Drew Angerer

Twilio (NYSE:TWLO) is a gold customary communications as a service [CaaS] firm. Its platform acts because the communications freeway for 275,000 clients which embrace large identify manufacturers resembling Airbnb (ABNB), Netflix (NFLX) and even Salesforce (CRM). In accordance with one examine, the worldwide unified communications as a service market was value ~$29 billion in 2021 and is forecasted to develop at a strong 13.4% compounded annual progress charge [CAGR] to achieve $69.93 billion by 2028. The corporate just lately introduced robust earnings for the second quarter of 2022, which beat prime and backside line estimates. Nonetheless, managements tepid steering precipitated the inventory to dump much more so. Twilio’s share worth has now been butchered by ~83% from its all-time highs in February 2021 and is undervalued. Let’s dive into the enterprise mannequin, financials, and valuation for the juicy particulars.

Enterprise Mannequin

In my final very in-depth submit on Twilio, I delved deep into its enterprise mannequin, here’s a fast evaluation.

Twilio’s merchandise may be segmented throughout three predominant areas;

Channels Purposes Connectivity.

Its “Channels” are its most well-known characteristic and permits corporations to ship automated and bulk textual content messages, notifications, emails and even telephone calls. For instance, when your meals supply supplier (resembling Deliveroo) which is one in every of Twilio’s clients sends you a textual content message to substantiate your order is enroute, that’s powered by Twilio. One other instance is if you obtain an automatic reserving textual content from Airbnb, who can also be a Twilio buyer.

Twilio Merchandise (Official Web site)

Its purposes section embrace merchandise resembling Twilio Flex which is the corporate’s “Cloud Contact Heart” service. Conventional bodily workplace name centres are likely to have excessive overheads (hire, electrical energy, telephone payments and many others) and aren’t simply scalable. Whereas, a “Cloud Heart” permits new distant employees to be onboarded quick an simply. This agility and suppleness is very helpful given the pandemic lockdowns is prevalent in corporations’ minds. Within the second quarter, Twilio signed a monster deal for Twilio Flex with a big Fortune 100 retailer. The corporate may even leverage its buyer information platform from the acquisition of Phase to assist organizations convey collectively siloed information and get a 360′ view of the client.

Its Connectivity section contains the connectivity of Web of Issues (IoT) units, telephone numbers and IT connectivity providers resembling SIP trunking which permits VoIP (Voice over Web) calling.

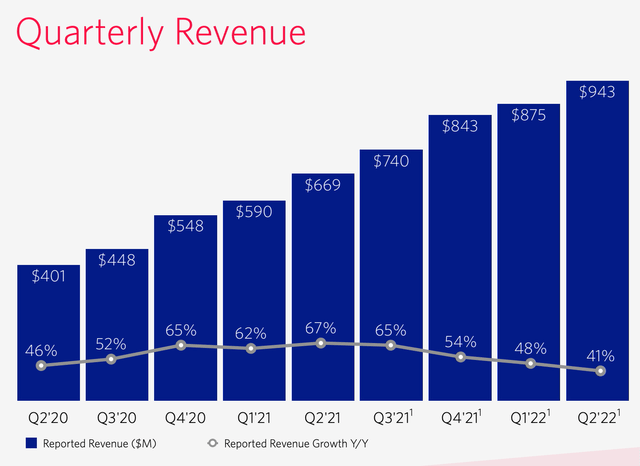

Robust Second Quarter

Twilio generated robust second quarter income of $943 million, up a blistering 41% yr over yr. With natural income of $862 million, up a fast 33% yr over yr. Its progress charge has began to decelerate relative to earlier quarters however a few of that may be attributed to lockdowns, which precipitated an acceleration within the digital transformation of companies. It also needs to be famous that regardless of the decrease progress charge, this nonetheless beat analyst expectations by $22.39 million.

Income (Q2 earnings Report)

The highest line income progress contains $34 million from Zipwhip a toll free messaging platform the corporate acquired in 2021. This income additionally included $44 million from 10DLC A2P charges. Do not let that acronym confuse you, it stands for Software-to-Particular person (A2P) kind messaging through native 10-digit lengthy code (10DLC) telephone numbers. Principally, it is a new enterprise textual content message customary which plans to scale back the variety of spammers utilizing automated textual content message providers. T-Cell and AT&T have launched additional payment for unverified customers and thus this may very well be robust tailwind behind Twilio’s compliant providing.

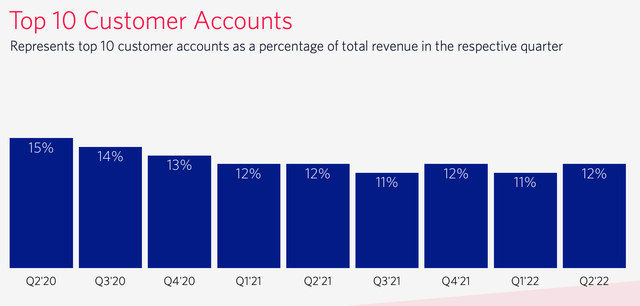

As talked about within the intro, Twilio has a diversified buyer base of over 275,000 lively accounts. In lots of SaaS corporations the highest 10 clients can take up a big portion of income and this provides a danger to traders. Nonetheless, on this case Twilio has steadily diversified its buyer based mostly from the highest 10 making up 15% in 2020 to only 12% by the second quarter of 2022, which is a optimistic signal.

High Prospects (Q2 Earnings)

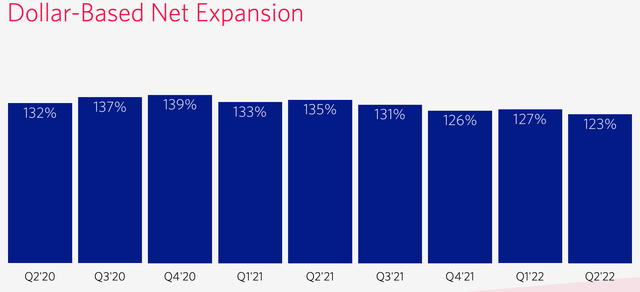

Its second quarter greenback based mostly web growth charge is a powerful 123%. This reveals clients are discovering Twilio’s merchandise “sticky” and spending extra. Nonetheless, it must be famous this growth charge has declined from the astronomical ~130%+ charges generated in 2020 and 2021. Once more, I consider this can be as a result of elevated expertise adoption in the course of the pandemic lockdown after which financial acceleration in 2021.

Greenback Primarily based Web growth (Q2 Earnings)

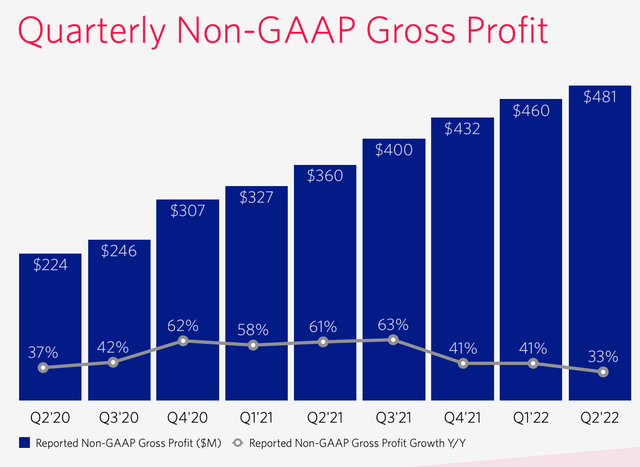

Quarterly Gross Revenue on a Non-GAAP foundation was $481 million within the second quarter. This represented a progress charge of 33% yr over yr, which was nice but in addition slower than prior quarters, which can be as a result of aforementioned causes.

Gross Revenue (Q2 Earnings report)

Twilio generated Earnings Per Share (Normalized) of -$0.11 which beat analyst estimates by $0.09.

The corporate has a fortress stability sheet with $4.4 billion in money and short-term investments and $1.3 billion in complete debt.

Regardless of Twilio’s robust quarter administration issued tepid steering of 30% to 32% income progress, which is slower than the 41% progress charge generated in Q2. This equates to a complete income of between $965 million to $975 million.

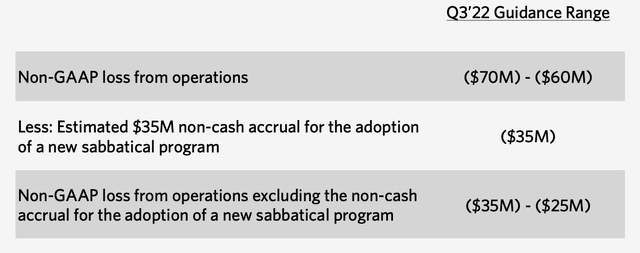

Third quarter working loss is $60 million to $70 million, which features a $35 million non-cash accrual for a brand new worker sabbatical program.

Steerage Vary (Q2 earnings report)

Superior Valuation

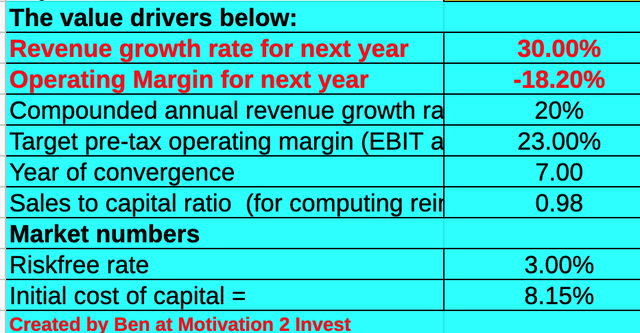

In an effort to worth Twilio inventory, I’ve plugged within the newest financials into my superior valuation mannequin, which makes use of the discounted money move (“DCF”) methodology of valuation. I’ve estimated a conservative 30% income progress for subsequent yr and 20% for the following 2 to five years.

Twilio Inventory Valuation (created by creator Ben at Motivation 2 make investments)

As well as, I’ve forecasted margins to extend to 23% throughout the subsequent 7 years as the corporate continues to scale and acquisition synergies begin to turn into extra prevalent. I’ve additionally capitalized R&D investments as a way to enhance the accuracy of the valuation.

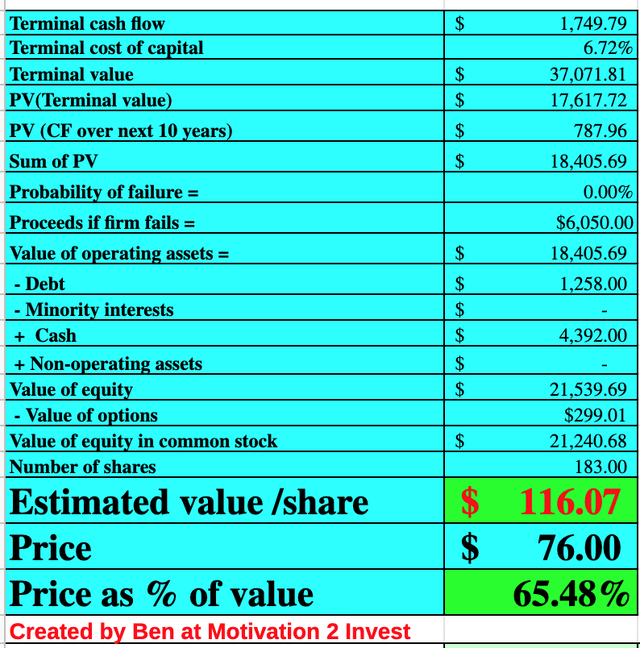

Twilio Inventory Valuation 2 (created by creator Ben at Motivation 2 Make investments)

Given these elements, I get a good worth of $116/share. The inventory is buying and selling at ~$76 on the time of writing, and thus is ~34% undervalued, which provides a considerable margin of security.

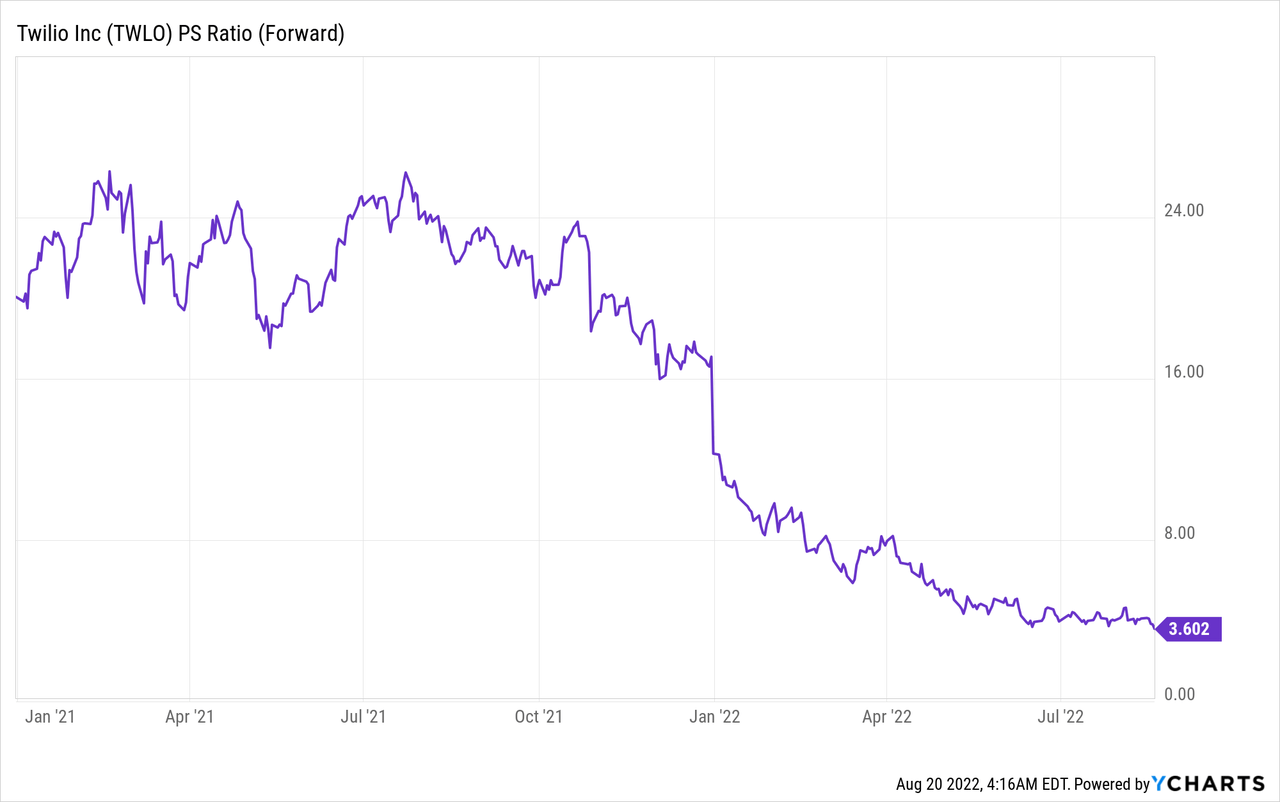

Twilio trades at a price-to-sales ratio = 3.82, which is the bottom stage since 2017 and even decrease than the pandemic low of P/S = 9.

Dangers?

Competitors

Twilio presents gold customary communication providers however they don’t seem to be alone out there. Amazon Internet Providers [AWS] (Amazon’s Cloud division) can be a firm in itself which just about presents each SaaS service you’ll be able to think about. As I just lately grew to become licensed in AWS cloud, I found a Easy Notification Service (SNS) which principally does the identical because the Twilio product, in providing bulk automated textual content messages and push notifications. However that’s not all, AWS additionally offers a Cloud contact middle service known as Amazon Join, which competes immediately with Twilio Flex. Now though I consider Twilio has a powerful model in relation to its providers, the very fact an organization like Amazon has comparable providers reveals the corporate would not have a powerful moat.

Information Hack

In a weblog submit, Twilio introduced an unknown entity gained “unauthorized entry” to some buyer accounts on August 4. This was a basic phishing or fraud-based assault which apparently fooled some workers into giving their credentials. These attackers gained entry to Twilio’s inner methods and the corporate confirmed they have been in a position to entry sure buyer information. Though, this investigation remains to be ongoing, it isn’t nice signal for the corporate and its enterprise purchasers which demand excessive safety.

Remaining Ideas

Twilio offers the communication freeway for a lot of main corporations throughout the worldwide. Its group is repeatedly innovating and I do like the very fact the corporate is founder led, which I did not talk about deeply on this submit. Regardless of the competitors, the market is big, its retention charge is excessive and the inventory is undervalued.