Eoneren

Whereas being quick the Euro by way of the Invesco CurrencyShares Euro Belief (NYSEARCA:FXE) had been a profitable commerce in 2022, future returns are extra unsure, as financial insurance policies between the EU and the US attain a important inflection level. I imagine buyers ought to step to the sidelines and see how financial insurance policies develop within the coming few weeks earlier than re-engaging in both a protracted or a brief on the FXE.

Fund Overview

The Invesco CurrencyShares Euro Belief is designed to trace the worth of the Euro in USD. It is without doubt one of the bigger foreign money ETFs in the marketplace, with roughly $350 million in property. The FXE ETF prices a 0.40% expense ratio.

The primary promoting level of the FXE ETF vs. an precise funding within the Euro is that the ETF is well accessible by way of a standard brokerage account and the shares are trade traded and marginable. The shares of the ETF are backed by the property of the Belief, which doesn’t maintain or use derivatives. Lastly, buyers wouldn’t have to pay a foreign money conversion price, which is usually wrapped within the bid/ask unfold charged by banks.

Returns

The FXE ETF has returned -13.7% YTD, inline with the decline within the Euro vs. the USD (Determine 1).

Determine 1 – FXE returns (invesco.com)

Euro Weak spot Precipitated By Weak Economic system And Curiosity Charge Differential

Shorting the Euro had been one of the widespread and crowded trades in 2022, because the Euro suffered from a weak economic system and a widening rate of interest differential in comparison with the USD.

Though the ECB tried to reply to hovering inflation within the EU with rate of interest will increase of their very own, the truth that the European economic system was a lot weaker than the American economic system meant that their means to boost charges was decrease. To date, as of December 2, 2022, the Federal Reserve has raised the Fed Funds price to three.75%, whereas the equal ECB Deposit price is only one.50%.

Nevertheless, in current weeks, the Euro has rallied dramatically in opposition to the USD, erasing months of losses. What occurred and is that this going to proceed?

Speculators Reversed Shorts And Are Now The Longest In Years

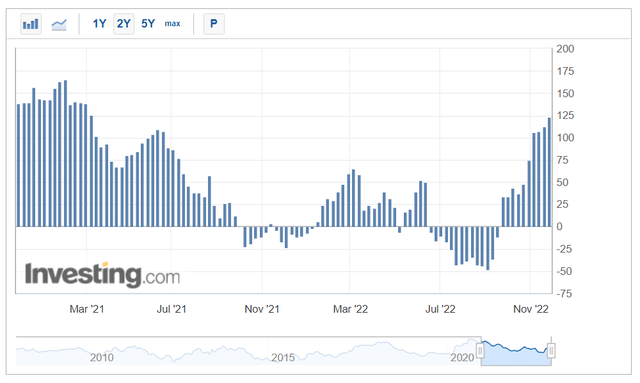

First, speculators started reversing their shorts on the Euro starting in September, shortly after the ECB stunned markets with a 75 bps price improve of their very own (Determine 2).

Determine 2 – CFTC internet speculative place in EUR (investing.com)

In current weeks, speculators have pressed their longs to the best ranges since early 2021, serving to the Euro lengthen positive aspects vs. the USD.

Slowing Tempo Of Fed Charge Will increase Narrows Ahead Curiosity Charge Differential

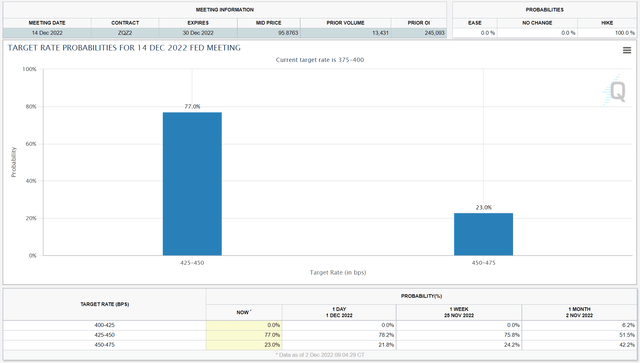

Subsequent, though the Federal Reserve raised the Fed Funds price by 75 bps on the November assembly, in addition they laid the groundwork for a slowdown within the tempo of price will increase. This was virtually confirmed by the Fed Chairman in his Brookings Institute speech on November 30, the place he mentioned the Fed might decelerate to a 50 bps hike as quickly as December.

This has led to a big repricing of the anticipated Fed Funds price stage for the December 14th FOMC assembly, from a 42% chance of 4.5% again in early November (earlier than the November FOMC assembly), to now solely a 23% chance (Determine 3).

Determine 3 – December Fed Funds expectations [CME]

With Eurozone inflation nonetheless above 10% in November vs. 7.7% within the U.S. in October, it seems the ECB must be extra hawkish than the Fed within the quick time period, which is able to additional slender the rate of interest differential.

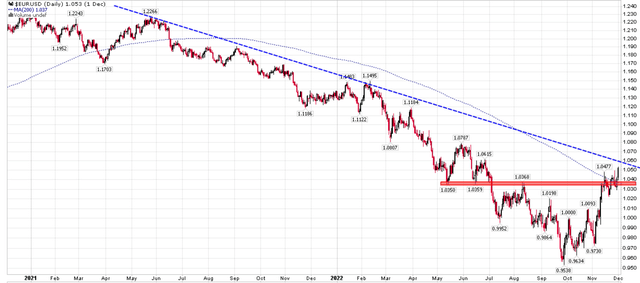

Technicals Approaching Key Ranges

Technically, the Euro is approaching a key multi-year downtrend that might affirm a brand new uptrend is in place. It has already cleared a key resistance stage between 1.035/1.037, in addition to the 200D shifting common (Determine 4).

Determine 4 – EUR approaching key downtrend (Writer created with value chart from stockcharts.com)

Dangers

The important thing draw back threat to the FXE ETF is the upcoming ECB price determination on December 15, 2022. As we will see from determine 2 above, speculators have turned fairly bullish on the Euro. The danger to additional Euro power is that if the ECB raises charges by 50 bps as anticipated, however gives a dovish outlook.

The upcoming FOMC determination on December 14 may be a catalyst. If the Fed is extra hawkish in its ahead steerage, that might negatively impression the Euro versus the USD.

Conclusion

Whereas being quick the Euro by way of the FXE ETF had been a profitable commerce in 2022, future returns are extra unsure, as financial insurance policies between the EU and the US attain a important inflection level. Because the Euro approaches a multi-year downtrend, threat/reward for both longs or shorts at this level is unfavorable. I imagine buyers ought to step to the sidelines and see how financial insurance policies develop within the coming few weeks earlier than re-engaging in both a protracted or a brief route.