It is a visitor contribution by Lyn Alden

The sharp rise in US Treasury yields over the previous yr has put downward stress on many growth-oriented equities, whereas dividend-focused equities have usually held up higher.

Any funding, when figuring out its approximate honest worth, have to be in comparison with one thing else. For equities, that “one thing else” is commonly the 10-year US Treasury yield, which is considered by many buyers because the benchmark nominally risk-free financial savings asset.

From there, there are lots of methods to worth an fairness. For instance, somebody might do in depth discounted money circulation evaluation, and use the sum of the 10-year yield and an fairness threat premium as their low cost price. Alternatively, somebody might evaluate the earnings yield of a inventory to the 10-year Treasury yield. For income-focused buyers, evaluating the dividend yield of shares you wish to purchase to the 10-year yield is among the easier strategies.

Traditionally, the 10-year Treasury yield has normally provided the next yield than blue chip dividend development shares, however this got here at the price of the coupon not rising throughout its length.

You may obtain the whole checklist of all 350+ blue-chip shares (plus essential monetary metrics resembling dividend yield, P/E ratios, and payout ratios) by clicking under:

In different phrases, an investor might get possibly a 5% yield from Treasuries, or a 3% yield from a few of the highest-quality shares, with the distinction being {that a} inventory may very well be anticipated to develop its dividend by 5-15% per yr over that holding interval, leading to extra complete revenue and extra capital appreciation than the Treasury be aware in trade for extra volatility and a threat of capital loss.

Nonetheless, on this trendy surroundings of ultra-low charges, this dynamic grew to become flipped. I’ll illustrate with three quintessential dividend champions, every with at the least 60 years of consecutive annual years of dividend development underneath their belt.

Procter & Gamble vs. The ten-Yr Yield

This chart reveals the unfold between Procter & Gamble’s (PG) dividend yield and the 10-year Treasury yield:

As we will see, the unfold was unfavorable more often than not, that means that PG’s dividend yield was decrease than the US Treasury yield. That is what we’d count on, for the reason that Treasury be aware is a pure financial savings and revenue asset whereas PG is a mixed income-and-growth asset.

Nonetheless, the 2010s decade was a bizarre one- the dividend yield was increased than the 10-year Treasury yield. An investor might get extra revenue *and* extra development with the inventory than the bond!

I think about this period to have been a bond bubble- many equities have been reasonably-valued throughout a lot of the last decade, whereas bonds have been overvalued.

Two Extra Examples

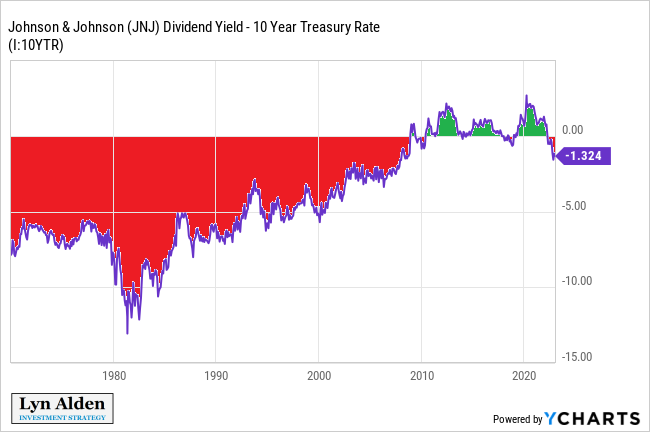

Johnson & Johnson (JNJ)’s yield unfold relative to the 10-year reveals the identical sample:

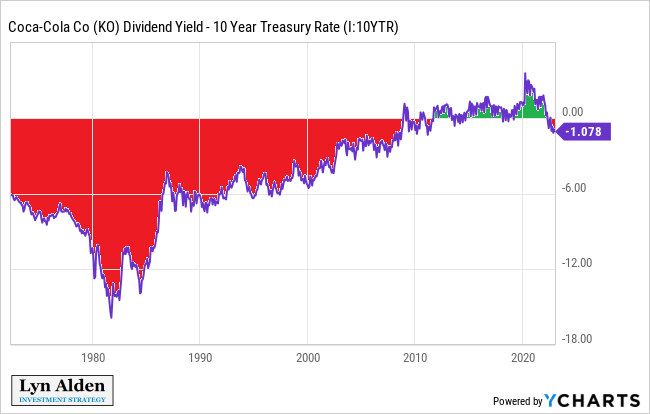

We are able to see the identical dynamic with Coca-Cola (KO):

There are dozens of different shares with charts like this. For almost all of corporations with 40+ years of consecutive annual dividend development, their yields have been under the Treasury price till the 2010s decade, and solely not too long ago have they returned to that state.

The Takeaway

In the course of the 2010s decade, equities have been a slam-dunk higher place to place capital than Treasuries. Sticking with dividend shares quite than bonds supplied extra present revenue plus extra development, which was traditionally uncommon.

Within the 2020s decade, the state of affairs appears to be returning to some extent of normalcy. Many dividend champions now yield decrease than the 10-year Treasury be aware, as they need to. Nonetheless, the unfold remains to be quite small in comparison with historical past, that means that the mix of revenue and development provided by a lot of these shares remains to be usually compelling in comparison with Treasuries for buyers with a long-term view.

Broad inventory buyers ought to plan for decrease anticipated returns over the subsequent decade in comparison with the prior decade, as a result of many fairness valuations are increased now than they have been after they began the 2010s decade, each in absolute phrases and relative to Treasuries.

Nonetheless, dividend equities normally are nonetheless not at all costly relative to Treasuries, even when they’re not fairly as low-cost as they have been a decade in the past. By means of cautious inventory choice, avoiding essentially the most overvalued securities, and specializing in out-of-favor high-quality corporations, there may be nonetheless loads of alternative within the dividend inventory universe in comparison with Treasuries.

The next articles include shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].