Michael M. Santiago

Goldman Sachs BDC Inc. (NYSE:GSBD) is a well-managed enterprise improvement firm with a First Lien focus, a strong and lined 11.3% dividend yield, and web funding revenue that has the potential to develop as a result of firm’s publicity to floating fee rates of interest.

The BDC’s funding portfolio can also be increasing, and credit score high quality remained secure within the third quarter.

Goldman Sachs BDC is a top-rated enterprise improvement firm that gives traders with a excessive yield in addition to revenue upside, for my part.

The inventory is at the moment buying and selling at a small premium to web asset worth, making GSBD interesting to passive revenue traders.

First Lien-Focus Equals Recession Safety

For its funding portfolio, Goldman Sachs BDC solely selects the safer varieties of debt: 92% of investments have been made in high-quality first liens, with the remaining 6% in second liens, offering passive revenue traders with essential layers of safety even throughout recessionary intervals.

Throughout recessions, enterprise improvement firms usually see a decline in common mortgage high quality, which manifests itself as a rise in non-accruals.

A non-accrual mortgage is one by which the borrower isn’t performing as anticipated and has usually fallen behind on curiosity funds as a result of some sort of economic stress.

Goldman Sachs BDC’s funding portfolio was valued at $3.62 billion as of September 30, 2022, a 16% improve YoY. Non-accruals amounted to 1.4% of the corporate’s funding worth at amortized value, up from 0.9% as of June 30, 2022.

Portfolio Asset Composition (Goldman Sachs BDC Inc)

Just one% of latest mortgage commitments made within the third quarter referred to Second Liens. Goldman Sachs BDC elevated its emphasis on First Liens, accounting for 99% of the $205 million in new mortgage commitments made through the quarter.

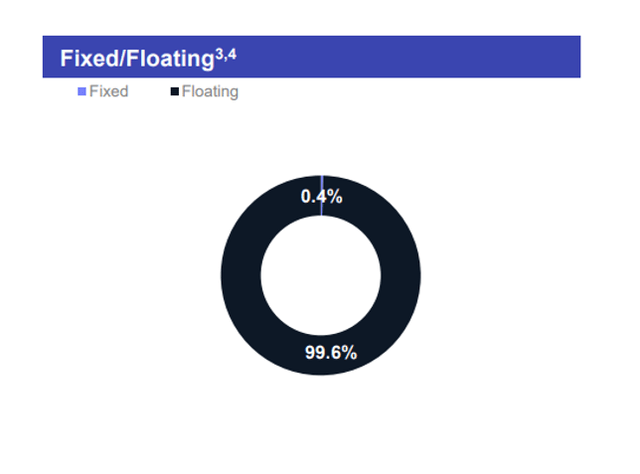

Virtually all of Goldman Sachs BDC’s mortgage contracts have floating charges (99.6% to be precise), which creates portfolio revenue upside for passive revenue traders so long as the central financial institution prioritizes inflation management.

Mounted And Floating Charges (Goldman Sachs BDC Inc)

Enhancing Dividend Protection

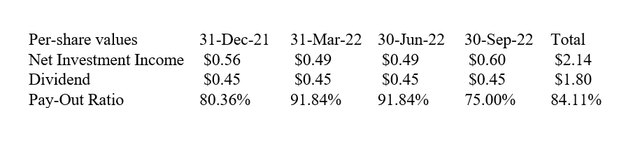

Goldman Sachs BDC earned $0.60 per share in web funding revenue within the third quarter, a 22% improve QoQ, and paid a $0.45 per share dividend.

The dividend pay-out ratio within the quarter ending September 30, 2022 was 75%, an enchancment from the earlier quarter’s dividend pay-out ratio of 92%.

The dividend is definitely lined, and except the enterprise improvement firm’s portfolio high quality deteriorates considerably, I see no drawback with Goldman Sachs BDC persevering with to pay the $0.45 per share per quarter it’s at the moment paying.

Dividend (Writer Created Desk Utilizing BDC Data)

Now A Premium Valuation

After I final checked out Goldman Sachs BDC, the corporate’s inventory was buying and selling at a 6% low cost to web asset worth. Due to the BDC’s inventory value restoration since my final protection, the inventory is now buying and selling at a 6% premium to Goldman Sachs BDC’s web asset worth of $15.02.

Value To E book Worth (YCharts)

Why Goldman Sachs BDC May See A Decrease Inventory Value

Given the standard and deal with security that Goldman Sachs BDC’s funding portfolio offers passive revenue traders, I imagine traders are at the moment paying a particularly reasonable value.

Nonetheless, there are apparent levers that might cut back the corporate’s web asset worth. Amongst them are fewer new mortgage originations and an increase in non-accruals.

A drop in rates of interest, versus a rise in charges that advantages the BDC’s floating fee asset base, could possibly be a drag on the BDC’s web funding revenue.

My Conclusion

Goldman Sachs BDC is certainly a higher-quality enterprise improvement firm, and the BDC’s portfolio carried out admirably all through the third quarter.

What I like about GSBD is that it focuses solely on First and Second Liens, which provides the funding portfolio a really defensive character, which is precisely what I need in preparation for the following recession.

To safe my revenue streams, I need well-managed, securely invested BDCs with a monitor document of execution and a rising portfolio worth, which GSBD offers.

The 11.3% dividend is definitely lined by web funding revenue, and the pay-out ratio is low sufficient to point that the BDC will have the ability to meet its dividend dedication to shareholders.