The Protection Superior Analysis Tasks Company (DARPA) has employed Inca Digital, a digital asset knowledge and analytics supplier, to look into cryptocurrency dangers to nationwide safety.

DARPA, the analysis and growth company of the U.S. Division of Protection, will look into exercise associated to the monetary purposes of distributed ledgers, CoinDesk reported Friday (Sept. 23).

The company gave Inca Digital a Section II Small Enterprise Innovation Analysis (SBIR) for the problem, with which Inca will develop a crypto ecosystem mapping instrument to investigate danger from crypto.

That can assist each the U.S. authorities and the non-public sector perceive how crypto could possibly be linked to crimes like cash laundering, terrorist financing and sanction evading. It’ll additionally see how crypto impacts conventional finance techniques and vice versa, per the report.

In the meantime, the Brazilian Federal Police have begun raids on six crypto exchanges.

Whereas the names of the exchanges weren’t listed, CoinDesk wrote Friday, the investigation is wanting into tax evasion and cash laundering the place crypto was concerned. Operation Colossus, which was carried out alongside the Brazilian tax authority, will perform 101 warrants from a felony court docket in São Paulo.

The police have additionally ordered a freeze on round $238 million in belongings and securities held by these underneath investigation, and the report famous there have been 28 exchanges underneath investigation that held an undisclosed quantity of digital belongings.

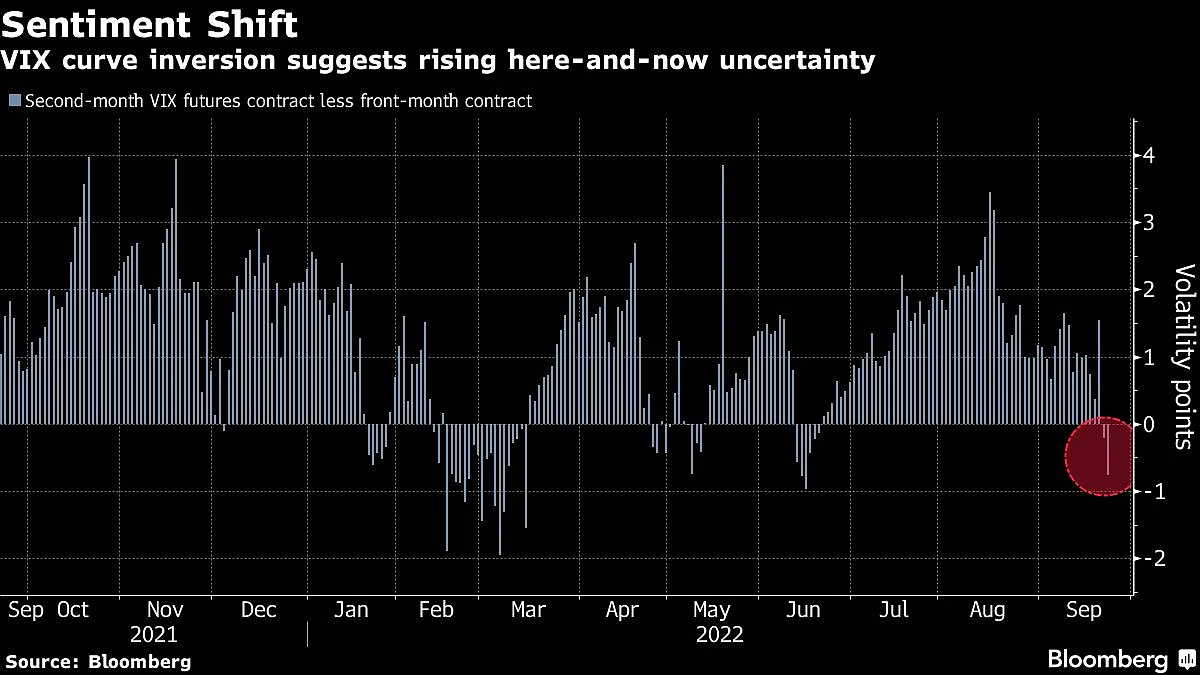

Moreover, bitcoin and varied different cryptocurrencies fell in worth on Friday, with buyers nonetheless dropping because the Federal Reserve has promised to remain aggressive preventing inflation.

Bitcoin fell by 3.7% through the session, and ether, the second largest, was down 4.7%, Bloomberg reported. The temper has been dour for some time now because the Fed and varied different central banks all over the world have raised rates of interest to attempt to struggle worth will increase.

Lastly, J.P. Morgan’s North American fairness workforce has lowered its worth goal for Coinbase International shares from $78 to $60 for December.

The crypto trade will get most of its income from U.S. crypto buying and selling ranges, which means the third and fourth quarter earnings hinge on crypto buying and selling curiosity.

“We predict stress on Coinbase income from falling cryptocurrency markets will stress the inventory worth,” J.P. Morgan analysts wrote, per a Yahoo Finance report.

In response to analysts, Coinbase is more likely to see low buying and selling quantity from U.S. retail crypto buyers by December, but it surely may choose up within the first quarter of subsequent 12 months.

For all PYMNTS crypto protection, subscribe to the day by day Crypto E-newsletter.

New PYMNTS Examine: How Customers Use Digital BanksA PYMNTS survey of two,124 US customers reveals that whereas two-thirds of customers have used FinTechs for some facet of banking companies, simply 9.3% name them their main financial institution.

https://www.pymnts.com/connectedeconomy/2022/today-in-the-connected-economy-paypal-visa-tackle-impact-investing/partial/