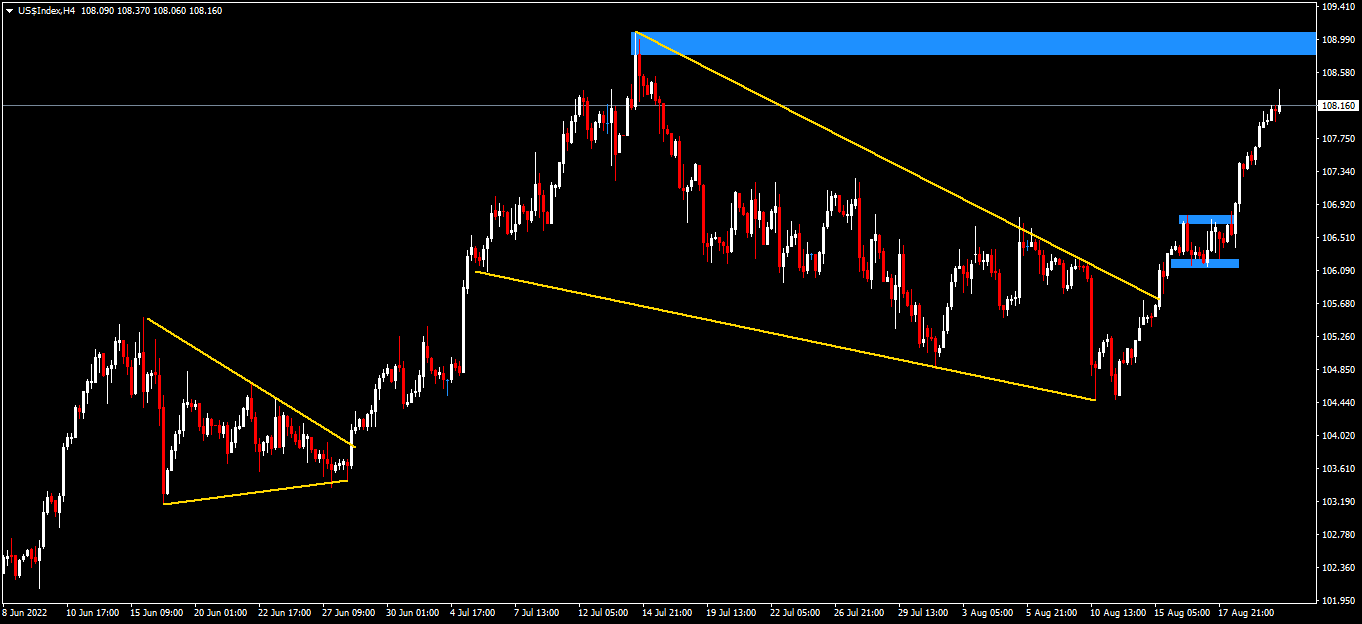

Greenback continues its surge, breaking six-week highs on its method in direction of the 109.00 key degree.

Greenback

The Greenback begins the week on the entrance foot, persevering with its good points for 4 straight buying and selling classes. After we take into account the lowering threat sentiment available in the market, coupled with buyers nonetheless attempting to evaluate and value within the hawkish feedback gathered from the FOMC minutes final week, the Greenback is more likely to revisit the important thing 109.00 degree whereas we look ahead to the pendulum to swing both aspect of the 50bps or 75bps chances heading into September.

Technical Evaluation (H4)

Technical Evaluation (H4)

When it comes to market construction, value has confirmed the bullish continuation sample (falling wedge) by printing out a subsequent impulsive wave after bouncing from the 104.44 help degree. The primary goal for this construction is the height formation across the 109.00 space and value continues to be on monitor to check the goal space as pre-empted in final week’s evaluation.

Euro

The Euro kicked off the week with bears largely nonetheless driving value for the reason that 1.03710 peak formation space which confirmed the excessive of a key technical degree on the tenth of August 2022. Consequently, the European foreign money hit ranges beneath parity within the buying and selling session on Monday morning and is ready to probably break beneath, contemplating the elemental outlook within the close to & long run centred across the rising vitality disaster, geopolitical considerations, recession fears, and the important thing variations between the FED and ECB.

Technical Evaluation (H4)

Technical Evaluation (H4)

When it comes to market construction, value has confirmed the bearish continuation sample (rising wedge) by printing out a subsequent impulsive wave after bouncing from the 1.03710 resistance degree. The primary goal for this construction is the height formation across the 0.99529 space and value continues to be on monitor to check the goal space as pre-empted in final week’s evaluation.

Pound

Sterling kicked off Monday morning including onto its losses from final week in an enormous 300pip transfer to the draw back towards the Greenback. This continued stress will be attributed to a hovering Greenback, largely pushed by safe-haven in-flows amid a risk-averse market setting to start with of the week. One of many different key driving elements is the rising price of vitality within the UK, with shoppers having to fork out 50% greater than what they paid final yr.

Till the federal government reaches some kind of an association with vitality suppliers, it will undoubtedly be one of many points the market might be maintaining tabs on, due to the knock-on impact excessive vitality costs have on the financial system.

Technical Evaluation (H4)

Technical Evaluation (H4)

When it comes to market construction, present value motion has confirmed the formation of the bearish continuation sample (bull flag) that shaped exterior of the bigger construction (rising channel), by yielding an impulsive wave that hit the predetermined goal on the peak formation on the 1.17910 space.

Henceforth value may print out a continuation sample and break beneath the low shaped on 14 July 2022 or print out a reversal sample and transfer again up into the present help vary. The previous is extra probably however each prospects exist, particularly as a result of there’s purchase sensitivity towards bearish momentum at this key help degree.

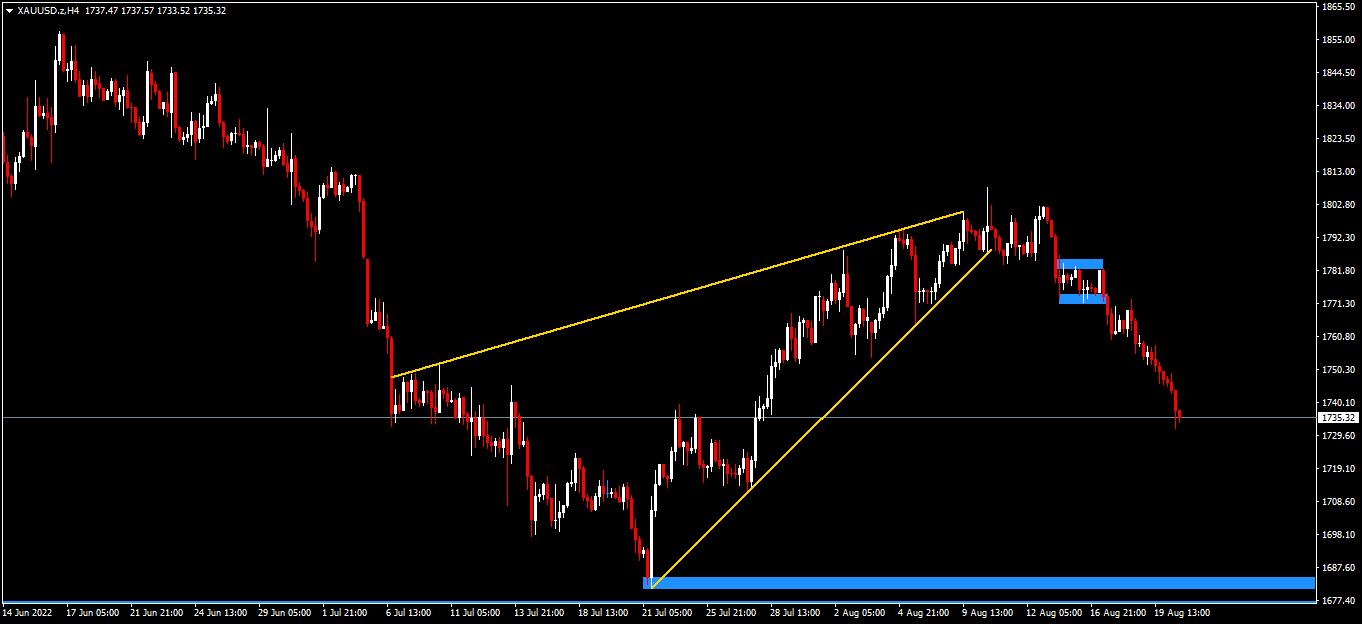

Gold

Gold heads into the brand new week including onto losses from final week for six consecutive buying and selling days. One of many key drivers is greenback demand amid a risk-averse market inundated by FED financial coverage, in addition to different central banks combating inflation by elevating rates of interest that negatively have an effect on the value of gold. Linked to the chance aversion can also be the rising vitality prices in Europe and Asia, which might be being pushed by the upkeep of the Russian gasoline pipeline which provides a considerable portion of vitality to the areas.

Technical Evaluation (H4)

Technical Evaluation (H4)

When it comes to market construction, value has moved correctively since across the twentieth of July 2022 from $1 680 in direction of the $1 805 space within the type of a bearish continuation sample (rising wedge). Worth has confirmed this sample by printing out a bear flag exterior the foremost construction and subsequently printing out an impulsive wave.

Henceforth, sellers may keep in management and hit the goal for this sell-side situation across the $1 680 degree, however smaller corrective buildings could kind within the interim and should be accounted for till a key structural degree is hit and creates a reversal sample.

Click on right here to entry our Financial Calendar

Ofentse Waisi

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.