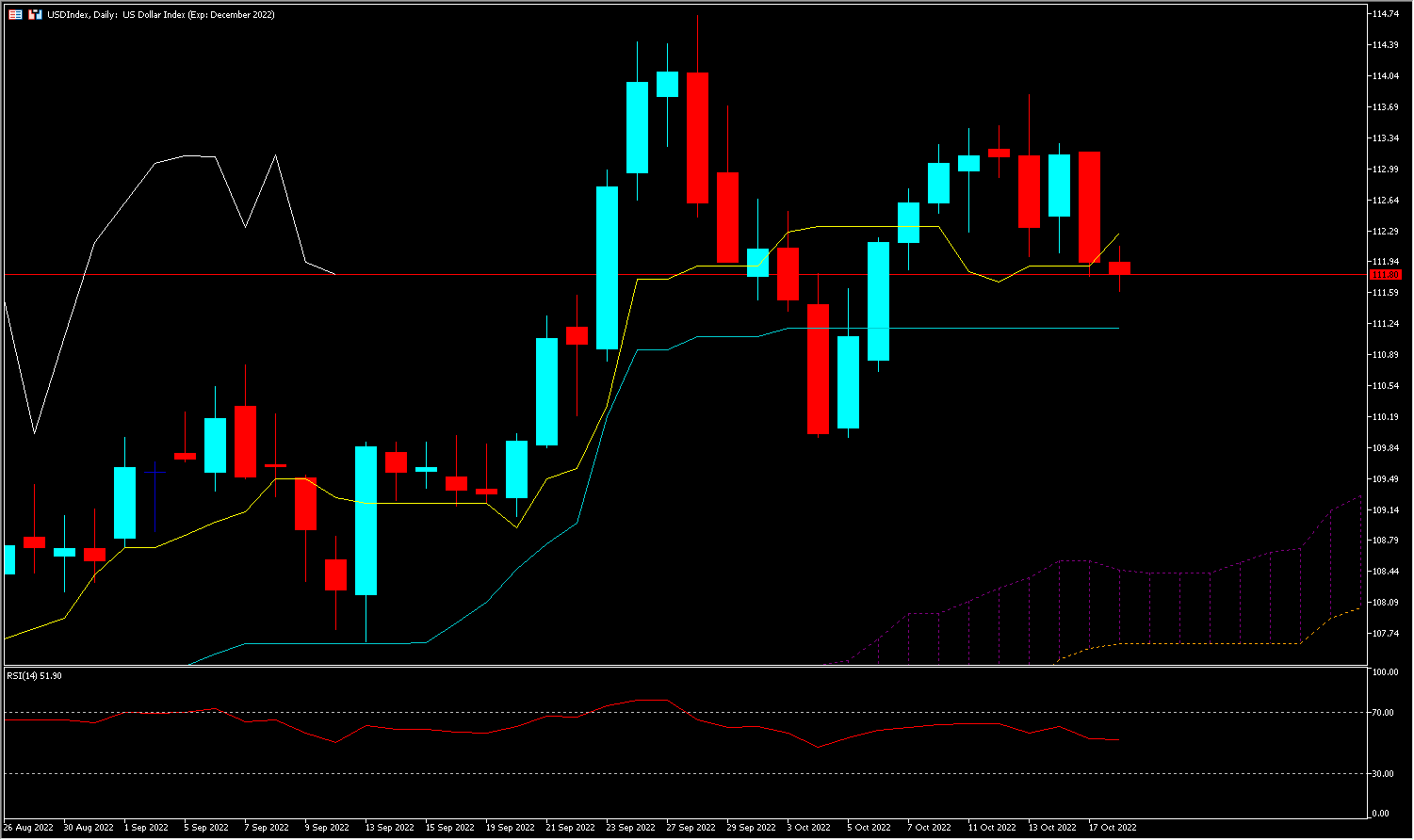

Following the outcomes of the annual US CPI which reached 8.2%, we’re seeing a rebound in all markets besides bonds and the USDIndex (see under).

The return of threat urge for food could also be partly defined by the impetus given by monetary establishments with their long-held positions, but in addition by the latest selections taken by the British central financial institution (BOE). The core CPI, which excludes meals and gasoline costs, rose on the quickest tempo since 1982, to six.6% (from 6.3% beforehand), which proved that US inflation might not be as transitory as hoped.

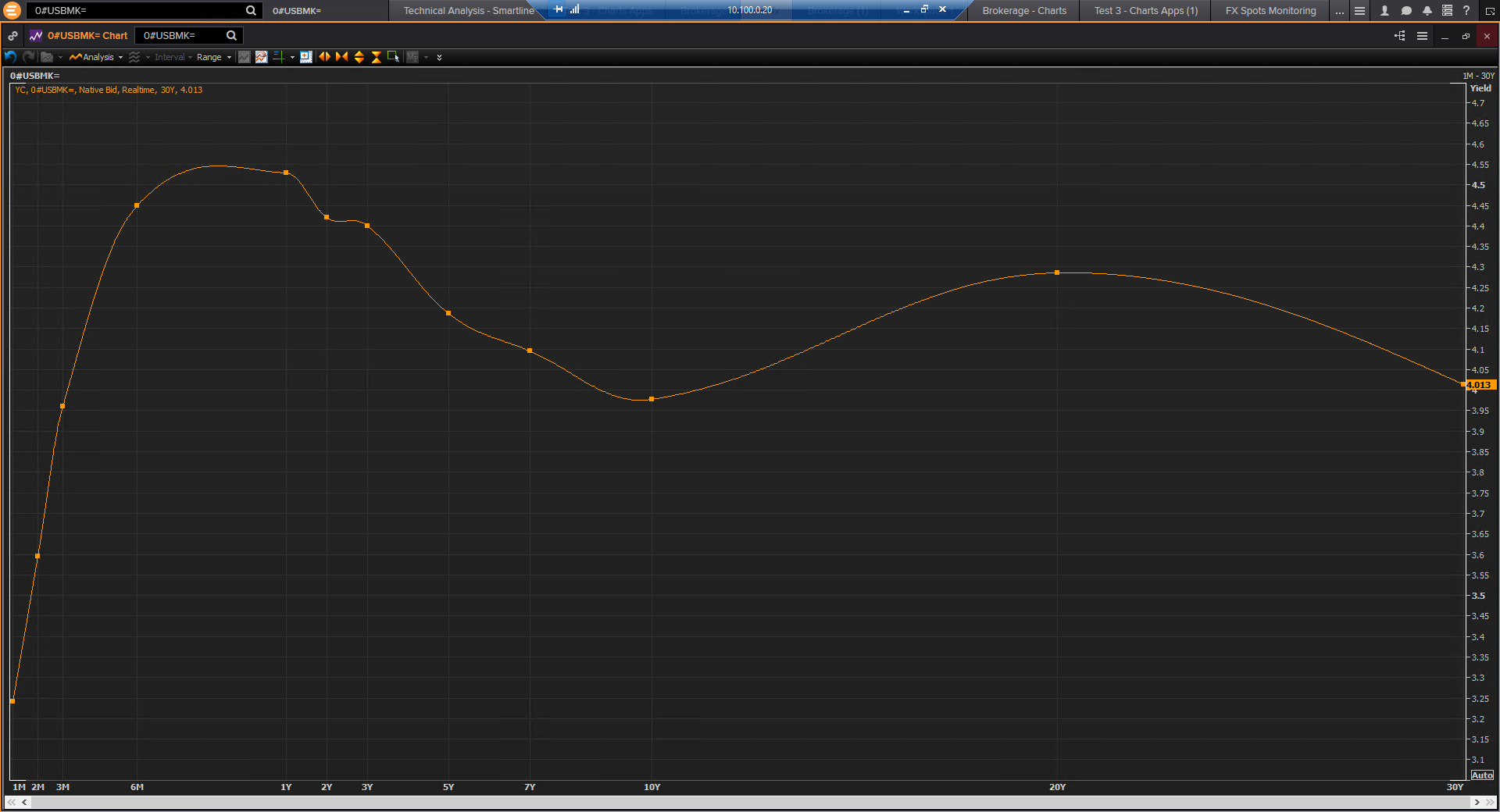

We are able to see under that whereas the yield curve remains to be flat, it’s elementary to know that traditionally a flat yield curve implies a future recession.

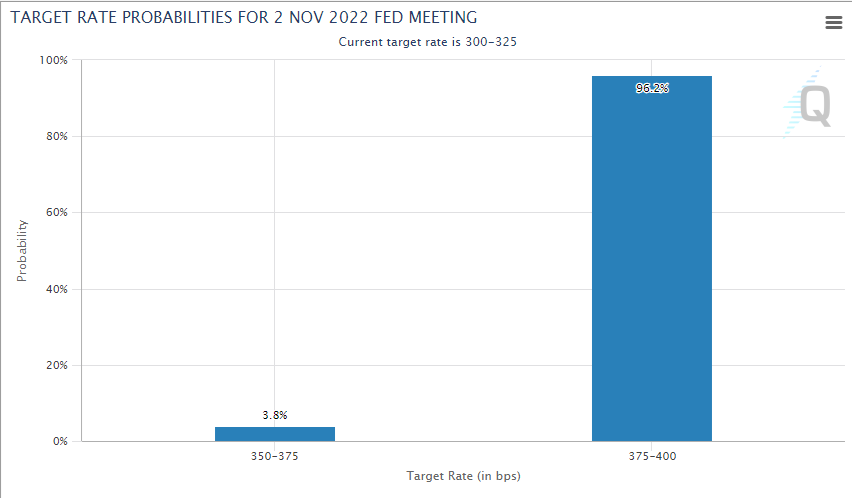

It’s clear that market contributors have continued to anticipate a nonetheless aggressive charge hike from the Fed. In keeping with CME Group 96.2% of contributors count on a 75bp hike in November (see under).

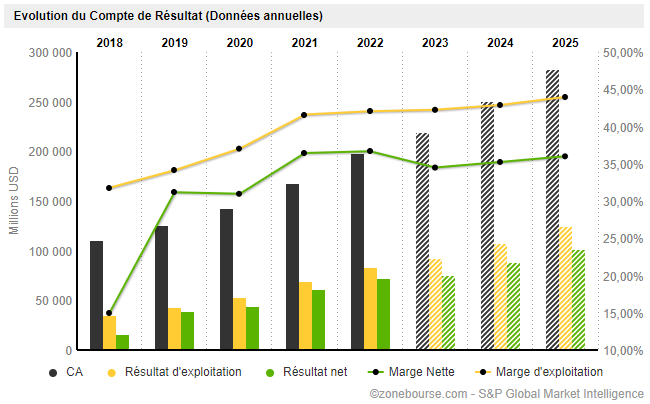

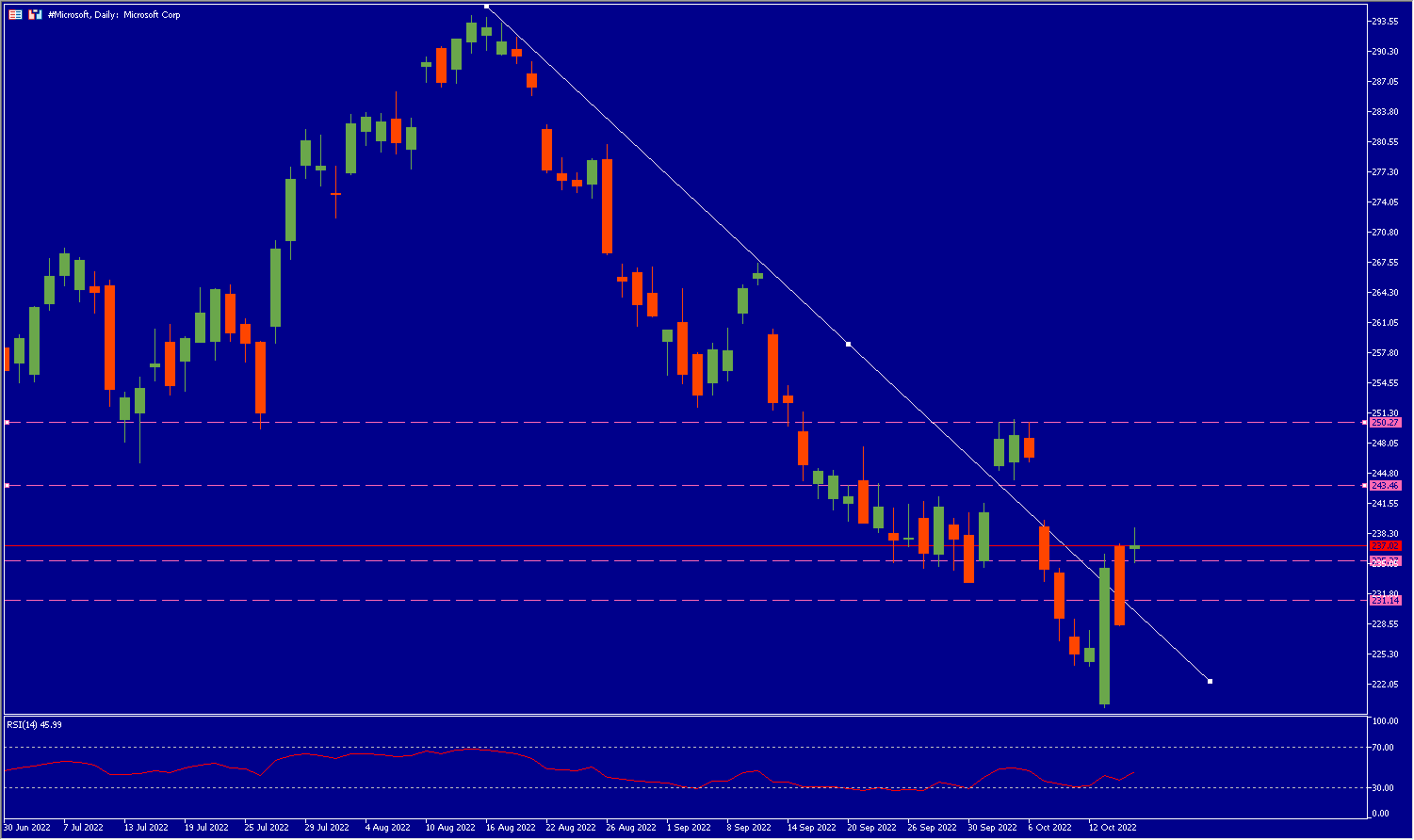

Microsoft, the world’s main software program and cloud firm, will launch its third quarter 2022 outcomes on 25 October forward of the Fed assembly. The producer is experiencing a slowdown in revenue development.

This morning the agency, which had already introduced plans to chop jobs representing lower than 1% of its whole workforce, is the newest expertise firm to indicate indicators of concern about future demand (see under).

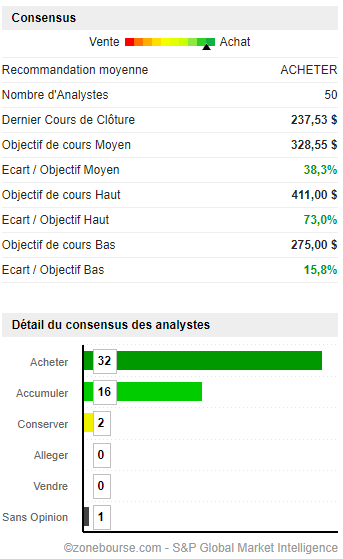

supply: zonebourse

To make issues worse its AR glasses are heading for an enormous industrial fiasco, because the $22billion contract could possibly be terminated by the US Military. Certainly, confronted with the fact of the sector, the gear remains to be very removed from honouring its guarantees. In reality, the other is true. One of many testers quoted by Enterprise Insider stated: “This machine would have gotten us killed”. In an e-mail, an worker defined in black and white that the corporate was anticipating “damaging suggestions” which will surely “proceed to be damaging because the enhancements have been minimal”.

Microsoft, one of many world’s fastest-growing firms over the previous 20 years, has been hit by the worldwide financial slowdown and its share value has fallen because the starting of the 12 months.

At first look evidently the way forward for the group is darkened, however out of fifty analysts in response to zonebourse 32 are shopping for, 16 are accumulating and a couple of are holding their shares.

supply: zonebourse

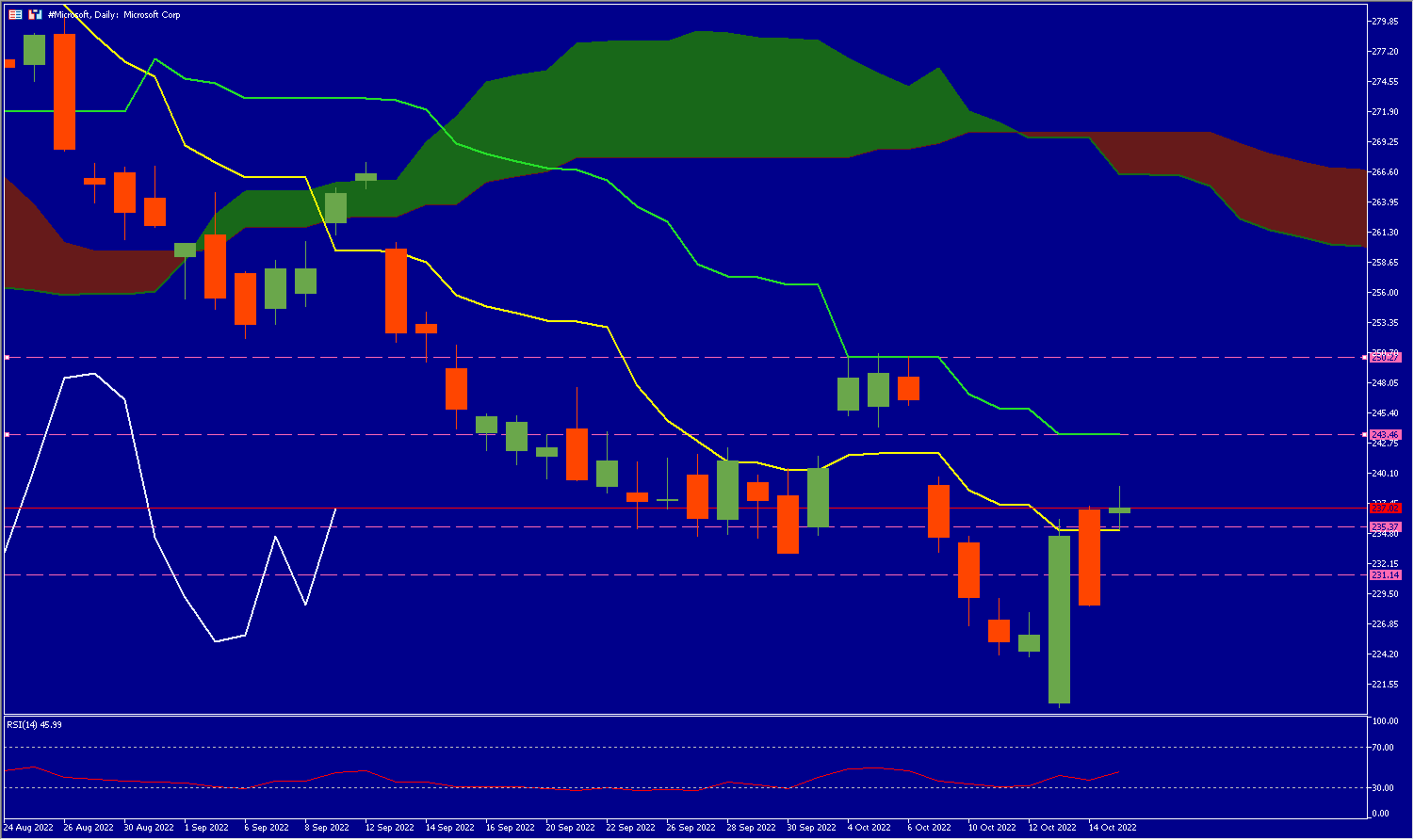

Technical Evaluation

Microsoft’s share value is at present on the $237 stage. It’s under its cloud, below its Kijun (inexperienced line) and above its Chikou Span (yellow line) in addition to its pattern line, and the Lagging Span (white line) can be reversed. This clearly signifies a bullish reversal try with the first goal being the Kijun (inexperienced line) which acts as resistance at $243.46; if it provides means value might then attain $250.27. If it fails, the value will take a look at the pattern line in direction of $231.14 (see under).

Click on right here to entry our Financial Calendar

Kader Djellouli

Disclaimer: This materials is offered as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.