Drew Angerer

Whereas increased prices stay an issue for any enterprise, American Airways Group (NASDAQ:AAL) and the airline sector have typically been capable of hike fares together with rising prices. The airways shares should not commerce at yearly lows as revenues are headed to high 2019 ranges on far much less flights right here in 2022. My funding thesis stays ultra-Bullish on the airways shares with a major deal with these taking pointless hits by the market on account of debt fears comparable to American Airways.

Fare Hike Capability

Whereas air fares have soared this 12 months on account of increased gasoline prices, the market would not seem to know that 2021 home air fares had been ~55% cheaper than in 1979. In 2019 {dollars}, the typical fare has fallen from $695 in 1979 to solely $297 final 12 months. Customers may afford 117 spherical journeys with disposable revenue now versus solely 43 again in 1979.

Supply: Airways.org

In essence, fares aren’t an enormous expense today. Some massive will increase in fares aren’t burdensome sufficient to maintain shoppers from paying further prices for increased gasoline prices, particularly contemplating the diminished journey over the prior two years.

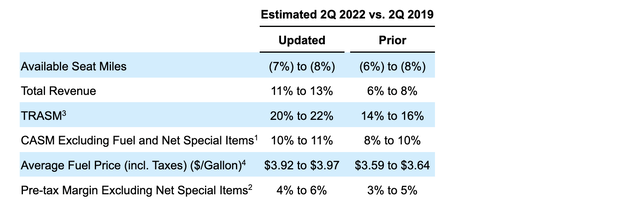

Again in early June, American Airways had already highlighted how revenues had been anticipated to high 2019 ranges by ~12% regardless of capability being down as much as 8%. The airline was arrange for a robust Summer time.

Supply: American Airways 8-Ok

The primary challenge with the numbers going ahead are the upper wage bills for pilots on account of a number of high-profile points together with the latest system glitch that canceled pilot assignments for 12,075 flights. American Airways already has a tentative take care of the pilot union for a 17% pay hike by means of 2024. The deal would supply a 6% increase on signing after which 5% raises in 2023 and 2024.

On high of those hikes, the airline has reportedly provided triple pay to present pilots to select up further flights in July to cowl these beneath the system glitch the place pilots had been allowed to drop flights. Whereas the airfares had been hiked for the upper jet gasoline costs, the extra prices for pilots in July weren’t a part of the plan when clients bought tickets.

Not So Burdensome Debt

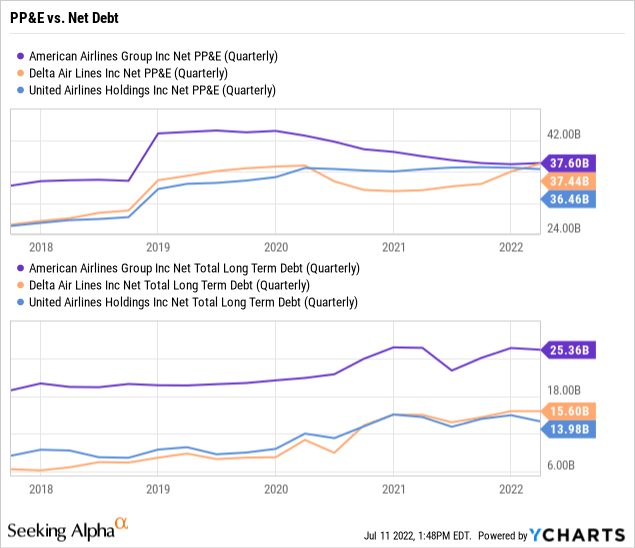

American Airways clearly has a ton of excellent debt, however the market all the time desires to disregard the rationale for this debt. The airline has $37.6 billion in internet Property, Plant & Gear on account of buying fashionable plane and different tools through using debt.

The opposite legacy friends have equally massive PP&E quantities. Each Delta Air Traces (DAL) and United Airways (UAL) have ~$37 billion in associated plane property and tools.

In these regards, these airways are effectively outfitted to deal with very massive debt ranges. Whereas American Airways has $25.4 billion in internet debt, the airline has $12.2 billion of PP&E in extra of internet debt. The opposite legacy airways are in higher positions with PP&E in extra of internet debt at ~$22 billion.

These airways do not have burdensome debt with revenues set to achieve file ranges and tools in extra of internet debt ranges. After all, American Airways must generate constant constructive money stream in an effort to lower debt ranges and cut back curiosity bills. Decrease curiosity bills will feed to increased money flows.

As even Argus Analysis factors out when turning destructive on American Airways, the inventory solely trades at 7x 2023 EPS targets. On historic norms, the airline inventory trades at a typical valuation, but American Airways had ~$220 million in further curiosity bills in Q1’22 and simply chopping these bills to pre-COVID Q1’20 ranges of $236 million, the airline would save $880 million in curiosity bills or over $1 per share in further earnings.

The timeline to scale back internet debt ranges to pre-COVID ranges within the $21 billion vary is unclear, however the airline may generate the money flows over the subsequent few years to attain this goal. American Airways plans to scale back the general debt ranges $15 billion by 2025, however a variety of this discount is from utilizing extreme money balances of almost $13.5 billion when together with restricted money.

Takeaway

The important thing investor takeaway is that American Airways clearly faces a interval of upper prices, however the airways have simply hiked airfares because of the comparatively low cost price of flying within the 2020s. The inventory is loopy low cost at 6.5x 2023 EPS targets whereas these estimates are set to soar with debt reductions and additional development in years forward.