RgStudio

It is a scary time for a lot of traders proper now.

Every day Shot

We simply noticed the worst inflation-adjusted annualized returns for shares since 1872 in line with Goldman Sachs.

And 10% of U.S. shares are down 90+% with practically 33% down 70+%.

Recession fears are rising by the month, with an increasing number of blue-chip economist corporations saying {that a} delicate, and even extreme recession is perhaps crucial for the Fed to slay the inflation dragon.

A deep recession can be wanted to carry down hovering inflation, and excessive costs are going to be very sticky, BofA says:

Deutsche Financial institution’s newest consumer survey discovered that 90% of respondents anticipated a U.S. recession by the top of subsequent yr, which was up from 35% of respondents in December, in line with Bloomberg.” – Enterprise Insider

David Rice

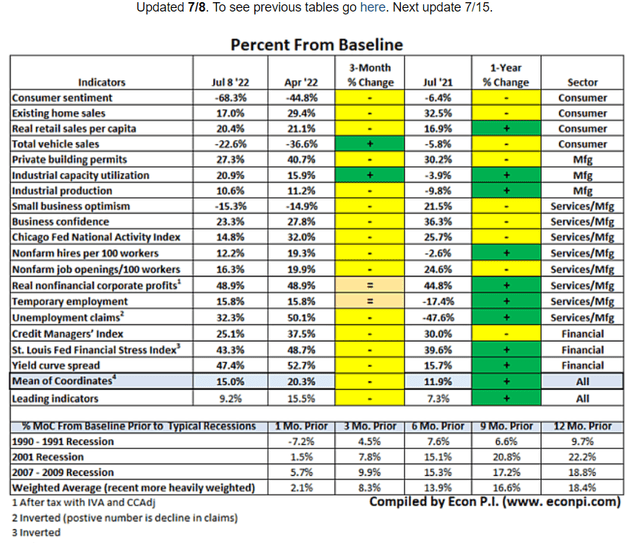

16 of 18 financial indicators have weakened within the final three months, and their common worth (above historic baseline) signifies {that a} recession might start inside about seven months.

Every day Shot

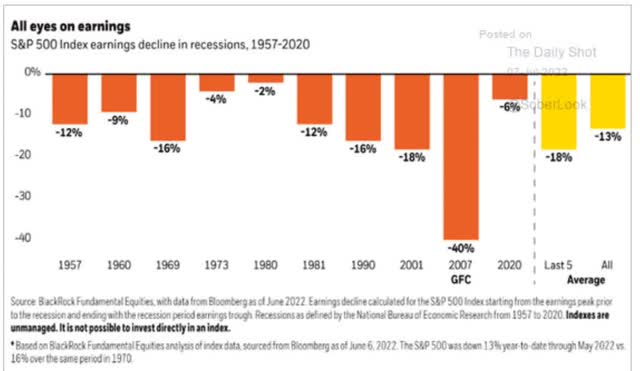

The common recession since 1957 sees earnings fall 13%, although the final 5 recessions have averaged an 18% decline.

Every day Shot

Based mostly on the PMI information, the Monetary Occasions estimates a 15% EPS decline is perhaps coming.

housing information factors to a possible -20% decline Morgan Stanley’s base-case recession forecast is a 20% decline

The dangerous information is that recession danger is rising. The excellent news is that the world’s most reliable high-yield blue-chips may also help you sleep properly at night time, continue to grow your earnings, AND lock in unbelievable long-term earnings and wealth compounding that may provide help to retire in security and splendor.

A brand new Dividend Kings member simply acquired $100K in money and is searching for some nice concepts on generate the world’s most secure 4+% earnings, in addition to potential market, aristocrat, and even Nasdaq beating long-term returns.

So let me present you the way I used to be capable of display for seven of the most secure high-yield blue-chips, in a matter of minutes, to assist this member put their hard-earned cash to work in these unsure financial occasions.

How To Shortly And Simply Discover The World’s Most secure And Most Reliable Blue-Chips Even With A Potential Recession Simply Months Away

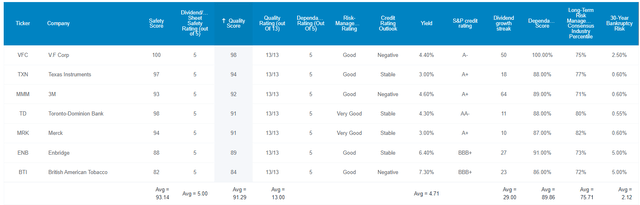

Here is the screening standards I used within the Dividend Kings Zen Analysis Terminal to get this record of world-class high-yield blue-chips.

Extremely SWAN record (as near excellent high quality firms as exist, huge moat aristocrats and future aristocrats) good purchase or higher 3+% yield 11+% long-term consensus return potential (greater than aristocrats and S&P).

Then I sorted by sector, and chosen the best whole return potential high-yield Extremely SWAN for every sector, arriving at a diversified and prudently risk-managed high-yield Extremely SWAN portfolio that retirees can belief in any recession.

Lastly, I used the Watchlist creation characteristic of the terminal to rapidly create the next watchlist, which permits me to summarize the equally weighted fundamentals (as much as 60 metrics) that I will be displaying you as we speak.

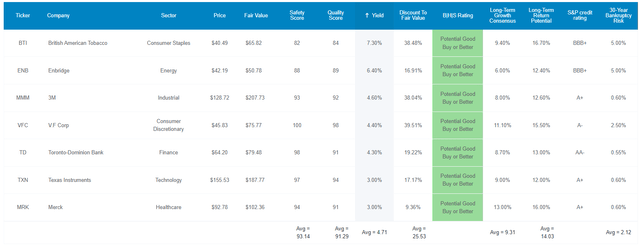

7 Excessive-Yield Blue-Chips Retirees Can Belief In This Recession

Dividend Kings Zen Analysis Terminal

I’ve linked to articles offering deeper seems at every firm’s development prospects, funding thesis, danger profile, valuation, and return potential.

TD and ENB are Canadian firms:

15% tax withholding on dividends in TAXABLE Accounts none in retirement accounts tax credit score accessible for US traders in taxable accounts to recoup the withholding.

Down Simply 7% In 2022, About 1/third As A lot As The S&P

(Supply: Portfolio Visualizer Premium)

Thus far in 2022, these Extremely SWANs are performing very defensively, down lower than 7%, about 67% lower than the broader market.

FAST Graphs Up Entrance

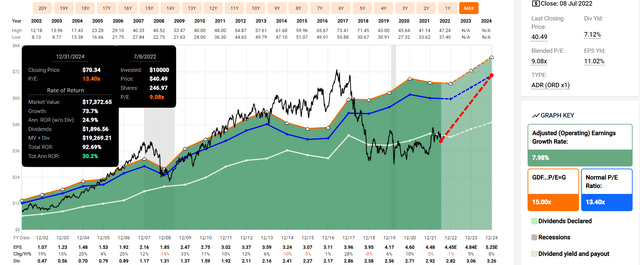

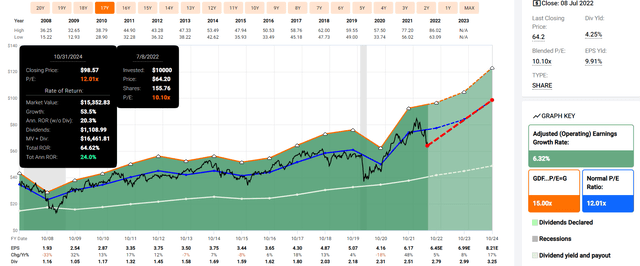

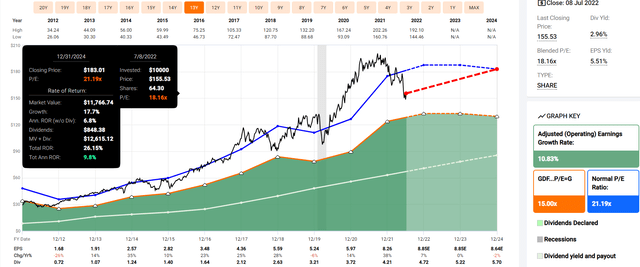

British American Tobacco 2024 Consensus Complete Return Potential

(Sources: FAST Graphs, FactSet)

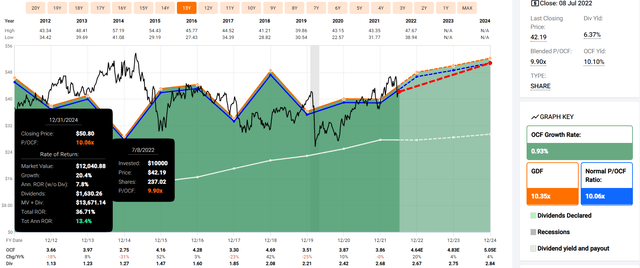

Enbridge 2024 Consensus Complete Return Potential

(Sources: FAST Graphs, FactSet)

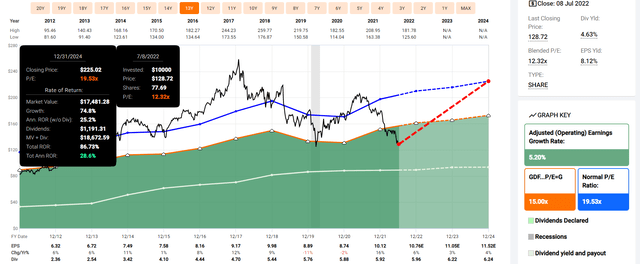

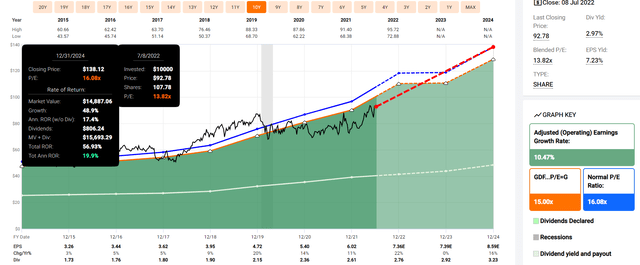

3M 2024 Consensus Complete Return Potential

(Sources: FAST Graphs, FactSet)

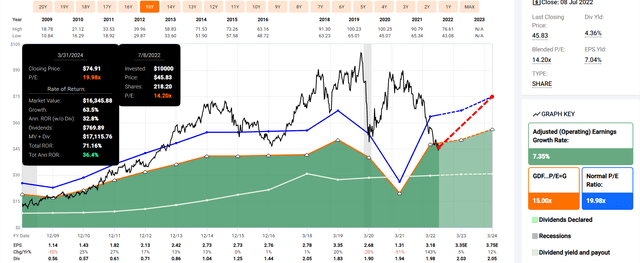

V.F Corp 2024 Consensus Complete Return Potential

(Sources: FAST Graphs, FactSet)

Toronto-Dominion 2024 Consensus Complete Return Potential

(Sources: FAST Graphs, FactSet)

Texas Devices 2024 Consensus Complete Return Potential

(Sources: FAST Graphs, FactSet)

Merck 2024 Consensus Complete Return Potential

(Sources: FAST Graphs, FactSet)

Given the common consensus for all these Extremely SWANs, an equally weighted portfolio is:

+23% yearly via the top of 2024 that is how a lot you’d earn IF every firm grew as anticipated and returned to historic truthful worth the risk-adjusted anticipated return is 15.8% CAGR (factoring within the likelihood of those firms not rising as anticipated and never returning to truthful worth till after 2024).

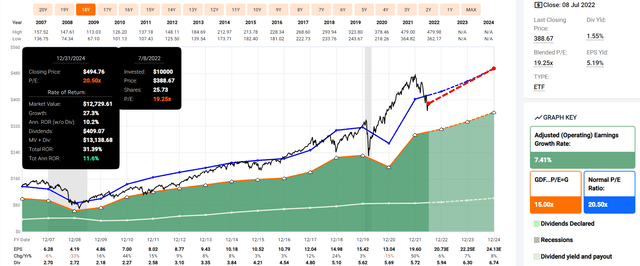

S&P 2024 Consensus Complete Return Potential

(Sources: FAST Graphs, FactSet)

The FactSet consensus for the S&P 500 is 12% annual returns, about half what analysts count on from these high-yield Extremely SWANs.

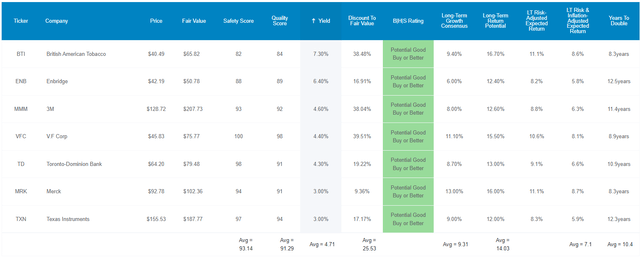

Why I Belief These Extremely SWANs And So Can You

Dividend Kings Zen Analysis Terminal

These aren’t simply sleep properly at night time blue-chips, they’re Extremely SWAN high quality firms that retirees can belief in any recession. How do we all know? As a result of their high quality is superior to the bluest of blue-chips, the dividend aristocrats.

Far Superior In High quality To The Dividend Aristocrats

Metric Dividend Aristocrats 7 Excessive-Yield Extremely SWANs Winner Aristocrats

Winner 7 Excessive-Yield Extremely SWANs

High quality 87% 91% 1 Security 89% 93% 1 Dependability 84% 90% 1 Lengthy-Time period Danger Administration Business Percentile 67% Above-Common 76% Good 1 Common Credit score Score A- Steady A- Steady 1 1 Common 30-12 months Chapter Danger 3.01% 2.12% Common Dividend Progress Streak (Years) 44.3 29.0 1 Common Return On Capital 100% 105% 1 Common ROC Business Percentile 83% 89% 1 13-12 months Median ROC 89% 87% 1 Complete 3 7

(Supply: DK Zen Analysis Terminal)

If this portfolio was a single firm it might be the sixtieth highest high quality firm on the DK 500 Masterlist.

How important is that this? The DK 500 Grasp Checklist is likely one of the world’s greatest watchlists, together with:

each dividend aristocrat (S&P firms with 25+ yr dividend development streaks) each dividend champion (each firm, together with overseas, with 25+ yr dividend development streaks) each dividend king (each firm with 50+ yr dividend development streaks) each overseas aristocrat (each firm with 20+ yr dividend development streaks) each Extremely SWAN (huge moat aristocrats, as near excellent high quality firms as exist) 40 of the world’s greatest development shares.

In different phrases, even among the many world’s greatest firms, these Extremely SWANs increased high quality than 88% of them.

These Extremely SWANs supply one of many most secure 4.7% yields on earth. How secure?

Score Dividend Kings Security Rating (162 Level Security Mannequin) Approximate Dividend Lower Danger (Common Recession) Approximate Dividend Lower Danger In Pandemic Degree Recession 1 – unsafe 0% to twenty% over 4% 16+% 2- under common 21% to 40% over 2% 8% to 16% 3 – common 41% to 60% 2% 4% to eight% 4 – secure 61% to 80% 1% 2% to 4% 5- very secure 81% to 100% 0.5% 1% to 2% 7 Excessive-Yield Extremely SWANs 93% 0.50% 1.40% Danger Score Low-Danger (76th business percentile risk-management consensus) A- secure outlook credit standing 2.1% 30-year chapter danger 20% OR LESS Max Danger Cap Advice (Every)

Within the common recession since WWII, the chance of a dividend minimize is about 1 in 200. In a extreme recession, just like the Pandemic, or Nice Recession, it is about 1 in 71.

Ben Graham thought of a 20+ yr dividend development streak an essential signal of fantastic high quality. These Extremely SWANs common a 29-year streak, making this an efficient dividend aristocrat portfolio.

Joel Greenblatt, one of many biggest traders in historical past, considers return on capital to be his gold customary proxy for high quality and moatiness.

the premise for his 40% annual returns for 21 years at Gotham Capital annual-pre-tax revenue/the cash it takes to run the enterprise.

The S&P 500’s 2021 ROC was 14.6% and the dividend aristocrats 100%.

These Extremely SWANs common 105%, indicating supreme high quality and huge moats.

Their ROC is within the 89th percentile of their respective industries, additional confirming their huge moats.

And their 13-year median ROC of 87% confirms secure and even enhancing huge moats.

S&P estimates the common danger of chapter over the following 30 years (Warren Buffett’s definition of elementary danger) at 2.12%, virtually 50% decrease than the dividend aristocrats.

And 6 score companies estimate these Extremely Swan’s long-term risk-management is of their 76th business percentile. What does that imply?

Classification Common Consensus LT Danger-Administration Business Percentile

Danger-Administration Score

S&P International (SPGI) #1 Danger Administration In The Grasp Checklist 94 Distinctive Sturdy ESG Shares 78

Good – Bordering On Very Good

7 Excessive-Yield Extremely SWANs 76

Good

International Dividend Shares 75 Good Extremely SWANs 71 Good Low Volatility Shares 68 Above-Common Dividend Aristocrats 67 Above-Common Dividend Kings 63 Above-Common Grasp Checklist common 62 Above-Common Hyper-Progress shares 61 Above-Common Month-to-month Dividend Shares 60 Above-Common Dividend Champions 57 Common

(Supply: DK Analysis Terminal)

Superior danger administration to the dividend aristocrats and even increased than the common Extremely SWAN.

OK, so now that you simply perceive the supreme high quality of those firms, let’s have a look at why you would possibly need to purchase them as we speak.

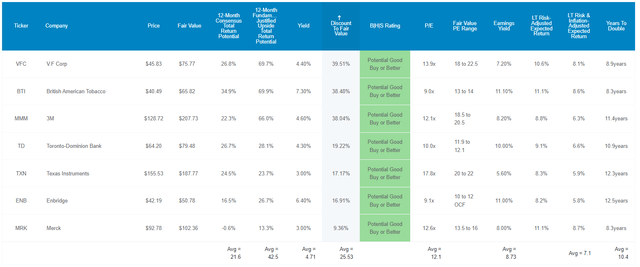

Fantastic Corporations At Fantastic Costs

Dividend Kings Zen Analysis Terminal

For context, the S&P 500 trades at 16.3X ahead earnings, a 3% low cost to its 10-year, 25-year, and 45-year common market-determined truthful worth of 16.9X.

These Extremely SWANs, whose high quality is superior to the aristocrats, a lot much less the S&P 500, commerce at simply 12.1X earnings and a 26% historic low cost.

Analysts count on them to ship 22% whole returns in simply the following yr alone (vs 23% CAGR consensus via 2024) however their fundamentals are so enticing {that a} 43% whole return inside 12 months can be justified.

if these firms all grew as anticipated and returned to truthful worth inside 12 months, traders would make 43% whole returns.

However my aim is not that will help you earn JUST 22% returns over 12 months and even 43%. My aim is that will help you earn a whole lot and even 1000’s of % beneficial properties over years and a long time.

In different phrases, that will help you retire in security and splendor with the world’s greatest blue-chip bargains hiding in plain sight.

Lengthy-Time period Return Fundamentals That Can Assist You Retire In Security And Splendor

Dividend Kings Zen Analysis Terminal

Not solely do these Extremely SWANs supply one of many world’s most secure 4.7% yields, however analysts count on them to develop at 9.3% over time.

S&P has a 1.7% yield and eight.5% development consensus aristocrats 2.3% yield and eight.9% development consensus.

Meaning analysts assume these Extremely SWANs can ship 14% whole returns over time.

Funding Technique Yield LT Consensus Progress LT Consensus Complete Return Potential Lengthy-Time period Danger-Adjusted Anticipated Return Lengthy-Time period Inflation And Danger-Adjusted Anticipated Returns Years To Double Your Inflation & Danger-Adjusted Wealth

10-12 months Inflation And Danger-Adjusted Anticipated Return

7 Excessive-Yield Extremely SWANs 4.7% 9.3% 14.0% 14.0% 11.5% 6.2 2.98 Nasdaq 1.0% 12.7% 13.7% 9.6% 7.1% 10.1 1.99 Dividend Aristocrats 2.4% 8.5% 10.9% 7.6% 5.2% 14.0 1.65 S&P 500 1.7% 8.5% 10.2% 7.1% 4.7% 15.4 1.58

(Sources: Morningstar, FactSet, Ycharts)

Analysts not solely count on these Extremely SWANs to run circles across the S&P and aristocrats however probably to even beat the Nasdaq long-term.

however with virtually 5X the very stable yield.

Adjusting for the chance of those firms not rising as anticipated and the bond market’s 30-year inflation expectations that is a 7.1% danger and inflation-adjusted anticipated return.

vs 5.2% aristocrats and 4.7% S&P 500 realistically you’ll be able to count on these Extremely SWANs to double your inflation-adjusted wealth each 10.4 years vs 14.0 years for the dividend aristocrats and 15.4 years for the S&P 500.

What might that imply for you over time? Probably life-changing earnings and wealth compounding.

Inflation-Adjusted Consensus Complete Return Forecast: $1,000 Preliminary Funding

Time Body (Years) 7.6% CAGR Inflation-Adjusted S&P Consensus 8.4% Inflation-Adjusted Aristocrats Consensus 11.5% CAGR Inflation-Adjusted 7 Excessive-Yield Extremely SWAN Consensus Distinction Between Inflation-Adjusted 7 Excessive-Yield Extremely SWAN Consensus Vs S&P Consensus 5 $1,445.67 $1,493.29 $1,725.67 $280.00 10 $2,089.97 $2,229.92 $2,977.95 $887.98 15 $3,021.42 $3,329.92 $5,138.96 $2,117.55 20 $4,367.98 $4,972.54 $8,868.17 $4,500.19 25 $6,314.67 $7,425.45 $15,303.56 $8,988.89 30 $9,128.95 $11,088.36 $26,408.95 $17,279.99

(Supply: DK Analysis Terminal, FactSet)

Analysts assume these high-yield Extremely SWANs might ship 26.4X inflation-adjusted returns over the following 30 years.

Time Body (Years) Ratio Aristocrats/S&P Consensus Ratio Inflation-Adjusted 7 Excessive-Yield Extremely SWAN Consensus vs S&P consensus 5 1.03 1.19 10 1.07 1.42 15 1.10 1.70 20 1.14 2.03 25 1.18 2.42 30 1.21 2.89

(Supply: DK Analysis Terminal, FactSet)

That is probably 3X greater than the S&P 500 and a pair of.5X greater than the dividend aristocrats.

the common retired couple age 65 has $510K in financial savings these Extremely SWANs might probably ship $8.8 million in further inflation-adjusted wealth over a 30-year retirement.

What proof is there that these high-yield Extremely SWANs can really ship one thing like 14% long-term returns?

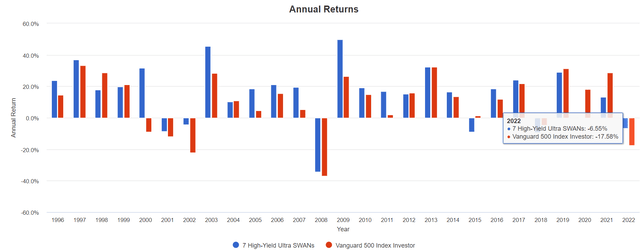

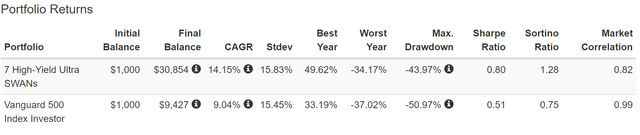

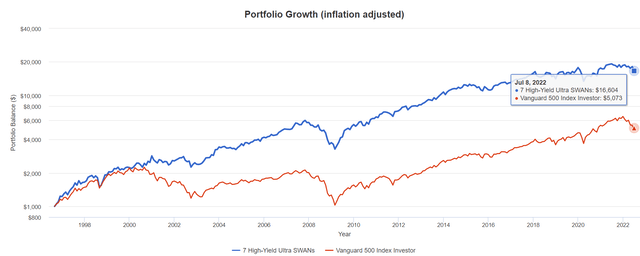

Historic Returns Since September 1996 (Equal Weight, Annual Rebalancing)

“The longer term does not repeat, nevertheless it typically rhymes.” – Mark Twain

Previous efficiency isn’t any assure of future outcomes, however research present that blue-chips with comparatively secure fundamentals over time supply predictable returns based mostly on yield, development, and valuation imply reversion.

Financial institution of America

So let’s have a look at how these Extremely SWANs did over the past 26 years, a time frame when 93% of whole returns have been the results of fundamentals, not luck.

(Supply: Portfolio Visualizer Premium)

Analysts count on 14% long-term returns sooner or later and over the past 26 years, these Extremely SWANs delivered 14.2% annual returns, together with 71% higher detrimental volatility-adjusted returns in comparison with the S&P 500.

Sortino ratio is extra whole return (vs 10-year treasuries) divided by detrimental volatility

(Supply: Portfolio Visualizer Premium)

Analysts count on these Extremely SWANs to ship about 15.3X inflation-adjusted returns over the following 25 years and beat the market by 3X.

Within the final 26 years, they’ve delivered 16.6X inflation-adjusted returns and overwhelmed the market by 3X.

(Supply: Portfolio Visualizer Premium)

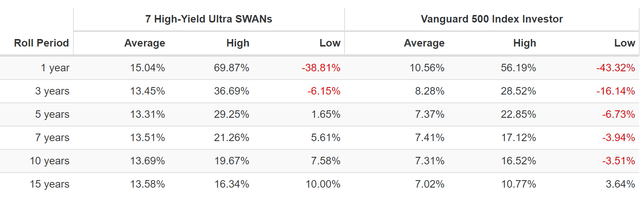

These Extremely SWANs delivered common rolling returns between 13.3% and 15% yearly for 26 years, relying on the time-frame.

Their worst 15-year return was 10% yearly, 3X greater than the S&P 500’s worst 15-year return.

worst 15-year return: 371% vs 70% S&P 500

(Supply: Portfolio Visualizer Premium)

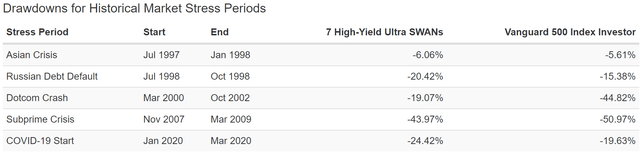

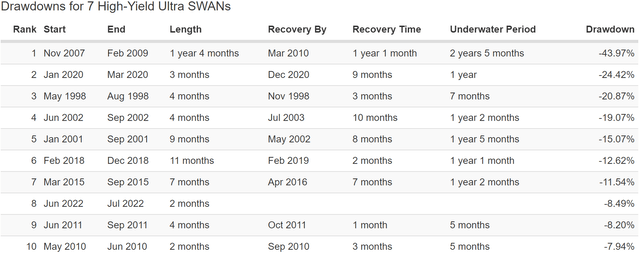

Whereas they do not at all times outperform the market during times of market stress, throughout the worst mega crashes, such because the tech crash and Nice Recession, they outperformed by important quantities.

(Supply: Portfolio Visualizer Premium)

(Supply: Portfolio Visualizer Premium)

On this bear market, they’re down 8.5%, lower than half the markets.

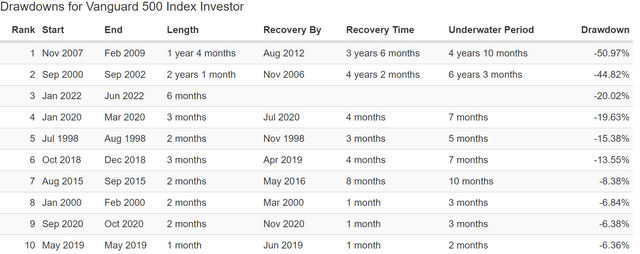

The S&P has taken so long as 6.25 years to return to file highs from the tech crash. These Extremely Swans’ longest restoration time was simply 2.5 years.

And let’s not overlook about the principle motive to contemplate shopping for these high-yield Extremely SWANs, beneficiant, stable, and rising dividends.

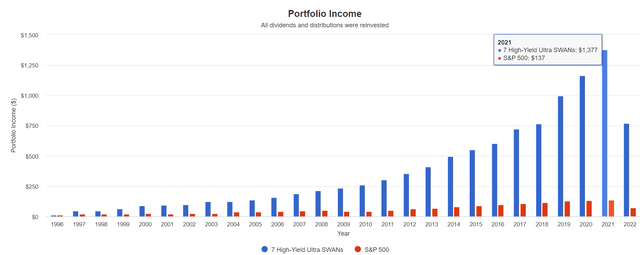

(Supply: Portfolio Visualizer Premium)

Portfolio 1997 Revenue Per $1,000 Funding 2022 Revenue Per $1,000 Funding Annual Revenue Progress Beginning Yield

2022 Yield On Value

S&P 500 $21 $142 7.95% 2.1% 14.2% 7 Excessive-Yield Extremely SWANs $47 $1,536 14.97% 4.7% 153.6%

(Supply: Portfolio Visualizer Premium)

During the last quarter-century, these Extremely SWANs went from a yield of 4.7% (the identical yield as as we speak) to a yield on price of 154%, delivering 15% annual earnings development that was 2X that of the S&P 500.

virtually matching the Nasdaq’s 18% annual earnings development

What about future earnings development?

Analyst Consensus Revenue Progress Forecast Danger-Adjusted Anticipated Revenue Progress Danger And Tax-Adjusted Anticipated Revenue Progress

Danger, Inflation, And Tax Adjusted Revenue Progress Consensus

13.9% 9.8% 8.3% 5.7%

(Supply: DK Analysis Terminal, FactSet)

Analysts count on 14% future earnings development from these Extremely SWANs, which adjusting for the chance of those firms not rising as anticipated, inflation, and taxes is 5.7% actual anticipated earnings development.

Now evaluate that to what they count on from the S&P 500.

Time Body S&P Inflation-Adjusted Dividend Progress S&P Inflation-Adjusted Earnings Progress 1871-2021 1.6% 2.1% 1945-2021 2.4% 3.5% 1981-2021 (Fashionable Falling Fee Period) 2.8% 3.8% 2008-2021 (Fashionable Low Fee Period) 3.5% 6.2% FactSet Future Consensus 2.0% 5.2%

(Sources: S&P, FactSet, Multipl.com)

Analysts count on the S&P 50 to ship 2% actual dividend development over time.

1.7% post-tax actual earnings development.

What a couple of 60/40 retirement portfolio?

0.5% consensus inflation, danger, and tax-adjusted earnings development.

In different phrases, these seven high-yield Extremely SWANs supply:

virtually 3X the market’s yield (and a a lot safer yield at that) virtually 3.5X its long-term inflation-adjusted consensus earnings development potential 10.4X higher long-term inflation-adjusted earnings development than a 60/40 retirement portfolio.

That is the ability of high-yield Extremely SWAN investing in a bear market.

Backside Line: 7 Excessive-Yield Blue-Chips Retirees Can Belief In This Recession

I am unable to inform you the place the market will backside, or when, solely what the blue-chip consensus expects.

Time Body Traditionally Common Bear Market Backside Non-Recessionary Bear Markets Since 1965 -21% (Achieved Could twentieth) Median Recessionary Bear Market Since WWII -24% (Citigroup base case with a gentle recession) June sixteenth Non-Recessionary Bear Markets Since 1928 -26% (Goldman Sachs base case with a gentle recession) Common Bear Markets Since WWII -30% (Morgan Stanley base case) Recessionary Bear Markets Since 1965 -36% (Financial institution of America recessionary base case) All 140 Bear Markets Since 1792 -37% Common Recessionary Bear Market Since 1928

-40% (Deutsche Financial institution, Bridgewater, SocGen Extreme Recessionary base case, Morgan Stanley Recessionary Base Case)

(Sources: Ben Carlson, Financial institution of America, Oxford Economics, Goldman Sachs)

Is the market accomplished falling? That can rely on the financial system, which in flip will rely on all of us, and the Fed, which in flip will rely on inflation.

However guess what? Retiring in security and splendor, on a river of stable and rising dividends does not require understanding when inflation will peak, the Fed will pivot, the financial system will backside, or shares will cease falling.

No person can predict rates of interest, the long run path of the financial system, or the inventory market. Dismiss all such forecasts and focus on what’s really taking place to the businesses through which you have invested.” – Peter Lynch

Here is what I can inform you with excessive confidence about VFC, BTI, ENB, TD, MRK, MMM, and TXN:

a really stable 4.7% yield (virtually 3X the S&P 500)’s high quality that is within the high 12% of the world’s greatest blue-chips increased high quality than the dividend aristocrats A- secure common credit standing (2.12% avg 30-year chapter danger in line with S&P) risk-management consensus: 76th business percentile 29-year common dividend development streak (an efficient aristocrat portfolio) 25% traditionally undervalued (12.2X earnings) analyst 12-month worth forecast: 25% whole return 12-month essentially justified whole return potential: 43% consensus whole return via 2024: 23% CAGR long-term consensus: 9.3% long-term consensus whole return potential: 14.0% vs 14.2% over the past 26 years

Would you like a really stable yield that is 3X increased than the markets? Who does not?

Would you like rock-solid dividend development dependability, as represented by a mean 29-year dividend development streak? I do know I certain do.

Would you like fortress stability sheets, as represented by an A- secure credit standing and 50% decrease elementary danger than the dividend aristocrats? Sure, please, I will have a few of that.

How about historic and consensus future returns that do not simply beat the S&P 500 and dividend aristocrats, however even the Nasdaq? Now we’re cooking with fuel.

That is the way you do high-yield blue-chip investing throughout a bear market, not reaching for sucker yields, however the world’s most reliable 4.7% yield.

That is how one can sleep properly at night time on this or any future recession, understanding your hard-earned financial savings are within the palms of among the world’s greatest wealth and earnings compounders and danger managers.

That is how one can cease obsessing over what occurs with inflation, rates of interest, the financial system, or the inventory market within the short-term.

Excessive-yield Extremely SWANs like these are how you are taking cost of your monetary future, make your individual luck on Wall Avenue, and retire in security and splendor.