coldsnowstorm

Co-produced with “Hidden Alternatives.”

The U.S. financial system is slowing down. The Fed has hit the brakes arduous with their quantitative tightening, and there’s a clear downtrend in job openings, dwelling gross sales, and manufacturing output. It’s primary economics that modifications made to parameters like rates of interest have a delayed impact – it takes time to percolate via the monetary system and slowly impacts inflation, enterprise operations, and customers. The Fed continues driving based mostly on incomplete information, and the financial system is on monitor to hit a recession subsequent yr. It’s vital that you just consider your necessities and your portfolio’s potential to supply for them.

What are your funding objectives? Whereas there might be a number of exceptions, they’ll broadly be categorized into

Schooling bills to your family members, notably school

Main Purchases – a automotive, a home, an enormous trip

Rising your wealth via your working years

Earnings in retirement

Constancy Canada

The earnings Methodology is a mode of investing the place you remodel your portfolio right into a dividend machine. Dividends are misunderstood to be solely a retiree’s funding technique. In your 20s, you put money into crypto and high-growth shares; in your mid-30s to 50s, you put money into sluggish growers and index funds; and nearer to retirement, you put money into dividend payers, bonds, and different fixed-income property, proper?

You might be fairly unsuitable; I encourage you to consider dividends as passive earnings. Everybody can use them, and if designed appropriately, they’ll snowball right into a parallel paycheck. A daily chunk of money predictably coming into your account can help and assist any of the objectives above. They could not have the coolness of crypto, the swankiness of SPACs, or the niftiness of NFTs, however these dividends make my portfolio glow up in darkish economies.

At HDO, we’re sturdy proponents of fastened earnings throughout these unsure instances. Why fastened earnings throughout a rising charge surroundings, chances are you’ll ask. The reply is straightforward; fastened earnings is sort of underrated these days, and securities are buying and selling at very low cost costs. We get to purchase them at deep reductions and safe a really dependable stream of earnings for years to return. Two most well-liked picks with as much as ~8.3% yields to get your earnings flowing.

Choose #1: RLJ-A, Yield 7.9%

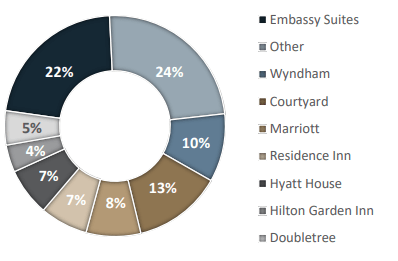

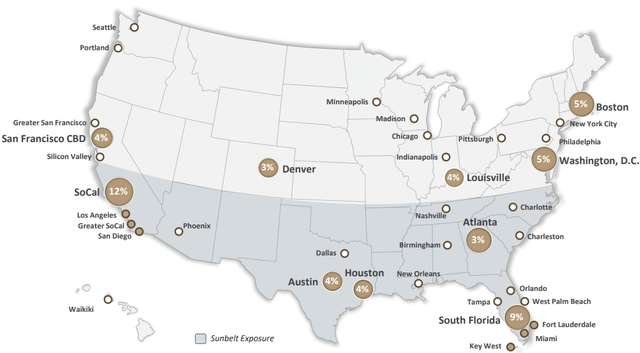

RLJ Lodging Belief (RLJ) is a lodge funding firm that owns full-service accommodations underneath well-recognized world manufacturers similar to Marriott (MAR), Hilton (HIL), Hyatt (H), and Wyndham (WH). The corporate maintains a portfolio of 96 accommodations with ~21,200 rooms situated in 23 states, with ~51% of its EBITDA generated from the sunbelt area. (Supply: RLJ November Convention Presentation)

RLJ November Convention Presentation RLJ November 2022 Investor Presentation

As a result of world pandemic and its impression on the journey business, 2019 efficiency is repeatedly used to match efficiency vs. the pre-pandemic interval. Throughout Q3, RLJ reported Income Per Obtainable Room (‘RevPAR’) to be 95% of 2019 ranges. With sustained profitability and rising EBITDA, RLJ elevated its frequent dividend by 400% in September. Moreover, the corporate has repurchased $57 million of inventory YTD and has $193 million remaining within the approved share repurchase plan. The raised dividend nonetheless places RLJ’s yield beneath pre-COVID ranges. However, an increase within the frequent dividend is an indication of a wholesome enterprise with reliable working money flows.

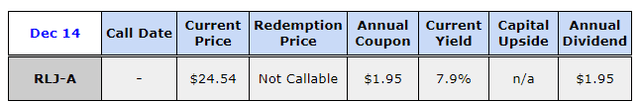

As earnings buyers, we’ll concentrate on the $1.95 Sequence A Cumulative Convertible Most popular Shares (RLJ.PA). Discover how there isn’t a point out of “redeemable.” RLJ-A can’t be known as and has no par worth.

Writer’s calculations

This makes it an nearly perpetual money machine and provides it almost a vast worth upside potential like equities. Buyers should observe that RLJ-A is not redeemable however is convertible into 0.2806 frequent shares on the preliminary conversion worth of $89.09 per frequent share. Nevertheless, the corporate can’t power this conversion until their frequent shares are buying and selling at 130% of the conversion worth for 20 of any 30 consecutive buying and selling days. So for RLJ-A to be compelled to transform, the frequent items should commerce at or above $115.82 – a whopping 860% enhance from present ranges.

If that occurs, RLJ-A shareholders will obtain a worth at or above $32.50/share, a +32% upside from present ranges. An unlikely occasion, but when we’ve got to half with our money machine, we will stay with that outcome!

RLJ-A’s annual $1.95 coupon represents an 7.9% yield at present costs. The corporate spends ~$25 million yearly in the direction of most well-liked dividends and ~$72 million YTD in the direction of curiosity expense. These are adequately lined by RLJ’s YTD internet money from working actions ($203 million). On the finish of Q3, the corporate had $488 million in money and money equivalents which covers the popular dividends for 20 years!

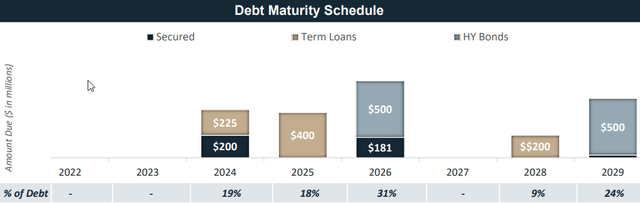

On the finish of Q3, RLJ eliminated its debt covenant restrictions and lowered its borrowing value by ~40 bps which interprets to a cool $9 million in annual curiosity financial savings. The corporate has no debt due till 2024, and ~99% of debt is fastened or hedged to defend them from these rising rates of interest.

RLJ November 2022 Investor Presentation

RLJ November 2022 Investor Presentation

RLJ-A presents a perpetual high-yield alternative from an organization with a rising frequent dividend and huge share buybacks. Since RLJ-A is cumulative, a rising frequent dividend provides sufficient safety to your earnings stream. Moreover, the corporate is in a cushty place to fulfill its curiosity and most well-liked dividend funds, and we will sit again and acquire 7.9% for years to return.

Choose #2: SPNT-B, Yield 8.3%

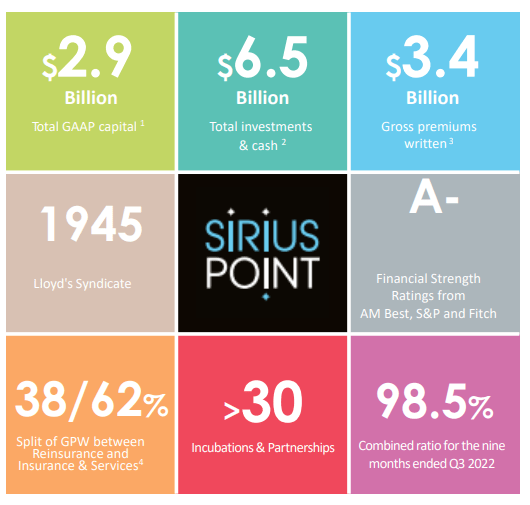

SiriusPoint Ltd. (SPNT) is a world insurer and reinsurer with $2.9 billion in complete capital. The Bermuda-based agency underwrites a worldwide portfolio of enterprise and supplies options to shoppers and brokers in ~150 nations. SPNT was shaped final yr from the merger of Triple Level and Sirius Group and is present process critical transformations to realize sustained profitability, together with a revamp of key administration positions. (Supply: November 2022 Investor Presentation)

SiriusPoint November 2022 Investor Presentation

In September, the corporate named Scott Egan because the CEO and not too long ago appointed Steve Yendall because the CFO. Moreover, throughout Q3, the corporate introduced that it will shut its workplaces in Miami, Hamburg, and Singapore and scale back its footprint in Liege, Belgium, and Toronto to restructure its underwriting platform. SPNT reported an underwriting lack of $88 million and a mixed ratio of 114.5% in Q3 (98.5% YTD). Whereas this appears unhealthy, it’s a materials YoY enchancment ($245 million loss and a mixed ratio of 150.2%). Out of the $115 million of disaster losses, Hurricane Ian accounts for $80 million.

Whereas reinsurance continues to crush general outcomes, the insurance coverage section reported a 33% YoY progress in core gross premiums written. This displays the shifting of SPNT’s enterprise combine from reinsurance to insurance coverage to scale back earnings volatility and enhance underwriting profitability.

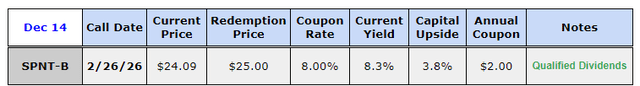

SiriusPoint’s Sequence B Resettable Mounted Fee Desire Shares (SPNT.PB) current a deeply discounted and high-yield alternative for earnings buyers. SPNT-B was structured on the time of the Third Level – Sirius Group merger and was designed to be very engaging for shareholders and was not supposed to lift capital from the general public markets. As such, SPNT-B enjoys an above-average 8% coupon with a profitable reset-rate construction post-redemption date that gives a superb protection in opposition to inflation. SPNT-B is a cumulative most well-liked safety, a uncommon attribute within the monetary companies business, offering extra earnings protections to shareholders.

SPNT-B most well-liked dividends value SPNT $16 million yearly, and the agency pays ~$38 million in the direction of curiosity bills. On the finish of Q3, SPNT reported $650 million in money and money equivalents, giving important flexibility to fulfill their debt curiosity and most well-liked dividend obligations. Fitch and S&P give SPNT an investment-grade credit standing and an A- monetary energy ranking.

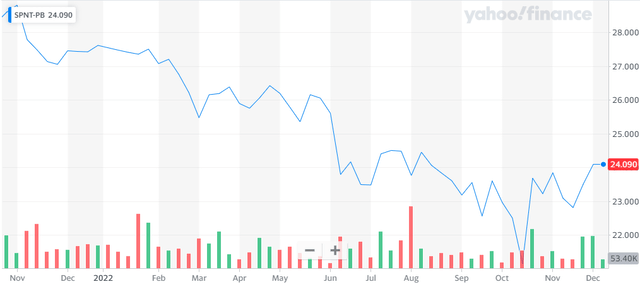

Resulting from uncertainties related to SPNT-B’s administration, restructuring, and path to profitability, the preferreds have bought off in current months. Present costs present a sexy 8.3% certified yield and ~4% upside to par worth.

Yahoo Finance Writer’s calculations

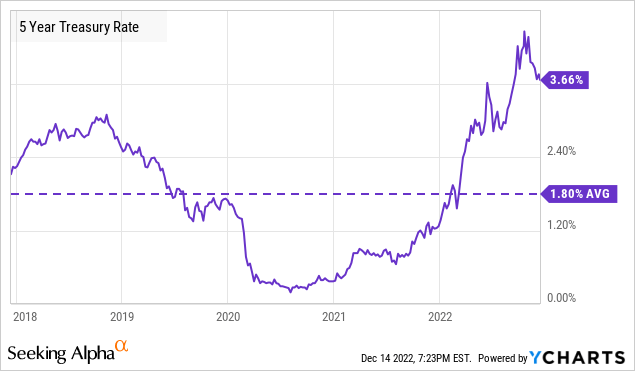

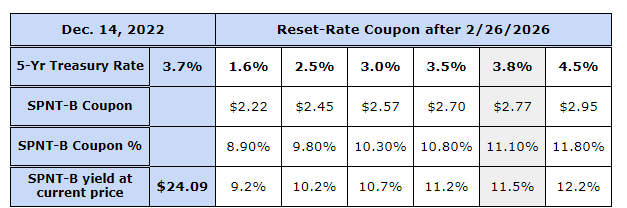

SPNT-B is a reset charge most well-liked. Its coupon post-redemption date (Feb 26, 2026) will likely be 7.298% + 5-yr Treasury Yield on the time, and this coupon will reset each 5 years. The typical 5-year Treasury yield over the previous ten years is 1.8%.

Even that charge will make SPNT-B’s yield post-call date considerably higher than at the moment’s.

Writer’s calculations

SPNT-B is rated BB+, differentiating it from peer-preferred securities, that are usually unrated. As earnings buyers, we’ll let the investment-grade SPNT restructure its enterprise and transfer towards sustainable profitability. We are going to patiently purchase and maintain its most well-liked and acquire a well-protected and certified 8.3% yield. Its reset charge setup positions us for even larger yields in three years, making SPNT-B a stable long-term inflation fighter.

Shutterstock

Conclusion

The inventory market is an emotional rollercoaster the place the capital upside of your favourite securities depends upon many unmeasurable components. The mindset of the funding neighborhood (retail and institutional buyers), upcoming occasions from the geopolitical spheres, the climate forecast, the mindset of the Federal Reserve board of governors – fairly an countless record. I can not crunch all these unquantifiable variables and do not wish to play a wild guessing sport with my hard-earned capital. My landlord is not going to waive my lease as a result of we’re in a bear market. There are bills to sort out in all markets, and I wish to place my portfolio to assist pay my payments.

Your month-to-month utility payments, automotive or mortgage funds, or earnings in retirement, dividends can present for them. The sooner you start investing, the extra time you need to develop a high-quality earnings stream. Hold constructing your dividend portfolio so that you by no means run out of cash in your requirement; we’ve got two picks with as much as 8.3% yields to get you began.