The simmering battle between the 2 behemoths of the crypto platform business was within the air, then immediately accelerated final Sunday when Binance, by means of its interim CEO Changpeng Zhao, determined to liquidate their total FTT Token following rumours of insolvency of the in-house funding fund Alameda which is owned by the long-lasting Sam Bankman-Fried who’s none apart from the CEO of the FTX trade platform (see under)

“As a part of Binance’s exit from FTX final yr, Binance obtained roughly the equal of US$2.1 billion in money (BUSD and FTT). As a result of current revelations which were made, now we have determined to liquidate any remaining FTT on our books.”

Cryptoast reviews thus: “These rumours come on the heels of a Coindesk report printed on November 2 which signifies that almost all of funds held by buying and selling agency Alameda Analysis are FTT, the token of the FTX platform. In consequence, Alameda Analysis could turn out to be bancrupt within the occasion of a pointy drop within the worth of FTTs, as was the case with Celsius.” This was all it took for the scent of blood to draw the sharks, though FTX and particularly Alameda had been fast to launch counter-measures by means of CEO Caroline Ellison. (see under)

“If you’re trying to minimise the market influence in your FTT gross sales, Alameda will probably be pleased to purchase them from you in the present day at $22!”

It appears clear that Binance noticed the proper alternative to take out a rising rival trade. The platform, which three years in the past acquired an fairness stake within the FTX platform in BUSD Binance tokens and FTTs, bought all of it again for $2.1 billion. Following the sale, the value of the token fell drastically by greater than 70%, from round 22 {dollars} to round 5 {dollars} in 24 hours, dragging in its wake all of the cryptomonies with solely BNB, the token of Binance, managing to restrict its losses.

Yesterday, international cryptocurrency large Binance signed a letter of intent to purchase out its competitor, and inside hours reached a deal to purchase the trade and safe buyer funds. Sam Bankman-Fried held a “very direct” assembly of all workers and stated “that is what’s taking place; it’s achieved”, in keeping with a supply near the matter. The whole transaction is happening beneath the watchful eye of the US Securities and Alternate Fee, the US federal regulatory company that oversees the monetary markets, and “it exhibits that no person is just too large to fail. FTX appeared untouchable,” stated Pascal Gauthier, CEO of digital pockets supplier Ledger.

This sudden and violent showdown has triggered a tsunami within the crypto ecosystem and reminds anybody who will pay attention that the business continues to be in its infancy and that the autumn of a significant participant results in a fall in confidence and excessive worth volatility.

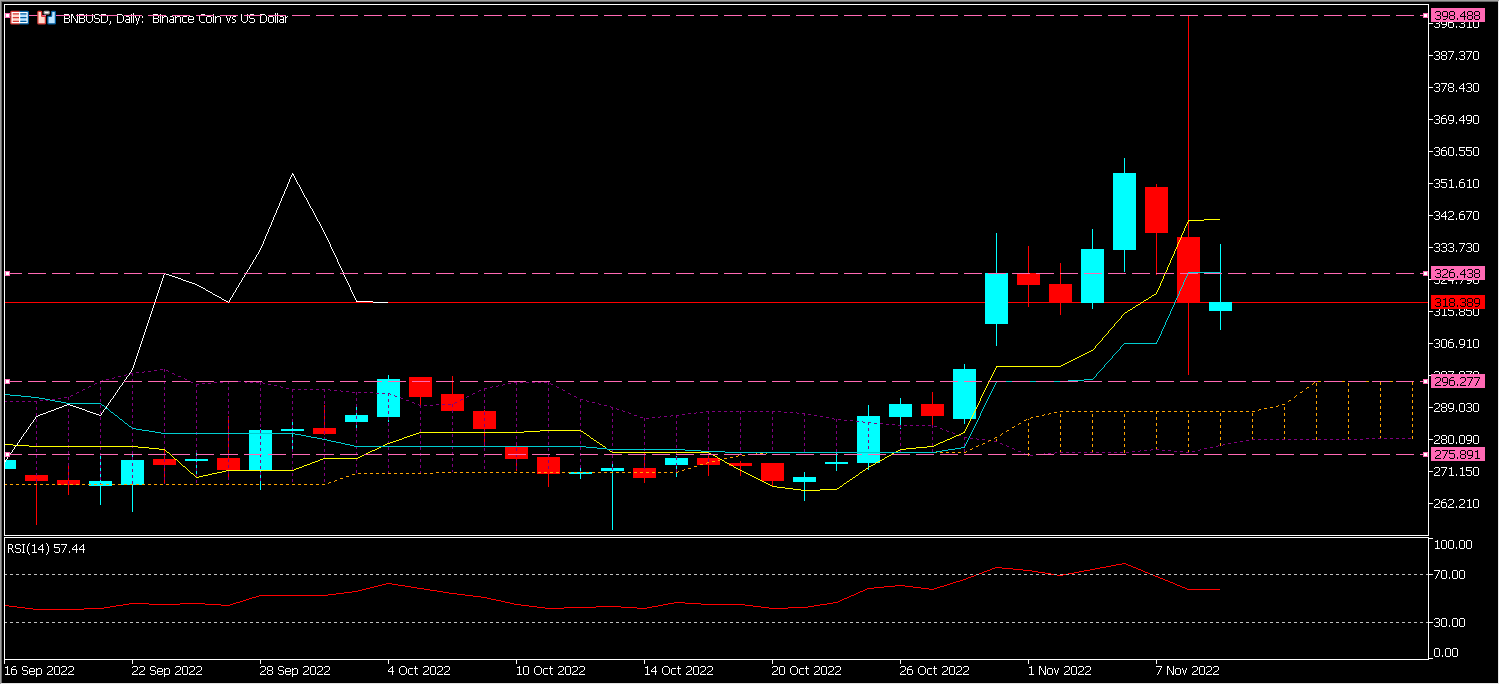

BNB Technical Evaluation

The worth of BNB is at the moment $315, above its cloud however under its Kijun (L.V) and Tenkan (L.J), the Lagging Span (LB) is above its friends which means a hesitation as to the long run route. Within the case of bullish momentum the value may attain initially $326 on the degree of its Kijun after which a second time $398, whereas within the reverse case the value may attain $296 after which $272. (see under)

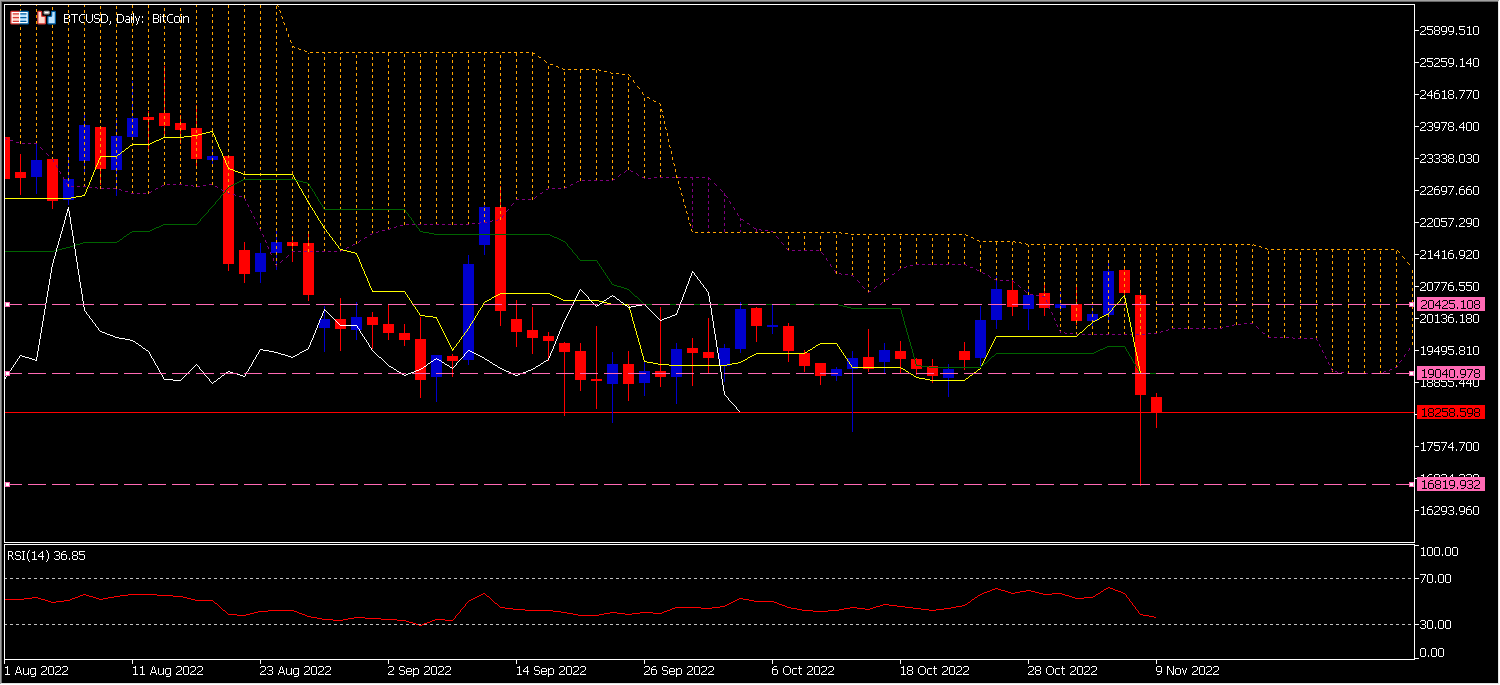

BTC Technical Evaluation

The BTC worth is at the moment at $18115, under its cloud; its Kijun (LV) and Tenkan (LJ), the Lagging Spans (LB) is under its friends which clearly means a bearish momentum. The worth may attain $16819k initially after which if it manages to interrupt assist it will open the door to a possible worth of $14k. In any other case it may attain its Kijun on the $19040 degree after which in a second part the $20425 degree.

As talked about above a drop in confidence causes excessive volatility as will be seen within the under chart with Crypto volumes exploding on the way in which up which means that traders are dashing to guard themselves in opposition to the value drop.

The primary chart exhibits BTC volumes over 1 week and 1 month.

The second chart exhibits the BTC 35 delta over 1 week and 30 days.

Click on right here to entry our Financial Calendar

Kader Djellouli

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.