Eric Francis

Why Munger’s Unfazed

Charlie Munger’s no stranger to going in opposition to the group. He is outperformed the marketplace for the higher a part of the previous century. In 2009, when the remainder of the world was frozen in concern, Charlie Munger was shopping for financial institution shares on the backside tick. A testomony to Munger’s uncanny capability to see the longer term, he additionally purchased into BYD (OTCPK:BYDDF, OTCPK:BYDDY), the electrical automotive producer, across the identical time. The funding has since delivered returns of greater than 1000% for Every day Journal (DJCO) and Berkshire Hathaway (BRK.A, BRK.B).

Because the nice monetary disaster, Munger hasn’t purchased a factor. That’s, till now. Munger’s going in opposition to the group as soon as once more, doubling down on Alibaba Group Holding (NYSE:BABA, OTCPK:BABAF). At 98 years previous, Alibaba could possibly be Munger’s final huge guess, and his legacy hangs within the steadiness:

Every day Journal’s 13F Exercise (Dataroma)

Munger minimize his place by 50% in Q1 2022, and plenty of thought he was reversing course. Seems, he wasn’t. His newest 13F submitting reveals zero adjustments to the portfolio. It seems he was merely tax-loss harvesting after decreasing his value foundation in earlier quarters.

Chinese language shares are hated, simply as U.S. shares have been in 1974 and 2009. For contrarian traders, hated belongings current a possibility. Within the decade forward, we challenge returns of 20% each year for BABA.

Our Message To Administration

We have now one message we would wish to convey to Alibaba’s administration: purchase again all of the shares. Over the previous 10 years, share buybacks have despatched deep-moat shares like Mastercard (MA) and Apple (AAPL) hovering. Buybacks have an uncanny impact on share costs on account of the next:

They create a share scarcity They enhance EPS They ship returns on fairness hovering

On share buybacks, Charlie Munger as soon as advised famed investor Mohnish Pabrai, “Take note of the cannibals.” Mohnish elaborated:

“What he meant by ‘take a look at the cannibals’ is look fastidiously on the companies which can be shopping for again big quantities of their inventory.”

Alibaba is uniquely positioned with $40 billion of extra money on its steadiness sheet and organically rising free money circulation. The corporate has the flexibility to purchase again inventory like loopy, and that is already underway. Alibaba’s shares excellent are in steep decline, with the corporate authorizing a $25 billion buyback program, representing almost 10% of its market cap.

An Asset-Mild Progress Machine

Alibaba primarily goals to develop and purchase companies which have robust trade tailwinds, permitting for speedy development with minimal re-investment. This leaves shareholders with huge money flows and a world-class steadiness sheet.

Nearly each enterprise Alibaba’s in is a enterprise of the longer term. Whereas co-founder Jack Ma has his flaws, he is an impressive visionary and positioned the corporate effectively throughout his tenure. It helps that Alibaba’s largest shareholder, Masayoshi Son, from SoftBank, is an unimaginable visionary himself. Masa Son has mentioned his imaginative and prescient of the longer term, by which self-driving autos will ship Alibaba’s packaged items proper to the doorstep. Masa can be a permabull on A.I.

Alibaba’s Driverless Robots Make 10 Million Deliveries (Alizila)

Alibaba has robots working its Cainiao warehouses, however many of the firm’s transport is dealt with by third events, making Alibaba an asset-light e-commerce platform. Alibaba makes cash by offering small and enormous companies with advertisements and different digital companies. And, the corporate gives premium subscriptions to its Taobao members. Apart from its flagship e-commerce platforms, Alibaba’s concerned in companies like cloud computing, new retail, and digital funds.

The worldwide cloud market is anticipated to develop at 16% each year by way of to 2030, nevertheless it may develop even quicker in Asia; the continent continues to be within the early levels of cloud adoption. Alibaba Cloud is increasing and constructing information facilities in Thailand and South Korea. The corporate’s cloud section not too long ago reached profitability and will contribute to the underside line going ahead.

The Valuation Affords Monumental Returns

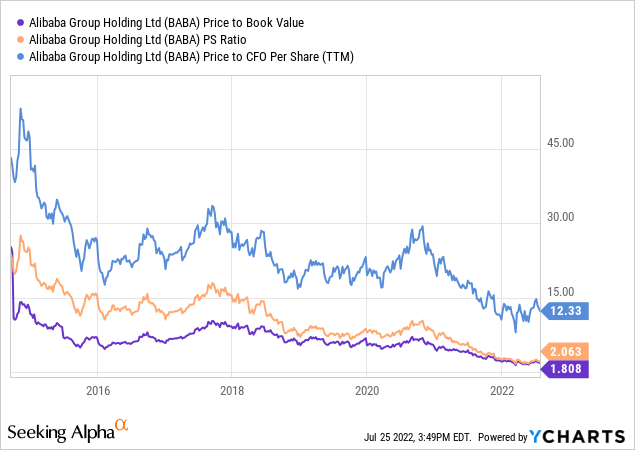

Alibaba inventory has been hammered and is extremely low-cost no matter the way you take a look at it:

BABA trades at a ahead P/E of simply 11.5 in accordance with Yahoo Finance. This suggests earnings of round $24 billion within the coming 12 months.

We anticipate upward revisions within the close to future. The present internet earnings shouldn’t be consultant of the corporate’s true earnings. Alibaba skilled a number of one-off hits prior to now 12 months, together with a $2.8 billion high-quality from the federal government, elevated advert spend on Taobao offers, and big goodwill write-downs. All of it will dissipate within the years forward, and Alibaba’s earnings ought to resume their sturdy development trajectory. Regardless of the poor financial circumstances in China, Alibaba reported excellent year-over-year income development of 19%.

It is exceptionally troublesome to forecast the longer term, nevertheless it will not cease us from making an attempt. We have analyzed the industries, potential margins, income development, strengths, and weaknesses of Alibaba’s enterprise segments. That is our estimate of the corporate’s 2032 earnings by section:

Complete $70.5 Billion China Commerce $35.0 Billion Worldwide Commerce $6.0 Billion Native Shopper Providers $2.0 Billion Cainiao $2.0 Billion Cloud $12.0 Billion Digital Media And Leisure $0.5 Billion

Fairness Technique Investees

$12.5 Billion

Innovation Initiatives And Others

$0.5 Billion Alibaba’s 2032 Earnings By Section (Estimate)

Our 2032 value goal for Alibaba is $617 per share, implying returns of 20% each year.

We have assumed Alibaba will purchase again shares at roughly 3.0% each year. If the inventory stays this low-cost, the corporate may purchase again much more. However, Alibaba will even have to reinvest to defend its turf in opposition to the likes of JD.com (JD), Pinduoduo (PDD), Sea Restricted (SE), Tencent (OTCPK:TCEHY, OTCPK:TCTZF), and Amazon (AMZN). With 2 billion shares excellent in 2032, we get earnings per share of $35.25. We have assigned a terminal a number of of 17.5x.

Dangers To Think about

The dangers for Alibaba have been extraordinarily effectively documented, which is why the corporate’s share value is so depressed. For those who’re a brand new investor in Alibaba, right here are some things to think about:

The continuing regulation from the Chinese language authorities – Satirically, corporations like Google (GOOG, GOOGL), Apple, and Meta (META) at the moment are going through comparable anti-monopoly and information privateness laws from the US and Europe. VIE possession – From our understanding, this implies you personal the earnings contractually. Geopolitical and delisting danger – The USA threatened to delist Chinese language corporations in the event that they refuse to be audited by U.S. officers. Alibaba’s already audited by a world agency and plans to conform. Within the occasion of delisting, your shares would commerce over-the-counter like Tencent. Alibaba has a secondary itemizing in Hong Kong, which can turn out to be a twin major itemizing, opening up the investor base to Mainland China.

Conclusion

Alibaba is probably our favourite funding globally. In fact, outsized returns by no means come simply. As horrible tales swirl, this can be a deeply contrarian funding. Even down 70% from its highs, the unique thesis seems intact. We expect the corporate earn $70 billion by 2032, and enhance EPS additional through buybacks. Alibaba grew its income 19% year-over-year in what was a brutal macro surroundings. Within the decade forward, we estimate your endurance shall be rewarded with returns of 20% each year. Munger’s nonetheless bullish. Are you?