As dwelling costs and the price of lease hit all-time highs, many Individuals are questioning what dwelling association is finest for his or her monetary future—to lease or purchase? For a lot of, neither appears to be like significantly interesting.

As of Could 2022, housing costs are up about 14% year-over-year and up 45% from Could 2019. Mixed with rising rates of interest, the typical mortgage cost for a homebuyer buying a median-priced dwelling in June 2022 has elevated a staggering 48% over final yr.

Usually, in a local weather like this, individuals priced out of the housing market would flip to the rental market as their best choice, however that gives little reduction. In accordance with Redfin, rents are up about 15% year-over-year, and bidding wars for leases have gotten more and more widespread.

So which is best, renting or shopping for? The reply largely will depend on your private scenario, and loads of calculators on the web supply that will help you assess the query for your self.

Nevertheless, I discover the standard lease vs. purchase evaluation dialogue and instruments missing, as they current a false dichotomy. Shopping for and renting aren’t your solely choices. “Home hacking” is a 3rd dwelling association and is a viable and enticing different for tens of millions of Individuals seeking to save on their housing bills.

To assist reveal this level, I’ve made a free excel calculator which you could obtain right here to run a personalised evaluation. I’ve additionally performed an intensive evaluation of the most important 98 markets within the U.S. to measure the precise greenback influence of home hacking versus different dwelling preparations (conventional renting or shopping for).

Beneath I’ll present substantial information to showcase the advantages of home hacking. I’ll begin with a quick overview of home hacking, stroll via how my evaluation works, and supply information on among the finest markets within the nation.

Intro to Home Hacking

Home hacking is one other time period for an “owner-occupied actual property funding.” Mainly, the investor buys a rental property, lives in a single a part of the property, and rents out the remaining elements.

This could take two types:

Small multifamily properties. The investor purchases a two, three, or four-unit property, lives in a single unit, and rents out the remaining items. Single-family properties. The investor purchases a single-family dwelling, lives in a single bed room, and rents out the remaining bedrooms.

Home hacking is a singular dwelling association as a result of it combines lots of the advantages of homeownership with the advantages of rental property investing. A number of the major advantages are:

Making the most of owner-occupied financing. On the earth of mortgages, properties with 4 items or fewer are thought of residential properties. So long as the investor lives within the property, they’re eligible for owner-occupied financing—which comes with one of many lowest rates of interest of any mortgage. Moreover, a lot of these properties can qualify for an FHA mortgage, which implies the investor can put as little as 3.5% down and purchase as much as 4 items. Home hacking offers can earn cash in quite a lot of methods. Some home hacks will cashflow, which is superb. However, even when they don’t, the tax financial savings, mortgage pay-down, and potential for appreciation sometimes assist enhance the investor’s internet value greater than renting or conventional homeownership. Home hacking is a wonderful technique to study the actual property enterprise. Having home hacked for a few years myself, I can confidently say there isn’t any higher technique to study the property administration facet of the actual property investing trade than by dwelling in your individual funding. You’ll turn out to be a grasp at working together with your tenants, managing upkeep and restore, and recognizing value-add alternatives.

These are just some of the advantages. To study extra about home hacking, try this article.

In fact, this dwelling association isn’t for everybody. You want cash to place down and save upkeep reserves, and never everybody needs to share partitions. Once more, having finished this myself, sharing partitions will not be a giant deal, particularly in the event you take into account the numerous advantages home hacking can have in your long-term funds.

Home Hacking Evaluation

To quantify and reveal the influence of home hacking, I constructed a free calculator you’ll be able to obtain right here. I then took the median dwelling costs and the median lease for 98 of the most important U.S. cities to measure how useful home hacking is and in what markets it makes essentially the most sense.

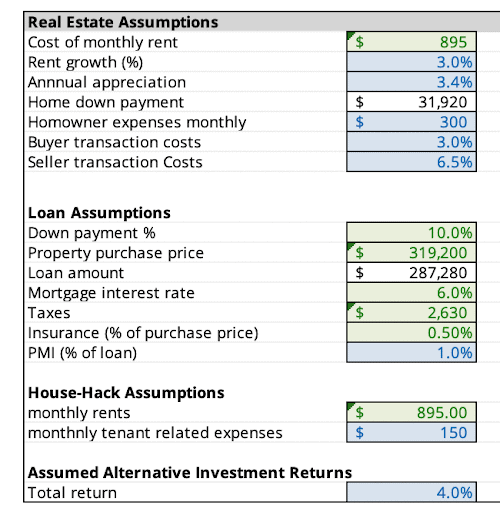

As I discussed above, this evaluation relies upon closely by yourself private scenario, so to check the 98 markets, I needed to make some assumptions, that are summarized as follows:

The investor has the money wanted for the down cost and any required reserves30-year mounted charge mortgage at a 6% rate of interest The lease paid as a renter and the lease generated as a house-hacker equals the median lease in a given metropolis (this finest simulates shopping for a duplex and renting out one unit). A median-priced house is bought within the given metropolisWithin the rental state of affairs, the would-be down cost (the cash retained by not making a down cost) is invested into the inventory market or different return-generating funding. In actuality, not all individuals would do that. I made some normal expense assumptions which you’ll be able to see within the pictures within the subsequent part

I additionally make one final massive assumption: the investor stays within the chosen dwelling association for the following 30 years. I do know that is unlikely, however it’s one of the best ways to run the evaluation. Many home hackers in the end refinance their house-hack, flip it into a standard funding property, after which buy one other property. For individuals who intend to pursue that technique, you’ll be able to safely assume that it’s going to make home hacking much more useful than my calculations present.

With these assumptions, I ran two eventualities: 20% down and 10% down (with a 1% non-public mortgage insurance coverage (PMI) cost).

20% Down Evaluation:

Even with rates of interest rising to six%, the typical home hacker will see a optimistic enhance to their internet value in simply 5.8 years, and that’s with comparatively conservative assumptions, which you’ll be able to see under. Take into account that this and all the information on this part are the averages for the nation. As you’ll see later, the advantages differ considerably from metropolis to metropolis.

Home Hacking vs. Renting

Over 10 years, the typical home hacker could have a internet value $104k better than the typical renter and a 30-year maintain interval that grows to greater than $1.1M. As I mentioned above, it’s unlikely anybody truly home hacks the identical property for 30 years, however this train exhibits the ability of home hacking versus renting on the subject of growing your internet value.

Internet Value Breakeven H.H. Profit: 5.8 years Internet Value 5-year H.H. Profit: -$7,400Internet Value 10-year H.H. Profit: $104,000Internet Value 30-year HH Profit: $1,104,900

Along with measuring the influence of home hacking on internet value, I additionally examined how the investor’s “money outlay” is impacted. This can be a measure of how a lot money you’ll have in your checking account, factoring within the down cost.

Due to the big 20% down cost on this state of affairs, the breakeven level for money outlay is greater than twice so long as the online value breakeven level, at 12.2 years. Be mindful this doesn’t essentially imply that you simply’ll be spending extra on housing every year. The truth is, it means the other. In lots of the years, you’ll generate optimistic money movement. Should you home hack, it is going to take 12.2 years on common so that you can recoup the money you spent in your down cost and shutting prices via your elevated money movement. However as we’ve lined, the investor is incomes returns on appreciation and mortgage paydown throughout that interval, along with money movement.

Money Outlay Breakeven HH Profit: 12.2 years Money Outlay 5-year HH Profit: -$4,200Money Outlay 10-year HH Profit: -$1,100Money Outlay 30-year HH Profit: $16,400

All instructed, after 10 years on this state of affairs, the house-hacker could be greater than $100,000 wealthier than the typical renter and, after 30 years, would have roughly $1.1M greater than the renter.

Home Hacking vs. Shopping for

When evaluating home hacking to conventional homeownership, the impacts are quick however much less pronounced.

The breakeven level for each money outlay and internet value is simply two years, however the 30-year profit caps out at $569,000 for internet value and $29,200 for money outlay. Not as dramatic because the rental comparability, however nonetheless an unbelievable distinction in outcomes.

Right here’s a abstract of the findings:

Internet Value Breakeven H.H. Profit: 2 years Internet Value 5-year H.H. Profit: $42,000Internet Value 10-year H.H. Profit: $119,200Internet Value 30-year H.H. Profit: $568,800

Money Outlay Breakeven HH Profit: 2 years Money Outlay 5-year HH Profit: $14,200Money Outlay 10-year HH Profit: $16,400Money Outlay 30-year HH Profit: $29,200

When home hacking as a substitute of conventional homeownership, the optimistic advantages to each money outlays and internet value are quick and translate into about $570,000 in wealth creation over 30 years.

10% Down Evaluation:

As a result of many home hackers put lower than 20% down on their property, I assumed it might be useful to re-run this state of affairs by placing 10% down. All different assumptions are the identical right here, besides {that a} 1% PMI expense is added to the calculation (which occurs while you put lower than 20% down on a property).

The outcomes from this state of affairs are nonetheless compelling however barely much less so than the 20% down state of affairs. It’s because the investor pays extra curiosity over time and 1% in PMI, which doesn’t go in direction of the principal or have any optimistic profit.

Listed below are the outcomes for evaluating renting towards home hacking:

Internet Value Breakeven Common: 8.2 years Internet Value 5-year H.H. Profit: -$40,410Internet Value 10-year H.H. Profit: $38,800Internet Value 30-year H.H. Profit: $930,000

Money Outlay Breakeven H.H. Profit:: 15 years Money Outlay 5-year HH Profit: -$11,400Money Outlay 10-year H.H. Profit: -$8,300Money Outlay 30-year H.H. Profit: $9,200

It takes longer for the breakeven level, however the upside continues to be big at about $930k over 30 years. That’s an unlimited enhance to the investor’s retirement.

When taking a look at home hacking towards conventional dwelling possession, the influence is similar because the outcomes above because of the manner I created my assumptions.

Internet Value Breakeven H.H. Profit: 2 years Internet Value 5-year H.H. Profit: $42,000Internet Value 10-year H.H. Profit: $119,200Internet Value 30-year H.H. Profit: $568,800

Money Outlay Breakeven HH Profit: 2 years Money Outlay 5-year HH Profit: $14,200Money Outlay 10-year HH Profit: $16,400Money Outlay 30-year HH Profit: $29,200

However the conclusion is similar: home hacking is often all the time higher than conventional homeownership, a minimum of with the assumptions I’m utilizing right here.

Metro Evaluation

The above evaluation exhibits the projected outcomes nationally, however the vary of outcomes varies based mostly on metropolis. In my evaluation utilizing the 20% down state of affairs, one metropolis (Detroit) had a internet value breakeven within the first yr, and two cities tied for final place. Spokane, WA, and Boise, ID, took 11 years to interrupt even.

So, it’s essential to see the place your market falls. To assist with that, I put this fast chart collectively that exhibits the online value breakeven level for the highest 98 markets within the U.S. with the 20% down state of affairs.

In fact, if you wish to customise this evaluation, you’ll be able to obtain my calculator without cost right here.

Conclusions

Home hacking is an unbelievable wealth-building software for these with the power and want to do it.

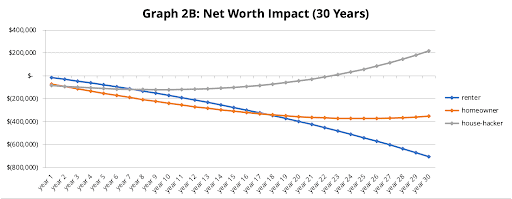

Whereas it looks like it takes some time for the advantages to repay, check out this graph that exhibits the online value advantage of home hacking over time for the median-priced properties and median lease within the U.S.

Discover that whereas the primary few years are intently clustered, the optimistic advantages of home hacking compound over time and start to point out exponential progress.

As I mentioned above, it’s unlikely anybody home hacks for 30 years, however I hope this text has conveyed how essential your alternative of dwelling association is. Should you home hack now, you’re nearly certain to see a optimistic profit to your internet value whether or not you reside in that property long-term or ultimately flip it into a standard rental and transfer on to a different home hack or funding.

Should you’re occupied with home hacking, an excellent first step is connecting to an investor-friendly agent, which you are able to do without cost on BiggerPockets right here.

Have you ever ever home hacked, or are you contemplating it now? Let me know within the feedback under.

On The Market is introduced by Fundrise

Fundrise is revolutionizing the way you put money into actual property.

With direct-access to high-quality actual property investments, Fundrise lets you construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has rapidly turn out to be America’s largest direct-to-investor actual property investing platform.

Study extra about Fundrise