Joe Raedle

Firm Overview

Shake Shack (NYSE:SHAK) is an American quick informal burger and scorching canine chain that started in New York Metropolis. Shake Shack has had greater than 350+ places since 2021, and the corporate has an worldwide presence, starting from Korea, Turkey, Center East, and Japan. Shake Shack accomplished its IPO in 2015 at $21 per share, elevating $105 million from the sale. Since then, shareholders have reaped the advantages of the chain’s strong development and recognition because the share worth has greater than doubled. Nonetheless, this yr has been a poor yr for Shake Shack buyers, as the corporate misplaced -32.1% year-to-date, in comparison with S&P 500’s decline of -23.1%.

Q2 Earnings

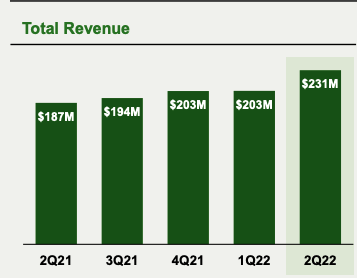

Shake Shack reported strong earnings for Q2, reporting a 23.1% year-over-year enhance to $230.8 million. In that very same time-frame, same-Shack Gross sales (a measurement of same-store gross sales) grew by 10.1% which is an effective demonstration of the continued sturdy franchise of the enterprise and robust demand for its merchandise. Shake Shack additionally opened up two drive-thrus within the quarter, and administration signified that the drive-thru shall be necessary for increasing the enterprise. As well as, the corporate has continued to open up new shops, and administration has estimated a gap of 35-40 shops this yr, which is a ten% enhance from final yr. Moreover, digital gross sales share of whole income has remained persistently excessive, hovering at 38% for Q2 2022. We imagine the sturdy digital penetration is an effective indicator of the corporate’s long-term enterprise prospects, as it’s simpler to upsell merchandise and market its product as soon as prospects are utilizing the digital platform. General, Q2 earnings have been nice for buyers in key metrics.

Q2 2022 Highlights

Margin Enlargement Alternative

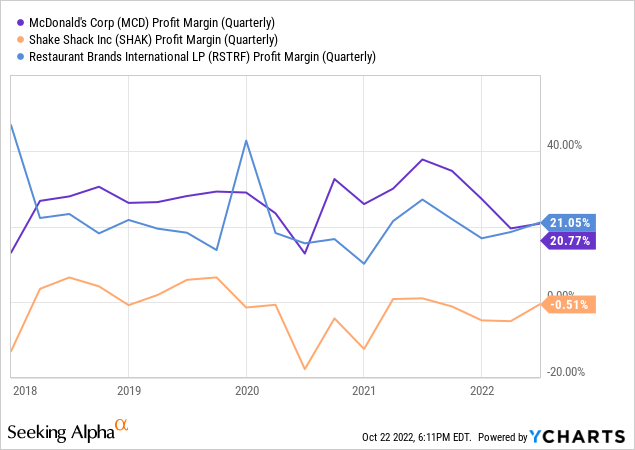

Shake Shack has a unfavourable revenue margin, as the corporate focuses on prime line development extra so than development within the backside line. We imagine that as Shake Shack tapers down its development plans, shareholder worth will enhance from margin enlargement, as the corporate cuts prices and pushes to derive increased margins from its enterprise endeavors. For instance, the present internet revenue margin of Shake Shack is hovering under 0% and having small unfavourable earnings. In the meantime, extra mature corporations like McDonald’s (MCD) and Restaurant Manufacturers Worldwide (QSR) (proprietor of Burger King) have a internet revenue margin of ~20%, which we imagine ought to be the goal internet revenue margin of Shake Shack. On condition that Shake Shack has an working revenue margin of 18.8%, we imagine that the corporate can enhance its internet revenue margin by reducing prices and enhancing efficiencies. General, we imagine it is sensible for Shake Shack to give attention to prime line development, and we expect that the following step for the corporate shall be to enhance margins and derive a better revenue to spice up shareholder worth.

Valuation

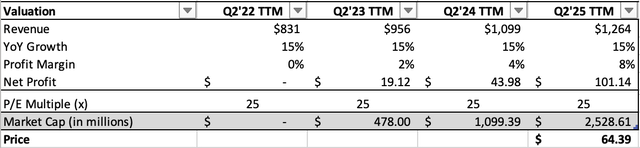

We base the valuation of Shake Shack primarily based on enhancing internet revenue margin story and better income development as the corporate continues to increase worldwide presence and enhance same-store gross sales. We base our valuation beginning with the Q2 2022 TTM income, and venture out the YoY development charge together with an enlargement within the internet revenue margin. Based mostly on our assumptions of 15% YoY development over the following three years (lower than the historic income CAGR), together with a goal internet revenue margin of 8% (nonetheless far under the online revenue margin in comparison with McDonald’s and Restaurant Manufacturers Worldwide), we derive a valuation of $2.5 billion utilizing a 25x P/E a number of, which represents a ~27% upside from present ranges. As the corporate continues to develop its margins, we imagine shareholders will see excessive capital appreciation after the forecasted time interval as properly.

SWMC Valuation Mannequin

Dangers

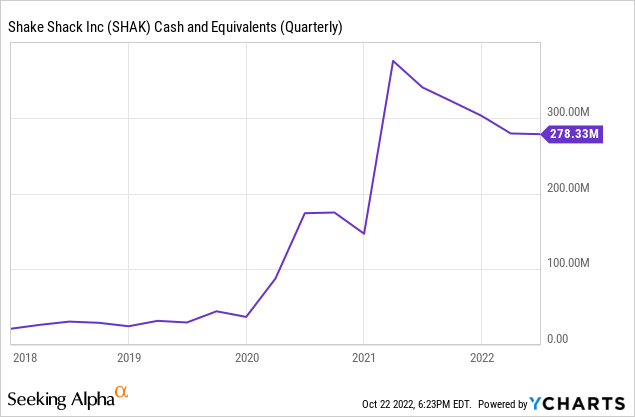

As a client discretionary firm, Shake Shack is uncovered to draw back dangers stemming from a downturn in consumption among the many U.S. and worldwide customers. Much like different industries within the sector, we imagine that increased inflation and a weaker financial surroundings can damage consumption total, which might immediately influence the variety of customers who select to spend on Shake Shack’s meals and different merchandise. However, we imagine Shake Shack’s recognition and robust model worth will present aggressive benefits that can preserve customers coming again to the product and there is ample analysis to counsel that quick meals chains function in a recession-resilient surroundings. Moreover, the corporate has $280 million in money available, which is greater than 10% of its market capitalization. With strong income development and money era, we don’t foresee any liquidity dangers that stem from their steadiness sheet.

Conclusion

General, we imagine Shake Shack stays a superb development story that may present earnings development as the corporate’s prime line expands together with an enchancment within the firm’s margins. Latest outcomes present that the corporate is doing a superb job increasing worldwide presence, and discovering sturdy development within the digital section together with gross sales on a same-store foundation. Our valuation additionally reveals that primarily based on cheap margin enlargement and income development, our pretty conservative mannequin reveals a considerable upside of 27% for the inventory.