Emirhan Karamuk/iStock Editorial by way of Getty Pictures

Funding Thesis

Mercedes Benz (OTCPK:MBGAF, OTCPK:MBGYY) is among the world’s best-known and most recognizable luxurious automobile manufacturers. Since its basis in 1926, the corporate has change into a worldwide image of high quality, type, and innovation. As the automotive trade continues to evolve, Mercedes-Benz’s technique should additionally adapt to stay a market chief. The corporate’s future technique is leveraging its sturdy model identification, specializing in the high-end section and electrical vehicles. The valuation is extraordinarily low in comparison with the competitors, and the dividend yield is excessive.

The longer term requires a brand new technique

The concentrate on electrical autos is not only by alternative. Bans on basic vehicles have gotten more and more probably and have already been determined in some instances. For instance, the EU needs to ban the sale of recent combustion engine autos from 2035. Even when one thing ought to change once more, automobile producers don’t have any alternative however to adapt and focus completely on electrical autos. In any other case, they are going to be left behind by the competitors. Mercedes plans that each one new vehicles will likely be electrical from 2030.

Concentrate on high-end and excessive margins

Till now, Mercedes has been energetic in nearly all value segments. This technique has been below stress for years, competing with very low-priced Chinese language and different producers. And now, this pattern additionally appears to proceed with electrical autos. Subsequent yr BYD is predicted to launch its low-cost entry-level line known as Seagull, beginning at $12,500. Mercedes would not need to become involved on this value battle; in spite of everything, it has a superb picture and is a world-renowned model.

Mercedes needs to focus on the next value vary sooner or later. The corporate needs to evolve into an genuine noble model and concentrate on top-end luxurious. What benefits, then, will this step carry? Why ought to this step be taken within the first place?

CEO Ola Källenius explains this shift in technique when it comes to larger revenue margins. The automaker set gross sales information final yr with its high-class fashions Maybach, AMG, G-Class, S-Class, and EQS. There are additionally financial components that the automaker needs to benefit from. Globally, the variety of rich individuals is rising, particularly amongst older generations. Moreover, this section has traditionally demonstrated above-average disaster resistance and sturdiness.

technique replace presentation

Within the case of luxurious items, it is usually simpler to implement value will increase, and the elevated prices for the required supplies are much less important. In the intervening time, the battery prices are round $128 per kilowatt-hour, though this determine consistently fluctuates. Within the Tesla Mannequin Y, a 60KWh is built-in, equivalent to prices of $7680. That is why Tesla has raised its costs, and BYD will supposedly put a sodium-based battery in its low-cost mannequin subsequent yr.

Q3 outcomes

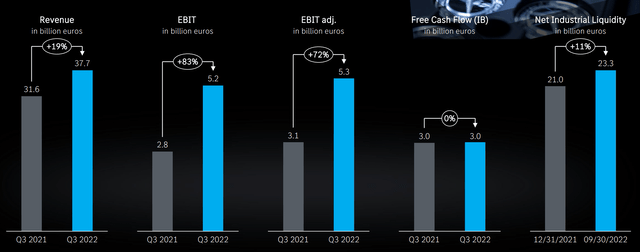

Within the final quarter, the corporate generated revenues of €37.7B, a rise of 19 % in comparison with the identical interval of the earlier yr. Greater than 530,000 vehicles had been bought. Regardless of the continued provide bottlenecks for semiconductors, the corporate achieved a considerable 38 % enhance in comparison with 2021. The underside line is an EBIT of €5.2B, an increase of 83 %. The free money circulate was €3B, and earnings per share €3.66. Excessive-end luxurious automobile gross sales had been up 5%, and electrical automobile gross sales had been up 39%. Electrical vehicles accounted for a complete of 85K of the 530k gross sales.

fairness roadshow presentation

Valuation

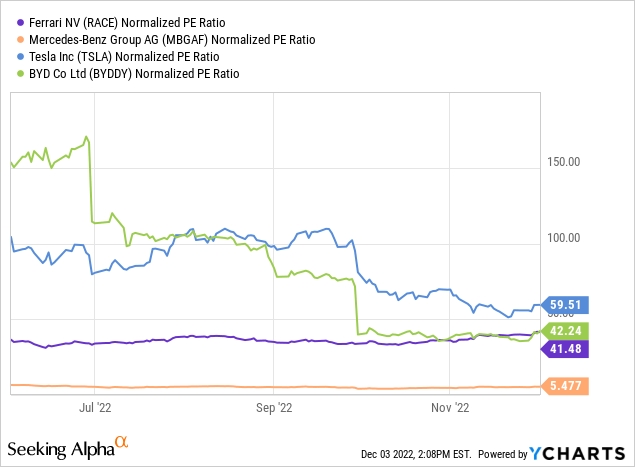

With just one quarter left, it’s protected to imagine that analyst estimates will likely be fairly correct. $12.70 earnings per share are anticipated, and the present share value is $67.70. A comparability with the competitors reveals how low cost that is.

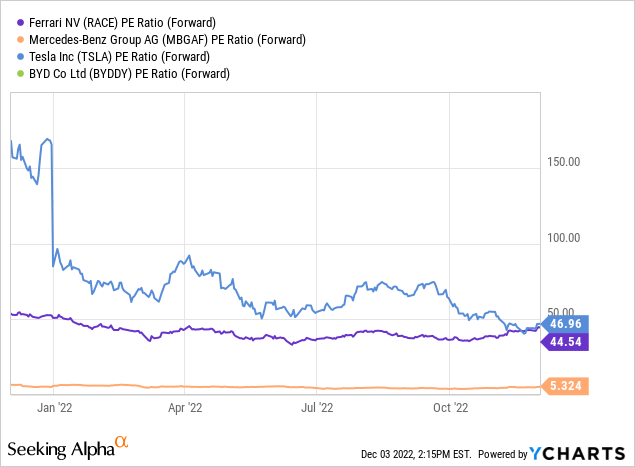

Nonetheless, it should be stated that many opponents have had considerably larger progress charges in recent times, and these proceed to be assumed. Due to this fact, one other graph with the ahead PE ratio. I do not know why BYD is lacking right here, however in accordance with Searching for Alpha, it’s 32. You may see that the distinction between Tesla and BYD is getting smaller however nonetheless big.

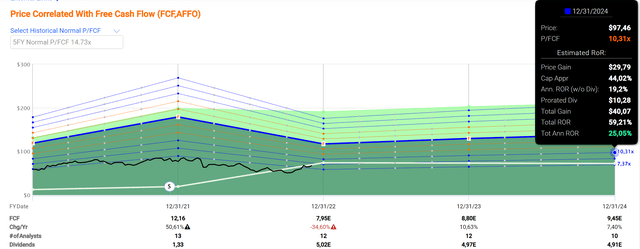

In accordance with FAST Graphs, the inventory traditionally trades at 14.7x free money circulate on common. Presently, it’s buying and selling at 8x. Assuming solely a 10x valuation till the tip of 2024, an annual return of 25% could be doable.

fastgraphs

There are a number of causes for this low valuation. First, basic automobile producers had been undervalued in the middle of the hype in comparison with electrical automobile startups. It was assumed they had been technologically too far behind and sluggish to make the turnaround. Due to this fact, electrical automobile startups had been attributed absurdly excessive valuations and worthwhile automobile producers had been bought off. Within the meantime, nonetheless, one can see that these firms managed to adapt in a short time.

Moreover, there was a basic outflow of capital from European shares to American shares for months. That is partly comprehensible given the geopolitical scenario and the stress inside Europe. Nonetheless, it’s only partly comprehensible as a result of Mercedes, for instance, is a globally energetic firm. On this respect, an organization like Tesla will endure simply as a lot when European buying energy dwindles.

Dividend

Like many German firms, Mercedes solely pays out dividends every year. The final one in April 2022 was for fiscal 2021 and was $5.26. Based mostly on the present share value, the yield is 7.7%. Nonetheless, the following one will most likely be decrease, as general earnings per share are anticipated to be 47% decrease than in 2021.

Dangers

In fact, these gross sales estimates over the following few years will not be positive, however they’re topic to quite a few dangers, particularly in such a delicate sector because the automotive trade.

Economists are warning that Europe or the entire world might enter a deep recession within the coming months. If this had been to occur, it might very probably have a direct damaging affect on client sentiment and would additionally very probably have an effect on the cyclical Mercedes share.

The provision bottlenecks nonetheless should be resolved and can solely be as soon as China ends its fixed lockdowns. The power disaster will probably damage the enterprise, as a lot manufacturing is in Germany. As well as, competitors is turning into stronger. Mercedes has at all times had a really top quality, however with electrical vehicles, the playing cards are roughly reshuffled as previous improvements play much less of a job. As an alternative, issues like autonomous driving, software program, and connectivity change into important.

fairness roadshow presentation

Conclusion

Mercedes has recovered very effectively from the catastrophic scenario in Covid instances. Though they now have extra competitors and new challenges because of the sudden shift to electrical vehicles, they at the least do have a transparent technique. I believe the share value has been pulled down an excessive amount of, particularly while you examine the corporate to the competitors. Given the low valuation, all dangers are sufficiently priced in, and the inventory nonetheless has loads of upside in comparison with its historic common valuations. Due to this fact, I consider a purchase is a worthwhile funding with a view to the following few years.