Up to date on October eleventh, 2022 by Bob CiuraSpreadsheet up to date every day

The NASDAQ Dividend Achievers Index is made up of 347 shares with 10+ consecutive years of dividend will increase, that additionally meet sure minimal measurement and liquidity necessities.

It is without doubt one of the greatest sources to search out high-quality dividend development shares.

The downloadable Dividend Achievers Spreadsheet Checklist under comprises the next for every inventory within the index:

Sector

Dividend yield

Title and ticker

Value-to-earnings ratio

Ahead price-to-earnings ratio

You’ll be able to obtain your free Excel checklist of all Dividend Achievers by clicking on the hyperlink under:

Be aware: The Dividend Achievers checklist is up to date utilizing the holdings from this Invesco ETF.

Use The Dividend Achievers Checklist To Discover High quality Dividend Progress Shares

The checklist of all Dividend Achievers is efficacious as a result of it offers dividend development buyers with an extended checklist of shares which have elevated their dividends for no less than 10+ consecutive years.

These are firms with shareholder-friendly administration groups dedicated to rewarding buyers. They’ve a capability to take action due to sustained earnings development.

Collectively, these two standards kind a strong pair. hey develop into much more highly effective for the investor who buys high-quality dividend development shares when they’re undervalued.

The spreadsheet above lets you type by price-to-earnings ratio (or dividend yield) so you may rapidly discover undervalued dividend paying companies with 10+ years of consecutive dividend will increase.

Right here’s the way to use the Dividend Achievers checklist to rapidly discover prime quality dividend development shares probably buying and selling at a reduction:

Obtain the checklist

Kind by P/E ratio (or ahead P/E ratio), lowest to highest

Filter out shares yielding lower than 3%

Analysis the highest shares additional to search out one of the best concepts

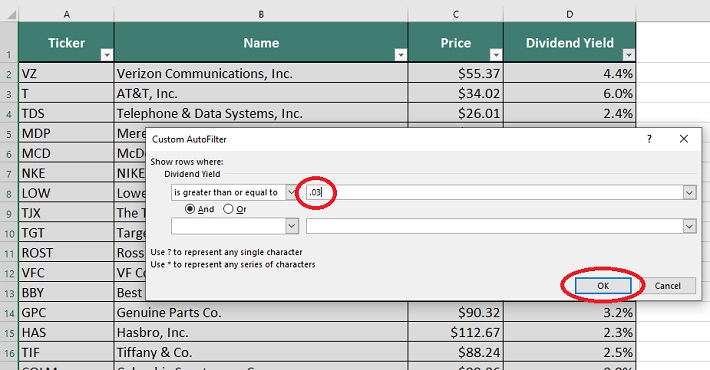

For these unfamiliar with Excel, right here’s the way to filter out shares yielding lower than 3%:

Step 1: Click on on the dividend yield filter button:

Step 2: Go to ‘Quantity Filters’, after which click on on ‘Larger Than or Equal To’:

Step 3: Enter your required yield quantity (as a decimal), .03 within the instance above. Then press ‘OK’.

That’s it; the remaining shares will all have dividend yields above 3%.

Different Dividend Lists

The Dividend Achievers checklist just isn’t the one method to rapidly display for shares with lengthy histories of dividend development.

The Dividend Aristocrats Index is comprised of 65 shares with 25+ years of consecutive dividend will increase. It’s extra unique than the Dividend Achievers Index.

There’s a comparable group generally known as the Dividend Champions, which even have raised their dividends for 25+ consecutive years.

The Dividend Champions is an even bigger checklist because it contains shares that don’t qualify as Dividend Aristocrats due to indexing or buying and selling quantity restrictions.

The Dividend Kings Checklist is much more unique. It’s comprised of 40 shares with 50+ years of consecutive dividend will increase.

The Blue Chip Shares checklist has 350+ shares that belong to both the Dividend Achievers, Dividend Aristocrats, or Dividend Kings checklist.

Efficiency of the Dividend Achievers Index

Up to now 5 years, the most important ETF that tracks the Dividend Achievers, the Invesco Dividend Achievers ETF (PFM), generated 9.8% annualized complete returns. It has underperformed the comparable ETF that tracks the S&P 500 Index (SPY), in the identical interval.

SPY has generated annualized complete returns of 11.5% prior to now 5 years. There are a pair causes for this.

First, the Dividend Aristocrats index is equally weighted, whereas the Dividend Achievers index is market cap weighted.

On the floor, this doesn’t sound prefer it issues a lot, however it has critical repercussions for returns.

Which means bigger shares with larger market caps make up a better portion of the Dividend Achievers index. The highest 5 Dividend Achievers by weight are listed under (together with their weight):

Microsoft (MSFT): 3.9%

UnitedHealth Group (UNH): 3.1%

Johnson & Johnson (JNJ): 2.8%

Exxon Mobil (XOM): 2.7%

Walmart Inc. (WMT): 2.4%

I’m not saying these giant holdings don’t make good dividend investments. Market cap has nearly no sway in figuring out one of the best Dividend Achievers. The issue with market cap weighting is that it’s the reverse of worth investing.

Think about {that a} shares’ price-to-earnings ratio rises from 10 to twenty whereas earnings don’t change. The corporate’s market cap would double. In the actual world, paying twice as a lot for a similar factor just isn’t a ‘whole lot’. With market cap weighting, the Dividend Achievers index would maintain double its funding within the enterprise that noticed its P/E ratio double.

Additionally, the Dividend Achievers index doesn’t enhance possession in companies which have seen their market caps decline. Which means if a unique enterprise noticed its price-to-earnings ratio decline from 30 to fifteen (and earnings had been unchanged), the index would see its possession of this enterprise fall by 50%.

Market cap weighting buys excessive and sells low. Market cap weighting doesn’t benefit from valuation, whereas equal weighting does.

With equal weighting, if an organization’s price-to-earnings ratio falls by 50%, the fund should purchase extra to maintain weights equal. Equally, an equal weighted fund should promote when the price-to-earnings ratio of a enterprise rises to maintain the fund equally weighted.

One other distinction between the 2 teams is dividend historical past. Whereas 10 years is a sizeable streak of consecutive dividend funds, it covers (at greatest) 1 financial cycle.

25 years of consecutive dividend will increase covers a number of financial cycles. Dividend Achievers should not have the identical stage of consistency as Dividend Aristocrats. Dividend historical past issues.

Ideas on Underperformance

SPY and PFM are each market cap weighted. PFM has the next expense ratio, however earlier than operating historic efficiency numbers I might have anticipated PFM to outperform SPY.

Dividend shares have traditionally outperformed non-dividend paying shares. Shares with lengthy dividend histories (Dividend Aristocrats) have traditionally outperformed the market.

Why haven’t the Dividend Achievers outperformed? One motive could possibly be that the valuation a number of of the broader SPY fund has expanded at a sooner price than for PFM.

The shortcoming of the Dividend Achievers index to outperform the S&P 500 over a time frame that has been comparatively favorable for dividend shares (resulting from falling rates of interest) is perplexing.

Regardless, there are higher dividend ETFs for fund buyers to select from.

A Beginning Level

The Dividend Achievers checklist is greatest used as a place to begin for locating high-quality dividend development shares.

Being on the checklist in itself doesn’t mechanically assure a person inventory has a sturdy aggressive benefit, or that it’s a good funding.

Lengthy-term buyers ought to confirm that an funding has a robust and sturdy aggressive benefit, a shareholder pleasant administration, and trades at an affordable (ideally low) valuation.

Combing the checklist for these sort of companies can tremendously pace up the search for prime quality shareholder pleasant companies buying and selling at truthful or higher costs.

Different Dividend Lists & Remaining Ideas

The Dividend Aristocrats checklist just isn’t the one method to rapidly display for shares that frequently pay rising dividends.

The most important home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].