Joe Raedle

Expensive Readers/Followers,

My stance on Keurig Dr Pepper (NASDAQ:KDP) is comparatively new. I observe beverage corporations, together with PepsiCo (PEP) and Coca-Cola (KO) in addition to their respective bottlers like Coca-Cola Consolidated, Inc. (COKE) carefully – and I personal some in most of them. Not outsized positions by any means – they have not been low-cost sufficient to essentially set up an enormous stake, however positions nonetheless.

These shopper staples make for a great funding with conservative dividends, however low draw back. It is a kind of corporations that you just “hope” will drop extra as a result of, what is going on to occur to them? Individuals are going to instantly cease consuming soda?

They will not be development monsters – however they’re protected. Let’s revisit KDP and see what we’ve right here.

Revisiting Keurig Dr Pepper

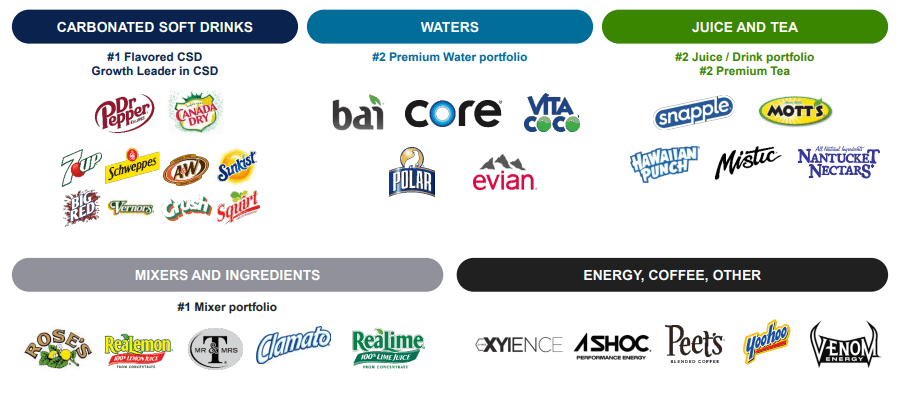

As I mentioned in my preliminary article, the corporate’s namesake soda is comparatively unknown exterior of the US in comparison with different, even native manufacturers of soda. After all, Dr Pepper is admittedly solely one of many firm’s many manufacturers, and there’s a lot extra to this enterprise (and why it’s enticing), than simply Dr Pepper.

Inexperienced Mountain Espresso Roasters and Keurig Inexperienced Mountain was, as model suggests, a Espresso and beverage maker which along with Dr Pepper Snapple shaped into the KDP conglomerate in 2018, with headquarters within the US. It employs over 27,000 folks.

KDP IR (KDP IR)

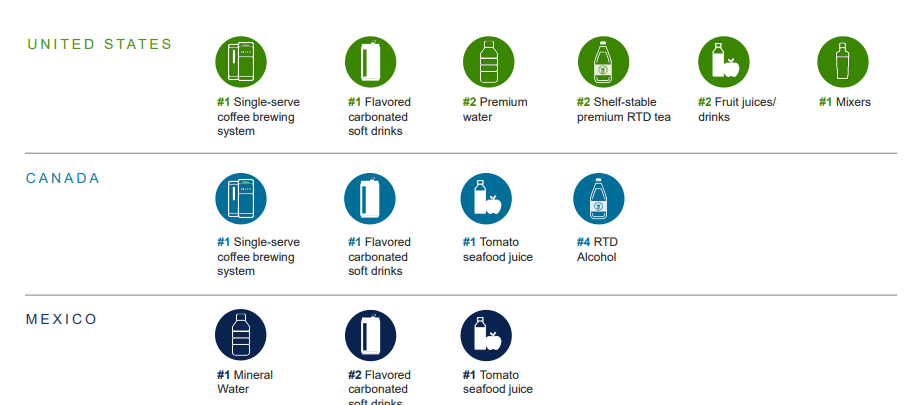

Extra importantly, it has a portfolio of some 100+ cold and hot drinks and because the title suggests, additionally accommodates your complete Keurig brewing system. So when investing on this firm you actually have the chance to get publicity to nice espresso, which is not all that simple, besides in case you think about companies like Nestle (OTCPK:NSRGY). A lot of the espresso corporations that I like aren’t truly publicly traded.

So the combination right this moment is espresso, sizzling cocoa, teas, and different drinks underneath manufacturers for its Keurig brewing machines, plus sodas and juices. It is actually one of the vital “full” drink/beverage corporations that I do know of, and one of the vital interesting.

KDP IR (KDP IR)

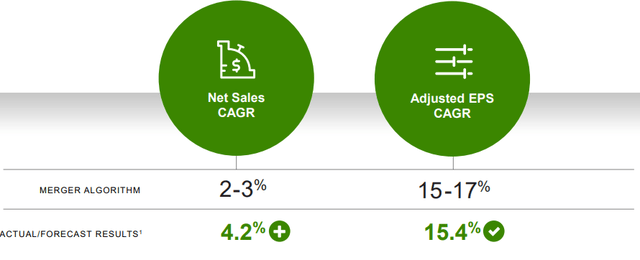

KDP has been capable of carry out considerably above the peer common since its IPO. It is reworking into what it views as being a “trendy beverage firm”, delivering strong EPS development whereas accelerating income past expectations. Merger forecasts known as for gross sales development numbers of two%-3% yearly. Precise outcomes have proved nicely past that at over 4% and have additionally delivered nearer to above 15% EPS development CAGR. These should not in any method dangerous or unattractive outcomes, particularly on this market.

Nonetheless, it stays very U.S.-centric.

KDP IR (KDP IR)

Whereas you will get a Keurig machine right here for example (on Amazon), we’re far more used to Nespresso, Tassimo, and different manufacturers and platforms – I actually use Nespresso for my away-from-home espresso and a handbook espresso machine at dwelling. Keurig simply is not well-known right here.

Beverage markets are, for probably the most half, extremely high-moat markets with loads of crushing prices, shelf house challenges, and different retail-based headwinds that make breaking into the market laborious. My alternative has at all times been for the established gamers that in flip purchase up smaller corporations that “make it”, thus bettering their portfolio high quality and enchantment. That is why I personal all 3 majors, however not often concentrate on smaller companies on this phase. The dangers are just too excessive.

In the meantime, KDP dangers are “restricted” actually any method you have a look at them – at the least how I see it. The corporate’s development engines allow it to essentially “get into” households, with Keurig machines already in 21 million US households again in 2015. That quantity is as much as 33M in 2020 and is predicted to rise to past twice that going ahead.

The non-Espresso beverage portfolio is unquestionably a performer as nicely. Check out the fundamentals of this portfolio.

KDP IR (KDP IR)

With out exaggerating, I consider this to be a portfolio you need to be a stakeholder of. The corporate appears to cowl your complete beverage spectrum apart from alcohol (an entire completely different beast to get into), and what they’ve is unimaginable, as I see it.

Keurig won’t be as diversified as Nespresso in relation to the choice and luxurious of its espresso. If you happen to have a look at a few of the newest capsule improvements popping out of Nestlé headquarters, it places rivals to disgrace, nevertheless it’s nonetheless a really strong participant that both owns, licenses or companions with a lot of the main espresso corporations on this planet, and that features Swedish ones.

KDP is near future-proof as I see it. Individuals will proceed to drink espresso and soda in addition to the corporate’s portfolio of drinks, and I view KDP as maybe the best-positioned participant on this complete house, even when it is not the largest. Like the opposite soft-drink giants, it trades at a major premium, however there is a good argument to be made as to why the corporate is definitely price it, with a better development charge than a lot of the incumbents.

The corporate reaffirmed the 2022E numbers as late as December fifth. The newest outcomes we’ve to contemplate are 3Q22 outcomes, and people got here in at very robust ranges. The corporate delivered web gross sales will increase of within the double digits – similar for 9M/YTD YoY. it is actually an “all-weather” portfolio that whereas having some publicity to sugared drinks, to espresso, and to teas, has an excellent stability not like say, Coke.

That is not to say macro is not difficult. The corporate is impacted like some other enterprise by the associated fee will increase in uncooked supplies. There was additionally an enormous disruption within the espresso enterprise that has kind of rotated and is exhibiting excellent developments going into 4Q22.

The entire firm’s segments noticed spectacular development through the third quarter. A lot of it was elevated costs that the corporate, like most different staples companies, is profitable in passing onto customers.

The truth that GAAP working revenue is down 50.4% YoY displays the aforementioned non-cash impairment on Bai. Gross revenue was up although, regardless that there have been inflationary pressures and elevated advertising and marketing spend. Adjusting for non-recurring, adjusted working revenue was up 2%, which got here largely from an 8.6% improve in adjusted gross revenue – however pressured by transportation prices, warehouse prices, inflation impacts, labour prices/wage and advertising and marketing.

There is not, to my thoughts, something price mentioning on this quarter’s outcomes that would negatively carry the corporate down, as I see it.

So let’s transfer on to valuation.

Keurig Dr Pepper Valuation

The corporate’s friends stay apparent and aforementioned – nevertheless it can be in comparison with alcoholic beverage corporations, although these are likely to commerce at considerably completely different multiples.

It is largely Coca-Cola, Pepsi, Anheuser-Busch (BUD), Monster (MNST), Diageo (DEO), Constellation Manufacturers (STZ), and different corporations that work within the beverage sector. I argue additionally that we may evaluate it to bottling corporations to see whether or not we need to personal bottlers or producers – on this case, I personal a bit in each purchased throughout varied instances, and it is all about that valuation enchantment.

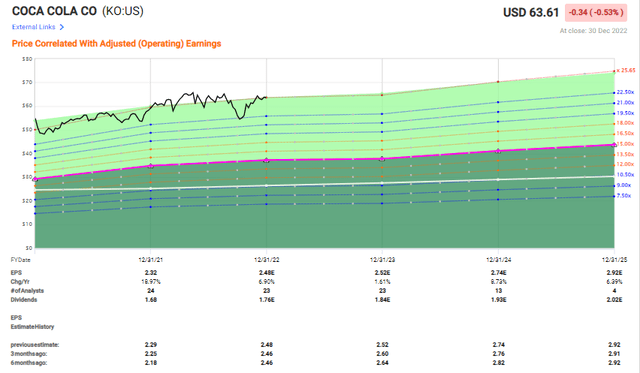

In my first article, I made it clear that I view KDP buying and selling at a reduction to most every thing besides the then-pressured alcoholic beverage corporations. The typical weighted P/E is as much as round 21.17x at this specific time. By way of P/E, that is nonetheless beneath par in comparison with a lot of the incumbents. Take Coca Cola for example.

KO trades at nearer to 26x P/E and has a considerably smaller development profile for the subsequent few years, however primarily the identical yield.

KO Valuation (F.A.S.T¨ Graphs)

Pepsi is even worse, coming in near 27x. Now, each of those incumbents are A+ rated when it comes to credit score – KDP is “solely” BBB. Does that imply that the variation is justified?

I might argue that it’s not. The variation of 1-2x P/E I may perceive, and even agree with, however 5-6x is an excessive amount of – and never justified on condition that KDP has considerably higher development prospects – double digits/excessive singles for the subsequent few years, or near, averaging at nearly 9% per yr till 2025E.

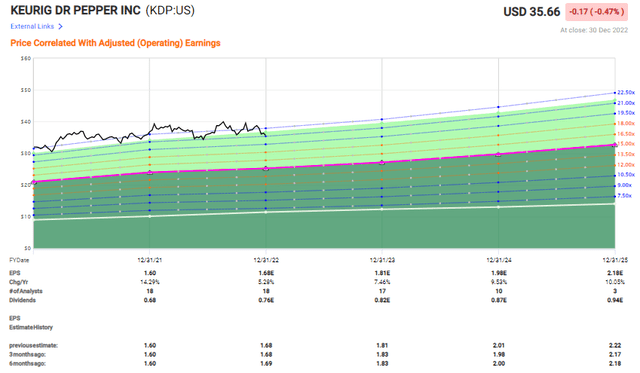

KDP Valuation (F.A.S.T graphs)

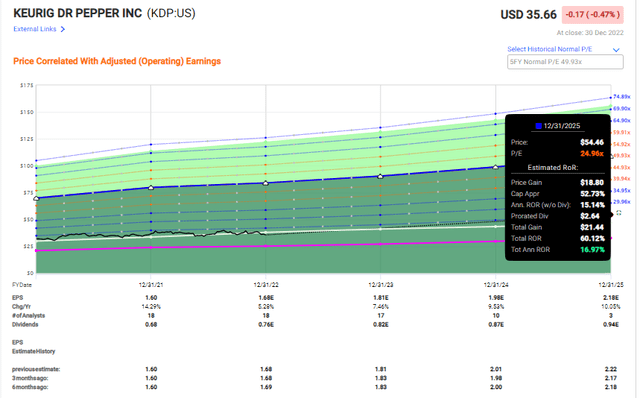

If we assume that the typical justified premium within the business is round 25X P/E, which is across the goal given by friends, then the corporate at the moment has an upward trajectory of just about 17% yearly till 2025.

KDP Upside (F.A.S.T graphs)

Potential draw back? Certain, it exists. Is it sensible that we see it decline constantly for an extended, very long time?

I proceed to say no to this chance. The corporate may be very not often beneath a P/E of 20X, and when it’s, it bounces again shortly – so any decline that is not foreshadowed by huge basic troubles must be seen as a robust “Purchase” indicator for this enterprise.

Bear in mind, these potentials are very probably primarily based on historic accuracy. Analyst forecasts for this firm and its predecessors are 100% on level or crushed positively. There isn’t a damaging miss with a ten% margin of error on this firm’s historical past. This involves a really safe forecast-based upside within the enterprise and within the inventory.

The mixed enchantment of a chilly beverage/tea/soda/water portfolio, coupled with its extraordinarily enticing, already-market-leading Keurig Espresso portfolio, the corporate is probably going to have the ability to ship “alpha”, outperforming the market on an actual TSR (Complete Shareholder return) foundation.

KDP shareholders will not turn out to be millionaires except they previous to investing in KDP are already millionaires. It isn’t that kind of inventory. What you are taking a look at here’s a 15%+ common annual RoR. Regardless of the way you slice that chance in right this moment’s market, that is one thing that must be seen as a pretty prospect right here – at the least for conservative dividend buyers.

Thesis for the widespread shares

KDP is a essentially interesting espresso and smooth drink firm, with an interesting portfolio of waters, teas, drinks, and occasional methods beloved by many and #1 available on the market. Essentially, the corporate may be very enticing. KDP is likely one of the extra enticing BUYs in your complete sector given its decrease valuation not solely in P/E a number of, however gross sales, EBITDA, and EBIT when in comparison with a few of its closest friends. I give the corporate a $40/share worth goal and begin out watching KDP with a “Purchase”.

Bear in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly huge – corporations at a reduction, permitting them to normalize over time and harvesting capital features and dividends within the meantime.

2. If the corporate goes nicely past normalization and goes into overvaluation, I harvest features and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them.

This firm is total qualitative. This firm is essentially protected/conservative & well-run. This firm pays a well-covered dividend. This firm is at the moment low-cost. This firm has a sensible upside primarily based on earnings development or a number of growth/reversion.

Whilst you could view it as considerably excessive to contemplate a 21.1x P/E beverage firm as “low-cost”, I level you to the peer averages for the corporate’s actual rivals. There may be worth right here, and you shouldn’t disregard it.

Nonetheless, some choices do exist right here.

Choices prospects for Keurig Dr Pepper

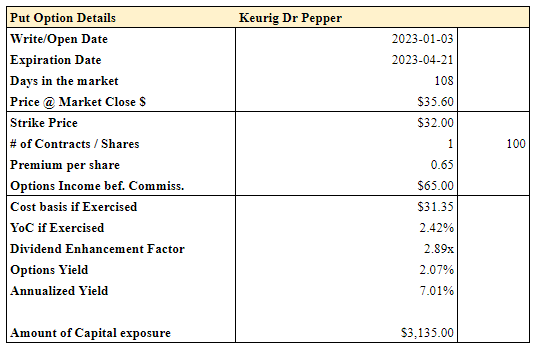

There do exist some possibility potentials for KDP – although I might warning you that the majority of those is actually saying “I need to purchase and I count on to run out ITM, I simply need a greater worth”, versus making a purely-oriented premium play with good annualized yield.

KDP Choice (Creator’s Information)

This represents the farthest out I am keen to go together with a PUT – round 100 days, and seven% annualized is not all that nice, nevertheless it’s an amazing worth for KDP, with $31.35 in case you embrace the premium. And if it actually does not drop, that is high quality too. I can perceive in case you really feel that 7% is not sufficient – my very own private minimal for places is 8.5% annualized, together with the risk-free charge for no matter money I am placing on the road and never having to place in right away.

You possibly can go for the 33 strikes – that might up the return to eight.67% primarily based on the information I am at the moment capable of pull exterior of market hours – however the greater you go, the faster you are prone to be ITM.

It is a first rate/acceptable PUT possibility, and I’d write this one or one near it. The capital outlay can be conservative, so far as choices go.

As we’re trying on the market right this moment, it appears that evidently the primary day goes to be a constructive one – that often does not bode nicely for writing Places, however we’ll see what occurs.