On this article

It’s lastly over! The loopy, unpredictable, and simply plain bizarre housing market of 2022 has ended. Although analysts like me will seemingly be learning the 2022 housing marketplace for years to return, we are able to lastly take a fast look again at what occurred this yr and infer what could be in retailer for the yr to return.

2022 was a story of two halves. January by Might/June was one sort of market, and July by December was a really completely different market. It’s not potential to find out the shift’s actual date, but it surely was inside this timeframe.

The First Half

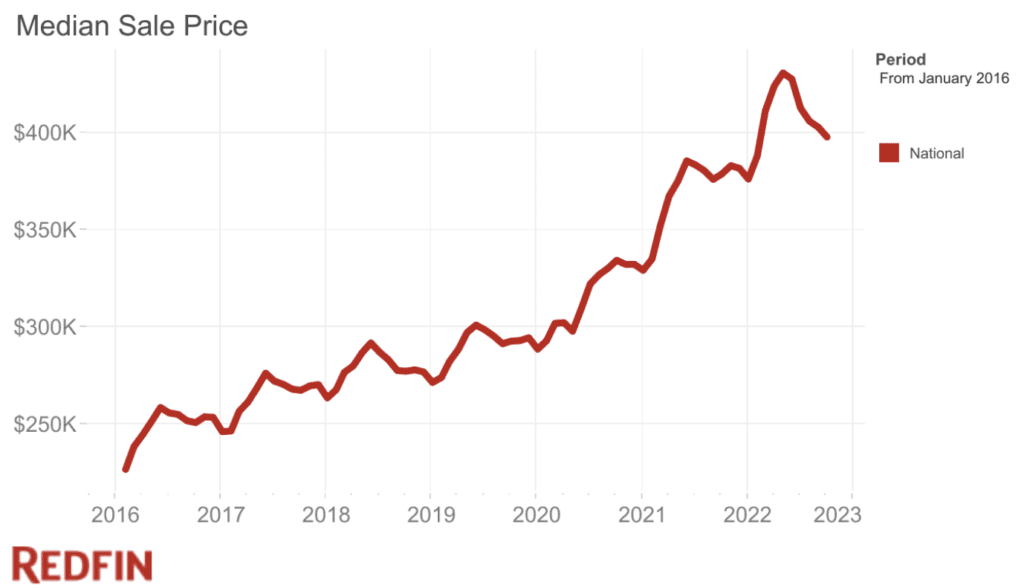

By way of the primary half of 2022, we noticed a continuation of the wild appreciation that outlined 2021. Each main variable that influences housing costs was placing upward strain available on the market. There was sturdy demographic demand fueled by millennials reaching their peak home-buying years. A decade of underbuilding contributed to a nationwide housing scarcity. Stock was nearly non-existent. And, after all, mortgage charges have been traditionally low.

However then, issues modified. In March of 2022, the Federal Reserve began elevating the federal funds fee, pushing up bond yields and mortgage charges. The change of coverage truly spiked demand as homebuyers and sellers rushed to transact earlier than the complete affect of upper mortgage charges have been felt. This, mixed with regular seasonality, allowed the social gathering to proceed and for costs to proceed going up for just a few additional months.

The Second Half

Finally, the affect of skyrocketing mortgage charges took maintain. Already dealing with ultra-high dwelling costs, greater mortgage charges priced many homebuyers out of the market, and demand fell. When demand falls, stock tends to rise, which is strictly what occurred.

As stock rose, sellers who have been drunk on energy over the past a number of years began to lose their leverage. Slowly, patrons began to have extra choices, and a little bit of stability returned to the market, pushing down costs.

Among the decline since June is seasonal, however as of December 2022, costs are down nearly 10% off their Might peak, and a typical seasonal decline is 5%-7%. The descent from the summer time peak was deeper in 2022.

It’s price noting that though costs are declining, they aren’t in free fall. Costs stay up year-over-year, and stock has began to reasonable. Mortgage charges have come down from October to December, and there are indicators that the drop-off is changing into much less steep. At this level, we stay in a correction, however not a crash.

What Will Occur In 2023?

Will we see a continuation of the downward development we’re in now? Will issues worsen? Or might the market reverse?

To me, it should once more be a story of two halves. I imagine within the first half of 2023, we’ll see a continuation of the market we’re in now: sellers don’t wish to promote, and patrons don’t wish to purchase. In fact, offers are nonetheless underway, however I anticipate gross sales quantity to stay properly under what we’ve seen for the final 7-10 years. Despite the fact that inflation is moderating, there stays an excessive amount of uncertainty within the financial system for the market to stabilize totally.

Hopefully, through the first half of 2023, we are going to see inflation come down and get extra readability about what is going on with the worldwide financial system. However what actually issues for housing quantity and residential costs is about one factor: affordability. If housing stays as unaffordable as it’s now, gross sales quantity and appreciation will keep low. If affordability recovers, I anticipate the housing market to stabilize and even perhaps see a modest restoration within the second half of 2023.

It sounds overly simplistic, however housing is simply too unaffordable in present market situations. Some estimates say that housing is the least inexpensive it’s been in over 40 years. Till this adjustments, the housing correction is right here to remain. The housing scarcity and demographic demand haven’t gone wherever. As quickly as affordability improves, I feel housing market exercise will resume.

Will Affordability Enhance?

Affordability is made up of three components:

Actual wages

Residence costs

Mortgage charges

Affordability can enhance if wages go up or dwelling costs and/or mortgage charges decline. Let’s take a fast take a look at if any of this stuff can occur.

Actual wages

In keeping with the Bureau of Labor Statistics, actual (inflation-adjusted) wages are down about 2% year-over-year however have ticked up about 0.5% since September. Nominal (not inflation-adjusted wages) is definitely up so much, however inflation is just too excessive and wipes out all of these beneficial properties.

Though it’s a optimistic signal that actual wages have ticked up a bit, it’s very modest. It’s potential that, as inflation moderates, actual wages will go up—however I discover it unlikely that that can occur in a significant method. To me, issues a couple of slowing financial system will gradual the tempo of wage development alongside inflation. Due to this fact, no actual progress on actual wages shall be made.

Housing costs

One space the place affordability is probably going to enhance is dwelling costs. Residential actual property costs will seemingly see year-over-year declines nationally, making properties extra inexpensive. For affordability to actually enhance, we’d most likely must see costs drop greater than 10%, and it’s very unclear if that can occur. If costs drop in any respect, and by how a lot, it should rely very a lot on mortgage charges.

Mortgage charges

Mortgage charges will be complicated, particularly lately. The Fed continues to boost the federal funds fee and has signaled they intend to maintain doing so into 2023. But, mortgage charges are falling. What’s happening right here?

Mortgage charges usually are not straight tied to the federal funds fee. As an alternative, it is rather carefully tied to the yield on 10-year treasuries. So, in a method, mortgage charges are extra influenced by bond traders than by the Fed (though bond traders are extremely influenced by the Fed. It’s complicated, I do know).

Over the past a number of weeks, bond yields have fallen for 2 causes. First, inflation is moderating sooner than anticipated, which tends to trigger a rally in bonds, sending bond yields down.

Secondly, there are fears of a world recession. These fears are likely to immediate world traders to hunt the protection of U.S. Treasury bonds, which pushes bond costs up and bond yields down. When bond yields fall, mortgage charges additionally are likely to fall, which is strictly what we’re seeing. So, mortgage charges could fall subsequent yr and finish the yr someplace between 5.5% and 6.5%, down from the latest peak of seven.23% in October 2022.

Conclusion

If my premise that the 2023 housing market hinges on affordability is right, then there are two believable outcomes for the second half of 2023.

First, mortgage charges fall, together with modest worth declines (lower than 10%), combining to extend affordability through the second half of 2023. This may seemingly trigger a bottoming of the housing market in Q1 2024, and we’d begin to see development available in the market once more come early 2024.

The opposite choice is affordability doesn’t enhance in 2023, most likely on account of persistently excessive inflation and mortgage charges. If that occurs, the second half of 2023 will appear like the primary half of 2023, and we’re seemingly in for an extended correction. On this state of affairs, we are going to most likely see housing costs drop 10-20% over the subsequent two years, and we gained’t see a bottoming of the market till late 2024/early 2025.

It’s robust to know what is going to occur, given the quantity of financial uncertainty. As of this writing, I feel the primary state of affairs is extra seemingly given the current developments in inflation and bond yields. However each choices are moderately seemingly at this level. Sadly, the subsequent twelve months are cloudy at greatest.

What do you suppose will occur in 2023? Let me know within the feedback under.

On The Market is offered by Fundrise

Fundrise is revolutionizing the way you spend money on actual property.

With direct-access to high-quality actual property investments, Fundrise lets you construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has rapidly grow to be America’s largest direct-to-investor actual property investing platform.

Be taught extra about Fundrise

Word By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.