marchmeena29

Blackstone Mortgage Belief, Inc. (NYSE:BXMT) reported third quarter earnings in late October, and the belief simply coated its dividend with distributable earnings.

Despite the fact that dividend will increase are unlikely within the close to future, BXMT is a high-quality passive revenue inventory that will proceed to supply buyers with predictable dividend revenue.

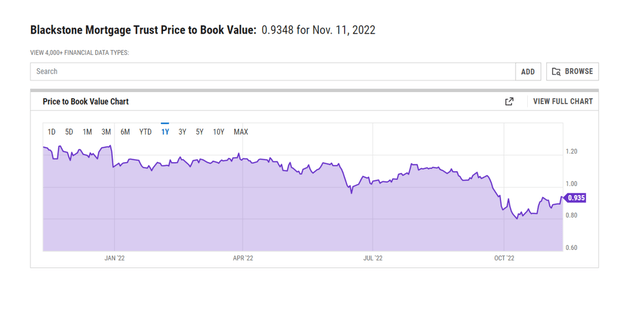

Moreover, BXMT continues to commerce at a 6% low cost to guide worth.

Why Would You Need To Earn The Belief

Blackstone Mortgage Belief owns a portfolio of high-quality senior loans which can be performing properly, and the belief is uncovered to floating proper rates of interest, which is clearly changing into a much bigger situation for the industrial actual property market.

To fight inflation, the central financial institution raised rates of interest by one other 75 foundation factors in November. As a result of Blackstone Mortgage Belief’s loans all have floating rates of interest, rising rates of interest profit the true property funding belief.

Within the third quarter, Blackstone Mortgage Belief originated $438 million in new loans, primarily within the industrial sector. In Q3’22, 78% of latest senior loans had been backed by industrial belongings, and all new originations had been 100% senior loans and 100% floating charge.

The overall mortgage portfolio of the true property funding belief was valued at $26.1 billion on the finish of the September quarter, and it continued to exist solely by floating charge senior loans.

3Q’22 Portfolio Exercise (Blackstone Mortgage Belief)

Dividend Coated By Distributable Earnings, Low Pay-Out Ratio

The most effective causes to put money into Blackstone Mortgage Belief is the corporate’s coated dividend, which offers passive revenue buyers with a constant stream of high-quality dividends that, in my view, may even be sustained throughout an financial downturn.

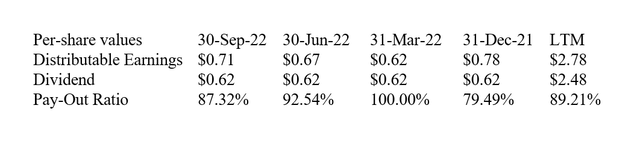

Within the third quarter, Blackstone Mortgage Belief earned $0.71 per share in distributable earnings, which was greater than sufficient to cowl the $0.62 per share dividend fee.

The dividend pay-out ratio within the third quarter was 87%, in comparison with 89% within the earlier 12 months. Blackstone Mortgage Belief’s pay-out ratio improved QoQ resulting from larger distributable earnings. In consequence, I consider the dividend payout may be very safe, which ought to make it simpler for passive revenue buyers to resolve whether or not to put money into the belief for the long run.

Traders ought to keep away from planning for a dividend enhance as a result of Blackstone Mortgage Belief has paid the identical quarterly dividend charge of $0.62 per share for years. BXMT presently has a inventory yield of 9.7% primarily based on a quarterly dividend of $0.62 per share.

Dividend And Distributable Earnings (Creator Created Desk Utilizing Belief Data)

BXMT Is Nonetheless Obtainable At A Low cost To Guide Worth

Till lately, Blackstone Mortgage Belief traded at a premium to guide worth, but when the inventory trades at a reduction, I cannot waste time and can enhance my funding within the industrial actual property firm.

In my view, there’s nonetheless time to buy Blackstone Mortgage Belief inventory at a 6% low cost to guide worth.

Worth To Guide Worth (YCharts)

Why Blackstone Mortgage Belief May See A Decrease Valuation

Blackstone Mortgage Belief has appreciable publicity to the industrial actual property market. If the true property market in the USA enters a extreme recession, the true property funding belief is prone to endure from declining originations and probably decrease distributable revenue, which may end in a decrease guide worth a number of.

Nonetheless, I consider that Blackstone Mortgage Belief’s senior mortgage focus offers robust safety towards a industrial actual property market correction and that the belief wouldn’t be pressured to scale back its dividend payout.

My Conclusion

Inflation is presently at 7.7%, and buyers don’t have any alternative however to speculate to guard themselves from the results of inflation.

Blackstone Mortgage Belief continues to be a strong alternative within the industrial actual property market, with the true property funding belief benefiting from robust originations within the third quarter. Within the third quarter, Blackstone Mortgage Belief additionally coated its dividend with distributable revenue, and the pay-out ratio truly improved QoQ.

As a result of the inventory of the true property funding belief continues to be buying and selling at a reduction to guide worth, I’ll proceed to advocate BXMT to passive revenue buyers in search of a long-term alternative to generate predictable dividend revenue.