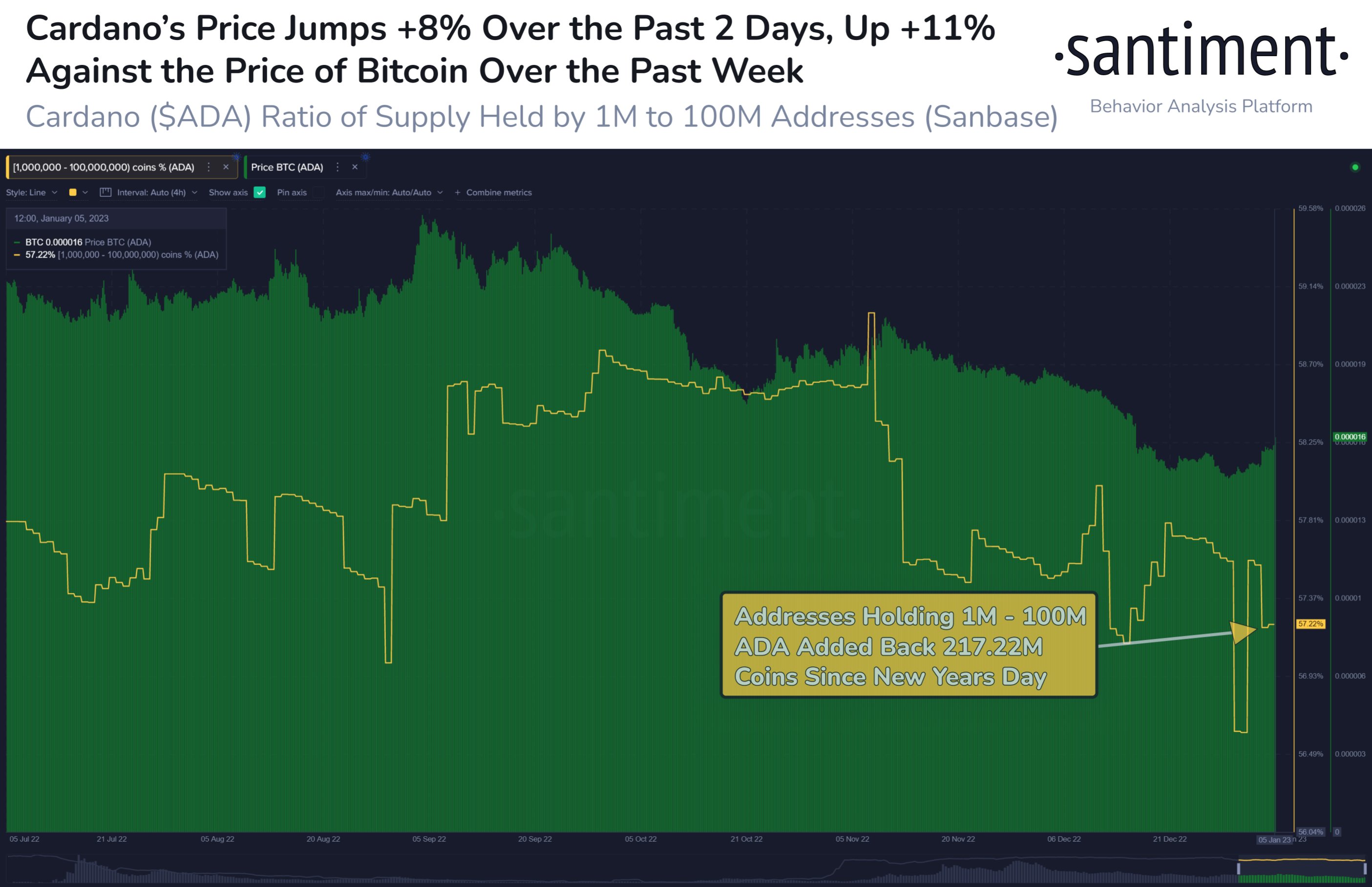

Turning to Cardano (ADA), Santiment says that whales of the sensible contract protocol have added over $60 million price of ADA after unloading the digital asset late final 12 months.

“Cardano is having fun with a mini-surge at this hour, and addresses holding between a million to 100 million ADA could also be a major validator to observe for a value breakout. After dumping 568.4 million cash the ultimate two months of 2022, they’ve added again 217.2 million ADA to begin 2023.”

Cardano is buying and selling at $0.277 at time of writing.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Verify Newest Information Headlines

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in online marketing.

Generated Picture: Midjourney