Ultima_Gaina/iStock by way of Getty Pictures

Funding Thesis

Ero Copper Corp. (NYSE:ERO), a mining firm headquartered in Vancouver with operations in Brazil, has formidable progress plans that if realized will permit it to capitalize on the hovering demand for copper, thought-about by many as indispensable for transitioning to a inexperienced international economic system. With comparatively excessive long-term progress estimates and a P/E ratio of 5.2 (as of 9/25/22), the inventory would usually characterize a no brainer cut price. Nonetheless, momentum issues.

The inventory’s dramatic (and considerably baffling) underperformance versus the S&P 500 and its direct opponents – along with near-term headwinds – are causes for concern. In the long term, we imagine this inventory will bounce again in a giant approach. Nonetheless, any turnaround is unlikely to occur by year-end given unprecedented publicity to copper costs on the worldwide market attributable to operational points at Ero’s major home buyer. To not point out, as a result of it pays no dividend, the inventory doesn’t characterize any refuge in a storm. Though we nonetheless suppose the inventory is a purchase, it’s for these causes the ranking comes with nice warning.

This text will first have a look at Ero Copper’s progress prospects and valuation relative to the market earlier than exploring near-term headwinds.

Development & Valuation

Reaching net-zero emissions by 2050, a goal set by greater than 70 nations, would require a speedy swap to electrical autos (EV) and renewable electrical energy on a scale that may ship copper demand surging to new heights. S&P World in a July research initiatives that the demand for copper, the “steel of electrification,” will double by 2035 because the world makes an attempt to tug off this inexperienced power transition.

Copper Demand Forecast 2021-2050 (S&P World)

Provide forecast situations recommend that the world may see a shortfall starting from 1.6 million metric tons (mmt) to almost 10 mmt as demand reaches near 50 mmt by 2035.

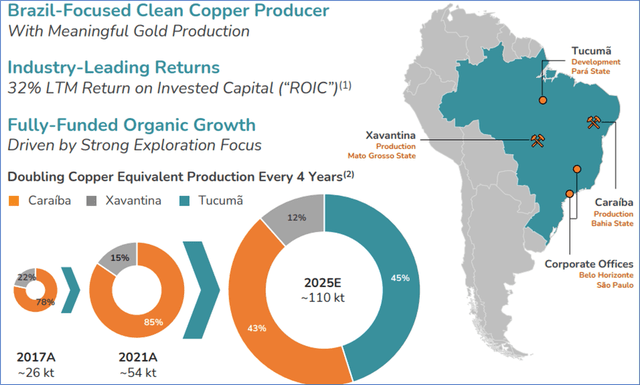

Ero Copper’s acknowledged goal is to take advantage of this hovering provide hole by increasing capability and output. The corporate has greater than doubled copper manufacturing since 2017 and plans on doubling it once more by 2025. All copper manufacturing to this point has come from the Caraiba Operations situated within the Curaça Valley, Bahia State (see map beneath), accounting for 83 % of income in Q2. The corporate generated about 17% of its income from gold mined out of the Xavantina Operations in Mato Gasso. Reaching its formidable long run targets will depend upon ramping up copper manufacturing at what it calls the Tucuma Venture in Para, Brazil. The primary manufacturing forecast for the Tucuma web site is anticipated in Q3 2024.

Ero Copper Manufacturing Development 2017-2025 (Ero Copper Investor Presentation September 2022)

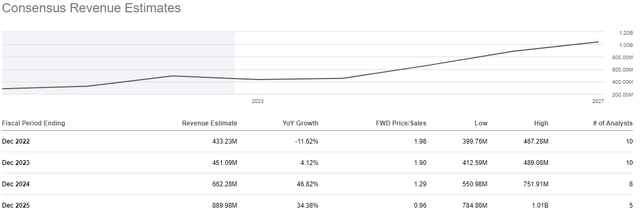

Ero’s progress plan has been pivotal in guiding expectations, with the Tucuma venture representing an thrilling and well timed increase in capability. Consensus estimates have Ero annual gross sales rising by greater than 100% within the subsequent three years – from about $430 million to nearly $890 million – as illustrated within the chart beneath. Discover the bounce in progress from 2023-2025 in anticipation of the brand new manufacturing coming on-line.

ERO income estimates (Searching for Alpha Premium)

In the meantime, EPS is projected to develop by greater than 200%, which could be seen by going to the ERO:CA view on Searching for Alpha. The corporate inventory has traded on the Toronto Inventory Change (TSX) since 2017 and solely since final June on the NYSE, therefore the Canadian aspect has extra analyst data. The analysts’ common value goal implies that the inventory value will develop by greater than 50% in 12 months.

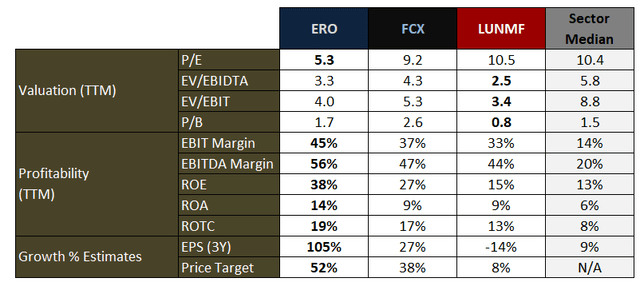

Mix these progress estimates with profitability figures relative to the sector median and its friends, and it’s clear Ero Copper’s inventory is undervalued. The beneath desk compares a few of these key metrics with the sector and two direct opponents: Freeport-McMoRan (FCX) and Lundin Mining Company (LUN:CA) (OTCPK:LUNMF). When it comes to valuation, Ero beats the sector median and FCX however LUN bests in EV/EBITDA, EV/EBIT, and value/e-book valuation grades. Ero nevertheless leads the sector and each opponents in all profitability metrics and progress targets.

Ero Valuation, Profitability, Development Metrics Comparability (Information Supply: Searching for Alpha)

Nice Worth, Dangerous Timing

Between now and 2024 the corporate can be extremely centered on boosting margins to take care of revenue progress, which is why analysts have been razor-focused on metrics associated to manufacturing prices and promoting costs. Though the administration workforce has proven an adept potential at value management and shielding themselves from copper value volatility, Ero missed Q2 income estimates attributable to these very elements, which led to some analyst downgrades.

After their major buyer, Brazilian smelter Paranapanema, had operational points, Ero was compelled to shift volumes onto the worldwide market, thereby exposing it to unfavorable fluctuations in commodity costs. Traditionally, Ero has had restricted publicity to actions in copper costs attributable to favorable cost phrases with home prospects. The reallocation coincided with a plunge within the value of copper futures, which is down practically 20% previously 12 months.

Different causes export gross sales result in greater unit working prices is as a result of lack of home tax credit and extra logistics bills, CFO Wayne Drier defined on Ero’s latest earnings name. Ultimately, the reallocation resulted in a $13 million discount in income for the quarter. CEO David Unusual, on the identical name, nevertheless, reassured that the operational points with the shopper and the numerous deviation in copper pricing had been each “unprecedented.”

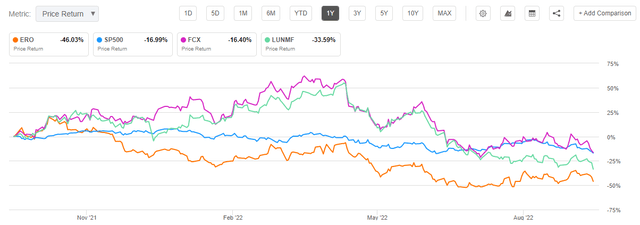

Ero actually had some dangerous luck timing-wise in debuting on the NYSE in June of final yr. Nonetheless, Ero’s inventory value has considerably underperformed each the S&P 500 and two of its prime direct opponents.

ERO 1Y Worth Efficiency Comparability (Searching for Alpha Premium)

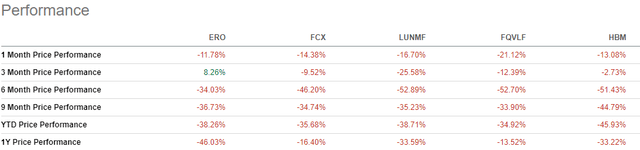

It’s onerous to attribute Ero Copper’s inventory value efficiency previously yr to poor macroconditions ensuing from rate of interest hikes when it underperformed the S&P 500 by 30 factors. It is likely to be some comfort to level out, nevertheless, that it has proven indicators of life throughout the previous 3 months, up over 8%, a lot better than 4 of its prime rivals: FCX, LUNMF, First Quantum Minerals Ltd (OTCPK:FQVLF) and Hudbay Minerals Inc. (HBM).

ERO value efficiency comparability (Searching for Alpha Premium)

Conclusion

Encouraging 3-year progress targets, formidable manufacturing growth aligned with projected booms in copper consumption, large revenue margins versus the market, and its low P/E ratio, make Ero Copper’s inventory a lovely long-term funding. Nonetheless, our purchase ranking is a cautious one in mild of the poor value momentum relative to the market and direct competitors, together with near-term headwinds. We stay up for the following earnings report back to see how the corporate fares in managing unfavorable fluctuations in copper costs and different prices related to a rise in exports as a share of gross sales quantity.