peakSTOCK/iStock through Getty Photographs

The artwork of dialog is the artwork of listening to in addition to of being heard.”― William Hazlitt

At the moment, we put Eargo, Inc.(NASDAQ:EAR) within the highlight for the primary time. This firm has quite a lot of points just lately which have prompted the inventory to nosedive deep into ‘Busted IPO’ territory. Are brighter instances on the horizon? An evaluation follows beneath.

Looking for Alpha

Firm Overview:

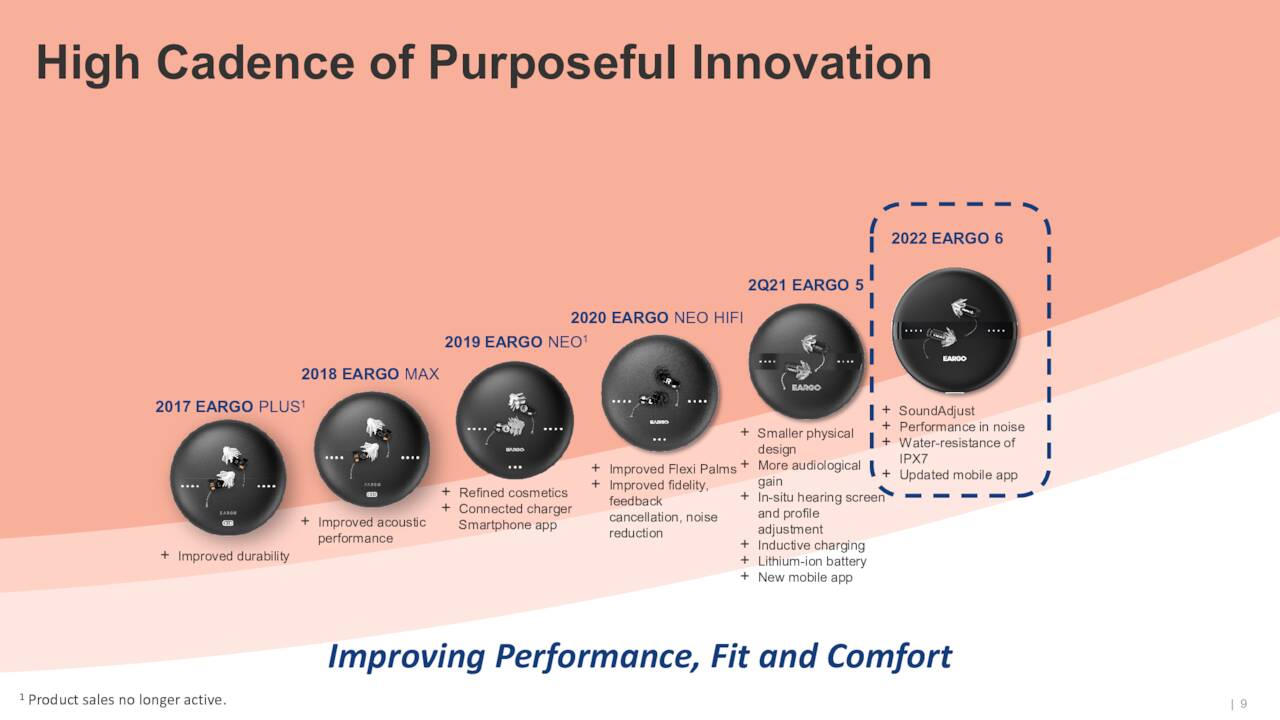

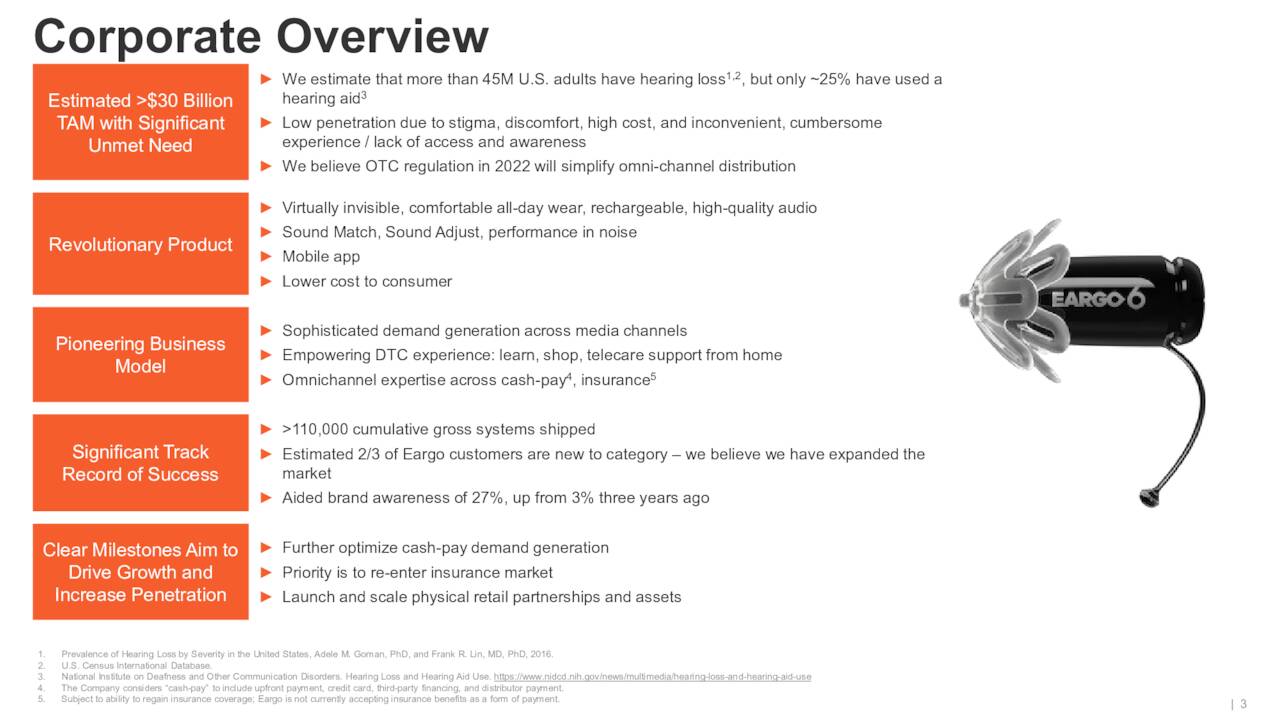

Eargo, Inc. is a small medical system maker headquartered in San Jose, CA. The corporate markets and sells listening to aids via direct-to-consumer and thru omni-channels. The inventory at the moment has an approximate market capitalization of $75 million. The corporate launched the most recent model of its listening to assist line, the Eargo 6 in January of this yr. The Eargo 6 is an FDA Class II exempt listening to system that includes Sound Alter expertise that mechanically optimizes the soundscape because the consumer strikes between environments.

June Firm Presentation

The corporate has been dogged by two main points because it went public. The primary was a prison investigation initiated by the U.S. Division of Justice associated to insurance coverage reimbursement claims submitted by the corporate on behalf of its prospects lined by the Federal Worker Well being Advantages (FEHB) program. Administration denied wrongdoing however settled this subject for $34.4 million within the Spring of this yr.

June Firm Presentation

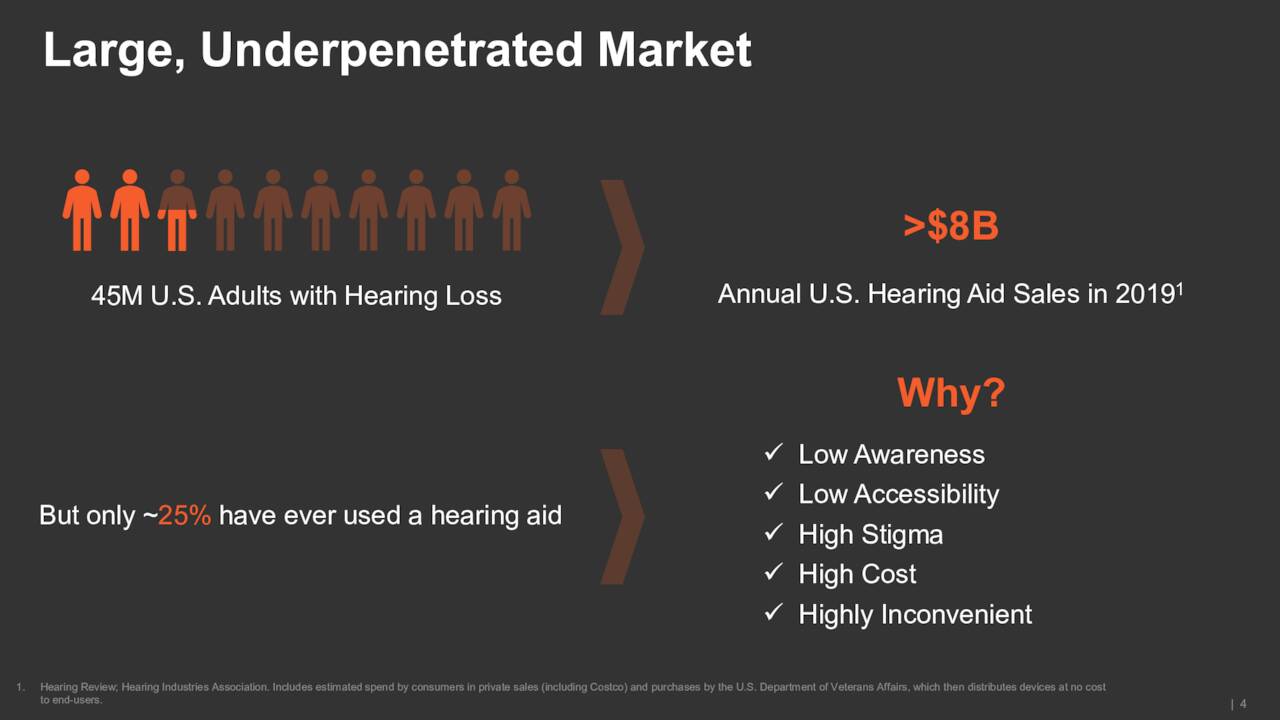

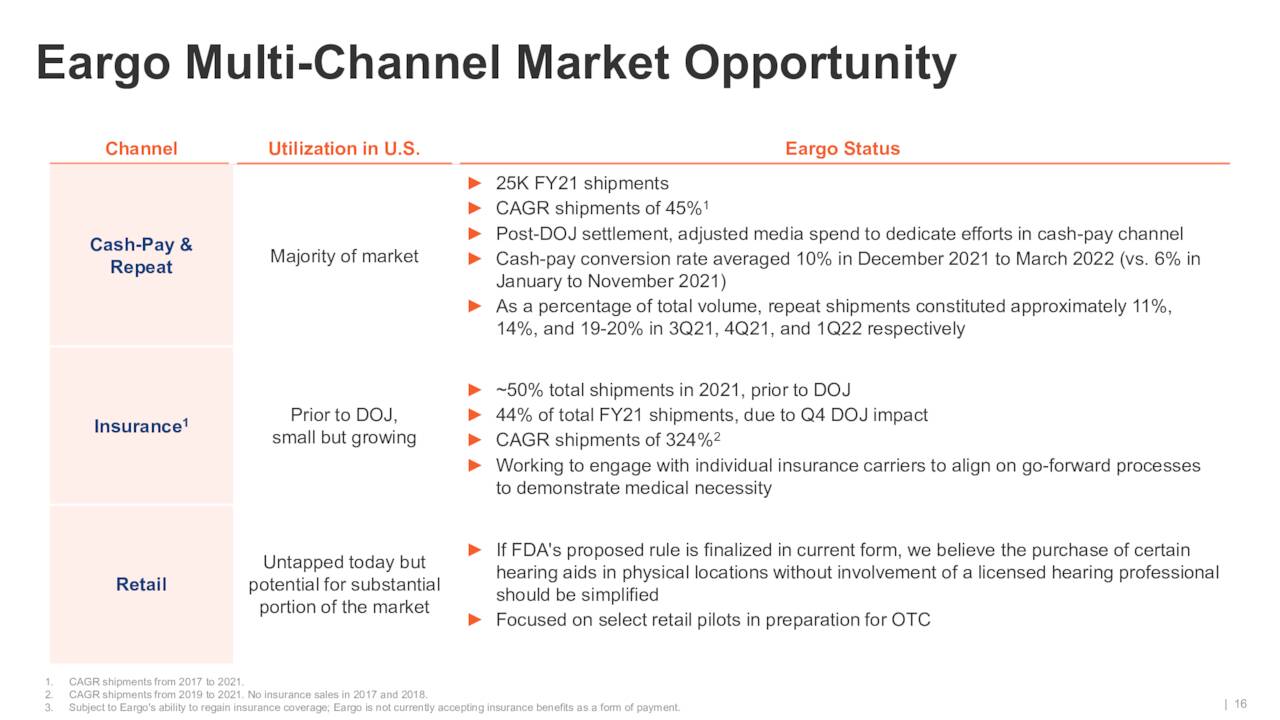

Eargo additionally now not accepted insurance coverage as a way of direct fee in late 2021. Within the second quarter of this yr, Eargo operated on a cash-pay solely foundation which tanked gross sales (see part beneath). The corporate did get some superb information on this entrance two weeks in the past because the FDA disclosed it will permit the sale of some listening to aids over-the-counter starting in October.

June Firm Presentation

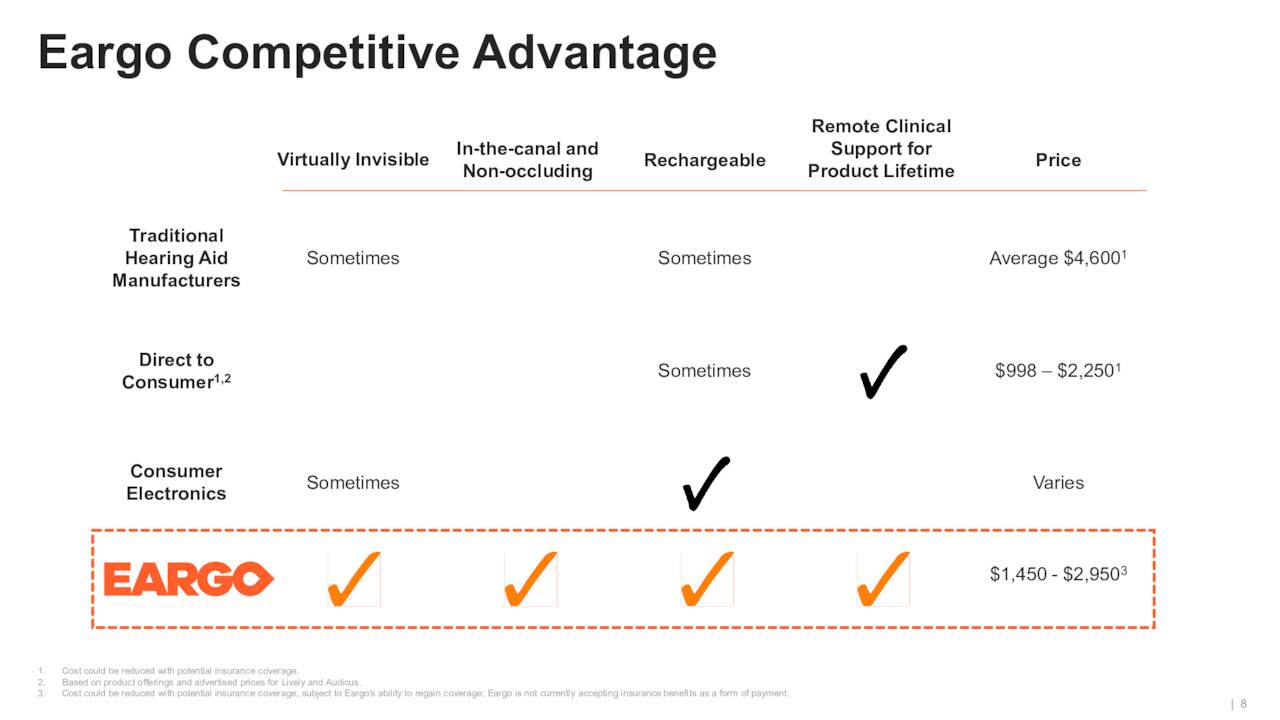

The corporate has shipped over 110,000 listening to assist gadgets in its historical past and believes the market is considerably underpenetrated particularly for its in-ear gadgets that supply a number of benefits to conventional listening to aids.

June Firm Presentation

Second Quarter Outcomes:

On August eighth, the corporate posted second quarter numbers. The corporate had a GAAP lack of 78 cents a share as revenues plunged practically 70% on a year-over-year foundation to $7.25 million. Each high and backside traces missed expectations badly.

Returns rose to a 3rd of gross sales from simply lower than 1 / 4 in the identical interval a yr in the past. GAAP gross margin was 34.7%, in comparison with 71.8% in 2Q2021. Administration acknowledged through its earnings press launch, the corporate could be targeted on 4 key areas going ahead.

Eargo’s omni-channel progress technique Probably regaining insurance coverage protection of Eargo for presidency staff below the FEHB program Refining and increasing the corporate’s bodily retail technique Optimize the cash-pay enterprise whereas persevering with to put money into innovation.

June Firm Presentation

Analyst Commentary & Stability Sheet:

Wells Fargo ($10 value goal), JPMorgan ($11 value goal) and William Blair both maintained or downgraded Eargo to a Maintain within the fourth quarter of 2021, however no analyst companies I can discover have issued any scores on Eargo thus far in 2022.

Simply over one out of each ten shares are at the moment held quick. Two insiders bought simply over $40,000 in combination earlier this month. One other insider bought lower than $15,000 price of fairness in March. That has been the one insider exercise in Eargo’s shares thus far in 2022.

The corporate ended the second quarter of the yr with simply over $106 million in money and marketable securities on its steadiness sheet. That is nearly solely as a result of an issuance of $100 million senior secured convertible notes that occurred late in June. That is the core tranche of a $125 million strategic funding from Affected person Sq. Capital. $16.2 million of those proceeds have been used to repay a earlier debt obligation. Administration will search stockholder approval to extend the variety of approved shares and subject full potential quantity of notice conversion shares at its annual assembly in October of this yr. If accredited, this may consist of recent shares of widespread inventory created by a rights providing.

The corporate posted a internet lack of $32.4 million on a GAAP foundation within the second quarter. $3.8 million of this was associated to authorized and different skilled charges pushed by actions associated to the DOJ investigation and $5.7 million was incurred as a result of issuance prices associated to the latest Notice Buy Settlement. Management acknowledged that money burn could be within the $20 million to $25 million vary for every of the 2 quarters remaining for the remainder of this fiscal yr.

Verdict:

The present analyst consensus has the corporate printing practically $2.50 a share in losses in FY2022 and revenues fall barely for the general yr to only over $31 million. They undertaking mid single-digit gross sales progress in FY2023 and internet losses get lower by a buck a share.

June Firm Presentation

The FDA resolution this month ought to assist bolster gross sales within the quarters forward. To what extent is difficult to undertaking till buyers see a full quarter of outcomes. This may not occur till the fourth quarter of this yr, though administration ought to present some shade on how the panorama is altering when it releases third quarter numbers in November.

June Firm Presentation

It’s straightforward to see why this inventory has declined 90% over the previous yr given the latest decline in gross sales, the litigation cloud that hung over the corporate for the primary 4 months of this yr, Eargo’s money burn, growing product returns and even the latest stepping down of the corporate’s chairman.

Till buyers see gross sales traction for 1 / 4 or two and the corporate completes its proposed rights providing, Eargo might be a inventory to keep away from. Nevertheless, Eargo is an organization price circling again on someday in 2023 to see if administration is profitable in beginning to proper the ship.

Phrases are sometimes misplaced on useless ears.”― Anthony T. Hincks