visualspace

An excellent Investor Day

Veeva Techniques (NYSE:VEEV) held its Investor Day final Friday. The market reacted very properly to the presentation and Q&A session, sending the top off round 10%. Veeva is a long-term holding in my portfolio with a 4% allocation. Let’s check out what occurred on the Investor Day.

Veeva inventory value throughout investor day (Google)

Penetrating new sectors

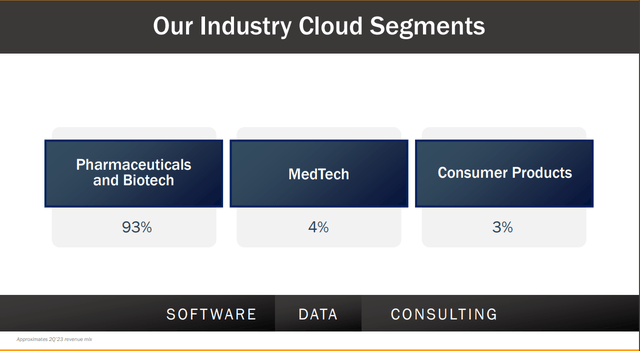

Veeva is the go-to ecosystem of enterprise options for the life sciences sector, the place the corporate is being utilized by 19/20 of the largest pharma firms on this planet. The corporate is firmly entrenched in Pharma and Biotech firms, the place Veeva is the go-to possibility for over 1000 prospects. The software program is extremely specialised for the wants of the pharma and biotech {industry}. The MedTech phase was only a byproduct previously, the place MedTech firms used a few of Veeva’s choices and made them work for his or her area of interest. Not too long ago Veeva introduced a devoted answer for the MedTech area, unifying the overall MedTech product lifecycle. The MedTech {industry} is a $500 billion subcategory of the $2 trillion life sciences {industry} and a extremely engaging marketplace for Veeva to get into. One other class that has been briefly talked about in prior earnings however hasn’t seen a lot focus is the Client Merchandise phase. Prospects right here could have completely different wants, however some options Veeva provides may be utilized. Moreover client packaged items, specialty chemical compounds or cosmetics, the corporate not too long ago began providing its providers to meals and beverage firms that use high quality management options for his or her merchandise.

Veeva income by segments (Veeva Investor Day)

Product excellence and portfolio power

Veeva’s portfolio may be roughly divided into the event cloud (R&D and High quality management options), Industrial Cloud (S&M options) and Knowledge Cloud (Knowledge options). Industrial presently accounts for almost all of the enterprise (56%), however R&D has been gaining share within the gross sales combine for years.

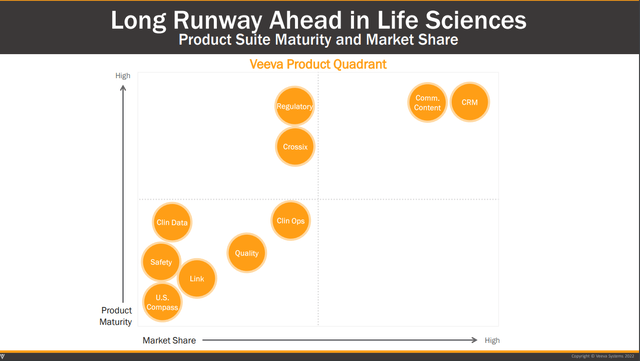

Veeva shared its Product Quadrant (see image beneath), exhibiting its completely different merchandise’ maturity and market share. We will see that solely two merchandise (CRM and Industrial Content material) are within the chief quadrant and each are within the Industrial Cloud phase. All different merchandise have a low market share. Founder and CEO Peter Gassner stated the next about how they consider market management:

we would like product excellence, which suggests we do not need too many merchandise, and each product must be the chief, and we really had a mathematical formulation within the industry-specific. We stated management means 40% or extra market share.

Peter Gassner, Investor Day 2022

Veeva Product Quadrant (Veeva Investor Day)

Moreover, Peter stated the next concerning the enterprise software program {industry} within the life sciences {industry}:

And I feel I did not assume we -when we began, I believed it is more than likely going to be extra of a duopoly kind of factor. It turns on the market’s normally 1 lead canine. And that is the way it works. So I do not assume there’s any distinction in any of these merchandise.

Peter Gassner, Investor Day 2022

With its long-term relationships with most pharma firms and enormous information units, the corporate is within the prime place to capitalize on this and enhance its pockets share with prospects over time. Many of those low-market share merchandise must be confirmed and as soon as Veeva has a case research of integration with a buyer, with the information to again up effectivity and price financial savings, they’ll promote it to increasingly more of its buyer base. I imagine that this and future merchandise that we do not even find out about but, together with its largely underpenetrated markets, MedTech and Client Merchandise, will present Veeva with an extended and sustained runway of progress.

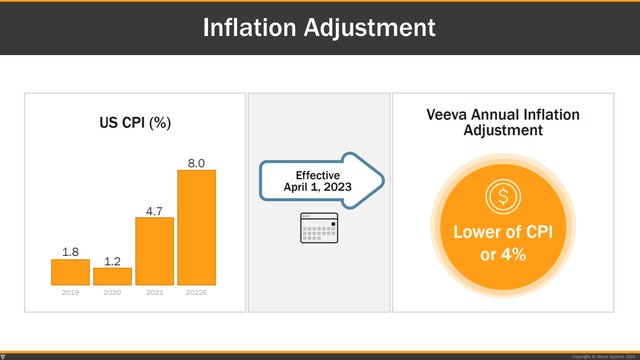

Inflation-adjusted contracts

The corporate introduced its first-ever value will increase for its choices. Previously, Veeva by no means raised costs on renewals. This now adjustments with an annual inflation adjustment or the CPI quantity or 4%, whichever is decrease. This can assist offset rising prices whereas being truthful with its prospects and preserving good relationships intact.

Inflation Changes (Veeva Investor Day)

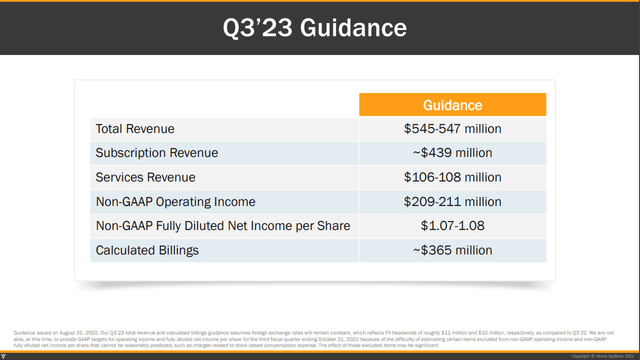

Confirming steerage

Veeva confirmed that it’ll “report outcomes at or above our earlier steerage.” The corporate additionally commented on its medium-term objective of $3 billion in revenues and 35% non-GAAP working margin by Calendar yr 2025. Veeva remains to be monitoring forward by about one yr and can announce a brand new Goal for 2030 after reaching the present goal.

Q3 23 Steerage (Veeva Investor Day)

M&A self-discipline

A query that has been on my thoughts for some time has additionally been addressed: What is the plan with the massive money steadiness? Veeva presently has $2.92 billion in money and short-term investments on the steadiness sheet versus a mere $63 million in debt, representing a Internet debt/EBITDA ratio of destructive 5.5x!

The corporate stated that it’s glad to have such a major money place on the steadiness sheet in these unsure instances and that they don’t wish to rush something. To date, they’ve had a 100% success price in M&A and wish to maintain it that means:

And so that you simply – the timing needs to be proper, the puzzle items have to suit collectively, and it’s a must to have the self-discipline to say no. So we take a look at we’ll take a look at 50 issues and say no 39 to 49 of them.

Brent Bowman, Veeva Investor Day 2022

I’m a purchaser

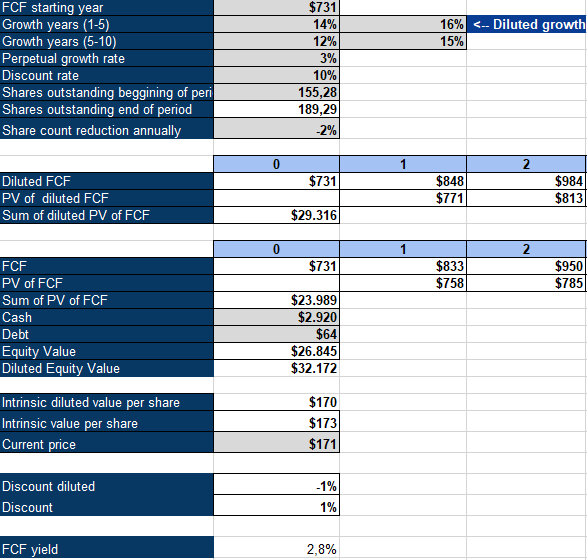

To worth Veeva, I exploit an inverse DCF mannequin with a ten% low cost price/required price of return, a 3% perpetual progress price and I assume a 2% annual dilution, in keeping with the final 5 years. The present value implies a 15-16% progress price for the enterprise, which I imagine may be sustained and exceeded for the subsequent decade given the large alternative in its low market share merchandise and observe file of product excellence. The added annual value will increase will even assist progress. I personal shares of Veeva and added to my place final week after the investor day at $165.

Veeva Inverse DCF (Authors Mannequin)