The Greenback Index begins the brand new week on the entrance foot amid renewed shopping for curiosity pushed by elevated danger aversion.

Greenback

The Greenback begins the brand new week rebounding from a 3 month low, breaching a one-week excessive on the again of renewed curiosity within the safe-haven foreign money. Components influencing this exuberance may be linked to an elevated hawkish rhetoric from FED officers, as they pour chilly water on a near-term pivot, in addition to renewed danger aversion from the market, as contemporary Covid instances spring up in China, prompting tighter restrictions, that are in keeping with China’s Zero-Covid coverage.

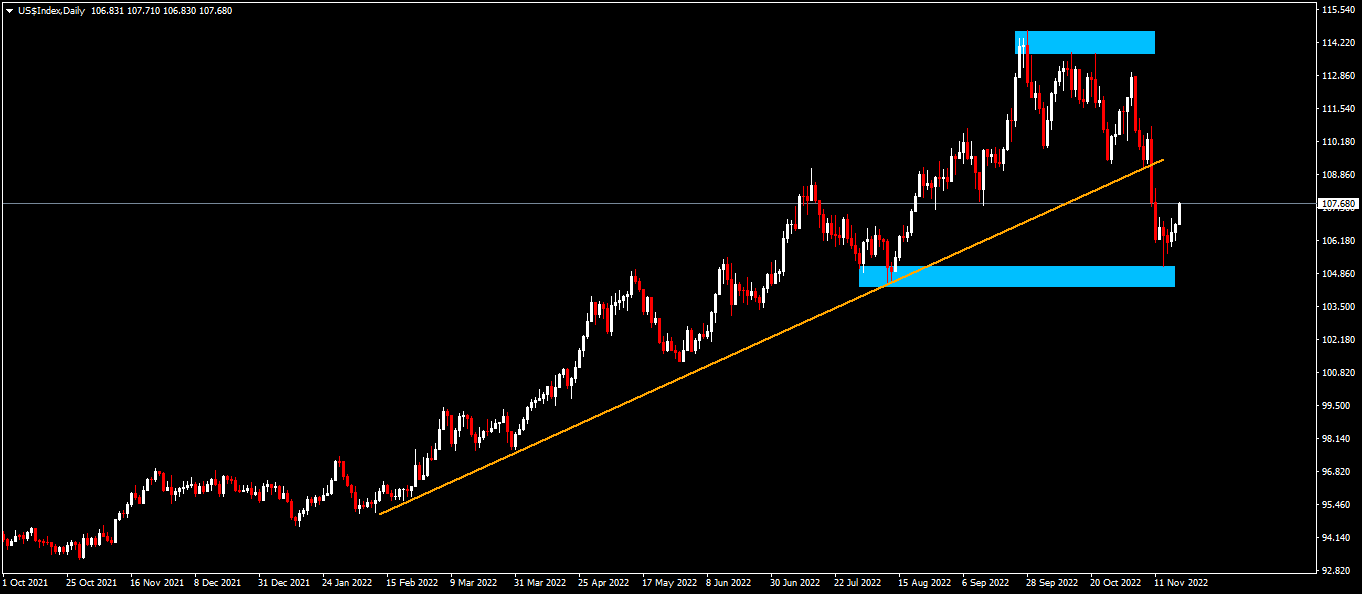

Technical Evaluation (D1)

When it comes to market construction, worth has come to a major juncture by invalidating the uptrend drawn from Feb 2022. Nevertheless, this by itself doesn’t suffice to affirm {that a} downtrend is about to ensue, as a result of a confluence of things stays unchecked. The following line within the sand was the 104.12 space the place the earlier higher-low was shaped, and contemporary shopping for curiosity was capitalized on as bulls entered the fray and gave assist on the degree. If bulls can defend this space, the narrative might nonetheless stay bullish, nonetheless the alternative applies if the world is invalidated by sellers.

Euro

The Euro kicks off the week heading for 3 consecutive decrease trending days, because it reaches its lowest worth degree for the reason that eleventh of November 2022. Components driving this strain on the European frequent foreign money may be linked to renewed shopping for curiosity within the Greenback as danger aversion units into the market. This flee to security comes on the again of elevated hawkish rhetoric supporting the Greenback, in addition to better-than-expected retail gross sales information from the US which solid doubt on the narrative that inflation had peaked and would have the web impact of slowing down client demand. Within the close to time period, the Euro may very well be supported by feedback made by ECB President Christine Lagarde on Friday, when she reiterated their dedication to bringing down inflation to 2% “in a well timed method”.

Technical Evaluation (D1)

When it comes to market construction, worth has invalidated the longer-term downtrend shaped from mid-Could 2022 and has achieved so in an impulsive break of construction. Nevertheless, this by itself doesn’t suffice to substantiate an outright reversal, as a retest of the decrease damaged constructions across the 0.99 space would wish to carry.

Pound

Sterling begins the week persevering with to struggle off a resurgent Greenback amid renewed shopping for curiosity within the secure haven foreign money. Components attributed to this strain on Sterling primarily emanate from the difficult market circumstances that lie forward in terms of its efficiency towards the Greenback, amid a poor macroeconomic outlook and the renewed hawkish stance from a number of FED officers downplaying the notion of an finish to the financial tightening cycle.

Technical Evaluation (D1)

When it comes to market construction, worth has invalidated the longer-term trendline, however has achieved so in a corrective method within the type of a rising increasing channel. The worth motion suggests a bull-trap on the present peak formation across the 1.201 space and will be the impetus bears are in search of to problem the bulls.

Gold

Gold heads into the brand new week with the momentum gained final week undoubtedly fading. This momentum was largely pushed by the current softer inflation print, which prompted the Greenback to weaken amid hypothesis of a possible pivot pushed by the report. Nevertheless, since then, upbeat retail gross sales information has basically sucked life out of that narrative. Going into the week, traders might be eyeing two issues; the FOMC assembly minutes, to evaluate the veracity of decreased rate of interest hikes, and China’s zero-covid coverage and the developments round their lockdown. The truth that China is a big client of Gold is essential as a result of if restrictions are imposed it might draw plenty of demand out of the market and ship the value falling.

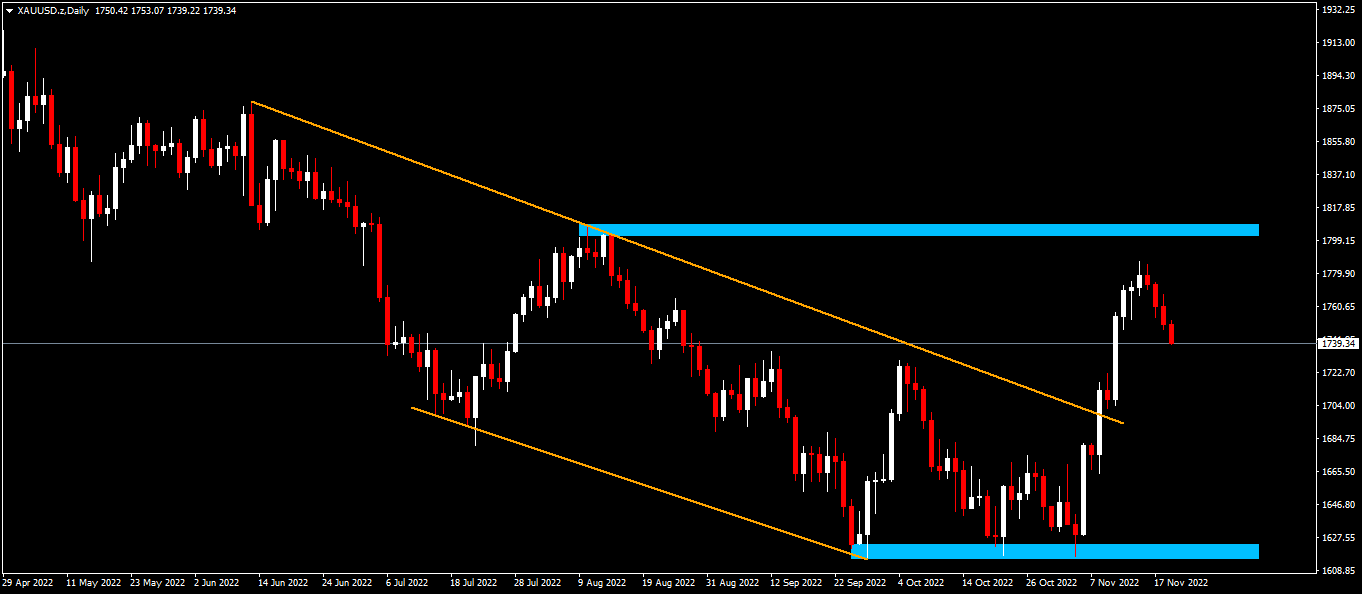

Technical Evaluation (D1)

When it comes to market construction, Gold has simply damaged out of the outer trendline on the downtrend, which signifies an vital inflection level within the bearish narrative. Nevertheless, this by itself won’t suffice to sign the tip of the downward momentum, as the ultimate line within the sand for sellers to defend is the $1 809 space. If breached, this might give bulls the impetus to drive the narrative additional and if it holds, new sellers is likely to be all for testing the bulls.

Click on right here to entry our Financial Calendar

Ofentse Waisi

Monetary Market Analyst

Disclaimer: This materials is supplied as a basic advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.