Arlette Lopez/iStock Editorial by way of Getty Pictures

Main Mexican financial institution Santander Mexico’s (NYSE:BSMX) monetary place might not be fairly as sturdy as that of its friends BBVA Bancomer (BBVA) and Banorte (OTCQX:GBOOF), however profitability has been bettering in latest quarters. Its third-quarter P&L outcomes, as an example, had been boosted by contained working bills, sturdy mortgage progress, and fee-based revenue whereas sustaining asset high quality beneath management.

Within the close to time period, outcomes ought to proceed to learn from the tailwinds noticed in Q3 2022 – fee hikes have proven no indicators of abating anytime quickly, whereas the restoration of Mexico’s economic system stays on observe. The valuation is reasonable as nicely, however given the success of parentco Santander Group’s (SAN) tender supply for the remaining minority curiosity, any upside will likely be capped by the fwd e book worth of the corporate heading into an anticipated delisting in Q1 2023.

Broad-Primarily based Power Drives Report Excessive ROEs

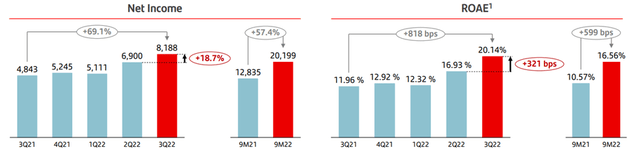

BSMX outpaced consensus in Q3, with web revenue reaching P$8.2bn (+19% QoQ and +69% YoY), largely on the again of a significant P$3.7bn launch of provisions associated to giant company loans. Whereas this can be a one-off earnings increase, the constructive efficiency elsewhere, significantly within the retail portfolio, was commendable. The accelerated progress right here means the share of shopper loans throughout the BSMX mortgage portfolio now stands at 17.0% in Q3 2022 – a powerful 2percentpt achieve relative to the 15.0% share in Q3 2020.

Santander Mexico

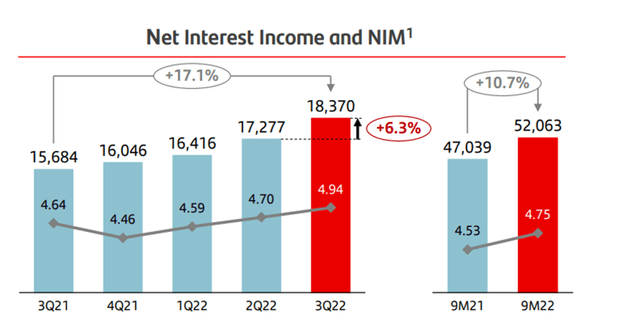

Total, the web curiosity revenue enlargement above mortgage progress for the quarter at (+6% QoQ and +17% YoY) was constructive, and regardless that the web curiosity margin (NIM) remained at 4.3%, this was right down to progress in interest-earning belongings (+10% QoQ and +18% YoY). The mix of BSMX’s basic energy and decrease provisions meant ROE expanded to a file excessive of 20.5% in Q3 – a +360bps QoQ rise and nicely above the 11.9% achieved final 12 months. Maybe much more impressively, this progress was achieved with out sacrificing asset high quality – BSMX reported a major decline in delinquencies for the quarter, in addition to traditionally low (and nicely under pre-COVID) NPL ranges.

Santander Mexico

Steering Revision Alerts Continued Momentum Forward

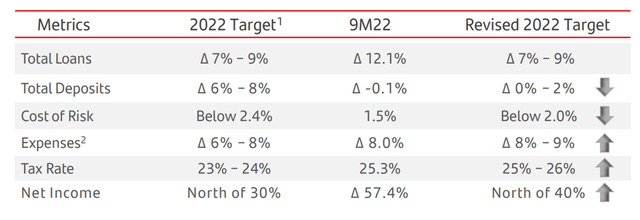

Coming off the Q3 outperformance, administration has revised its steering numbers greater. Earnings progress is now guided to hit ~40% this 12 months (up from 30% beforehand), with price will increase anticipated to be in keeping with inflation at +8-9% this 12 months. The associated fee steering comes regardless of the financial institution’s dedication to investing in digital initiatives, together with a separate digital financial institution. Per administration, the financial institution has utilized for a digital banking license and expects to obtain approval in Q1 2023, with operations slated to start by end-2023. Whereas it stays early days, the rise of digital banking doubtless means extra competitors (and extra spending) within the coming years, given the emergence of different new digital gamers. But, the expansion alternative from digital adoption, in addition to the numerous unbanked inhabitants in Mexico, ought to help a lovely long-term ROI.

Santander Mexico

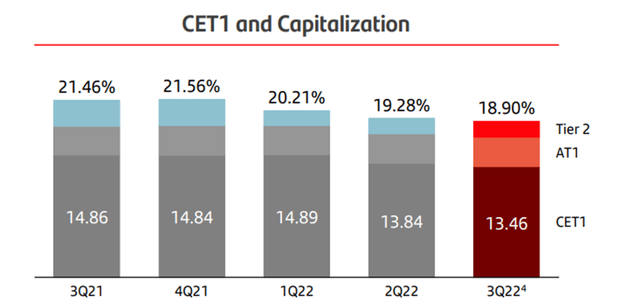

The outlook for the financial institution’s capital place additionally appears good – administration has guided to a normalizing price of danger within the coming quarters regardless of the shift towards higher-risk shopper and bank card loans. This is sensible, in my opinion, provided that in Q3, all segments sustained charge-off ratios at multi-year lows regardless of the sturdy progress throughout the BSMX mortgage portfolio. Flexibility on capital return is proscribed, nonetheless, given the financial institution is constrained by a 12-12.2% tier-1 ratio goal. That stated, I wouldn’t be stunned to see the financial institution pay out extra capital subsequent 12 months ought to it cross the upcoming capital stress assessments (attributable to be introduced to the Mexican Nationwide Banking and Securities Fee (CNBV) early subsequent 12 months).

Santander Mexico

Santander Buyout on Monitor

Heading into earnings, parentco SAN had disclosed a money supply for the remaining 3.76% stake in BSMX that it doesn’t already personal at a valuation equal to the e book worth per share of the final quarterly report. For context, the e book worth previous to the supply was P$23.61/share (equal to $5.90/ADR), so at a high-single-digit % premium to the pre-announcement closing worth, the deal is a financially engaging one for SAN.

The deal will come as no shock to buyers – recall that SAN had beforehand launched three tender provides for minorities, with the final one in December 2021 ensuing within the parentco crossing the 96% possession threshold. Strategically, the tender supply additionally makes good sense, in my opinion, given SAN’s total technique of rising its presence in progress markets like Mexico. It additionally displays the parentco’s confidence within the high quality of the BSMX franchise in addition to the long-term progress potential. Assuming the execution goes as deliberate, the deal is predicted to shut earlier than Q1 2023, topic to regulatory clearance.

Pending Buyout Caps the Upside Potential

BSMX delivered file ROEs in Q3 2022, as its bottom-line outcomes obtained a well timed increase from a reversal of provisioning bills, together with stronger income and below-inflation working bills. Even assuming no additional provisioning reversals within the subsequent few quarters, although, BSMX has ample room to develop its ROEs as rates of interest in Mexico transfer (and keep) greater for an prolonged time period. The continued restoration of Mexico’s economic system presents a pleasant earnings tailwind as nicely. But, the tender supply from parentco Santander Group to accumulate the remaining float means any upside will likely be capped on the fwd e book worth. With the valuation already at ~1x e book and a competing bid unlikely, I’m impartial on BSMX.