By Ven Ram, Bloomberg Markets Stay reporter and strategist

Gold is essentially the most resilient asset to personal if the Federal Reserve continues to lift charges, whereas shares are the worst place to be, with non-dollar currencies falling between the 2.

Gold has had an empirical period of simply over three years within the present Fed cycle, in contrast with shares at 7.1 years. The non-dollar currencies that make up the G-10 have seen a period of 5.3 years.

Length measures the share change of an asset in response to a 1 share level shift in rates of interest.

Gold remains to be hovering close to its low for this cycle of $1,615 an oz, a 12% decline because the begin of the 12 months that has come because the Fed raised its benchmark rate of interest by 300 foundation factors, with one other 75 foundation factors priced in from this week’s coverage evaluate.

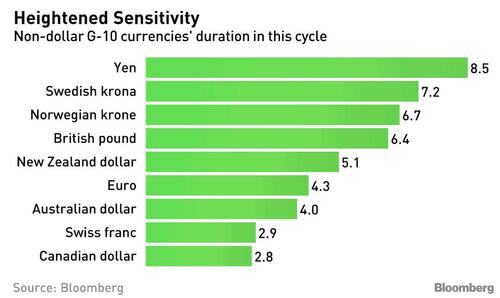

Non-dollar G-10 currencies have seen a median period of 5.3 years within the present cycle, highlighting their sensitivity to any perceptible shift in interest-rate differentials.

Nonetheless, shares are the most delicate to shifts within the Fed’s benchmark, with the S&P 500 demonstrating a period of seven.1 years and the Nasdaq 100 about 9.6 years.

The sensitivity of shares is in distinction to prior Fed cycles, when calculations present their period was far much less. The heightened period on this cycle is a mirrored image of how low earnings’ yields on shares had fallen earlier than the Fed began elevating charges.

Gold’s relative resilience echoes a examine accomplished again in 2020 that confirmed the steel had a superb diploma of convexity. In essence, gold stands to lose much less when rates of interest rise and achieve extra when charges fall by the identical quantity.

Whereas the estimated period then was 17, that measure has clearly fallen much more on this cycle, accentuating the results of convexity.

Amongst currencies, the yen, the Nordic advanced and sterling have been essentially the most weak to the Fed’s price will increase because the chart reveals:

The yen’s travails are well-known, with its descent to 150 per greenback final month in keeping with the shift in inflation-adjusted interest-rate differentials in favor of the buck. Its period of virtually 9 means that it could proceed to be weak ought to the Fed elevate its benchmark to round 5% because the markets are actually pricing in.

The high-duration measures of the Swedish and Norwegian currencies in addition to the pound illustrate how delicate the three economies are to developments outdoors their shores. Specifically, sterling’s near-15% decline in opposition to the greenback this 12 months is exaggerated in relation to strikes in interest-rate differentials. As explored right here in larger element, the pound’s woes underscore its heightened correlation with the euro.

Whereas the evaluation on period reveals that gold is a comparatively secure place to be within the forex cycle, it have to be famous that it’s nonetheless not fully resistant to adjustments in rates of interest.

All informed, the examine offers a helpful ballpark of seemingly declines in varied belongings ought to the Fed proceed to lift rates of interest to drive inflation towards its 2% purpose.