USD spiked, Oil fell and the Euro inched nearer to parity. The robust haven bid rise because the prospect of additional tightening by central banks, renewed COVID outbreaks in China and Europe’s vitality shortages spooked traders. The Fed’s George, the dissenter in favor of a 50 bp June hike, famous issues over aggressive coverage motion & the hawk Bullard nonetheless favors a 75 bp transfer. Recession angst once more cropped up and hammered equities with weak spot in megacap tech knocking the USA100 down -2.26%. USDIndex above 108.00. Wall Avenue’s losses have deepened. China imposing strict covid restrictions amid an increase within the subvariant BA.5 Omicron. Earnings season begins on Thursday with JPMorgan kicking it off. It may very well be a troublesome season for income given rising prices. Bloomberg cites IBES knowledge from Refinitive displaying Q2 y/y earnings progress of 5.7% which might be the slowest since This fall 2020 and down from 6.8% from April 1.

Twitter Inc TWTR.N despatched a letter to Elon Musk saying his effort to desert his $44 billion takeover is “invalid and wrongful” and that Twitter has not breached any of its obligations, in keeping with a regulatory submitting.

USDIndex damaged via the 108.00 degree, at the moment at 108.32 – highest since October 2002.

Yields: 10-year sector was the outperformer yesterday, again under the three.00% degree once more to 2.97%.

Shares: USA100 tumbled -2.26%. The USA500 is off -1.15%, and the USA30 has slid -0.52%.

USOIL all the way down to $102.00 help.

Gold regular for a third day at $1,730.

FX Markets: EURUSD dip to inside 4 pips of parity at 1.0004, USDJPY spiked to 137.47. The AUDUSD slumped and was one of many worst performers versus the USD amid rising recession angst that has overshadowed the 2 consecutive 50 bp hikes from the RBA.

At present – PepsiCo earnings, German ZEW, & BoE’s Governor Bailey speech

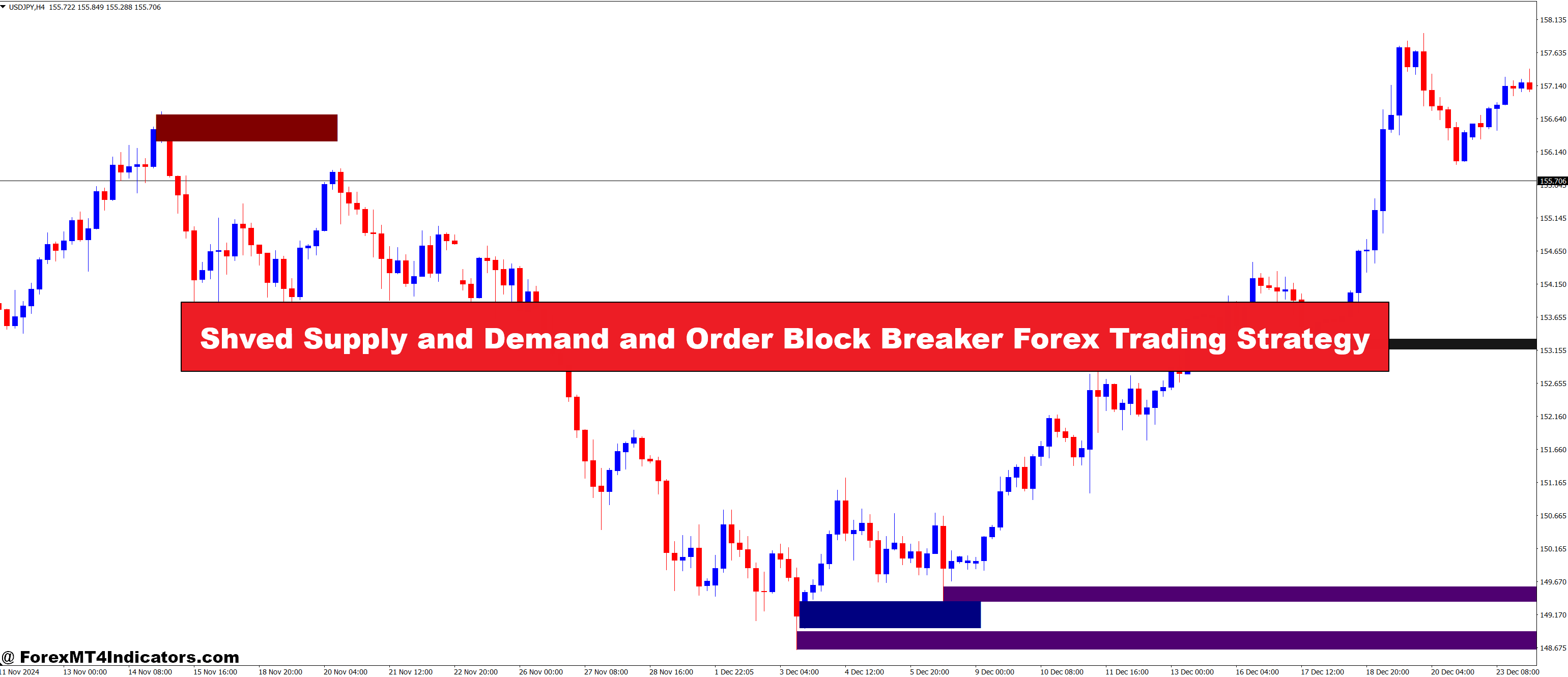

Greatest FX Mover @ (06:30 GMT) GBPJPY (-0.25%) Fallen from a check of 164.50 on Monday, to 162.40 now, traded under 162.00 on Thursday. MA’s aligned decrease, MACD histogram & sign line decrease and under 0 Line, RSI 33.00 and falling. H1 ATR 0.287, Day by day ATR 1.895.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.