Galeanu Mihai

The buyer staples sector was a transparent winner in comparison with main indexes in 2022 as traders turned defensive, however how will 2023 shake out?

As a part of its sport plan for 2023, UBS mentioned it has a shift of preferences inside the client staples sector. After weighing inflation pressures, elevated rates of interest and a pullback on client discretionary spending, UBS mentioned it’s most constructive on the beverage class given the superior progress traits, pricing energy, and tilt in the direction of top quality. UBS additionally favors family private care names over packaged meals shares 2023 on the expectation HPC will expertise higher earnings progress pushed by a bigger restoration in gross margins and skew in the direction of increased high quality than meals.

“The truth is, HPC corporations function in additional enticing finish markets (quicker progress, increased focus, and higher pricing energy) than Meals and we imagine this can start to take focus as worth beneficial properties average.”

The 12 months forward can also be anticipated to see a sharper concentrate on stability sheets from traders, which units up effectively for the staples group after corporations used extra earnings and proceeds from divestitures in the course of the pandemic to pay down debt and enhance total stability sheet positions. Wanting forward, packaged meals corporations particularly are anticipated to start deploying their stability sheets to drive incremental progress shifting ahead. “We imagine large-cap packaged meals names with low leverage will look to capitalize on M&A alternatives as natural fundamentals average,” famous Grom.

If the Shopper Staples Choose Sector SPDR ETF (NYSEARCA:XLP) is to outperform once more in 2023, a number of the heavy lifting could possibly be executed by high holdings Procter & Gamble (PG), Costco (COST), and Walmart (WMT). Tobacco mainstays Altria (MO) and Philip Morris Worldwide (PM) are additionally high ten holdings of most staples ETFs.

UBS analyst Peter Grom and crew forecast Basic Mills (GIS), Kellogg (Okay), and Mondelez Worldwide (MDLZ) will face essentially the most important FX headwinds to EPS throughout giant cap meals names. On the bullish facet of the ledger, the agency’s high giant cap picks for subsequent 12 months are Hershey (HSY), Conagra (CAG), Colagte-Palmolive (CL), PepsiCo (PEP), Coca-Cola (KO), and Constellation Manufacturers (STZ). As for SMID cap shares, the highest picks referred to as out have been Merely Items Meals (SMPL), Nomad Meals (NOMD), Very important Farms (VITL), and Celsius Holdings (CELH). The agency additionally has Purchase rankings on Coca-Cola (KO) and Energizer Holdings (ENR)

The buyer staples sector nonetheless blazes robust on a Looking for Alpha Quant Ranking foundation as effectively with 35 shares incomes a Purchase quant score. The shares within the group with the very highest quant rating are Efficiency Meals Group Firm (PFGC), Cal-Maine Meals (CALM), Industrias Bachoco, S.A.B (IBA), Lancaster Colony Company (LANC), and Sendas Distribuidora S.A (ASAI).

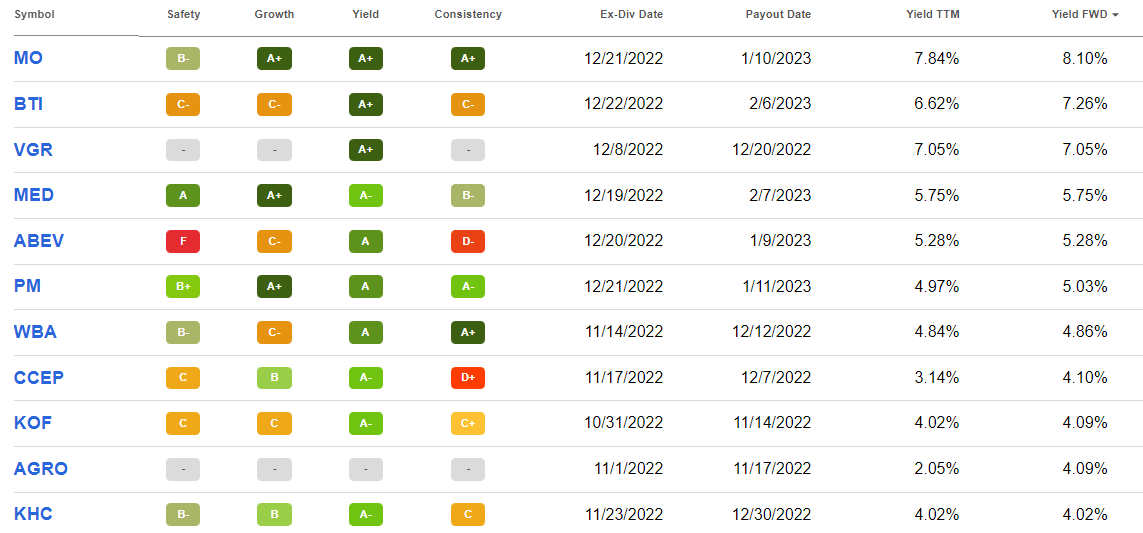

After all, dividend traders have a lot to work with within the client staples sector. Of observe, there are a handful of staples shares which have a Quant Ranking of Maintain or higher, dividend yield of 4.00% of upper, and PE ratio beneath 20. Create your favourite display right here.