On this article

2023 shall be harder for the housing market, however not the worst, in accordance with the Nationwide Affiliation of Realtors (NAR).

The Annual Actual Property Forecast Summit, organized by the NAR, delivered its verdict on 2023 late final 12 months. The prognosis, put collectively by NAR Chief Economist Lawrence Yun, could be summarized as a sluggish 12 months for residence sellers. Though no rapid disaster is prone to hit the housing market, all the present developments level to a 12 months of declining gross sales and slower residence worth development in most areas.

Having stated that, Yun identifies a number of rising housing markets that may possible expertise worth will increase in 2023, very similar to Austin and different cities did throughout the pandemic.

House Gross sales Will Proceed to Fall

Probably the most important prediction is that residence gross sales will proceed to drop in 2023. We’ve been on a downward pattern by 2022, which is able to possible proceed. Present residence gross sales dropped 16% throughout 2022 and is now on the lowest ranges since 2014.

New housing begins are faring considerably higher, trending round its historic averages. The marketplace for new housing begins survived its worst disaster within the aftermath of the 2008 monetary crash, making a sluggish however regular restoration over the previous decade.

The slowing down of this section of the housing market subsequent 12 months is consultant of the general downward pattern, however, as Yun factors out, “new residence gross sales are holding up higher than present residence gross sales as a result of new residence gross sales actually took a dive throughout the foreclosures disaster and by no means totally recovered from that, and therefore that they had a low base reference to match.”

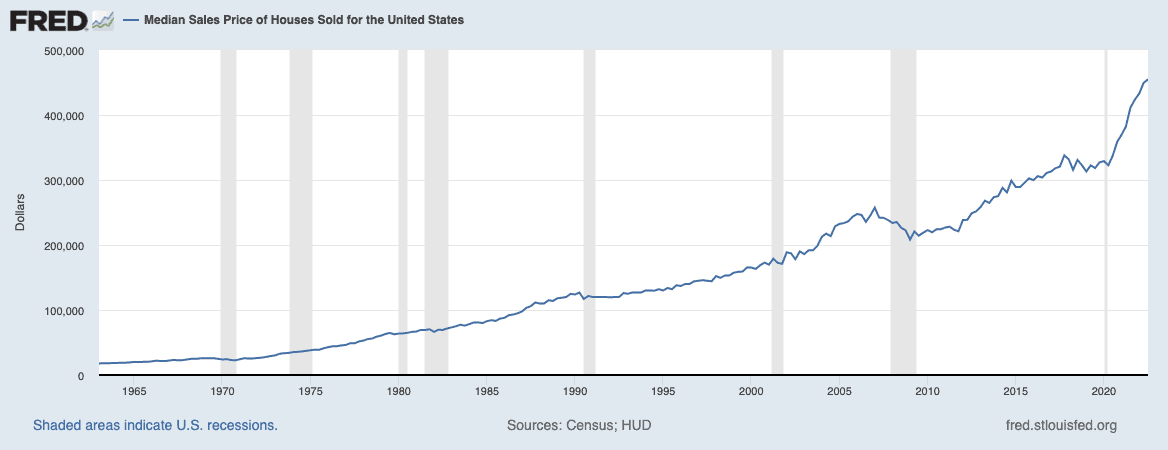

House Value Progress Will Flatline or Decline

House worth development is anticipated to flatline in 2023, ending the Covid worth increase formally. The present prediction is a median enhance of simply 0.3% to a median residence worth of practically $455,000. What that actually means is that the housing market continues to be rising, simply slowly.

In keeping with the NAR, we’ve averted a large crash or something near a disaster. The job market has confirmed to stay sturdy, some markets have held their floor on worth, and inflation has begun its descent. Yun factors out that ‘‘immediately there are some layoffs within the mortgage trade and possibly the know-how trade has stopped hiring individuals, however in case you have a look at the online, there are nonetheless job creating situations.’’

The opposite lifeline that’s prevented a crash is the mortgage market. It’s protected to say that the tightening of borrowing guidelines after the subprime mortgage disaster of 2008 has made the housing market extra resilient. “Subprime mortgages, these shady, dangerous, self-reporting mortgages, have been extensively prevalent over the past cycle. This time round, individuals have to fulfill the brand new rules, so we don’t have these dangerous mortgages”, stated Yun. The NAR additionally predicts that mortgage charges will fall beneath 6% someday throughout Q3 2023 and stay there by the top of the 12 months.

Lastly, the supply-demand hole won’t be bridged anytime quickly. Which means that purchaser demand will proceed to prop up the marketplace for many months to come back, which is able to hold residence costs steady in most areas except you might be in California, which is predicted to expertise a big decline in residence costs of 10-15%.

The Subsequent Austin?

The NAR factors in direction of the next metros because the housing market hotspots of 2023:

Atlanta, Georgia

Raleigh, North Carolina

Dallas-Fort Price, Texas

Fayetteville-Springdale-Rogers, Arkansas-Missouri

Greenville, South Carolina

Charleston, South Carolina

Huntsville, Alabama

Jacksonville, Florida

San Antonio, Texas

Knoxville, Tennessee

The South will paved the way in 2023. In keeping with Yun, “Southern states, typically talking, meet the standards of affordable affordability, in-migration, and high-paying jobs being created.”

Actual property traders ought to pay attention to this pattern in the event that they wish to capitalize on these market alternatives earlier than they inevitably grow to be oversaturated, as has been the case with Austin.

Discover an Agent in Minutes

Match with an investor-friendly actual property agent who can assist you discover, analyze, and shut your subsequent deal.

Streamline your search.Faucet right into a trusted community.Leverage market and technique experience.

Observe By BiggerPockets: These are opinions written by the writer and don’t essentially symbolize the opinions of BiggerPockets.