Up to date on November thirtieth, 2022 by Bob Ciura

At Certain Dividend, we frequently steer earnings traders towards the Dividend Aristocrats. Traders on the lookout for high-quality dividend shares to purchase and maintain for the long-run, can discover many engaging shares on this prestigious checklist.

The Dividend Aristocrats are a choose group of 65 shares within the S&P 500 Index, with 25+ consecutive years of dividend will increase.

You may obtain an Excel spreadsheet of all 65 Dividend Aristocrats (with metrics that matter resembling dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

We sometimes rank shares based mostly on their five-year anticipated annual returns, as acknowledged within the Certain Evaluation Analysis Database.

However for traders primarily involved in earnings, additionally it is helpful to rank the Dividend Aristocrats in line with their dividend yields.

This text will rank the 20 highest-yielding Dividend Aristocrats at the moment.

Desk of Contents

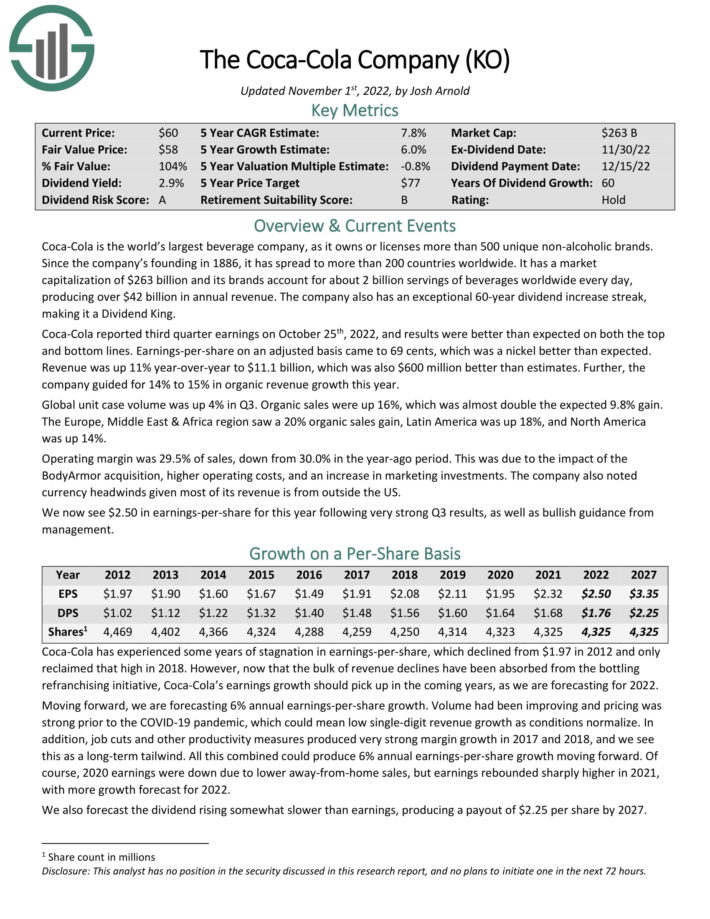

Excessive Yield Dividend Aristocrat #20: The Coca-Cola Firm (KO)

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. For the reason that firm’s founding in 1886, it has unfold to greater than 200 international locations worldwide.

Supply: Investor Presentation

The corporate additionally has an distinctive 59-year dividend improve streak.

As a serious holding of Berkshire Hathaway’s funding portfolio, Coca-Cola is a Warren Buffett inventory.

Coca-Cola reported third quarter earnings on October twenty fifth, 2022, and outcomes had been higher than anticipated on each the highest and backside traces. Earnings-per-share on an adjusted foundation got here to 69 cents, which was a nickel higher than anticipated.

Income was up 11% year-over-year to $11.1 billion, which was additionally $600 million higher than estimates. Additional, the corporate guided for 14% to fifteen% in natural income development this yr.

International unit case quantity was up 4% in Q3. Natural gross sales had been up 16%, which was virtually double the anticipated 9.8% acquire. The Europe, Center East & Africa area noticed a 20% natural gross sales acquire, Latin America was up 18%, and North America was up 14%.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

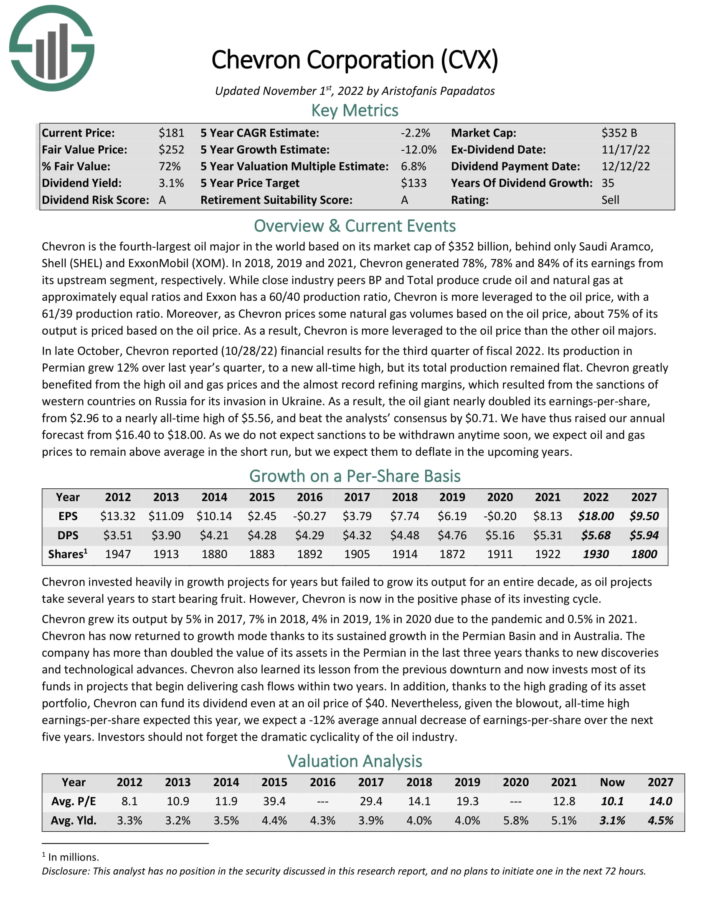

Excessive Yield Dividend Aristocrat #19: Chevron Company (CVX)

Chevron is the third–largest oil main on the planet. In 2021, Chevron generated 84% of its earnings from its upstream section. The corporate has elevated its dividend for over 40 consecutive years.

In late October, Chevron reported (10/28/22) monetary outcomes for the third quarter of fiscal 2022. Its manufacturing in Permian grew 12% over final yr’s quarter, to a brand new all-time excessive, however its whole manufacturing remained flat. Chevron significantly benefited from the excessive oil and fuel costs and the virtually file refining margins, which resulted from the sanctions of western international locations on Russia for its invasion in Ukraine.

In consequence, the oil big almost doubled its earnings-per-share, from $2.96 to a virtually all-time excessive of $5.56, and beat the analysts’ consensus by $0.71.

Supply: Investor Presentation

Chevron is a Dividend Aristocrat with over 40 consecutive years of dividend will increase.

Click on right here to obtain our most up-to-date Certain Evaluation report on CVX (preview of web page 1 of three proven beneath):

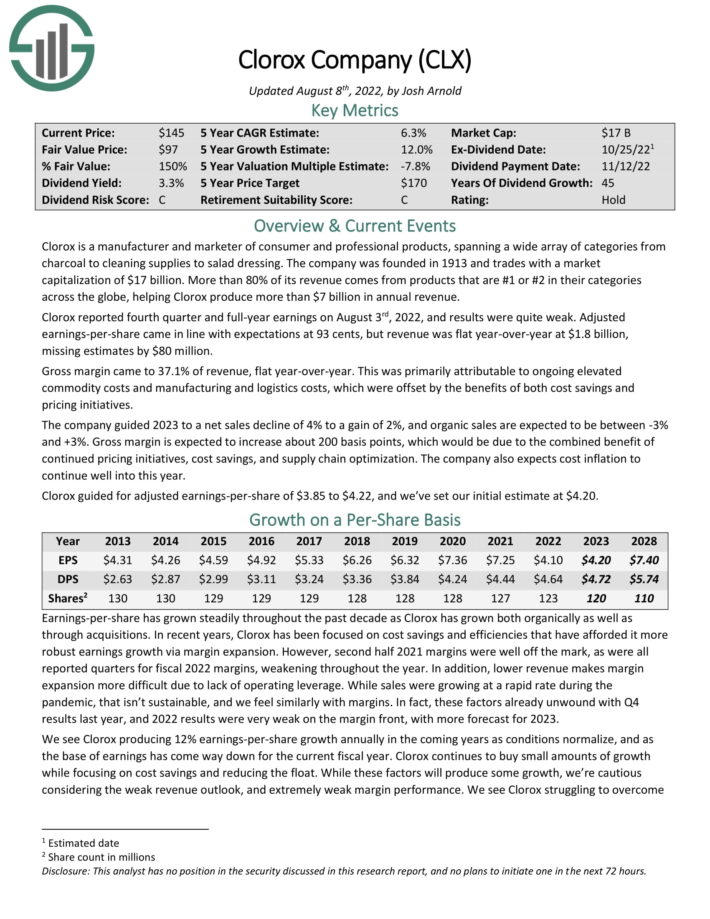

Excessive Yield Dividend Aristocrat #18: The Clorox Firm (CLX)

The Clorox Firm is a producer and marketer of shopper {and professional} merchandise, spanning a wide selection of classes from charcoal to cleansing provides to salad dressing. Greater than 80% of its income comes from merchandise which can be #1 or #2 of their classes throughout the globe, serving to Clorox produce greater than $7 billion in annual income.

Supply: Investor Presentation

Clorox reported fourth quarter and full-year earnings on August third, 2022, and outcomes had been fairly weak. Adjusted earnings-per-share got here consistent with expectations at 93 cents, however income was flat year-over-year at $1.8 billion, lacking estimates by $80 million.

Gross margin got here to 37.1% of income, flat year-over-year. This was primarily attributable to ongoing elevated commodity prices and manufacturing and logistics prices, which had been offset by the advantages of each value financial savings and pricing initiatives.

The corporate guided 2023 to a internet gross sales decline of 4% to a acquire of two%, and natural gross sales are anticipated to be between -3% and +3%. Gross margin is anticipated to extend about 200 foundation factors, which might be because of the mixed advantage of continued pricing initiatives, value financial savings, and provide chain optimization. The corporate additionally expects value inflation to proceed properly into this yr. Clorox guided for adjusted earnings-per-share of $3.85 to $4.22.

Click on right here to obtain our most up-to-date Certain Evaluation report on Clorox (preview of web page 1 of three proven beneath):

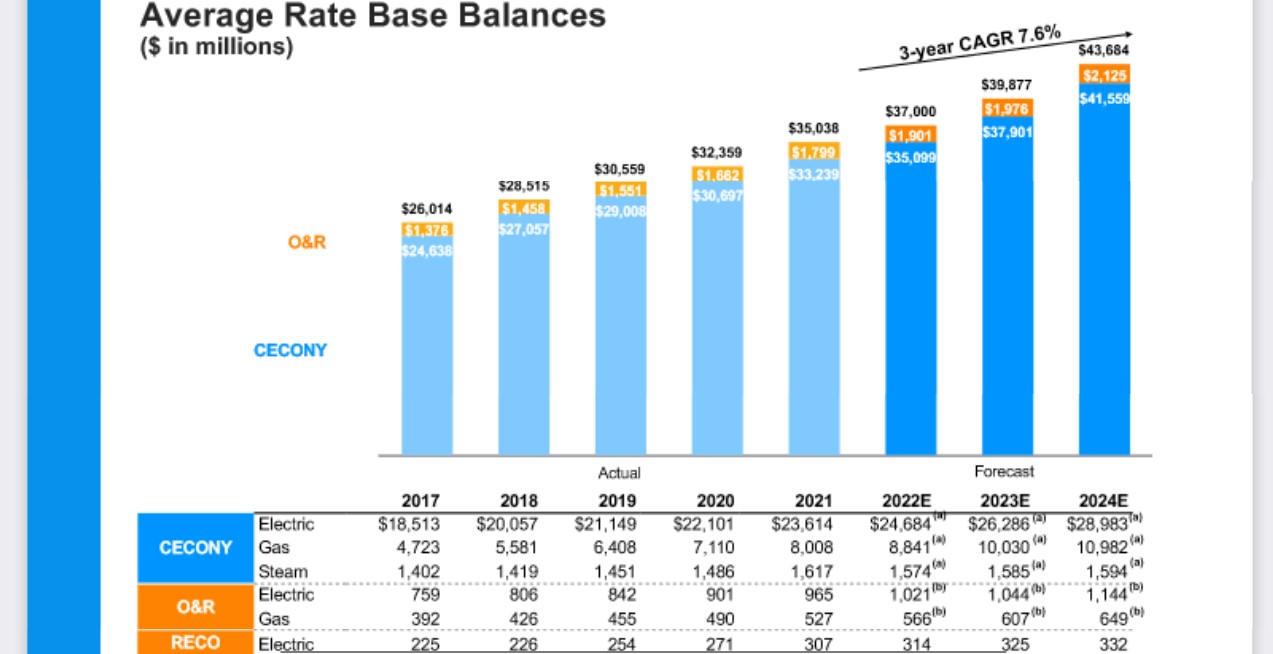

Excessive Yield Dividend Aristocrat #17: Consolidated Edison (ED)

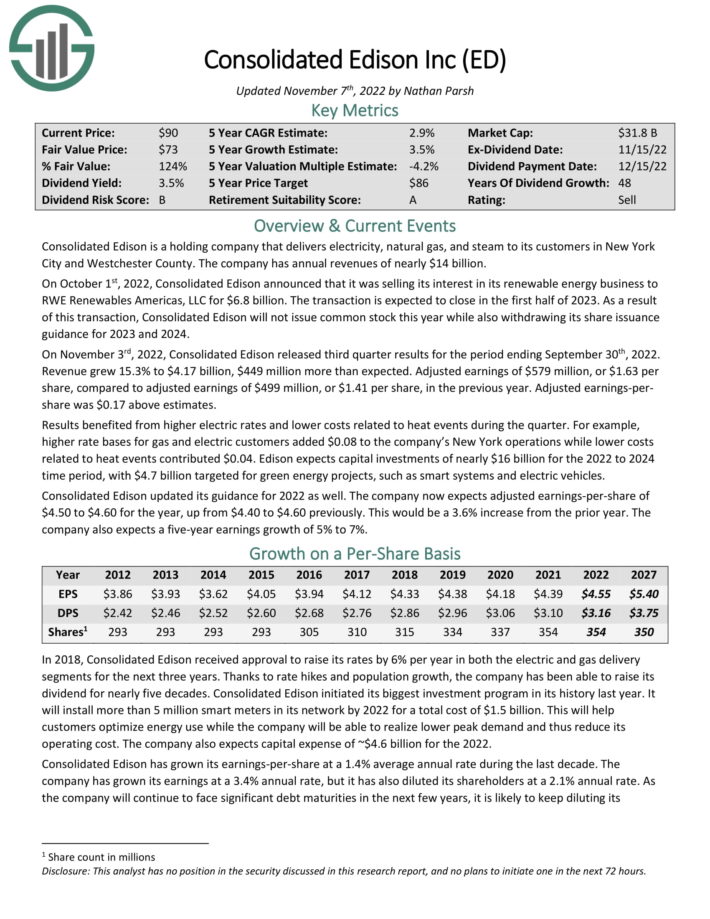

Consolidated Edison is a holding firm that delivers electrical energy, pure fuel, and steam to its clients in New York Metropolis and Westchester County. It has annual revenues of almost $13 billion.

On November third, 2022, Consolidated Edison launched third quarter outcomes for the interval ending September thirtieth, 2022. Income grew 15.3% to $4.17 billion, $449 million greater than anticipated. Adjusted earnings of $579 million, or $1.63 per share, in comparison with adjusted earnings of $499 million, or $1.41 per share, within the earlier yr. Adjusted earnings-pershare was $0.17 above estimates.

Outcomes benefited from increased electrical charges and decrease prices associated to warmth occasions in the course of the quarter. For instance, increased charge bases for fuel and electrical clients added $0.08 to the corporate’s New York operations whereas decrease prices associated to warmth occasions contributed $0.04. Edison expects capital investments of almost $16 billion for the 2022 to 2024 time interval, with $4.7 billion focused for inexperienced vitality initiatives, resembling sensible techniques and electrical autos.

Consolidated Edison up to date its steerage for 2022 as properly. The corporate now expects adjusted earnings-per-share of $4.50 to $4.60 for the yr, up from $4.40 to $4.60 beforehand. This might be a 3.6% improve from the prior yr. The corporate additionally expects a five-year earnings development of 5% to 7%.

Fee will increase are a serious driver of Consolidated Edison’s development.

Supply: Investor Presentation

Click on right here to obtain our most up-to-date Certain Evaluation report on ConEd (preview of web page 1 of three proven beneath):

Excessive Yield Dividend Aristocrat #16: ExxonMobil Company (XOM)

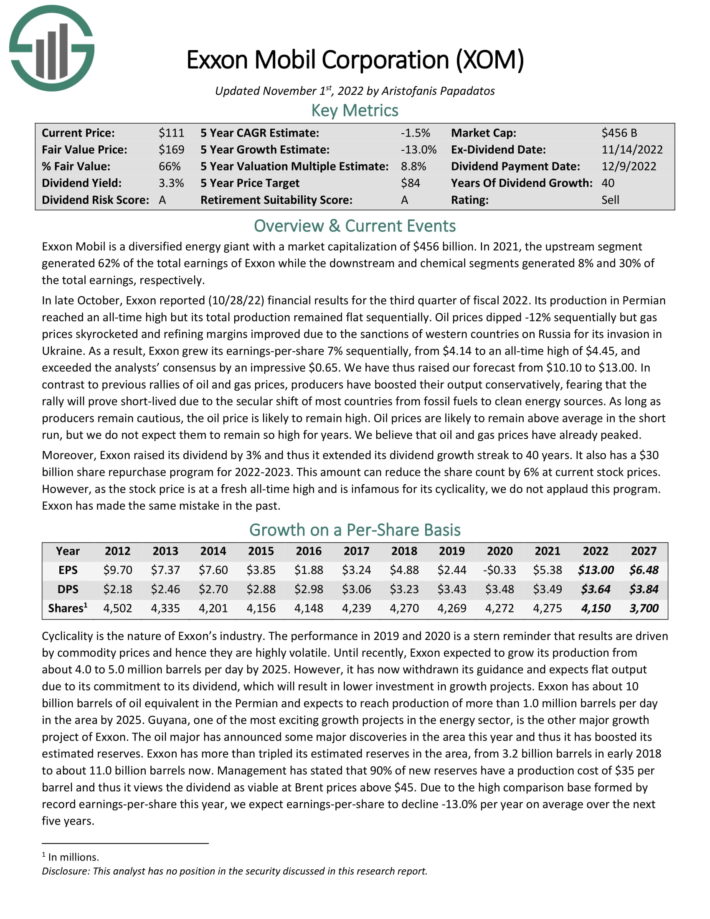

Exxon Mobil is a diversified vitality big with a market capitalization above $300 billion. In 2021, the upstream section generated 62% of the full earnings of Exxon whereas the downstream and chemical segments generated 8% and 30% of the full earnings, respectively.

In late October, Exxon reported (10/28/22) monetary outcomes for the third quarter of fiscal 2022. Its manufacturing within the Permian reached an all-time excessive however its whole manufacturing remained flat sequentially. Oil costs dipped 12% sequentially however fuel costs skyrocketed and refining margins improved because of the sanctions of western international locations on Russia for its invasion in Ukraine. In consequence, Exxon grew its earnings-per-share 7% sequentially, from $4.14 to an all-time excessive of $4.45, and exceeded the analysts’ consensus by $0.65.

Furthermore, Exxon raised its dividend by 3% and thus it prolonged its dividend development streak to 40 years. It additionally has a $30 billion share repurchase program for 2022-2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on Exxon Mobil (preview of web page 1 of three proven beneath):

Excessive Yield Dividend Aristocrat #15: Kimberly-Clark (KMB)

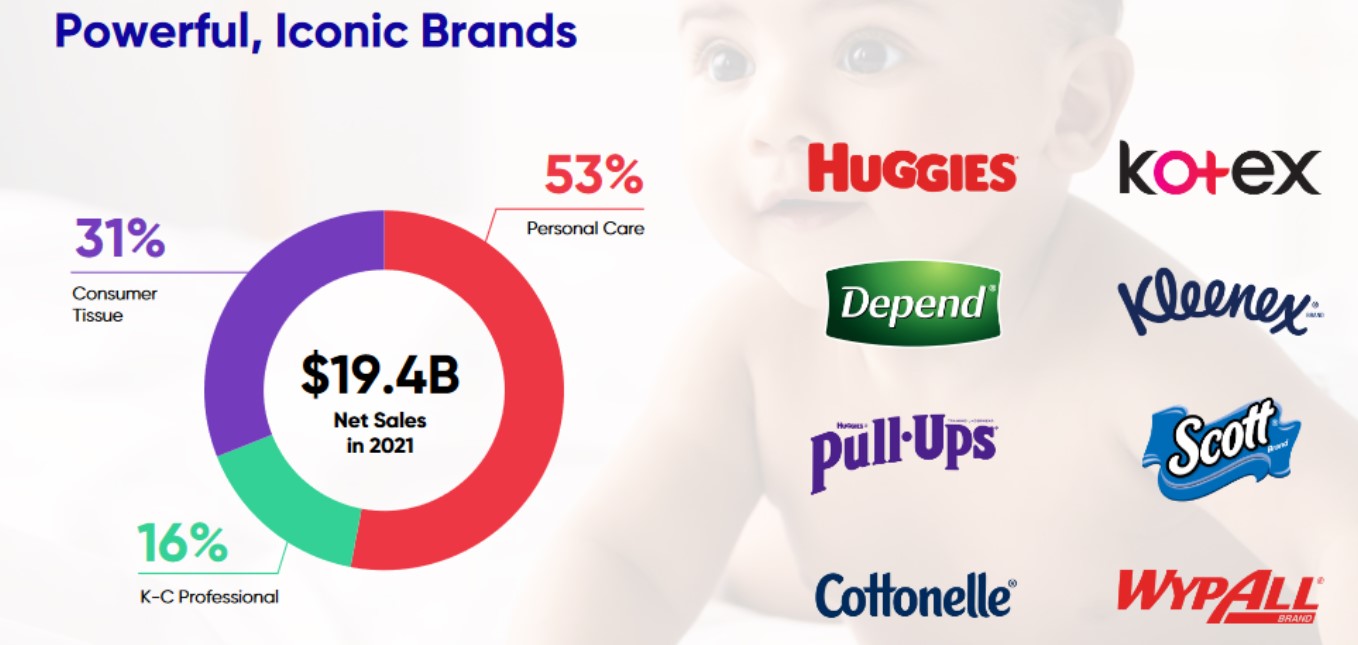

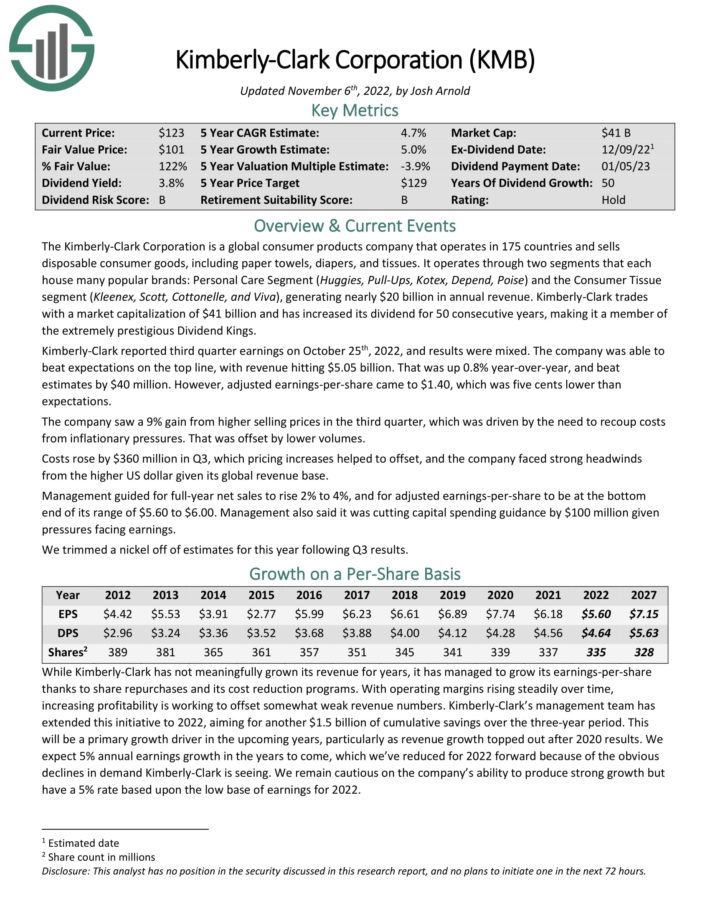

Kimberly-Clark is a worldwide shopper merchandise firm that operates in 175 international locations and sells disposable shopper items, together with paper towels, diapers, and tissues.

It operates by two segments that every home many standard manufacturers: Private Care Phase (Huggies, Pull-Ups, Kotex, Rely, Poise) and the Client Tissue section (Kleenex, Scott, Cottonelle, and Viva), producing almost $20 billion in annual income.

Supply: Investor Presentation

Kimberly-Clark reported third quarter earnings on October twenty fifth, 2022, and outcomes had been blended. The corporate beat expectations on the highest line, with income hitting $5.05 billion. That was up 0.8% year-over-year, and beat estimates by $40 million. Nevertheless, adjusted earnings-per-share got here to $1.40, which was 5 cents decrease than expectations.

The corporate noticed a 9% acquire from increased promoting costs within the third quarter, which was pushed by the necessity to recoup prices from inflationary pressures. That was offset by decrease volumes.

Click on right here to obtain our most up-to-date Certain Evaluation report on Kimberly-Clark (preview of web page 1 of three proven beneath):

Excessive Yield Dividend Aristocrat #14: Medtronic plc (MDT)

Medtronic is the most important producer of biomedical gadgets and implantable applied sciences on the planet. The corporate serves physicians, hospitals, and sufferers in additional than 150.

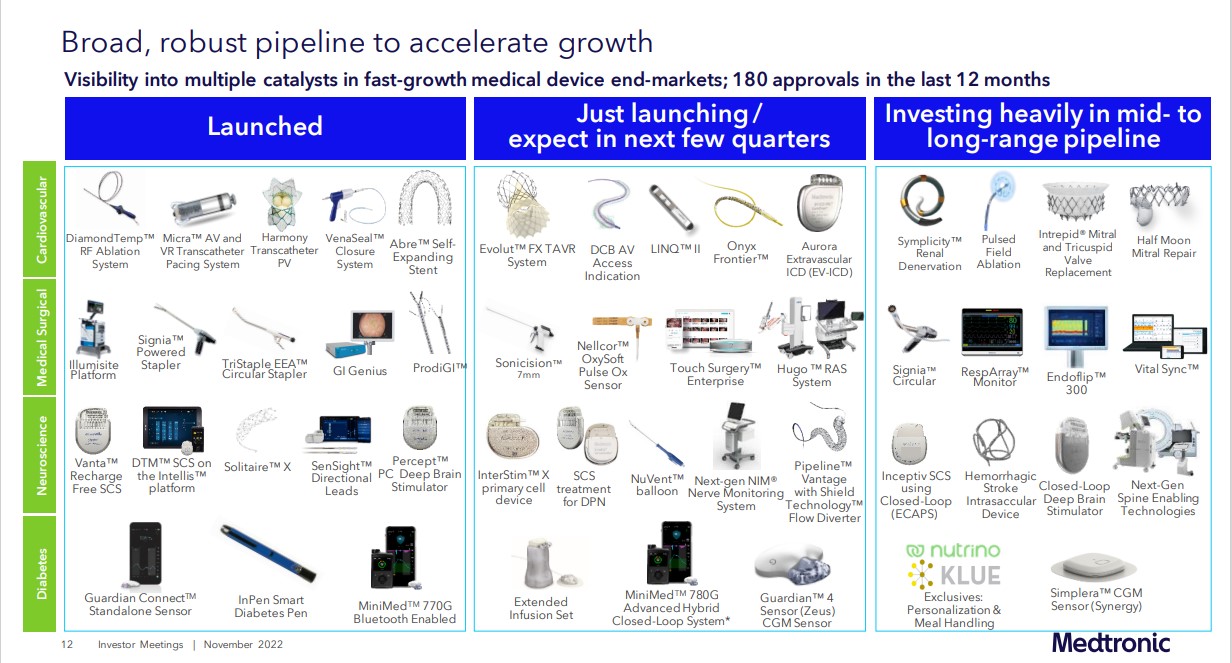

Medtronic has 4 working segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. It has a powerful product pipeline to gasoline its future development.

Supply: Investor Presentation

Medtronic has raised its dividend for 45 consecutive years. The corporate generated $32 billion in income in its final fiscal yr.

In Might 2022, Medtronic raised its dividend to $0.68 per share; the corporate’s forty fifth consecutive yearly improve.

In late November, Medtronic reported (11/22/22) outcomes for the second quarter of fiscal yr 2023. Natural income grew 2% over final yr’s quarter however income dipped -3% and earnings-per-share fell -2% on account of a powerful greenback. Outcomes had been harm by sluggish provide restoration and modest market process volumes in some companies.

Medtronic lowered its steerage for annual earnings-per-share from $5.53-$5.65 to $5.25-$5.30.

Click on right here to obtain our most up-to-date Certain Evaluation report on MDT (preview of web page 1 of three proven beneath):

Excessive Yield Dividend Aristocrat #13: AbbVie Inc. (ABBV)

AbbVie Inc. is a pharmaceutical firm spun off by Abbott Laboratories (ABT) in 2013. Its most necessary product is Humira, which is now dealing with biosimilar competitors in Europe, which has had a noticeable influence on the corporate. Humira will lose patent safety within the U.S. in 2023.

Even so, AbbVie stays an enormous within the healthcare sector, with a big and diversified product portfolio.

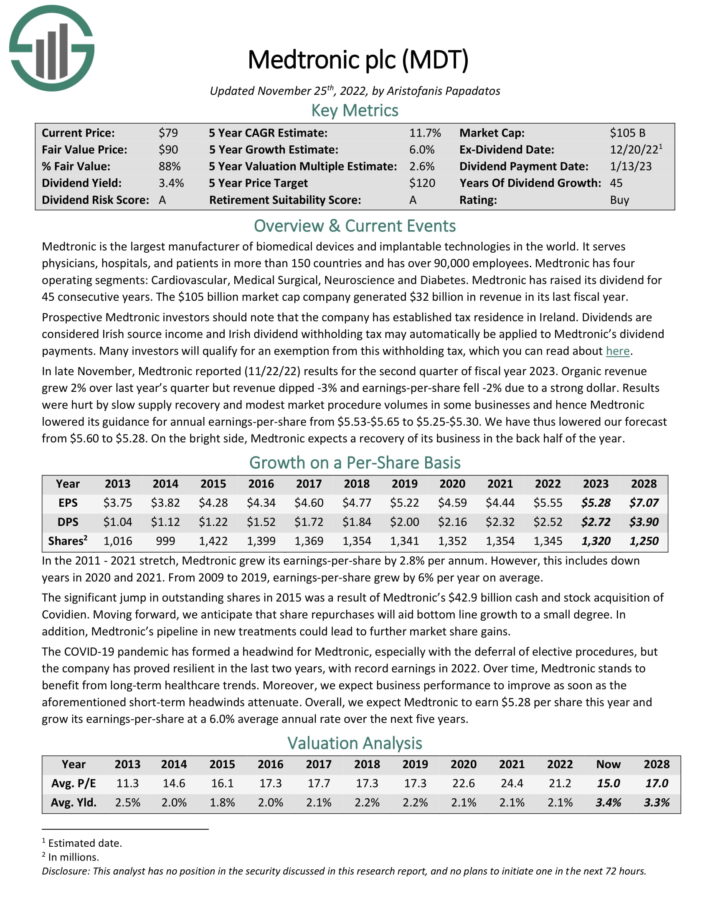

AbbVie reported its third quarter earnings outcomes on October 28. Revenues of $14.8 billion which was 3% greater than AbbVie’s revenues in the course of the earlier yr’s quarter. Income missed consensus by $130 million. Revenues had been positively impacted by compelling development from a few of its newer medication, together with Skyrizi and Rinvoq, whereas Humira remained AbbVie’s largest drug by way of general income contribution.

AbbVie earned $3.66 per share in the course of the third quarter, which was 29% greater than the corporate’s earnings-per-share in the course of the earlier yr’s quarter. AbbVie’s earnings-per-share beat the consensus analyst estimate by $0.10. AbbVie’s steerage for 2022’s adjusted earnings-per-share was lowered barely since our final replace, the corporate now expects to earn $13.76 – $13.96 on a per-share foundation this yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on AbbVie (preview of web page 1 of three proven beneath):

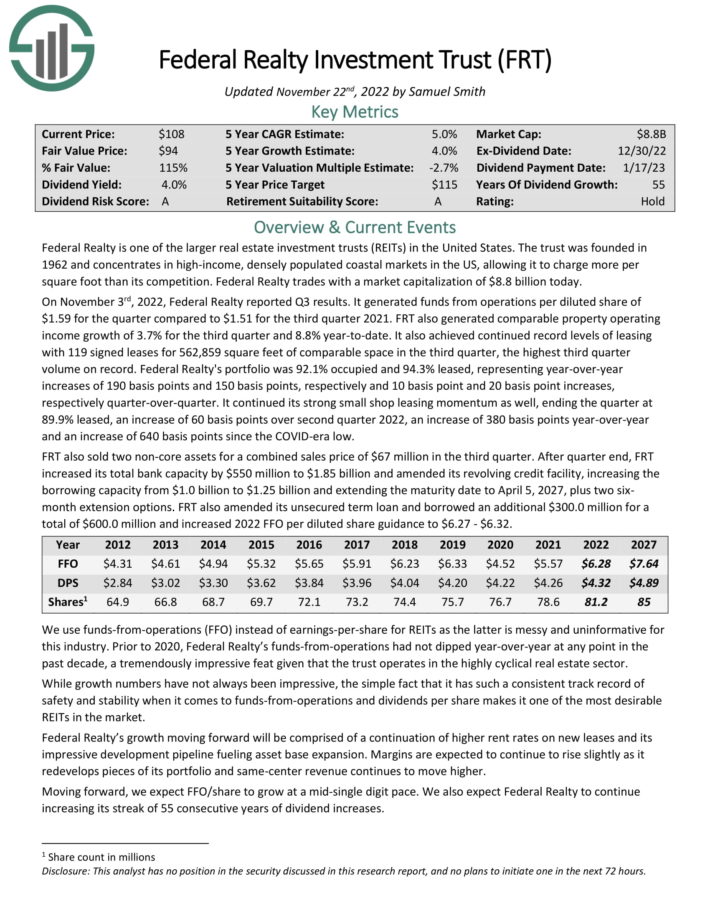

Excessive Yield Dividend Aristocrat #12: Federal Realty Funding Belief (FRT)

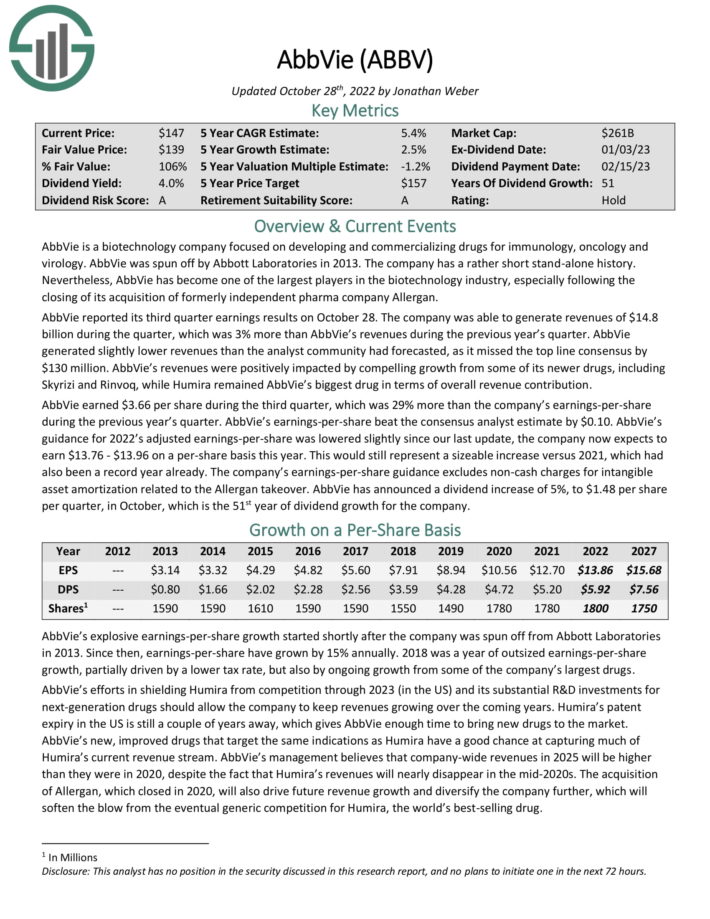

Federal Realty was based in 1962. As a Actual Property Funding Belief, Federal Realty’s enterprise mannequin is to personal and hire out actual property properties. It makes use of a good portion of its rental earnings, in addition to exterior financing, to amass new properties. This helps create a “snow-ball” impact of rising earnings over time.

Federal Realty primarily owns buying facilities. Nevertheless, it additionally operates in redevelopment of multi-purpose properties together with retail, residences, and condominiums. The portfolio is very diversified by way of tenant base.

Supply: Investor Presentation

On November third, 2022, Federal Realty reported Q3 outcomes. It generated funds from operations per diluted share of $1.59 for the quarter in comparison with $1.51 for the third quarter 2021. FRT additionally generated comparable property working earnings development of three.7% for the third quarter and eight.8% year-to-date.

It additionally achieved continued file ranges of leasing with 119 signed leases for 562,859 sq. toes of comparable house within the third quarter, the best third quarter quantity on file. Federal Realty’s portfolio was 92.1% occupied and 94.3% leased, representing year-over-year will increase of 190 foundation factors and 150 foundation factors, respectively and 10 foundation level and 20 foundation level will increase, respectively quarter-over-quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on Federal Realty (preview of web page 1 of three proven beneath):

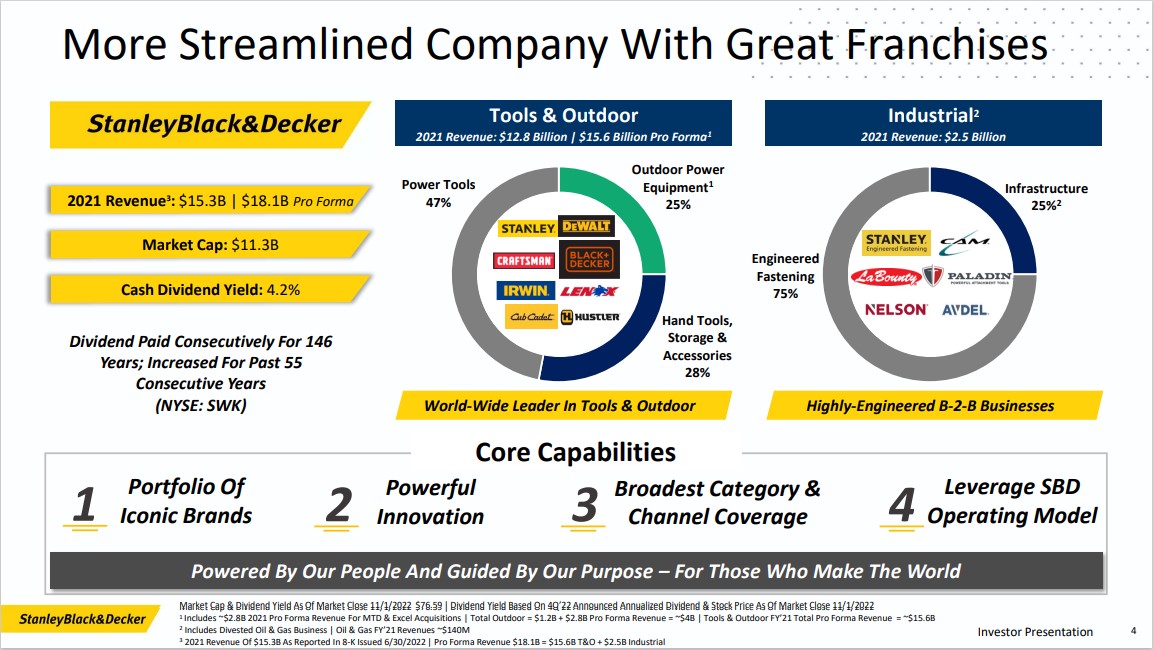

Excessive Yield Dividend Aristocrat #11: Stanley Black & Decker (SWK)

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated gadgets. The corporate holds the highest world place in instruments and storage gross sales. Stanley Black & Decker is second on the planet within the areas of economic digital safety and engineered fastening.

Supply: Investor Presentation

On July twentieth, 2022, Stanley Black & Decker raised its quarterly dividend 1.3% to $0.80, extending the corporate’s dividend development streak to 55 consecutive years.

On October twenty seventh, 2022, Stanley Black & Decker introduced third quarter outcomes for the interval ending September thirtieth, 2022. Income grew 9% to $4.1 billion, topping estimates by $120 million. Adjusted earnings-per-share of $0.76 in contrast very unfavorably to $2.77 within the prior yr, however was $0.06 above expectations.

Natural development declined 2%. Gross sales for Instruments & Out of doors, the most important section inside the firm, skilled an natural decline of 5% as a 7% profit from pricing was as soon as once more greater than offset by a decline in quantity. North America fell 4% and each rising markets and Europe had been decrease by 2%.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWK (preview of web page 1 of three proven beneath):

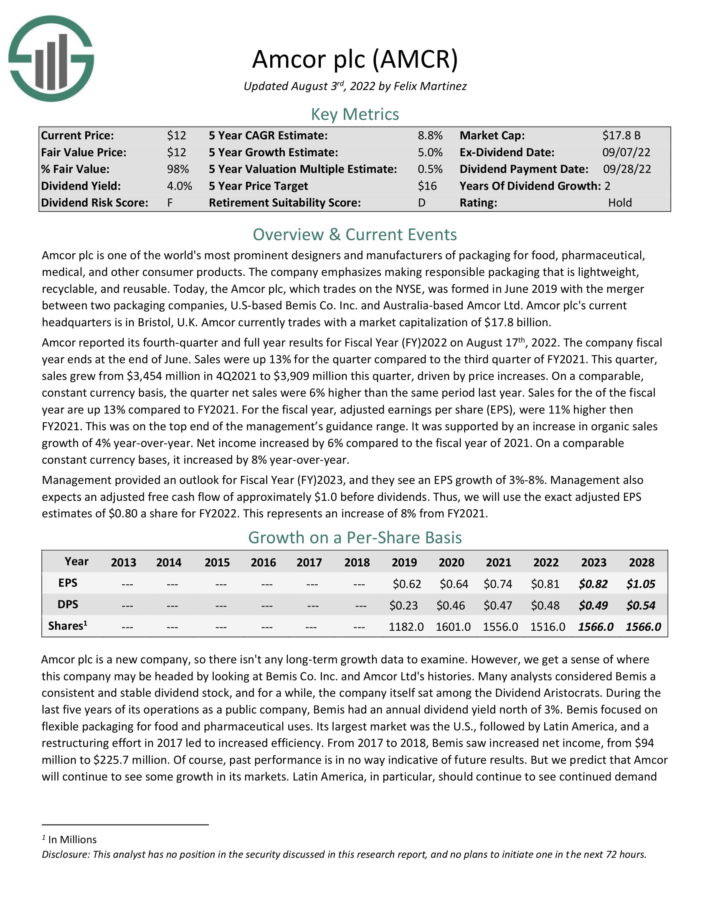

Excessive Yield Dividend Aristocrat #10: Amcor plc (AMCR)

Amcor is likely one of the world’s most distinguished designers and producers of packaging for meals, pharmaceutical, medical, and different shopper merchandise. The corporate is headquartered within the U.Okay.

Amcor reported its fourth-quarter and full yr outcomes for Fiscal 12 months (FY)2022 on August seventeenth, 2022. The corporate fiscal yr ends on the finish of June. Gross sales had been up 13% for the quarter in comparison with the third quarter of FY2021. This quarter, gross sales grew from $3,454 million in 4Q2021 to $3,909 million this quarter, pushed by value will increase.

On a comparable, fixed forex foundation, the quarter internet gross sales had been 6% increased than the identical interval final yr. Gross sales for the of the fiscal yr are up 13% in comparison with FY2021.

For the fiscal yr, adjusted earnings per share (EPS), had been 11% increased then FY2021. This was on the highest finish of the administration’s steerage vary. It was supported by a rise in natural gross sales development of 4% year-over-year. Web earnings elevated by 6% in comparison with the fiscal yr of 2021. On a comparable fixed forex bases, it elevated by 8% year-over-year.

Administration supplied an outlook for Fiscal 12 months (FY) 2023, and so they see an EPS development of three%-8%.

Click on right here to obtain our most up-to-date Certain Evaluation report on Amcor (preview of web page 1 of three proven beneath):

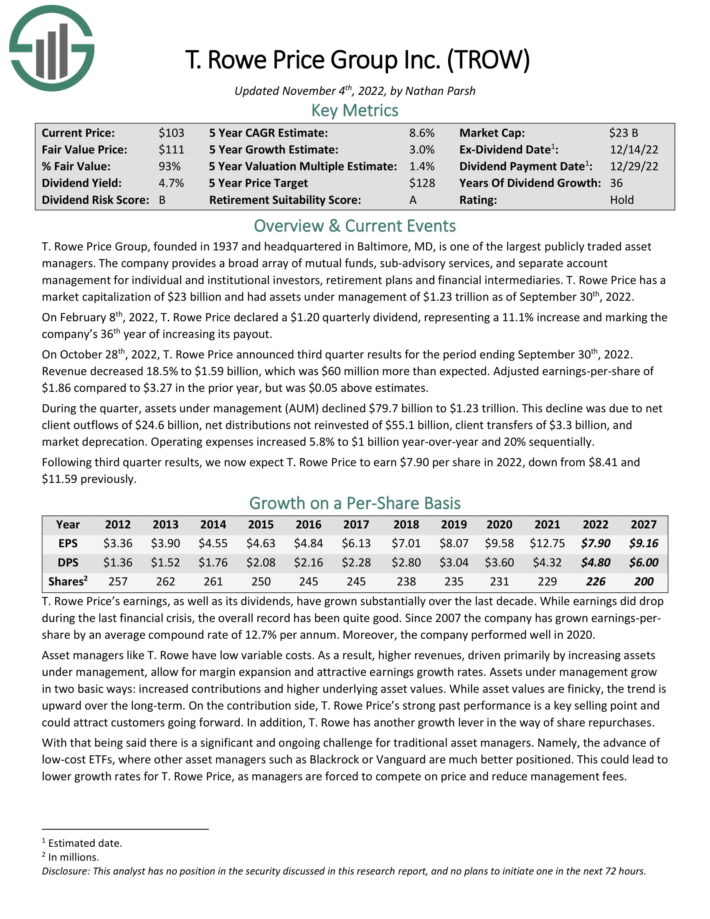

Excessive Yield Dividend Aristocrat #9: T. Rowe Value Group (TROW)

T. Rowe Value Group is likely one of the largest publicly traded asset managers. The corporate gives a broad array of mutual funds, subadvisory providers, and separate account administration for particular person and institutional traders, retirement plans and monetary intermediaries.

On October twenty eighth, 2022, T. Rowe Value introduced third quarter outcomes for the interval ending September thirtieth, 2022. Income decreased 18.5% to $1.59 billion, which was $60 million greater than anticipated. Adjusted earnings-per-share of $1.86 in comparison with $3.27 within the prior yr, however was $0.05 above estimates.

Throughout the quarter, belongings below administration (AUM) declined $79.7 billion to $1.23 trillion. This decline was on account of internet consumer outflows of $24.6 billion, internet distributions not reinvested of $55.1 billion, consumer transfers of $3.3 billion, and market deprecation. Working bills elevated 5.8% to $1 billion year-over-year and 20% sequentially.

Click on right here to obtain our most up-to-date Certain Evaluation report on TROW (preview of web page 1 of three proven beneath):

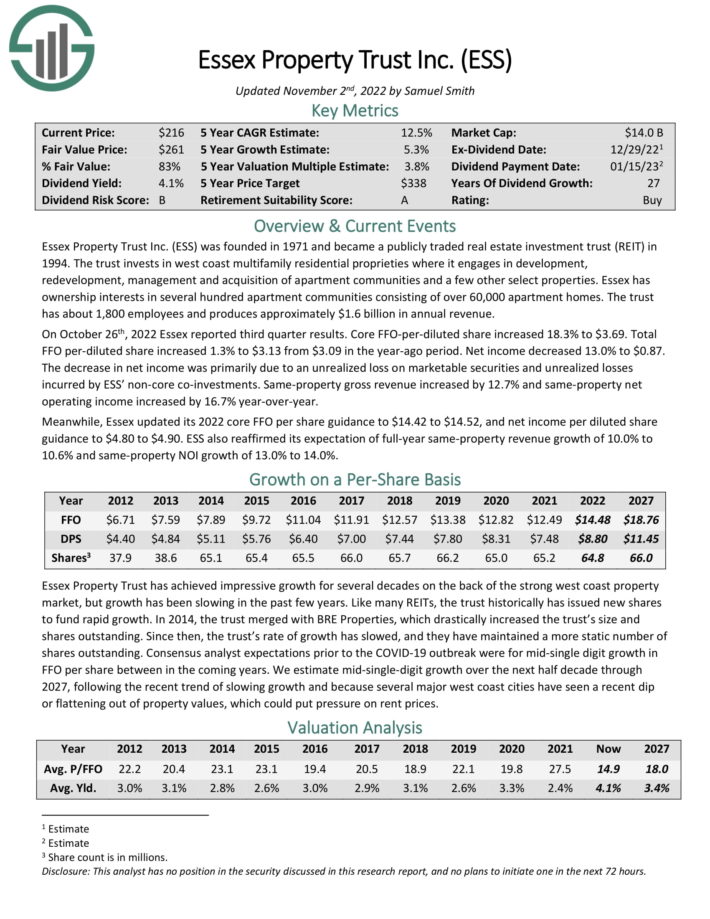

Excessive Yield Dividend Aristocrat #8: Essex Property Belief (ESS)

Essex Property Belief was based in 1971. The belief invests in west coast multifamily residential proprieties the place it engages in improvement, redevelopment, administration and acquisition of condo communities and some different choose properties. Essex has possession pursuits in a number of hundred condo communities consisting of over 60,000 condo houses. The belief has about 1,800 staff and produces roughly $1.6 billion in annual income.

Supply: Investor Presentation

On October twenty sixth, 2022 Essex reported third quarter outcomes. Core FFO-per-diluted share elevated 18.3% to $3.69. Complete FFO per-diluted share elevated 1.3% to $3.13 from $3.09 within the year-ago interval. Web earnings decreased 13.0% to $0.87.

The lower in internet earnings was primarily on account of an unrealized loss on marketable securities and unrealized losses incurred by ESS’ non-core co-investments. Identical-property gross income elevated by 12.7% and same-property internet working earnings elevated by 16.7% year-over-year.

In the meantime, Essex up to date its 2022 core FFO per share steerage to $14.42 to $14.52, and internet earnings per diluted share steerage to $4.80 to $4.90. ESS additionally reaffirmed its expectation of full-year same-property income development of 10.0% to 10.6% and same-property NOI development of 13.0% to 14.0%.

Click on right here to obtain our most up-to-date Certain Evaluation report on ESS (preview of web page 1 of three proven beneath):

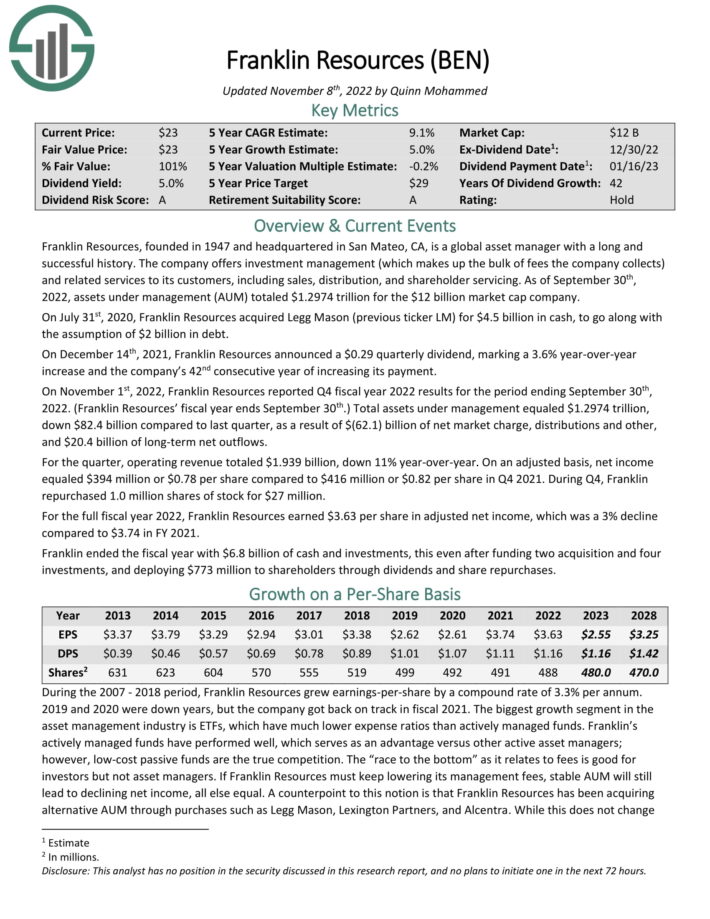

Excessive Yield Dividend Aristocrat #7: Franklin Assets (BEN)

Franklin Assets is a worldwide asset supervisor with an extended and profitable historical past. The corporate affords funding administration (which makes up the majority of charges the corporate collects) and associated providers to its clients, together with gross sales, distribution, and shareholder servicing.

On December 14th, 2021, Franklin Assets introduced a $0.29 quarterly dividend, marking a 3.6% year-over-year improve and the corporate’s 42nd consecutive year of accelerating its cost.

On November 1st, 2022, Franklin Assets reported This fall fiscal yr 2022 outcomes for the interval ending September thirtieth, 2022. (Franklin Assets’ fiscal yr ends September thirtieth.) Complete belongings below administration equaled $1.2974 trillion, down $82.4 billion in comparison with final quarter, because of $(62.1) billion of internet market cost, distributions and different, and $20.4 billion of long-term internet outflows.

For the quarter, working income totaled $1.939 billion, down 11% year-over-year. On an adjusted foundation, internet earnings equaled $394 million or $0.78 per share in comparison with $416 million or $0.82 per share in This fall 2021. Throughout This fall, Franklin repurchased 1.0 million shares of inventory for $27 million.

For the total fiscal yr 2022, Franklin Assets earned $3.63 per share in adjusted internet earnings, which was a 3% decline in comparison with $3.74 in FY 2021.

Click on right here to obtain our most up-to-date Certain Evaluation report on Franklin Assets (preview of web page 1 of three proven beneath):

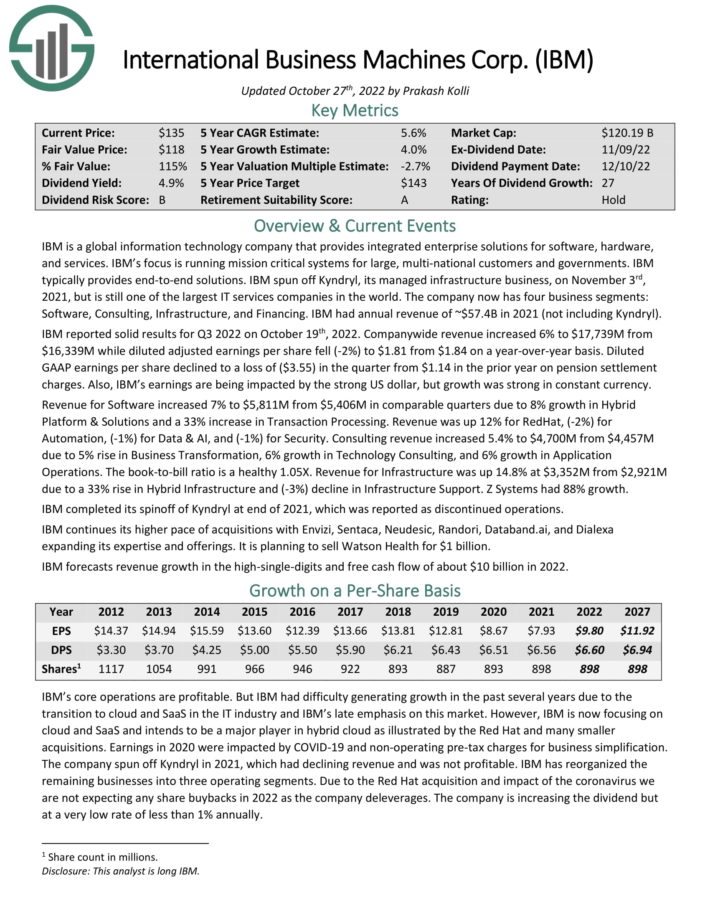

Excessive Yield Dividend Aristocrat #6: Worldwide Enterprise Machines (IBM)

IBM is a worldwide informationrmation expertise firm that gives built-in enterprise options for software program, {hardware}, and providers. IBM’s focus is operating mission essential techniques for giant, multi-nationwide clients and governments. IBM sometimes gives end-to-end options.

The corporate now has 4 enterprise segments: Software program, Consulting, Infrastructure, and Financing. IBM had annual income of ~$57.4B in 2021 (not together with Kyndryl).

IBM reported stable outcomes for Q3 2022 on October nineteenth, 2022. Firm-wide income elevated 6% to $17,739M from $16,339M whereas diluted adjusted earnings per share fell (-2%) to $1.81 from $1.84 on a year-over-year foundation. Diluted GAAP earnings per share declined to a lack of ($3.55) within the quarter from $1.14 within the prior yr on pension settlement fees. Additionally, IBM’s earnings are being impacted by the robust US greenback, however development was robust in fixed forex.

Income for Software program elevated 7% to $5,811M from $5,406M in comparable quarters on account of 8% development in Hybrid Platform & Options and a 33% improve in Transaction Processing. Income was up 12% for RedHat, (-2%) for Automation, (-1%) for Knowledge & AI, and (-1%) for Safety. Consulting income elevated 5.4%.

Click on right here to obtain our most up-to-date Certain Evaluation report on IBM (preview of web page 1 of three proven beneath):

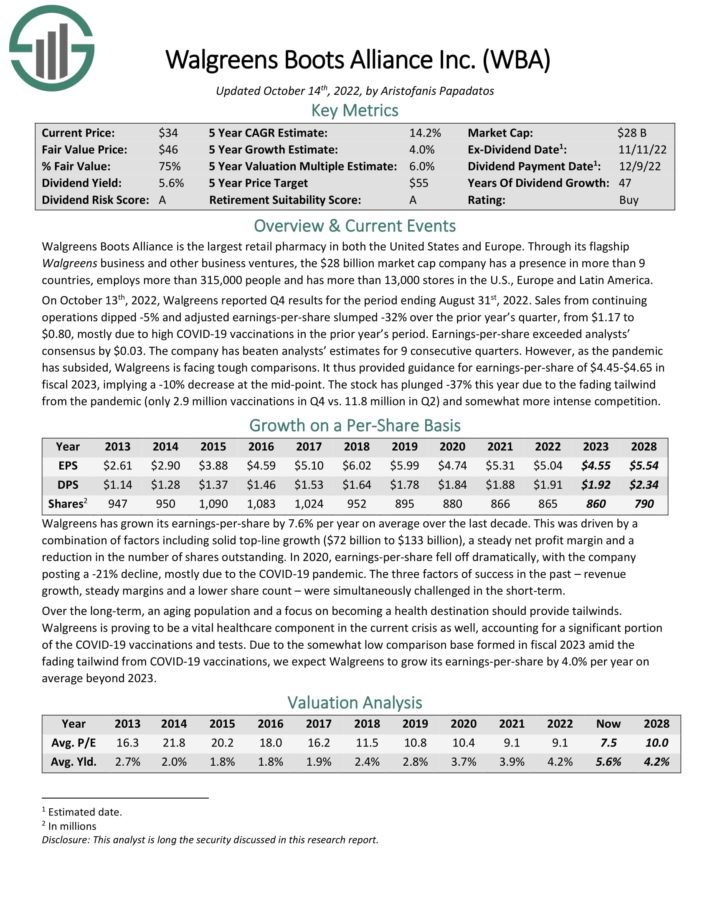

Excessive Yield Dividend Aristocrat #5: Walgreens-Boots Alliance (WBA)

Walgreens Boots Alliance is the most important retail pharmacy in each the USA and Europe. Via its flagship Walgreens enterprise and different business ventures, the firm employs extra than 325,000 individuals and has greater than 13,000 shops.

Walgreens Boots Alliance is the most important retail pharmacy in each the USA and Europe. Via its flagship Walgreens enterprise and different business ventures, the firm employs extra than 325,000 individuals and has greater than 13,000 shops.

On October thirteenth, 2022, Walgreens reported This fall outcomes for the interval ending August thirty first, 2022. Gross sales from persevering with operations declined by 5% and adjusted earnings-per-share declined by 32% year-over-year, principally on account of excessive COVID-19 vaccinations within the prior yr interval. Earnings-per-share exceeded analysts’ consensus by $0.03. The corporate has crushed analysts’ estimates for 9 consecutive quarters.

Because the pandemic has subsided, Walgreens is dealing with robust comparisons. It supplied steerage for earnings-per-share of $4.45-$4.65 in fiscal 2023, implying a ten% lower on the mid-point.

Click on right here to obtain our most up-to-date Certain Evaluation report on Walgreens (preview of web page 1 of three proven beneath):

Excessive Yield Dividend Aristocrat #4: 3M Firm (MMM)

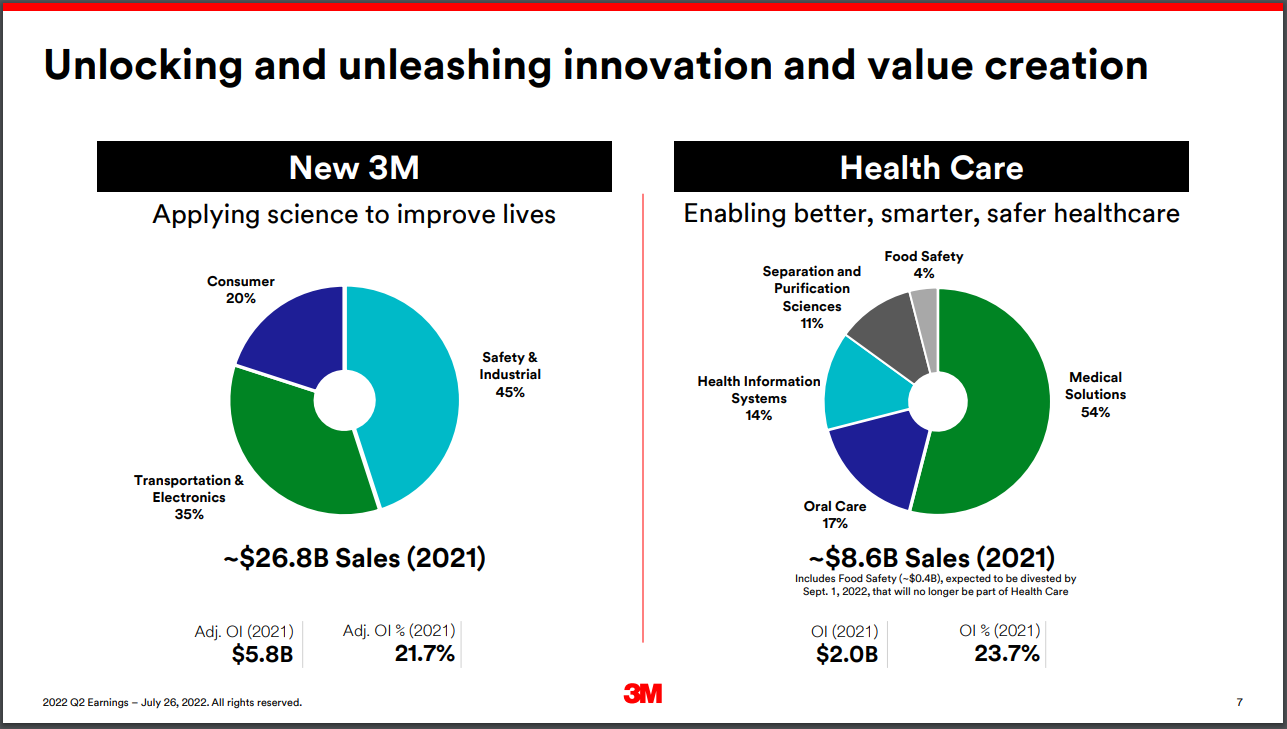

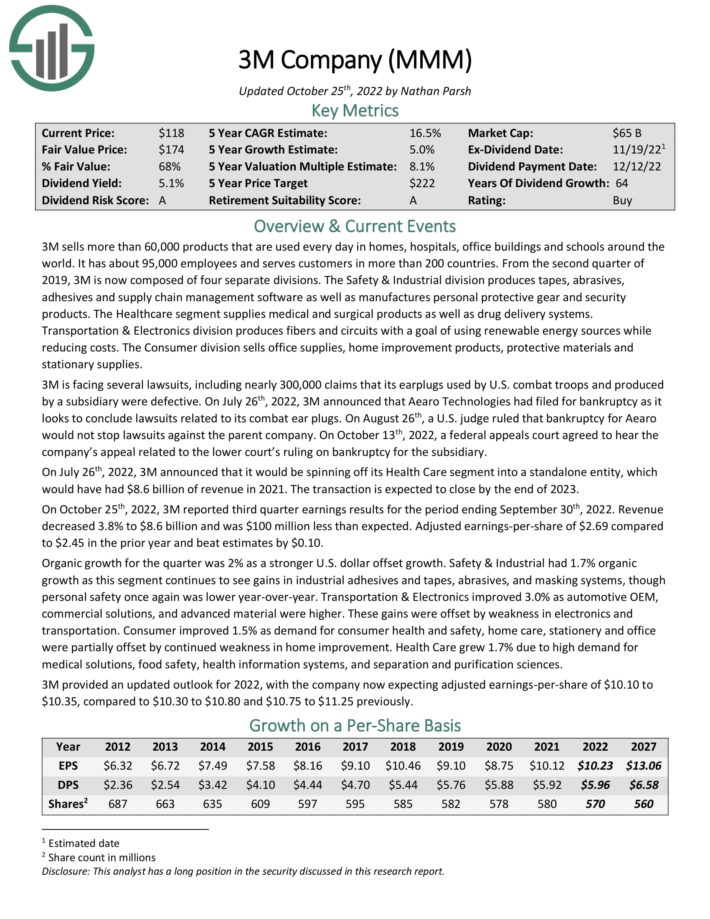

3M sells greater than 60,000 merchandise which can be used every single day in houses, hospitals, workplace buildings and colleges across the world. It has about 95,000 staff and serves clients in additional than 200 international locations.

On July twenty sixth, the corporate reported second-quarter outcomes. For the quarter, income fell 3% to $8.7 billion. Adjusted EPS declined 10% year-over-year, from $2.75 in Q2 2021 to $2.48 in Q2 2022.

Together with its quarterly outcomes, the corporate individually introduced that it’s going to spinoff its healthcare section. This can be a main announcement, because the healthcare enterprise itself generates over $8 billion in annual gross sales.

Supply: Investor Presentation

The corporate additionally introduced that it will be spinning off its Well being Care section right into a standalone entity, which might have had $8.6 billion of income in 2021. The transaction is anticipated to shut by the tip of 2023.3M supplied an up to date outlook for 2022, with the corporate now anticipating adjusted earnings-per-share of $10.30 to $10.80 for the yr, down from $10.75 to $11.25 beforehand.

Click on right here to obtain our most up-to-date Certain Evaluation report on 3M (preview of web page 1 of three proven beneath):

Excessive Yield Dividend Aristocrat #3: Realty Revenue (O)

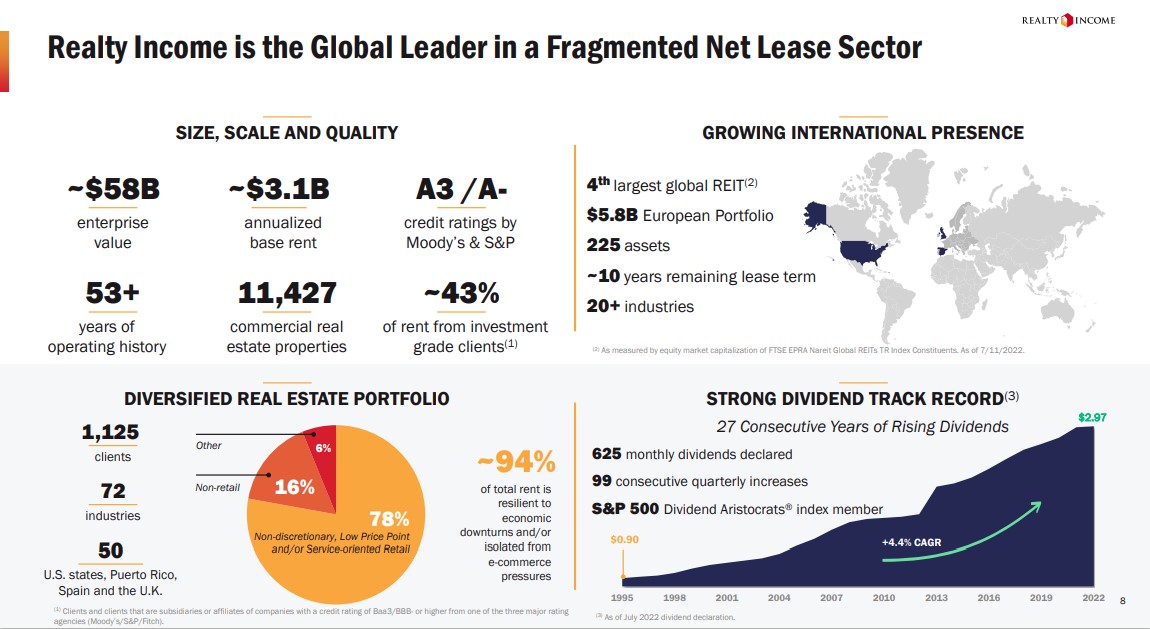

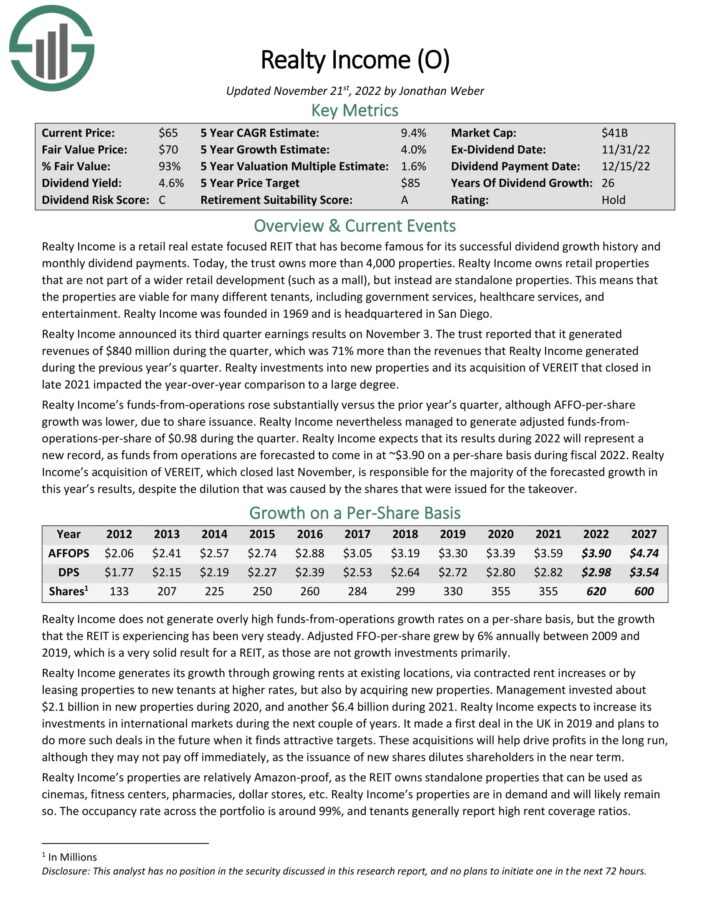

Realty Revenue is a retail-focused REIT that owns greater than 6,500 properties. It owns retail properties that aren’t a part of a wider retail improvement (resembling a mall), however as an alternative are standalone properties.

Which means that the properties are viable for a lot of completely different tenants, together with authorities providers, healthcare providers, and leisure.

Supply: Investor Presentation

The corporate’s lengthy historical past of dividend funds and will increase is because of its high-quality enterprise mannequin and diversified property portfolio.

Realty Revenue introduced its third quarter earnings outcomes on November 3. The belief reported that it generated revenues of $840 million in the course of the quarter, which was 71% greater than the revenues that Realty Revenue generated in the course of the earlier yr’s quarter.

Realty investments into new properties and its acquisition of VEREIT that closed in late 2021 impacted the year-over-year comparability to a big diploma. Realty Revenue’s funds-from-operations rose considerably versus the prior yr’s quarter, though AFFO-per-share development was decrease, on account of share issuance.

Realty Revenue nonetheless managed to generate adjusted FFO-per-share of $0.98 in the course of the quarter. Realty Revenue expects that its outcomes throughout 2022 will symbolize a brand new file, as funds from operations are forecasted to return in at ~$3.90 on a per-share foundation throughout fiscal 2022.

Click on right here to obtain our most up-to-date Certain Evaluation report on Realty Revenue (preview of web page 1 of three proven beneath):

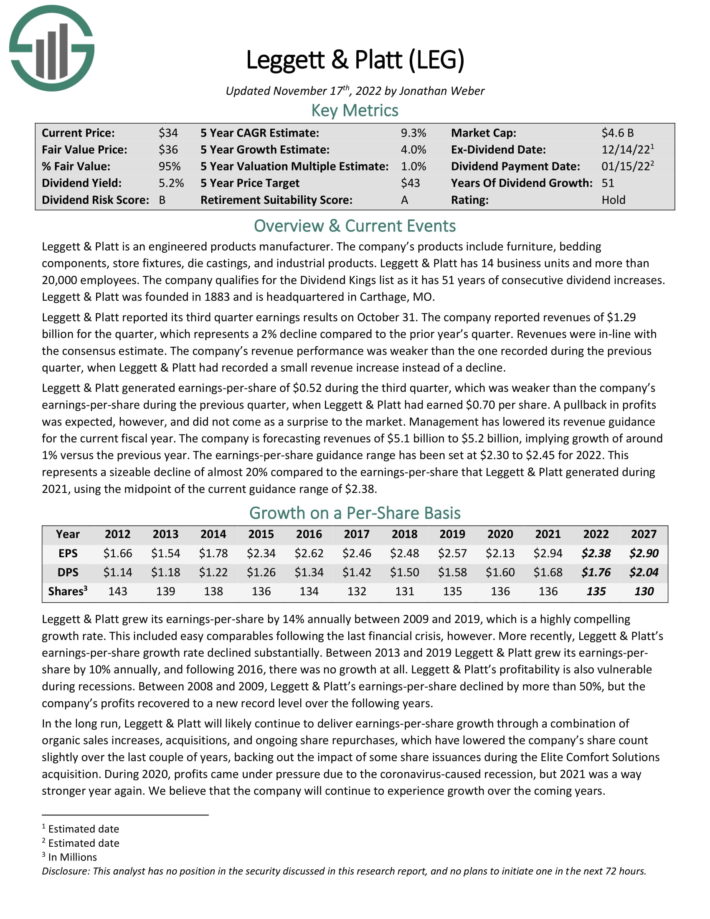

Excessive Yield Dividend Aristocrat #2: Leggett & Platt (LEG)

Leggett & Platt is an engineered merchandise producer. The corporate’s merchandise embrace furnishings, bedding parts, retailer fixtures, die castings, and industrial merchandise. Leggett & Platt has 14 enterprise models and greater than 20,000 staff. The corporate qualifies for the Dividend Kings because it has 50 years of consecutive dividend will increase.

Leggett & Platt reported its third quarter earnings outcomes on October 31. Income of $1.29 billion represented a 2% decline in comparison with the prior yr’s quarter. Revenues had been in-line with the consensus estimate. Earnings-per-share of $0.52 in the course of the third quarter, was a sequential decline from $0.70 per share within the earlier quarter.

Administration additionally lowered its income steerage for the present fiscal yr. The corporate is forecasting revenues of $5.1 billion to $5.2 billion, implying development of round 1% versus the earlier yr. The earnings-per-share steerage vary has been set at $2.30 to $2.45 for 2022. This represents a sizeable decline of virtually 20% in comparison with 2021, utilizing the midpoint of the present steerage vary of $2.38.

Click on right here to obtain our most up-to-date Certain Evaluation report on Leggett & Platt (preview of web page 1 of three proven beneath):

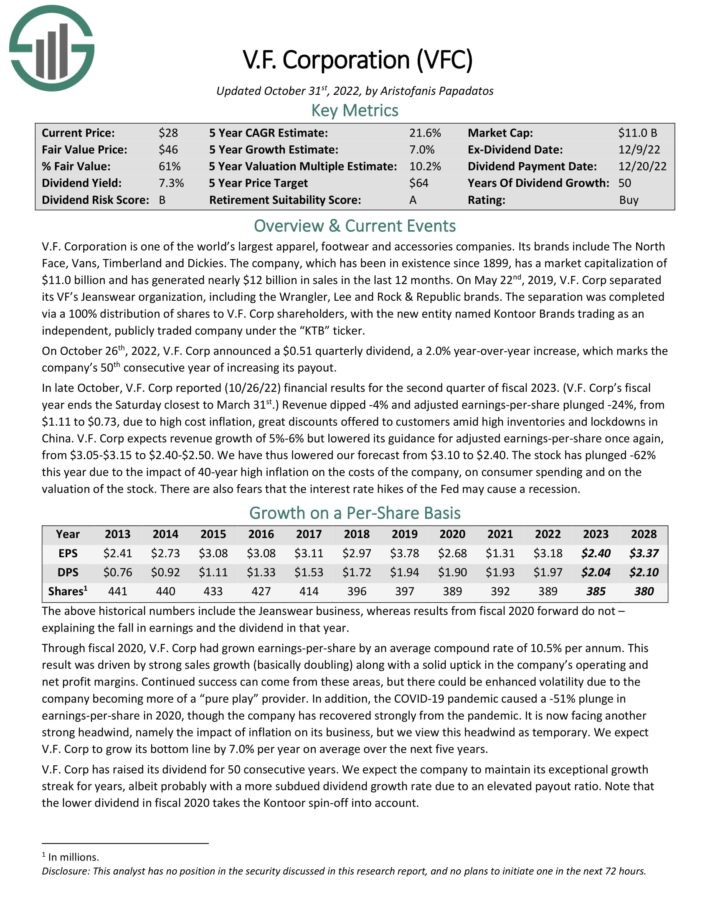

Excessive Yield Dividend Aristocrat #1: V.F. Corp. (VFC)

V.F. Company is likely one of the world’s largest attire, footwear and equipment firms. The corporate’s manufacturers embrace The North Face, Vans, Timberland and Dickies. The corporate, which has been in existence since 1899, generated over $11 billion in gross sales within the final 12 months.

On October twenty sixth, 2022, V.F. Corp introduced a $0.51 quarterly dividend, a 2.0% year-over-year improve, which marks the corporate’s fiftieth consecutive yr of accelerating its payout.

In late October, V.F. Corp reported (10/26/22) monetary outcomes for the second quarter of fiscal 2023. (V.F. Corp’s fiscal yr ends the Saturday closest to March thirty first.) Income declined by 4% and adjusted earnings-per-share plunged 24%, from $1.11 to $0.73. The decline in EPS was on account of excessive value inflation, product discounting, and excessive inventories and lockdowns in China.

V.F. Corp expects income development of 5%-6% however lowered its steerage for adjusted earnings-per-share as soon as once more, from $3.05-$3.15 to $2.40-$2.50.

Click on right here to obtain our most up-to-date Certain Evaluation report on V.F. Corp. (preview of web page 1 of three proven beneath):

Remaining Ideas

Excessive dividend yields are laborious to seek out in at the moment’s investing local weather. The common dividend yield of the S&P 500 Index has steadily fallen over the previous decade, and is now simply 1.5%.

Traders can discover considerably increased yields, however many excessive high-yield shares have questionable enterprise fundamentals. Traders ought to be cautious of shares with yields above 10%.

Luckily, traders wouldn’t have to sacrifice high quality within the seek for yield. These 20 Dividend Aristocrats have market-beating dividend yields. However in addition they have high-quality enterprise fashions, sturdy aggressive benefits, and long-term development potential.

You might also be seeking to put money into dividend development shares with excessive chances of constant to lift their dividends every year into the longer term.

Moreover, the next Certain Dividend databases comprise probably the most dependable dividend growers in our funding universe:

The Dividend Achievers: dividend shares with 10+ years of consecutive dividend will increase.

The Dividend Champions Record: shares which have elevated their dividends for 25+ consecutive years.Word: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have further necessities like being in The S&P 500.

The Dividend Kings: thought of to be the last word dividend development shares, the Dividend Kings checklist is comprised of shares with 50+ years of consecutive dividend will increase.

The Excessive Yield Dividend Kings Record is comprised of the 20 Dividend Kings with the best present yields.

The Excessive Dividend Shares Record: shares that enchantment to traders within the highest yields of 5% or extra.

The Finest DRIP Shares: 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

If you happen to’re on the lookout for shares with distinctive dividend traits, think about the next Certain Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].