Katharina13/iStock Editorial by way of Getty Pictures

Coca-Cola Europacific Companions PLC (NASDAQ:CCEP) affords buyers publicity to a big Coca-Cola bottler throughout Europe and, now, Asia Pacific.

The enterprise is performing solidly, with revenues rising strongly. Additionally it is beginning to see the advantages of its acquisition of bottler Amatil. The dividend yield appears significantly enticing in the meanwhile. Nevertheless, I see the corporate as totally valued, so keep a “maintain” score.

Enterprise Efficiency Stays Stable

The enterprise has been performing solidly, and the mixing of Amatil appears to have gone effectively. In its quarterly buying and selling replace, the corporate referred to the mixing as “effectively superior.” I used to be involved in regards to the capacity of the corporate to handle this distant enterprise whereas managing its earlier one on the identical time. Thus far, although, thankfully these doubts have come to naught.

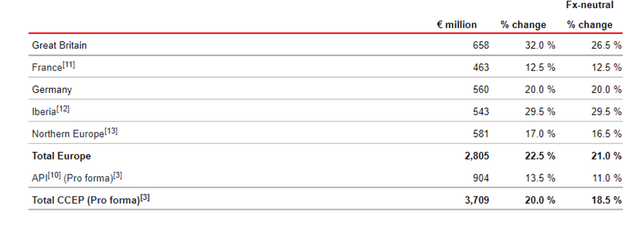

The corporate’s most up-to-date numbers, for the primary quarter, stacked up effectively.

firm announcement

Breaking this down by market, it may be seen that the corporate is performing very strongly from a gross sales perspective throughout the board.

firm announcement

For the current yr, the corporate expects income professional forma comparable progress of 8-10%. For working revenue, it forecasts professional forma comparable progress of 6-9%.

Trying again over the previous few years, whereas income progress has been pretty constant, earnings have moved round loads and present no constant upwards trajectory.

2015

2016

2017

2018

2019

2020

2021

Income (€M)

6329

9133

11062

11518

12017

10806

13,763

Submit-tax revenue (€M)

513

549

688

909

1090

498

988

Primary earnings per share (€)

2.23

1.45

1.42

1.88

2.34

1.09

2.15

Chart compiled by creator utilizing knowledge from firm annual monetary studies

Might integrating Amatil and realizing the advantages of scale and attain of the merger assist to spice up earnings? I believe it might. But it surely stays the case that the efficiency of the corporate over the previous few years has been unspectacular and inconsistent. I don’t suppose that the merger in itself solves that downside.

I do count on enhancing enterprise efficiency. This yr is wanting sturdy, and I count on continued progress over the following couple of years, because the Amatil acquisition synergies are totally realized. However the firm’s observe file lacks consistency, and it’s topic to disappointments in given markets. So, though it’s in progress mode now, I’m not assured that CCEP earnings will persistently develop.

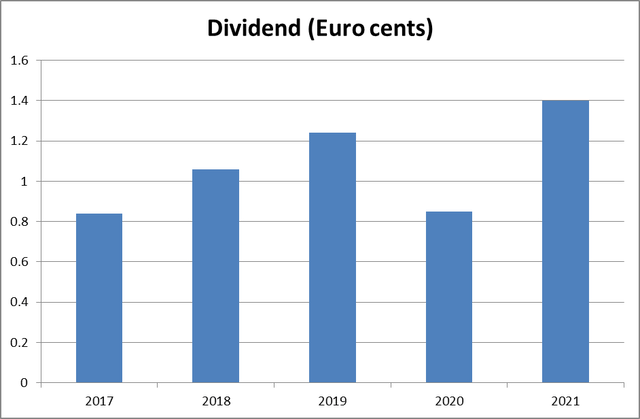

The Dividend is Enticing

Setting apart the pandemic-hit 2020, the corporate has been rising dividends at a good clip.

CCEP dividend historical past

The corporate has reverted to paying biannual dividends. The primary dividend this yr was 56c per share. The corporate has indicated that the second half dividend will likely be calculated “on the subject of the present yr annualized complete dividend payout ratio of roughly 50%.” So, does that equate to a different improve within the full-year dividend? Primarily based on the sturdy enterprise efficiency anticipated for the yr, I count on that it does.

From a dividend perspective, the share appears enticing from a long-term perspective. At its present worth, the dividend yield is 4.3%. I discover that a beautiful yield in itself (whereas The Coca-Cola Firm (KO) is a unique kind of enterprise, its yield is 2.9% proper now). On prime of that, the corporate’s pricing energy might allow it to maintain elevating the dividend over time, that means the possible yield is even increased.

Valuation

The final time I lined the agency, final June, I concluded that it was pretty valued and assigned it a “maintain” score. Since then, the shares have fallen 18%.

They now commerce on a price-to-earnings ratio of 23. I don’t regard that as low-cost. I do suppose the corporate has some enticing traits in its enterprise mannequin that give it pricing energy. I believe enterprise efficiency might enhance in coming years, and the dividend is enticing. However I don’t see the shares as low-cost. I, subsequently, keep my “maintain” score.