Just a little over a decade again, the Indian energy sector seemed like probably the most fascinating investing alternatives. Expectations of excessive development, big energy deficits and grand authorities plans for a number of ultra-mega energy tasks (UMPP) attracted giant investments from Indian enterprise homes and worldwide non-public fairness giants.

However then, the sector acquired short-circuited. The whole lot that would go mistaken, went mistaken — decrease than forecast financial development, overzealous bidding for tasks, important foreign money depreciation and better rates of interest that resulted in venture prices going manner out of finances, lack of gas provides, and discom points. All mixed, resulted in an enormous outage within the sector for over a decade. Many tasks ended up unviable and landed in chapter courts. From its earlier peak in 2008, the BSE Energy index was down by 60 per cent by January 2020 (previous to the Covid crash) in comparison with the Sensex rise of over 100 per cent.

Nevertheless, publish the Covid crash of March 2020, the sector has seen a big turnaround. From Covid lows of 1331 the BSE Energy Index is up 247 per cent as towards Sensex features of 120 per cent. The index even crossed its 2008 peak in August 2022. What has been driving this optimism within the sector? It may be attributed to many components — supportive fiscal/financial insurance policies driving financial development, shakeout within the sector leading to sturdy gamers rising stronger and weak ones getting weeded out.

Decoding the sizzles and fizzles of thermal energy genco shares

Decoding the sizzles and fizzles of thermal energy genco shares

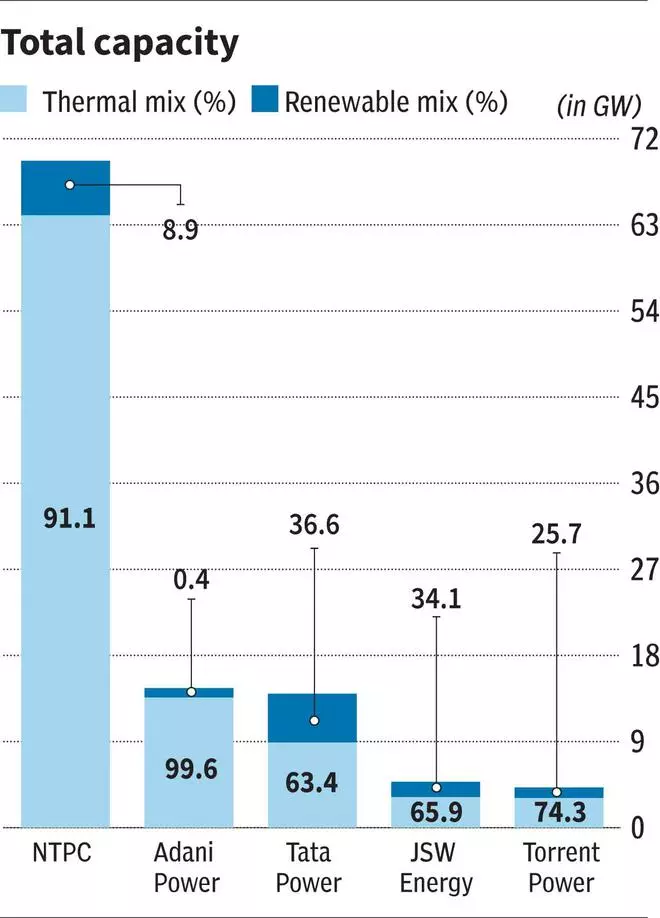

There are causes now to consider the worst could also be over for the sector. However what does the longer term seem like? Whereas it’s anyone’s guess how the close to time period will play out, given prospects of the worldwide financial slowdown, traits in commodity costs (coal, fuel and many others), and market volatility, the long-term prospects seem brighter now. With thermal energy remaining the mainstay (70 per cent of present energy generated within the nation) and the big thermal gencos (besides Adani Energy) aggressively diversify into renewables as nicely, listed below are the components to contemplate earlier than zeroing in on them.

PPA/Tariffs and gas provides

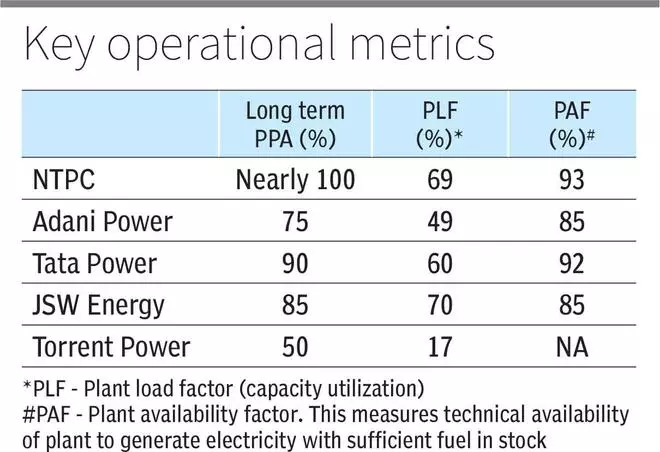

Thermal energy gencos usually promote electrical energy by means of long-term Energy Buy Agreements (PPAs) or by way of short-term preparations equivalent to auction-based bilateral agreements (as much as one 12 months) and energy buying and selling platforms (as much as 11 days). Majority of energy is bought by way of long-term PPAs of round 25 years to distribution firms. Greater the capability tied up with long-term PPAs, larger is the income visibility.

To have seamless energy technology, it’s obligatory for firms to have sources for gas procurement (coal, fuel and lignite), which could embody gas provide preparations (FSAs) with Coal India and its subsidiaries, procure by way of captive mines, or e-auction in service provider buying and selling platforms. Lack of such preparations up to now led to sure firms resorting to an costly possibility — imported coal. As an example, of a complete 195.03 MT of coal, round 87 per cent of NTPC’s coal comes by way of annual contracted amount beneath FSA with Coal India, whereas the remaining is from captive mines, bridge linkage and importing. Lengthy-term FSA ensures gas availability and helps in stock administration. Corporations even have crops depending on imported coal.

Profitability is especially reliant on what kind of tariffs they get on their PPAs. Tariff dedication right here can broadly be labeled into two sorts — cost-plus based mostly and aggressive bidding based mostly. For cost-plus based mostly PPAs, tariff contains fastened capability cost on plant availability (measured by PAF) and power (variable) cost. Plant can get better 100 per cent of the fastened cost with post-tax venture ROE of 15.5 per cent over and above prices at normative ranges, offered plant is technically obtainable greater than 80-85 per cent with adequate gas in inventory.

Additional, firms can earn incentives in the event that they obtain PLFs greater than 85 per cent. Gas (power) price may be allowed relying on effectivity ranges. As an example, majority of NTPC’s put in capability earns tariff on cost-plus foundation on account of which the corporate has stability in earnings and money flows. Nevertheless, the case isn’t the identical with aggressive based mostly tariff as all the prices can’t be of pass-through nature whereas sure elements may need escalation clause. There have been cases when aggressive bidding led to unprofitable tasks. As an example, Tata Energy emerged because the lowest bidder at tariff of ₹2.26 per kwh for Mundra’s imported coal-based UMPP of 4 GW. Additional, it acquired 30 per cent stake in Indonesia-based coal mines for its coal provides. Nevertheless, as a consequence of adjustments in mining laws in Indonesia, the price of gas rose and consequently, it grew to become troublesome for Tata Energy to run the Mundra plant profitably.

Tariffs earned by promoting energy on service provider buying and selling platforms like IEX and PXIL exposes firms to volatility in earnings as tariffs can fluctuate every day. As an example, as per an ICRA report, after remaining excessive within the vary of ₹8-10 per unit throughout June finish quarter, the spot tariffs have moderated to ₹3-3.5 per unit.

Ideally, gencos ought to promote majority of energy by way of long-term PPAs backed by long-term FSAs. Having crops as near the (coal) pit-head as attainable can be a differentiating think about price competitiveness. A small service provider buying and selling part might help firms generate opportunistic earnings, however this can’t be the mainstay as it will probably result in unstable earnings.

Discoms

Non-realisation of billed quantity, years of mounting losses as a consequence of tariff order delays and inadequate enhance in tariffs on sale of energy to end-customers regardless of prices handed on by gencos have adversely affected the monetary well being of state distribution firms (discoms). They’re at the moment tormented by humongous money owed and dues to gencos. Delayed funds by discoms creates working capital points for gencos which, in flip, results in insufficient procurement with respect to normative availability necessities of coal as advance cost is meant to be remodeled there. As an example, NTPC was owed about ₹27,000 crore by state gencos as of FY22. As per Central Electrical energy Authority (CEA), on account of the money crunch created by such a scenario, sure harassed thermal gencos needed to resort to short-term loans with charges as costly as 12-13 per cent, which might additional burden their financials.

After all, there have been makes an attempt to resolve these points. For discom-related points, fallback choices exist within the type of letters of credit score, termination of PPA contract and service provider base promoting can be found. Nevertheless, lack of PPA can result in termination of FSA, creating gas safety points for the businesses. To deal with discom financials and genco receivable points, in June 2022, the Energy Ministry notified amended late cost surcharge (LPS) guidelines to liquidate discom dues on EMI foundation to make sure cost self-discipline. Eight States opted to clear dues on their very own, 5 took loans from PFC and REC — and people flouting guidelines and deadlines have been barred from transactions on the facility trade. However well timed and satisfactory tariff revisions are essential to sustainably enhance the financials of discoms. It stays to be seen to what extent adjustments in LPS guidelines assist thermal energy gencos.

Decoding the sizzles and fizzles of thermal energy genco shares

Decoding the sizzles and fizzles of thermal energy genco shares

Renewable technique

Consistent with the Authorities’s goal of altering the power combine to usher in 50 per cent of non-fossil gas capability by 2030, main thermal gencos have began foraying into inexperienced power house with aggressive capex plans. Tata Energy seems frontrunner on this house as it’s slowing its capex in thermal and has ventured into renewable companies equivalent to EV charging, photo voltaic micro grids, rooftop photo voltaic and photo voltaic EPC. Its renewables subsidiary even attracted funding of near ₹4,000 crore by monetising a 11.43 per cent stake. JSW Power has introduced its goal of accelerating put in capability from 4.8 GW to 10 GW with a 61 per cent share of renewables by 2030. Additional, the corporate has ventured into Battery Power Storage System. NTPC at the moment has 2.5 GW of renewable capability however round 5.3 GW of capability is beneath development. It targets renewable capability of round 60 GW by 2032. It goals to switch its renewable property to newly integrated subsidiary NGEL and monetise stake of 10-20 per cent by H2FY23. Torrent Energy has about 1 GW of renewable capability which it goals to extend to round 5 GW within the subsequent 3-4 years. Adani Energy doesn’t appear to have any renewable plans, relatively such tasks are alleged to be carried out by the group’s different arm, Adani Inexperienced.

It must be famous that in the case of capability utilisation, renewables fares a lot worse than thermal energy gencos. Considerably larger capability is required in renewables to match the facility generated by a thermal plant.

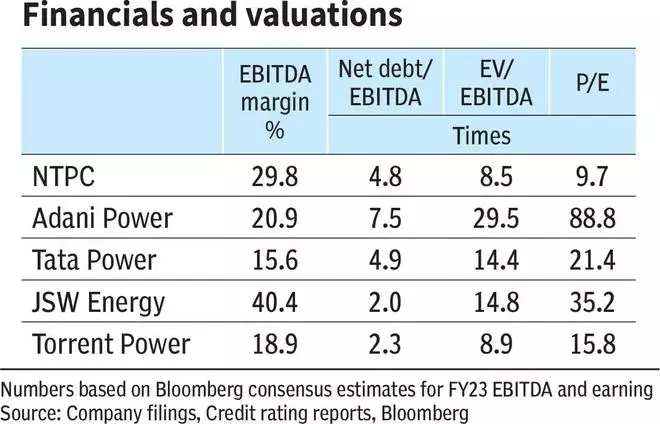

Corporations’ financials and key takeaways

The largest thermal participant NTPC appears to have probably the most secure financials backed by regulatory cost-plus PPAs, long-term coal linkages and 60 per cent of crops positioned at pit-heads. Nevertheless, in contrast to different firms, NTPC has much less room for opportunistic earnings from service provider tariffs. JSW Power has seen a rise in portion of PPA-based capability, together with 35 per cent of pithead crops. It earns cost-plus tariffs which led to sturdy margins coupled with good money place and low debt. Nevertheless, the inventory’s valuation appears to be like stretched as sturdy fundamentals and its renewable technique already appear priced in.

Adani Energy has seen volatility in earnings with 25 per cent of its capability uncovered to service provider tariffs and points on the materialisation of coal as a consequence of logistical points. The scenario appears to be enhancing for the corporate, because of beneficial components equivalent to imported coal pass-through, higher coal materialisation from FSAs and clearing of dues by discoms. Tata Energy runs an built-in mannequin within the energy house, whereby thermal energy technology accounts for near 30 per cent of income whereas the remaining comes from transmission, distribution, renewables and coal mining. Tata Energy’s profitability is these days aided by invoking of Part 11 which has quickly allowed its imported coal-based Mundra plant a pass-through of gas prices until December 2022. This was not allowed earlier.

Additional, its coal mining enterprise in Indonesia can be producing earnings owing to growing coal costs. The spike in firm’s valuation in current instances has been on account of its renewable technique and non permanent aid for Mundra. Nevertheless, there stays uncertainty on future gas price pass-through for Mundra. Torrent Energy is a gas-based technology firm with the distribution section additionally contributing to revenues. Whereas its financials are backed by regulatory cost-plus based mostly preparations, untied capability and low PLFs stay challenges.

In the end, to choose, buyers can verify how a lot of gencos’ thermal capability is tied up with long-term PPAs and FSAs for income visibility and whether or not main prices are pass-through beneath their tariff preparations. Capability availability and utilisation, proximity of coal-based crops to coal mines and the renewable technique are additionally components to contemplate in inventory selections. Besides NTPC, different gencos have seen main spike of their valuations on account of their renewables technique and different components. Evidently for majority of gencos, the positives are already priced in whereas for NTPC, monetisation of renewable arm could be a catalyst for additional upside.