Sundry Pictures

Enphase Power (NASDAQ:ENPH) has seen a formidable run in 2022, with the share value up over 42%. With loads of tailwinds for your entire sector this has made some firm’s valuations inflated, such is the case for Enphase. With a excessive ahead p/e of 60, the present share value would current a variety of potential draw back dangers for an investor. Given these causes I believe the plan of action could be to promote any shares within the firm, and look ahead to a greater entry level once more.

Q3 Earnings Report

On October.25 2022 Enphase Power supplied traders with their Q3 earnings report. For me there have been fairly just a few highlights showcasing the corporate’s capacity to generate revenues and improve the underside line regardless of an more and more tough financial atmosphere.

Income Sheet For Enphase (Enphase Q3 Earnings Report)

With revenues coming in at $634 million, a rise of simply over 80% in comparison with final yr, Enphase Power is proving themselves to be one thing to rely on. Like I additionally talked about, the underside line noticed an enormous leap too. EPS was $0.80 per share this quarter, an enormous improve from final yr’s efficiency of $0.15 per share.

With the continued vitality disaster in Europe, Enphase Power noticed a big improve of their revenues from its operations right here. Revenues elevated by 70% in comparison with the second quarter of 2022, an enormous improve exhibiting the potential the corporate has for abroad operations.

All in all Enphase had a really profitable third quarter, capable of improve gross margins and in addition its backside line in nice vogue. It remained optimistic about its future and skill to effectively maneuver round any obstacles.

Development Outlook

When it comes to outlook for the final quarter of 2022 Enphase Power has supplied some forecasts. Revenues are anticipated to be between $680 million and $720 million, one thing I believe they may undoubtedly be capable of obtain. The corporate supplied us with an investor presentation, the place they go extra in-depth in sure areas.

Trying on the market outlook for Enphase there are many tailwinds. With their all-in-one product aimed toward creating an ecosystem of residence vitality they’ve a big market to develop in. In line with most researchers, the marketplace for residential photo voltaic tools hasn’t been penetrated greater than round 7-9% at the moment. Proper now the TAM for residential photo voltaic adoption is $14.2 billion. However trying forward this may improve to $44.77 billion by 2030.

With an elevated demand for a inexperienced vitality supply, Enphase could have a neater time getting their merchandise bought and hopefully land bigger and bigger tasks with it too. Up till now ENPH has been capable of maneuver shortly and effectively taking increasingly market share and grow to be a dependable provider of vitality tools.

The Market Share

Given the current optimistic earnings report that Enphase Power supplied traders, it may be famous that they now maintain round 22.83% of the market. This makes them one of many largest firms within the area. With opponents equivalent to JinkoSolar (JKS) and SolarEdge (SEDG), Enphase is making a mark and establishing themselves because the photo voltaic module and storage firm for purchasers.

Trying on the approach these firms are anticipated to develop there may be a median EPS progress of between 20 and 25% for them. That appears practical as your entire sector is predicted to develop 21-22% CAGR for the subsequent 10 years. What places me off Enphase proper now’s the wealthy valuation. The identical goes for its opponents JinkoSolar and SolarEdge. What may be higher for traders as a substitute is to search for smaller firms providing a greater entry level.

The Monetary State

Realizing how an organization is doing financially at all times comes all the way down to understanding the stability sheet correctly. Within the case of Enphase Power there are just a few pink flags I’ve discovered, however there are additionally issues I discover good.

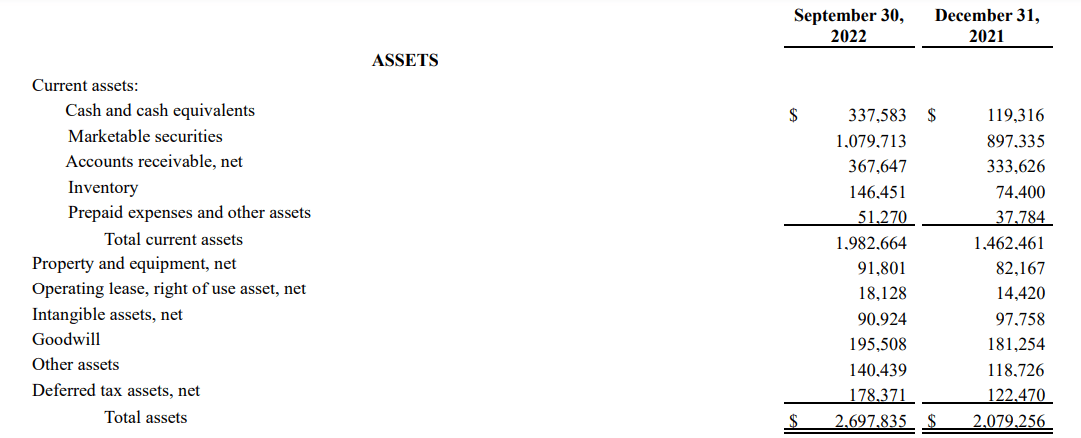

Belongings Of Enphase Power (Enphase Q3 Earnings Report)

First could be the amount of money the corporate holds compared to the quantity of debt they’ve. From the final earnings report, Enphase held $337 million in money and had $1.1 billion in debt. Nearly 4x extra debt than money shouldn’t be an excellent place to be in as an organization. It brings uncertainty and drastically will increase the chance of share dilution for my part.

Enphase Liabilities (Enphase Q3 Earnings Report)

When it comes to share dilution, Enphase has not relaxed on diluting their shareholders. With the excellent shares going from 82 million to 135 million is worrying. However with money stream topping out at $400 million within the final report, I’ve religion that maybe this drastic improve in shares will decelerate quickly.

Enphase Excellent Shares (Searching for Alpha)

One of many positives I discovered on the stability sheet could be that belongings are rising quicker than liabilities proper now. That normally implies that the corporate is not taking up an excessive amount of new debt and stays affordable. I might nevertheless be careful for the “accounts payable” part sooner or later, as that may give an indicator of the rise in provides.

Valuing Enphase Power

That is the onerous half for me. The market is very large for Enphase and I’d very properly be improper with my assumptions. However having some type of grip in regards to the practical quantity an organization is price is important for my part.

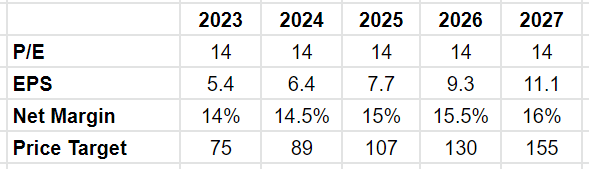

The Potential Valuation Of Enphase (Writer’s Personal Calculations)

The value targets I’ve may appear approach too conservative, however I believe that is higher so I may be shocked on the upside than the draw back. I’ve put the p/e at 14 since I consider they’re rising at a speedy tempo and have a comparatively good monetary state and deserve a a number of that displays that. The EPS I anticipate to develop round 20% CAGR till 2027. However after that I anticipate that the market will likely be fairly saturated and it will likely be tough for Enphase Power to extract any extra worth from the client base.

One factor I consider the corporate will be capable of obtain is best and higher web margins. They have already got very spectacular margins in comparison with a variety of different opponents, the hope I’ve is that they may keep them on the very least.

Proper now Enphase is at a a lot larger value than any of my future assumptions. I do not really feel snug shopping for at these ranges and anticipate it to drop to extra practical ranges ultimately. The draw back danger that you’ve shopping for any firm at a p/e of greater than 60 is immense. Due to these circumstances I would not put any cash into the corporate proper now.

Conclusion

Enphase is an unimaginable firm rising their high and backside line at a speedy tempo, even in comparison with a few of their opponents. With a market that has loads of tailwinds I do not anticipate ENPH to battle getting their product bought sooner or later.

On the stability sheet there are some good issues and a few dangerous issues. Money stream being optimistic and belongings rising quicker than liabilities is to me are a number of the positives. However with money being nearly 4x lower than the debt it has me apprehensive about potential share dilution.

In the intervening time Enphase Power is buying and selling at round $270 per share with a p/e of above 60. This can be a very wealthy valuation and on the present charge the corporate is rising it does not appear to me the valuation is practical. I must pay an enormous premium to get part of the corporate proper now. Due to that my draw back danger is way larger than the potential reward and this forces me to steer clear of investing and advocate a promote ranking. If the valuations come down and attain numbers I’m extra snug with, I might have a second thought of it.