RapidEye

Funding Thesis

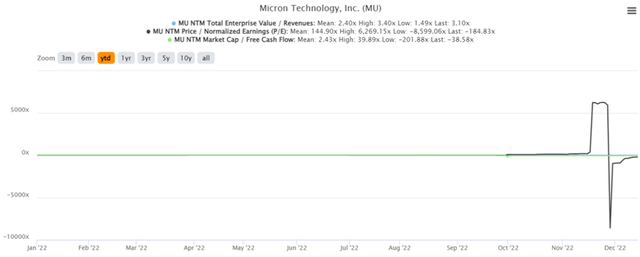

MU YTD Inventory Value

Looking for Alpha

Regardless of the market-wide optimism witnessed earlier, the Micron Know-how, Inc. (NASDAQ:NASDAQ:MU) inventory continues to commerce sideways at $52.04, representing a minimal 7.41% restoration from October’s backside ranges. In any other case, indicating a tragic -45.65% plunge YTD. Nevertheless, we reckon that the pessimism is overly carried out, resulting from its glorious projected profitability by FY2025 and the growth plans in New York.

The Feds could increase the terminal charges to five.1% towards the earlier projection of 4.6%, indicating extended curiosity ache by 2024, considerably worsened by China’s quick and livid reopening cadence. Nonetheless, we select to stay assured concerning the latter, for the reason that nation (together with Taiwan and Hong Kong) accounts for 36.26% of the corporate’s income in FY2022 regardless of the sustained Zero Covid Coverage then. With market analysts projecting a flurry of ‘revenge’ spending over the following few quarters, China’s GDP is anticipated to recuperate tremendously to five% by 2023, in comparison with the projection of three% in 2022 and 6% in 2019.

Mixed with the Chinese language authorities’s 300B Yuan stimulus bundle, this dramatic inventory valuation and stock correction could not final lengthy, since MU could outperform expectations from FQ2’23 onwards. Due to this fact, traders with greater threat tolerance ought to think about nibbling at present blood-bath ranges, as a result of extremely engaging threat/reward ratio. Naturally, portfolios also needs to be sized appropriately within the occasion of volatility.

The MU Administration Proved Extremely Prudent In Correcting A Temporal Ache

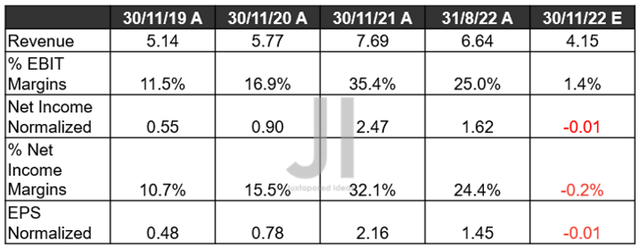

MU Income, Web Revenue ( in billion $ ) %, EBIT %, and EPS

S&P Capital IQ

For the upcoming FQ1’23 earnings name, MU has catastrophically guided lower-than-expected revenues and EPS, triggering huge uncertainties certainly. Nevertheless, we reckon that these numbers are overly prudent, giving the administration a chance to outperform remarkably. We’ll see, since issues could decide up tremendously from FQ2’23 onwards.

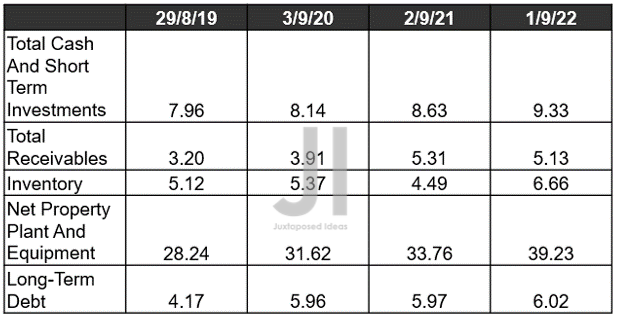

MU Steadiness Sheet ( in billion $ )

S&P Capital IQ

Within the meantime, MU’s stability sheet stays very wholesome by FQ4’22, with sturdy money/ investments of $9.33B and complete receivables of $5.13B. Thereby, triggering an improved internet money owed ranges of -$3.4B for FY2022, in comparison with -$3.06B in FY2021 and -$1.96B in FY2020. Although its stock ranges could seem elevated at $6.66B (30% enhance towards FY2019 ranges), we should additionally spotlight that these are comparatively cheap in comparison with Nvidia’s (NVDA) $4.45B at 454.95%, Superior Micro Units’ (AMD) at $3.36B at 343.07%, and eventually Intel’s (INTC) at $12.83B at 46.74%.

Moreover, MU’s long-term money owed are cheap at $6.02B, since solely $1.18B shall be due by 2025, and the remaining are remarkably well-laddered by 2051. Due to this fact, we aren’t involved about this temporal headwinds in any respect.

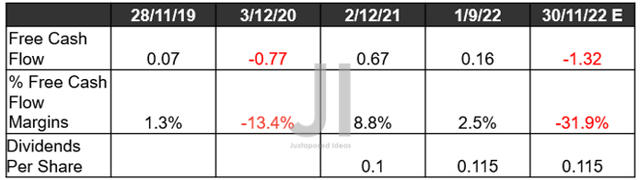

MU FCF ( in billion $ ) % and Dividends

S&P Capital IQ

As well as, market analysts nonetheless count on MU to pay an in-line dividend of $0.115 for the upcoming quarter, regardless of the elevated capital expenditures up to now. The corporate reported a Capex of $12.07B in FY2022, with a projected -37.31% YoY deceleration to $7.56B for FY2023, based mostly on the administration’s projected cuts. Nevertheless, we stay assured about its prospects, since these trade situations are merely cyclical and don’t pose any long-term headwinds on the corporate’s elementary efficiency.

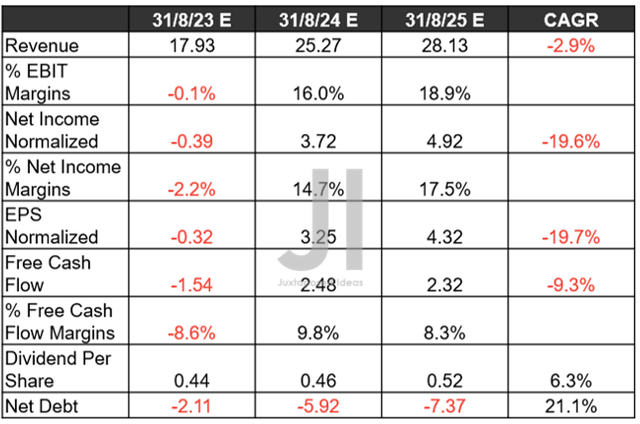

MU Projected Income, Web Revenue ( in billion $ ) %, EBIT %, EPS, FCF %, Dividends, and Money owed

S&P Capital IQ

Whereas MU’s high and backside line progress is anticipated to decelerate YoY for FY2023, we aren’t involved since its revenues could quickly recuperate by FY2025, nearing hyper-pandemic highs. Moreover, market analysts could probably improve its short-term efficiency relying on the administration’s ahead steerage within the upcoming earnings name and China’s voracious urge for food in FQ2’23. Thereby, triggering a possible accelerated return to pre-pandemic EBIT and internet revenue margins of 33.3% and 31.2%, respectively.

Notably, MU could additional develop the well being of its stability sheet to internet money owed of -$7.37B by FY2025, indicating huge enhancements in its rapid liquidity regardless of the deliberate manufacturing facility in New York. First rate certainly, since its dividends are additionally anticipated to develop to $0.52 on the identical time, indicating speculative yields of 0.99% towards its 4Y historic yield of 0.13% and sector median of 1.55%.

Within the meantime, we encourage you to learn our earlier articles, which might assist you higher perceive its place and market alternatives.

Micron: Destruction Of Demand – Delicate Balancing Act Forward Micron Inventory: Impending Rollercoaster Journey

So, Is MU Inventory A Purchase, Promote, or Maintain?

MU YTD EV/Income and P/E Valuations

S&P Capital IQ

MU is at present buying and selling at an EV/NTM Income of three.10x, NTM P/E of -184.83x, and NTM Market Cap/ FCF of 38.58x, clearly attributed to the administration’s overly prudent FQ1’23 steerage. In any other case, the inventory has been averaging at a P/E imply of 11.98x over the previous three years and eight.31x pre-pandemic. Primarily based on its FY2025 EPS of $4.32 and up to date P/E imply of 11.75x, we’re a average value goal of $50.76, indicating a minimal margin of security certainly.

Nevertheless, we select to be somewhat extra optimistic, resulting from MU’s potential restoration from FQ2’23 onwards. Primarily based on an expanded EPS by 15% and an bold P/E valuation of 13x, we could witness MU reaching an aggressive value goal of $64.48 within the quick time period, indicating a wonderful 23.90% upside from present ranges. Due to this fact, we select to re-rate MU inventory as a speculative Purchase.