The IPO of Kaynes Expertise (Kaynes), which opened for subscription on November 10, is on until November 14. The problems measurement of round ₹ 850 crore consists of a contemporary situation of ₹530 crore, the remainder being supply on the market by promoter and one other investor.The corporate intends to make use of the proceeds from contemporary situation for capex/capability growth, compensation of borrowings and funding working capital necessities. The promoter shareholding, which is at 80 per cent now, will cut back to 64 per cent put up situation.

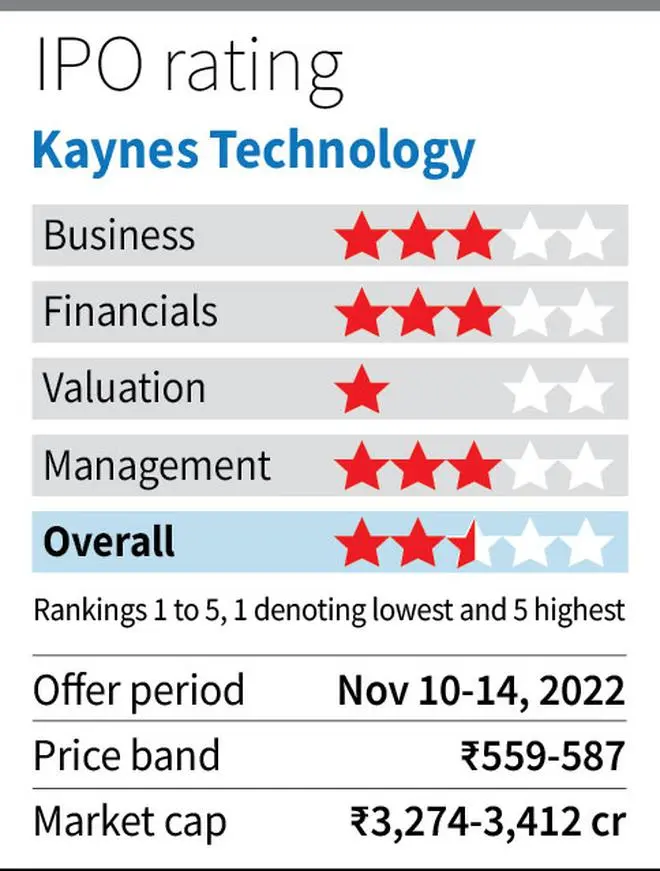

Kaynes is within the enterprise of built-in electronics manufacturing. Whereas the expansion prospect is fascinating, on the higher finish of the IPO worth band of ₹559-587/share, Kaynes is valued at very costly ranges. On put up situation shareholding foundation, the valuation works out to 82 instances FY22 PE and round 87 instances annualised June Q FY23 earnings. Such a valuation greater than adequately components development prospects and leaves no margin of security for buyers. Therefore long-term buyers can provide the IPO a miss.

Enterprise

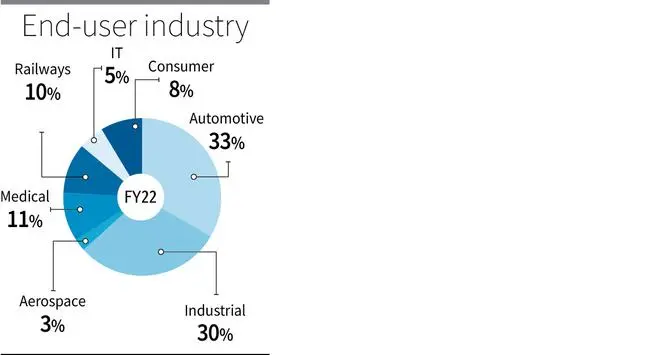

As an built-in electronics manufacturing participant, Kaynes has capabilities throughout a broad spectrum of digital system design and manufacturing companies (ESDM). It has expertise in offering conceptual design, course of engineering, built-in manufacturing and life cycle assist for main gamers throughout a number of industries (see infographics). It operates out of eight manufacturing places within the nation. A few of the merchandise amongst many equipped by Kaynes are cluster printed circuit board assemblies, electronics for automotive lighting, road mild controllers, engine management panels, vitality meters, wired and wi-fi headsets, and many others. Relative to sector, the corporate has a fairly diversified buyer base with prime 10 prospects contributing to 51 per cent of income. Round 20 per cent of firm’s income comes from exports.

Prospects

Whereas ESDM gamers initially began off as contract producers a couple of many years again, at the moment lots of them companion with authentic tools producers (OEMs) proper from product design and prototyping/testing part, thereby growing their worth within the general product life cycle. World ESDM trade was at $804 billion in 2020, with India’s share at a minuscule 1.8 per cent. China leads the pack with a share of 45 per cent, adopted by the US at 16 per cent. As per a Frost and Sullivan report, the market measurement is anticipated at $1,002 billion in 2025, with prospects that India’s contribution could be as excessive as 8.1 per cent, implying a CAGR of 41 per cent for the trade. Whereas this is likely to be overly optimistic, the expansion however could be good. Components that work in favour are authorities push and incentives to advertise manufacturing in India, home value competitiveness (Indian wages 46 per cent cheaper than China as per a report), import substitution, China+1 technique of world corporations, and many others.

Dangers

A few of the key gamers within the trade in India moreover Kaynes are listed gamers — Dixon Applied sciences, Amber Industries, SGS Syrma; and unlisted gamers like Bharat FIH, SFO Applied sciences, Avalon Applied sciences and Sanmina-SCI Expertise. Bharat FIH and Sanmina-SCI are Indian items of formidable worldwide gamers.

On the identical time, that is additionally an trade with very excessive competitors (home and established worldwide gamers) and low margins. World slowdown can also be a near-term threat which will impression income and pressurise margins. Industries and corporations with decrease margins are likely to expertise greater volatility in earnings. Increased rates of interest may also impression value of working capital and impression profitability. Thus, development prospects must be thought of together with these dangers. Dependence on imports for key uncooked supplies until India is ready to arrange home capability for a similar can also be one other threat. For instance in FY 22, imported uncooked supplies accounted for 64.46 per cent of whole buy of uncooked supplies for Kaynes.

Financials and Valuation

In FY22, Kaynes reported income from operations of ₹706 crore and web revenue of ₹41.6 crore (web revenue margin of 5.8 per cent). Throughout FY20-22, income and earnings grew at a CAGR of 38 and 111 per cent respectively. Profitability improved from a mix of working leverage in addition to decrease curiosity prices. As in comparison with friends Kaynes has higher profitability. As per its presentation, whereas it reported EBITDA margins of 13.3 per cent in FY22, the identical for a few of its key friends is within the vary of two.7 to 11 per cent.

For June Q 2023, Kaynes reported income from operations of ₹199 crore (28 per cent of FY22 income) and web revenue of ₹10 crore (24 per cent of FY 22 earnings). On the finish of the quarter, the corporate had a stronger order e book of ₹2,266 crore (3x FY22 income).

Within the absence of any international shocks, the corporate’s development can proceed to development effectively however its valuation at 82 instances FY22 earnings makes the providing unattractive. Peer SGS Syrma, which got here out with its IPO not too long ago in August, is buying and selling at 67 instances FY22 earnings. Whereas friends additionally commerce costly, they don’t seem to issue enterprise dangers adequately.