AUDJPY, Every day

The RBA appeared to fulfil market expectations by providing clues within the RBA minutes on when it is going to finish its tightening cycle. In line with the minutes, the central financial institution mentioned ending tightening in December, however board members determined to lift charges for the third consecutive time by 25 foundation factors. Board members made the case for no adjustment for the primary time because the tightening cycle started in Might, which means that the cycle could also be coming to an finish. The minutes identified that no different central financial institution has stopped tightening but and the members additionally recognised that the World Financial institution’s predictions present that it’ll take a number of years earlier than inflation returns to the goal vary of 2% to 3%.

The minutes summarised that there’s substantial uncertainty within the financial outlook and that charge hikes are usually not on a predetermined path. Moreover, the market will anticipate developments at the least till the subsequent rate of interest assembly in February. The RBA continues to prioritise decreasing inflation, and policymakers are conscious of the hurt that prime inflation and rising rates of interest inflict on customers and corporations. Though the RBA will pause for a while, after efforts to cut back inflation that appears like a shiny spot. The danger of a wage-price spiral stays, if the RBA stops tightening too quickly, which can make the battle in opposition to inflation rather more difficult sooner or later.

In the meantime, the BOJ unexpectedly widened its higher goal vary on 10-year JGB yields. The BOJ, as extensively anticipated maintained the coverage steadiness charge at -0.10%, however unexpectedly widened the goal vary of the 10-year yield to 0.50% from the earlier higher certain of 0.25%.

BOJ Governor Kuroda stated it was too early for the BOJ to think about an exit from easing or a coverage evaluation, and Tuesday’s measures targeted on market performance.

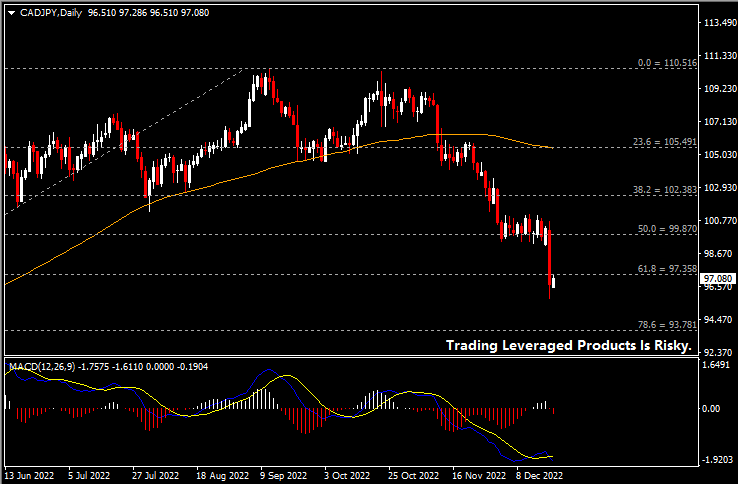

Technical Evaluation

The AUDJPY pair shaped a rounding prime reversal sample and broke the vital 91.00 assist and weakened greater than 4%. A rounding prime sample can develop over days, weeks, months and even years, with longer time frames to finish forecasting longer development adjustments. The principle level of recognising a rounding prime sample is to anticipate a major development change from a trending up value to a trending down value.

The bears in Tuesday’s (20/12) buying and selling recorded a low of 87.00 earlier than closing at 87.75, barely beneath the 87.29 assist recorded within the final Might buying and selling. The draw back motion is anticipated to proceed so long as buying and selling stays beneath the 90.50-96.00 resistance which is the neckline of the rounding prime.

Whereas the worth continues to be held on the assist degree, additional draw back is projected for FE138.2 at 85.16 from 98.46-90.80 and 95.77 pullback. RSI at oversold degree and MACD at steep promoting zone.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is supplied as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.