Printed on October twenty fourth, 2022 by Samuel Smith

Actual Property Funding Trusts (i.e., “REITs”) are tax-advantaged earnings automobiles which have change into more and more well-liked with traders and establishments lately. The explanation for that is that they don’t have to pay any earnings tax on the company degree, however as an alternative function move via entities.

In trade for this profit, they’re required to fulfill sure pointers, together with paying out not less than 90% of taxable earnings to shareholders within the type of dividends. Consequently, excessive yield and dividend progress traders typically love REITs and dedicate a substantial portion of their portfolios to them.

You’ll be able to obtain your free 200+ REIT listing (together with necessary monetary metrics like dividend yields and payout ratios) by clicking on the hyperlink beneath:

Definitely, excessive dividend REITs are engaging for dividend traders on the lookout for earnings proper now.

Nonetheless, not all REITs are excessive yielding and in reality, a few of them boast spectacular progress observe data. This makes them a better of each worlds sort funding, the place traders can take pleasure in a quickly rising dividend alongside excessive capital appreciation potential.

On this article, we are going to take a look at seven REITs which have strong progress potential for the foreseeable future.

Desk of Contents

#1. Revolutionary Industrial Properties Inc. (IIPR)

IIPR focuses on proudly owning marijuana cultivation and manufacturing properties, the place it gives essential entry to capital for marijuana companies.

Associated: 2022 Marijuana Shares Listing | The Finest Marijuana Shares To Make investments In Now

IIPR advantages from being the only real publicly traded REIT of its type in the US and has loved strong progress because of this. It presently owns properly over 100 properties throughout 19 states.

Supply: Investor Presentation

Its enterprise mannequin is kind of profitable and gives engaging risk-adjusted returns because of the 15-20 preliminary lease phrases which might be 100% triple internet and usually include robust preliminary rental yields and annual escalations.

The REIT has a powerful progress observe document as its AFFO per share has soared from $0.67 in 2017 to $5.55 in 2021 and an anticipated AFFO per share tally of $8.00 in 2022. Its dividend has additionally grown quickly, growing from $0.55 in 2017 to $5.72 in 2021 and a present annualized payout fee of $7.00 per share. NOI has elevated at a whopping 137% CAGR over this time interval whereas economies of scale have improved immensely as mirrored in its G&A as a share of NOI plummeting from 89% in 2017 to a mere 11.5% in 2021.

Shifting ahead, it continues to have an unimaginable progress profile, with the principle constraint being the authorized/regulatory atmosphere. The authorized and regulatory uncertainties however, analysts are total nonetheless bullish on IIPR’s potential to proceed rising. They count on the REIT to develop dividends per share at a 6% CAGR via 2024 and FFO per share at a 9.6% CAGR over the identical time span. Nonetheless, if the regulatory atmosphere improves quicker than anticipated, IIPR might probably ship a lot quicker progress than this already robust forecast.

#2. Rexford Industrial Realty, Inc. (REXR)

REXR focuses on proudly owning and working industrial properties situated in Southern California. Its portfolio presently consists of practically 42 million sq. ft. The REIT was based in 2001 and has generated very robust progress lately. Since 2018 it has generated a 32% NOI CAGR and a 15% FFO per share CAGR. Since 2017, its dividend has grown at an 18% CAGR and since 2017 the REIT has generated a 15% complete return CAGR. Over the previous three years, it has posted a 32% consolidated NOI CAGR, a 22% FFO per share CAGR, and a 17% dividend per share CAGR.

Its Q3 numbers got here in very robust as properly, with 98.6% portfolio occupancy, 40.1% consolidated NOI progress, 44.5% core FFO progress, and 16.3% FFO per share progress. In the meantime, its steadiness sheet stays in stable form, with about $1.2 billion in complete liquidity a BBB+ credit standing from S&P and a mere 15.9% internet debt to complete enterprise worth ratio.

Trying forward, analysts count on REXT to proceed producing robust progress numbers. By means of 2026, analysts forecast a 13.2% AFFO per share CAGR, a 12.8% FFO per share CAGR, and a 15.5% dividend per share CAGR.

This bullish outlook is partly because of its properly diversified and high-quality tenant base that ought to result in decrease draw back danger and quite a few progress alternatives.

Supply: Investor Presentation

On high of that, REXR additionally implements a value-add method to its asset administration as a way to drive superior leasing spreads. Final, however not least, REXR advantages from its singular give attention to the biggest U.S. industrial market and the fourth largest total industrial market on the planet as Southern California has the biggest ports within the nation, representing 40% of all U.S. containerized imports.

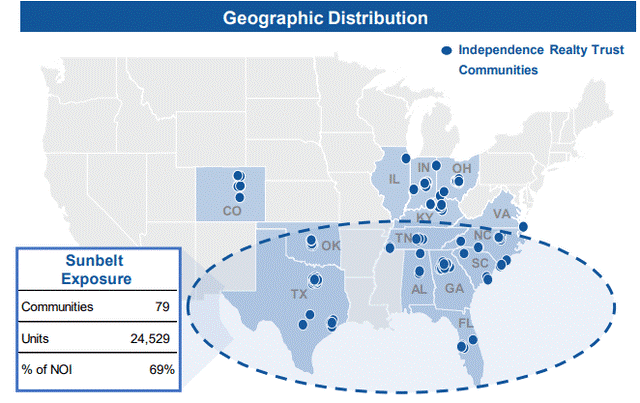

#3. Independence Realty Belief, Inc. (IRT)

IIRT focuses on multifamily residence communities in sunbelt markets. Whereas the REIT was tormented by its decrease high quality asset portfolio and better leverage in its early years after going public in 2013, administration has since then reworked the enterprise. It has acquired quite a few greater high quality residence communities, considerably deleveraged the steadiness sheet, and integrated value-add operations to its software equipment as a way to enhance returns on funding.

Supply: Investor Presentation

Whereas its previous observe document has been lower than stellar with FFO per share solely bettering to $0.84 in 2021 relative to its $0.81 quantity in 2013, the ahead outlook for the enterprise is significantly better. FFO and AFFO per share are anticipated to develop at a ten% CAGR via 2026 whereas dividends per share are anticipated to extend at an 11% CAGR over that very same interval.

This robust progress will seemingly be fueled by IRT’s mixture of considerable retained money flows, robust same-store NOI progress fee, and worth add enterprise, making it one of the vital intriguing multifamily funding alternatives in the mean time.

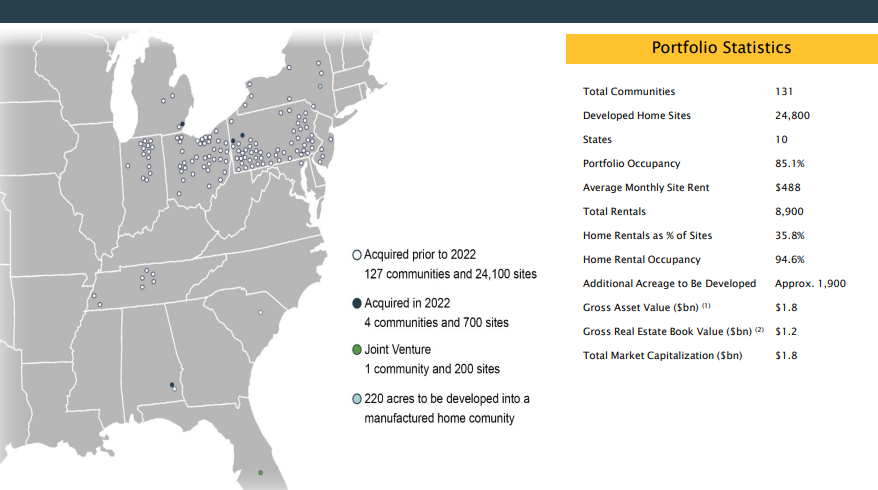

#4. UMH Properties, Inc. (UMH)

UMH focuses on proudly owning manufactured housing communities throughout the US and presently owns tens of 1000’s of properties in over 100 communities within the Midwest and Northeast. ‘

Supply: Investor Presentation

For a few years UMH struggled to develop its dividend and FFO per share, with FFO per share growing solely barely on an annualized foundation from 2012 to 2019 (from $0.62 per share in 2012 to $0.63 per share in 2019). Moreover, the annualized dividend per share remained flat at $0.72 the complete time and was typically not coated absolutely by money flows over that interval.

Nonetheless, since 2020 the corporate’s progress engine has lastly kicked into excessive gear. FFO per share elevated from $0.63 in 2019 to $0.87 in 2021 and the dividend per share lastly started to develop together with it. In 2021, UMH paid out $0.76 per share in dividends and is presently paying out a $0.80 annualized dividend.

Shifting ahead, this strong progress momentum is anticipated to proceed. Wall Road analysts undertaking FFO per share to develop at a 23.3% CAGR via 2024, AFFO per share to develop at a 20.4% CAGR, and the dividend per share to develop at a ~5% CAGR. Whereas the dividend per share progress might definitely be greater than what it’s projected to be, UMH is anticipated to retain extra capital as a way to gasoline additional profitable progress investments. What this does imply, nevertheless, is that UMH’s mid-single digit dividend CAGR will seemingly be sustainable for a long-time to come back and the speed of progress might even speed up.

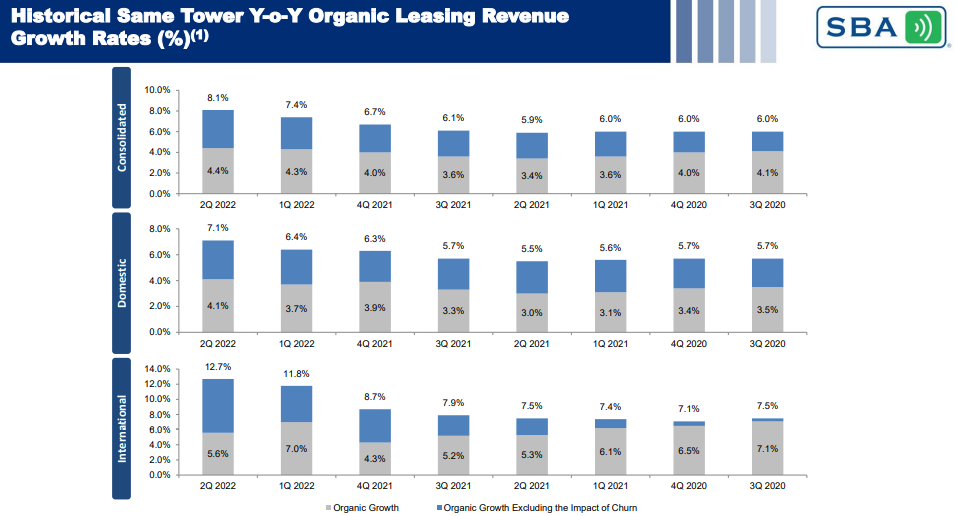

#5. SBA Communications Company (SBAC)

SBAC owns and operates wi-fi communications infrastructure equivalent to tower buildings for wi-fi antennas. In actual fact, it owns over 36,000 of those towers which it then leases out to wi-fi telecommunications corporations.

The REIT has generated spectacular progress prior to now and has actually seen it speed up in current quarters because the graphic beneath illustrates:

Supply: Investor Presentation

In 2012, SBAC generated $3.09 in AFFO per share and didn’t pay a dividend. In 2021, it generated $10.74 per share in AFFO and paid out $2.32 in dividends per share. This yr the REIT is anticipated to generate $12.06 in AFFO per share whereas paying out $2.84 per share in dividends.

Shifting ahead, SBAC is anticipated to proceed its unimaginable progress momentum. Dividends per share are anticipated to develop at a 21.1% CAGR via 2026 whereas AFFO per share is anticipated to develop at an 11.2% CAGR over the identical time interval. Consequently, SBAC is likely one of the most tasty progress REITs available in the market at this time.

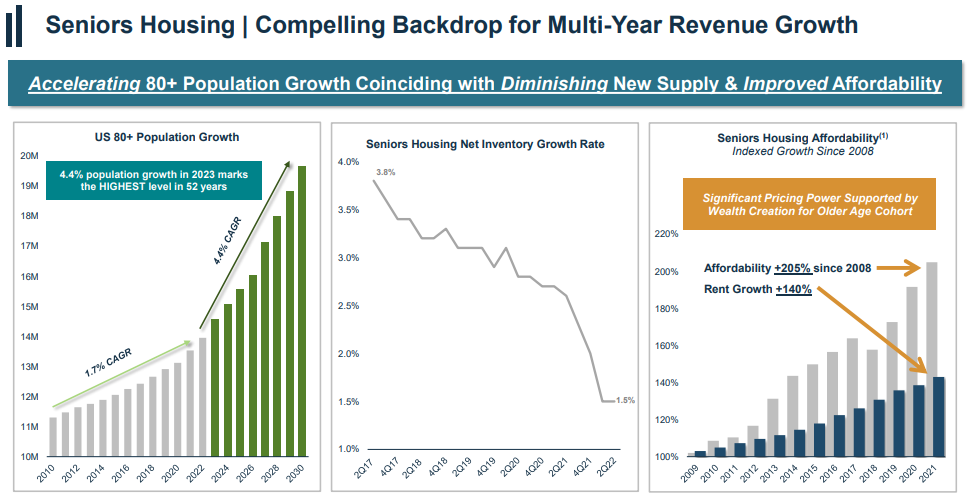

#6. Welltower Inc. (WELL)

WELL is a healthcare REIT that focuses on Senior Housing Operations, Senior Housing Triple-net, Outpatient Medical, Well being System, and Lengthy-Time period/Submit-Acute Care. Its earnings is pretty properly diversified throughout these segments, with its 2021 internet working earnings damaged down as following: 39.3% in Seniors Housing Working (“SHO”), 23.5% in Seniors Housing Triple-net, 23.2% in Outpatient Medical (“OM”), 8.8% in Well being System, and 5.2% in Lengthy-Time period / Submit-Acute Care.

WELL’s observe document over the previous decade is lower than spectacular on condition that its FFO per share and dividend per share have truly declined barely over that interval. In 2012, FFO per share was $3.52 and dividends per share had been $2.96. In 2021, FFO per share was $3.21 and dividend per share had been $2.44.

Nonetheless, shifting ahead, analysts count on WELL’s progress trajectory to choose up significantly, making it a compelling progress story. By means of 2026 WELL is anticipated to develop its dividend per share at a 12% CAGR, its FFO per share at an 11.6% CAGR, and its AFFO per share at a 13.2% CAGR.

The components behind this progress are the truth that the U.S. 80+ yr outdated inhabitants is anticipated to see its annualized progress fee enhance from 1.7% over the previous decade to 4.4% within the coming decade. The senior housing internet stock progress fee has plummeted lately from 3.8% in 2017 to 1.5% this yr.

In the meantime, the huge buildup in home-owner fairness and inventory market returns over the previous a number of a long time signifies that aged people trying to extra to senior housing can way more simply afford it.

Supply: Investor Presentation

Consequently, administration expects its occupancy fee and its pricing energy to soar within the coming years, boosting money flows and dividend progress together with it.

#7. Important Properties Belief (EPRT)

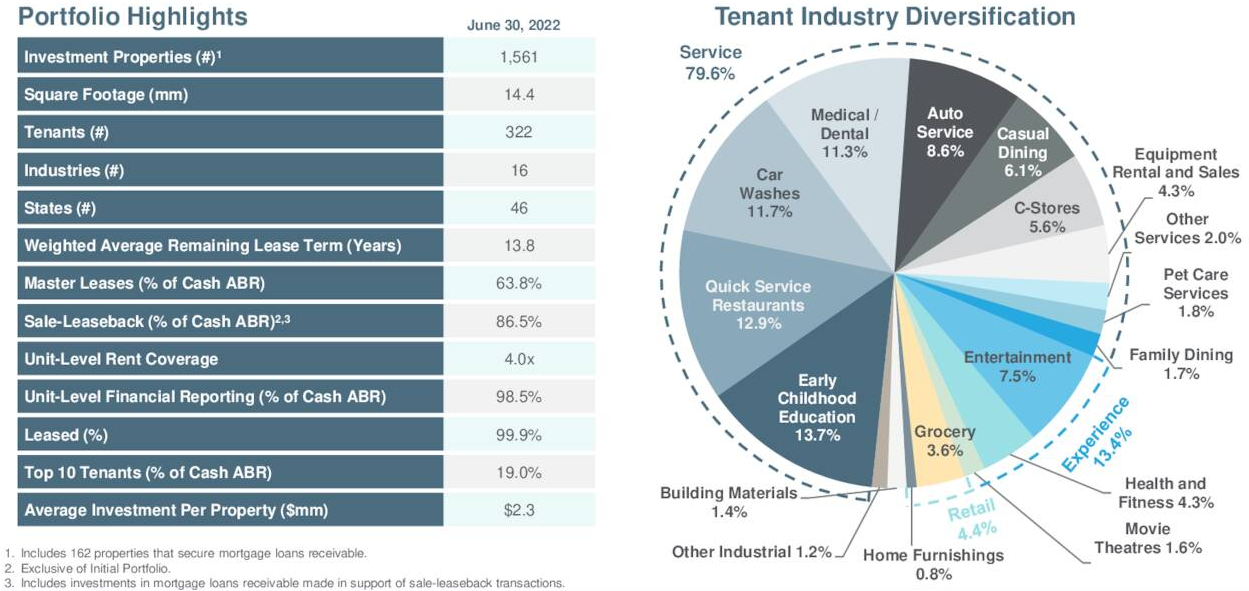

EPRT is a triple internet lease REIT with focuses on single-tenant properties leased out to center market corporations that function service-oriented or experience-based companies equivalent to eating places, automobile washes, automotive and medical companies, comfort shops, health facilities, and early childhood training. It has a well-diversified portfolio of over 1,500 properties unfold throughout 16 industries.

One among its greatest focuses is to buy properties that may simply be repurposed and launched to a unique tenant within the occasion that one among its current tenants defaults on their lease. Consequently, its enterprise mannequin is kind of low danger, particularly when mixed with its triple internet lease construction.

Supply: Investor Presentation

EPRT went public lately (2018) however has already compiled a powerful observe document for producing strong progress alongside paying out a lovely dividend. In 2018, EPRT generated $0.78 in AFFO per share and paid out $0.43 in dividends per share. In 2021, it generated $1.34 in AFFO per share and paid out $0.98 in dividends per share. This yr, EPRT is anticipated to proceed its spectacular progress momentum by producing $1.53 in AFFO per share whereas paying out $1.08 in in dividends per share.

By means of 2026, it’s anticipated to generate a ~6% AFFO per share CAGR alongside a dividend per share CAGR of ~5%. Whereas these numbers are usually not fairly as spectacular as among the others on this listing, its recession resistance, predictable and scalable progress technique, and present dividend yield of over 5.5% make it a compelling dividend progress REIT.

Conclusion

Whereas REITs are usually not usually identified – nor bought – for his or her progress however relatively as passive earnings machines, there are exceptions on the market. One of many beauties of shopping for excessive progress REITs like those mentioned on this article is that traders can obtain large tax-advantaged compounding. Since REITs don’t pay company earnings taxes, taxes are solely paid by traders on the dividends that they obtain.

Consequently, high-growth REITs that retain a substantial share of money flows and might reinvest it at excessive returns get an added enhance since continued progress in earnings on the REIT degree is tax free.

At a time when many growth-oriented investments just like the REITs shared on this article have been crushed down by rising rates of interest, now could possibly be a superb time to put money into these thrilling wealth compounders and dividend progress machines.

Certain Dividend maintains comparable databases on the next helpful universes of shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected]