gorodenkoff/iStock by way of Getty Pictures

Q2, to date, has confirmed to be the quarter that gave us an onslaught of unhealthy information all through the expansion/tech area. There are only a few exceptions to this development, and GoodRx (NASDAQ:GDRX) is one of them. The embattled consumer-health firm, recognized for providing deep reductions on pharmaceuticals to customers, resolved one of many key elementary dangers clouding its future, whereas additionally exhibiting a powerful response to large value will increase applied on its subscription applications.

The preliminary response to GoodRx’s Q2 enterprise replace was a virtually 30% rally, although the late August gloom that has plagued the broader markets has sapped a lot of that energy away. Yr up to now, GoodRx stays down greater than 80%, main many traders to ask the query: is it time to purchase the dip?

I am going to minimize to the chase right here: after absorbing GoodRx’s newest updates, I’m considerably extra sanguine on the corporate’s prospects than earlier than. Nevertheless, given lingering COVID-driven demand impacts and the expectation that GoodRx’s margin profile will proceed to say no, I stay solely impartial on GoodRx.

To me, GoodRx stays a combined bag of each constructive and damaging components. On the intense aspect right here:

Income diversification efforts. Although GoodRx made a reputation for itself by way of prescription drug discounting, the corporate has lately diversified its income streams by way of subscription plans, on-line well being content material, telemedicine, and pharmacy providers. Dependable income streams. In idea, pharmaceuticals are recurring purchases – so GoodRx’s minimize of those transactions can be a recurring income stream, on prime of its subscription income. This income additionally comes at fairly excessive gross margins, including to GoodRx’s scalability potential.

On the similar time, nevertheless, we’ve to be cautious of the dangers:

The grocery store problem demonstrated how reliant GoodRx is on third-parties. With out robust relationships with retailers and pharmacies, GoodRx’s room to develop is severely handicapped. Lingering COVID impacts. Physician and pharmacy visits proceed to be down versus pre-pandemic ranges. Whereas GoodRx is of the idea that this has led to a backlog of undiagnosed circumstances that can ultimately result in a splurge of prescription drug buying, this thesis has not but performed out.

There is a cloud over the enterprise within the close to time period. GoodRx has ceased its steering for the yr, citing that the impacts from the lately resolved grocer fallout are tough to estimate. Then there’s additionally the corporate’s warning that adjusted EBITDA margins are coming down, because of the income development slowdown in addition to general inflationary pressures.

The underside line right here: whereas we’re constructive on the corporate’s decision of the grocery store problem (into which we’ll dive into extra element within the subsequent part), there are nonetheless too many unknowns on this small-cap identify that make it tough to speculate comfortably at present ranges.

There’s a worth part right here: at present share costs close to $6, GoodRx trades at a market cap of $2.46 billion and an enterprise worth of $2.39 billion. Primarily based on trailing twelve-month adjusted EBITDA of $236.0 million, GoodRx trades at simply over ~10x TTM adjusted EBITDA – a discount. However with lack of readability on whether or not the corporate will have the ability to develop its prime line and earnings, it is best to undertake a watch-and-wait stance and keep on the sidelines for now.

Q2 obtain

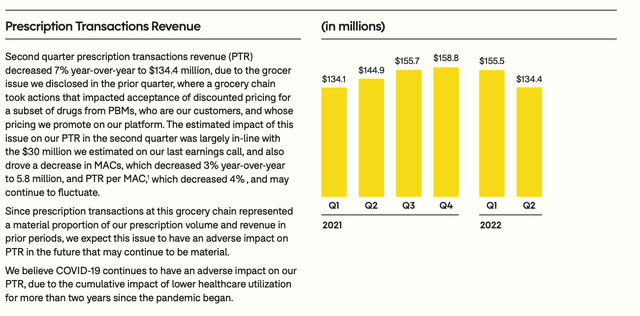

Let’s now cowl the foremost highlights popping out of GoodRx’s second-quarter replace. First off, the corporate noticed prescription transactions income decline -7% y/y to $134.4 million, as proven within the chart under:

GoodRx prescription transaction income (GoodRx Q2 shareholder letter)

The corporate attributed the vast majority of this decline, nevertheless, to a roughly $30 million affect from the non-acceptance of GoodRx reductions at considered one of its massive grocery companions, broadly believed to be Kroger (KR). Within the absence of this affect, income would have grown 13% y/y.

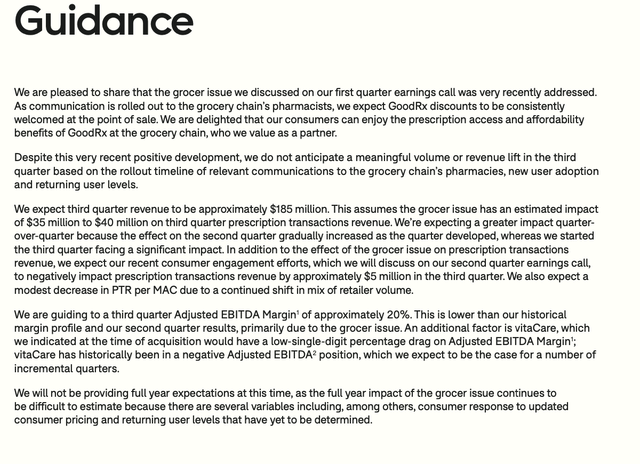

The excellent news – and the primary cause the inventory initially spiked post-earnings – is that this dispute has been resolved. As famous within the steering assertion under, this grocer is now within the means of rolling out communications to its pharmacist companions who will once more be accepting GoodRx reductions.

GoodRx steering assertion (GoodRx Q2 shareholder letter)

As additionally famous above, nevertheless, GoodRx is withdrawing its full-year steering as a result of it expects to proceed being impacted by this problem in Q3 and probably This fall because the re-acceptance is being rolled out.

Outdoors of the noise from this dispute, nevertheless, GoodRx nonetheless famous that it’s seeing development under expectations owing to COVID headwinds. CEO Doug Hirsch was clear about management’s disappointment within the firm’s outcomes, as per his ready remarks on the Q2 earnings name:

We’re disenchanted with our efficiency this yr, and I think you are feeling the identical method. We anticipated each larger development and stronger margins and that we’d be serving to extra Individuals get the healthcare they want at a value they’ll afford.

On our fourth quarter earnings name, we reset expectations as a result of our historic cohorts from the COVID interval contributed lower than we anticipated, then our prescription transactions providing was impacted by the grocery store problem we mentioned on our first quarter earnings name.

We didn’t count on to be on this place. I can say that Trevor and I, as each founders and important GoodRx shareholders, haven’t any larger precedence than getting GoodRx again on monitor.”

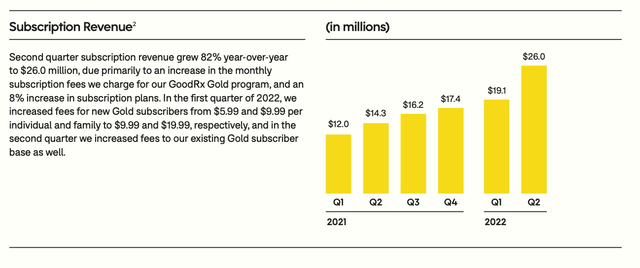

One vivid spot within the quarter, nevertheless: although subscriptions are nonetheless a comparatively small ~14% slice of general income, it grew massively in Q2 as a result of a rise in subscription costs. Q2 subscription income of $26.0 million grew 82% y/y and 36% sequentially versus Q1:

GoodRx Q2 subscription income (GoodRx Q2 shareholder letter)

The corporate applied a big enhance in subscription charges, from $5.99 to $9.99 for particular person plans and $9.99 to $19.99 for household plans. These charges utilized each to new subscribers in addition to present ones. The corporate famous it was happy with the shopper response to those value will increase, and that churn met expectations.

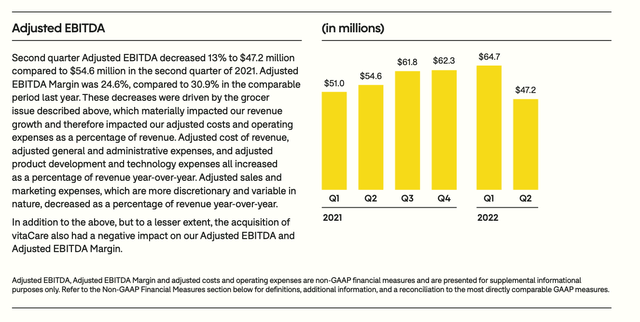

General profitability nonetheless tanked, nevertheless, given the income overhang from the grocery store problem. Adjusted EBITDA declined -13% y/y to $47.2 million, which represented a 24.6% adjusted EBITDA margin – six factors weaker than within the year-ago Q2.

GoodRx adjusted EBITDA (GoodRx Q2 shareholder letter)

GoodRx expects adjusted EBITDA margins to proceed sliding to the ~20% vary in Q3.

Key takeaways

The decision of GoodRx’s grocer dispute lifts a significant cloud from the corporate’s near-term future, as that dispute had the potential to upend the corporate’s total enterprise mannequin. On the similar time, nevertheless, that dispute was not GoodRx’s solely problem; weak prescription demand tendencies have been one other overhang on the corporate for the reason that pandemic started, and there would not appear to be a near-term repair in place. Watch and wait right here, however do not rush in.