The US greenback was the strongest foreign money this week and the strongest foreign money at this time. The NZD was the weakest of the majors at this time.

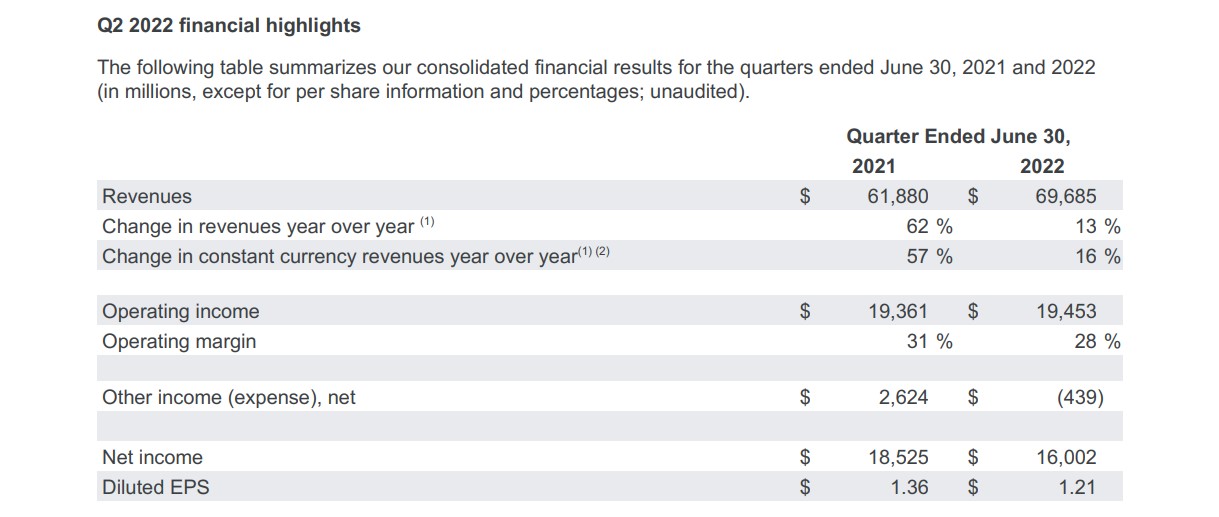

The strongest to the weakest of the foremost currencies

The buck this week, rose towards all the foremost currencies helped by extra hawkish Federal Reserve feedback, and world considerations about progress in China, the euro zone, and UK as a consequence of increased inflation, Covid headwinds, increased US yields and the Ukraine conflict.

EURUSD fell -217 pips -2.12% on the week (USD increased by 2.12%). The excessive value was reached on Monday, the low value was at this time. Yesterday, the pair fell under the decrease excessive that confined the pair in July and into early August all the way down to 1.0096. The transfer tilted the bias much more to the draw back and the promoting continued into the New York afternoon session the place the low value reached 1.0031, simply 31 pips from the parity stage. Recall in July the low reached 0.9951 earlier than beginning the run to the August excessive at 1.03678.

The GBPUSD additionally traded at it is week’s excessive on Monday (at 1.2147). For the week, the USD rose by 2.56% vs the GBP. After a rebound increased on Tuesday and into Wednesday felll simply wanting the Monday excessive (the excessive reached 1.2142), the consumers turned to sellers and the pair is ending with a 3 day down streak. The low value at this time reached 1.1791. The low value for the yr and going again to March 2020 reached 1.17594. Key assist stage going into subsequent week’s buying and selling.

The USDJPY after waffling up and down on Monday and ending marginally decrease on the day (the low reached 132.54), the pair moved up on every of the next 4 buying and selling days. For the week, the buck rose 2.52% vs the JPY. The excessive value at this time prolonged to 137.22 which took the pair simply above a swing space between 137.00 and 137.152. The value backed off into the shut, and is closing slightly below that space at 136.86. Subsequent week, that space might be a key barometer for buying and selling to begin the week.

The USDCHF closed increased on every of its 5 buying and selling days this week (increased greenback). The greenback rose 1.85% vs the CHF.

The AUDUSD (greenback increased by 3.45%) and NZDUSD closed decrease every day (increased USD – by 4.33%). The RBNZ fee hike of fifty foundation factors did little to assist the NZD towards the buck..

A snapshot of different markets because the week involves a detailed reveals:

Spot gold is down $12 or -0.69% at $1746.89.Spot silver is down $-0.46 or -2.39% at $19.04.Crude oil is buying and selling close to unchanged at $90.02 after an up and down sessionBitcoin is buying and selling at sharply decrease on the day at $21,320. Final Friday, the value closed at $24,407. So for the week the value is down $3087

Within the US inventory market this week, the foremost indices shut decrease for the first time in 5 buying and selling weeks:

Dow industrial common fell -0.1percentS&P index fell -1.2percentNASDAQ index fell -2.62percentRussell 2000 fell -2.92%

Within the US debt market:

2 yr yield is buying and selling at 3.24%. Final Friday it settled at 3.253percent5 yr is at 3.098% after closing final week at 2.960percent10 yr is at 2.972% after closing final week at 2.837percent30 yr is at 3.213% after closing final week at 3.115%